To market, to market to buy a fat pig. All fall down. Locally we actually recovered off our worst levels for the day to end the session off one quarter of a percent, resource stocks which were backed by a weaker currency helped prop up some tired looking industrial stocks. The Rand, after a brief surge through 9.70 has weakened all the way out to 10 to the US Dollar again. We are currently without our TV's at the moment, we have shuffled the offices up a little and have engineered the TV's to hang in the middle of the office. Pictures to follow when it is all working, hopefully later today.

So we did not see the ADP employment number come in yesterday, which was lighter than anticipated. The number clocked 135 thousand additional jobs added for the month of May, the full report is available here: ADP National Employment Report May 2013. Oh, and the other sort of important thing that happened was that the 30 year average mortgage rate went above 4 percent last evening. The expectations in the coming 12 to 18 months is for the rate to settle anywhere between 4 and 5, but historically that is still pretty cheap. This time in 2011 we were at and around 4.5 percent, so anyone who has been working hard to pay down their mortgage in North America has been doing themselves a huge favour lately.

Although, no one that I read is quite sure where rates will settle next, they will go higher, but how much and at what pace? Remembering that the Fed meets every 45 days, so 8 meetings a year, if you want to diarise the 2014 dates, you can already: 2014 FOMC Meetings. It could be the case that come the middle of next year we could see rates in the US start to tick up. If of course the FOMC was happy with the outlook for growth and in particular the outlook for employment. Last evening's Fed beige book I saw was described as particularly beige. Dour. Boring. Although to be fair, beige is not too intrusive either, is a good colour for pants and fishing wear, if that is your sort of thing. Catching fish that is, I presume you all wear pants!

What is the Fed beige book? Surely not a scrapbook! No, in fact it is a summary of the districts, so each section of the country gives their assessment of economic conditions: Beige Book - June 5, 2013. So what did Mr. Market draw out from this? I am not sure, but the sell off mode actually continued and in New York the market had given back a lot of the last few weeks hard work. The S&P 500 is off nearly 80 points from the highs, or nearly 5 percent. So I guess you could argue that is "kind of" a big sell off, but the market is up 12.81 percent year to date. So it is still big you see, the market is still comfortably up for the year. Lukewarm beige book, if there is such a thing. I saw the love him or hate him Jim Cramer say that he was lining his charitable trust up for some purchases.

What? What is this about? The IMF say in their recent report that Greece Makes Progress, But More Effort Needed to Restore Growth. Well that is like telling your peers that they can't do anything without permission and then suddenly telling them to try harder and take initiative. The complete report is available here: GREECE 2013 ARTICLE IV CONSULTATION.

The sad truth is that this has possibly been one of the worst economic contractions in modern times, of that sort of size and scale. The paper lays it out: "Overall, the economy contracted by 22 percent between 2008 and 2012 and unemployment rose to 27 percent; youth unemployment now exceeds 60 percent. As domestic demand shrank across all categories, net exports provided support largely through shrinking imports." Was Greece punished unnecessarily, or were they made to take their medicine that they deferred during the happy days? The percentage of nonperforming loans has reached crisis levels, 25 percent. For some perspective, Spain is around 5 percent.

But, there is light at the end of the dark, dark road that the Greeks have travelled. Unit labour costs are coming back into line, even though not at competitive levels just as of yet. But more work still needs to be done: "The labor market has traditionally suffered from a closed and inflexible system of collective bargaining, very high firing costs (severance payments and redundancy notification periods), a high national minimum wage relative to competitors, and high non-wage labor costs." Sounds familiar, no?

I do not know if there are lessons from this, too much state intervention, too many benefits, not enough compliance, too much government involvement in business, corruption becoming ingrained into society and I suspect that the list could go on. The Greeks have learned the very hard way and perhaps living standards will not return to those of six/seven years ago until the end of this decade. At least they have the Euro zone, as weird as that might sound to some. Without the Euro zone the countries savings base would be decimated, pensions would halve overnight, but somehow people seemed to think that the adoption of the Drachma would be "good" for Greece. A real life sad example, which impacts on ordinary people.

Byron beats the streets

- Apple are always in the news but over the last few days they have hit the headlines slightly more than usual. Sasha did mention it yesterday but I found a WSJ article which explained the implications of the Samsung Court ruling very well. In case you missed it, Apple lost a legal ruling which has banned them from selling certain models in the US.

The article titled Ruling Won't Break Apple's Skin explains it better than I ever could.

"Yet only devices using AT&T's network fall under the ruling. And only a handful of older models are affected. What's more, only two of the affected models, the iPhone 4 and the "3G version" of the iPad 2, are still being sold. Slightly more than a third of Apple's overall sales are in the U.S. And, according to a survey by Consumer Intelligence Research Partners, half of iPhone 4s and two-thirds of 3G iPad 2s sold in the U.S. are on AT&T's network. Respectively, they generate 13% and 14% of U.S. iPhone and iPad sales, according to CIRP.

Putting all those numbers together suggests that, at most, the ban impacts roughly 2% of Apple's sales, based on March-quarter numbers."

The stock was only down 0.93% yesterday which was probably more to do with a weaker market than the news itself. If you saw the headlines and felt a bit anxious I hope this explanation has sorted that out.

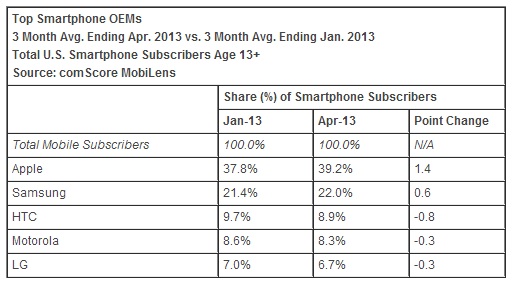

The other news I saw with regards to Apple was positive and related to market share in the US. comScore who are the leaders in measuring smartphone data released the following table on their website. Click here if you want to read the full release.

Basically, because of strong demand for the iPhone 5 they are actually gaining market share in the US. This is important to note because the US market is the most sophisticated when it comes to smartphones so their opinion matters. Although the platform IOS is well behind Android, the iPhone is comfortably the most popular phone in The States and that market share is growing.

What I also found interesting was that smartphone penetration in the US was only 58%. If there is still a lot of room to grow in this market, the potential in developing markets must be mind blowing. If you remember Sasha covered all of this yesterday with that Ericsson report.

Yes, there are huge market share wars between the smartphone manufacturers but people forget that there is still a lot of room out there for these players to grow. This town is still big enough for the two of them.

Home again, home again, jiggety-jog. Markets are lower here again today. Retail shares have been hit quite hard over the last few days. People are still worried about the credit cycle here locally, and we are starting to hear noises about indebted mine workers. And unfortunately it is getting closer to "strike season". Weekly jobless claims today might actually determine where we end up, and then of course tomorrow, the nonfarm payrolls number! That is always huge.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment