To market, to market to buy a fat pig. Yesterday was PMI day, a day that clocks around every month and is supposed to reveal the health of the globes companies. PMI is known as the Purchasing Managers Index, in the US the Institute for Supply Management (founded nearly 100 years ago in 1915) conducts these surveys on private companies. HSBC have one in China, as well as the official one by government, the BoJ does one called the tankan, but perhaps the best one known globally is Markit.

Now the calculation is quite simple, that is of course if you like mathematics equations. The Index equals (P1*1) + (P2*0.5) + (P3*0). Easy. P1 is the number of respondents that report an improvement, P2 is the number of respondents that report no change and P3 is the number of respondents that report a deterioration. I found this formula and explanation at Wikipedia. Now in the world of surveys of this sort, not all questions carry the same weighting, for instance a question about new orders carries a higher weighting than a question about suppliers delivery times, even if both can tell you something about the current strength of the economy. And that I guess is what these PMI reads are supposed to do.

There is actually a great explanation of the definitions on the Bureau for Economic Research South Africa website:

- SA PMI = 0.25 Business activity +

- 0.30 New sales orders +

- 0.20 Employment +

- 0.15 Supplier deliveries +

- 0.10 Inventories

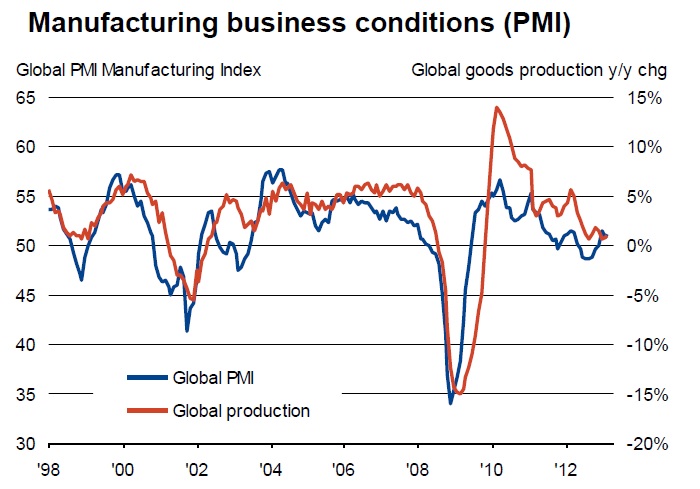

In a South African context we managed to just squeak above 50 and remain slightly unchanged at 50.4 points in May, according to the Kagiso Purchasing Managers' Index (PMI). Locally the suggestion is that we are indeed recovering off the depressed levels of the first quarter, but the recovery is slow and very stodgy. Globally the people at Markit suggest Manufacturing remains stuck near stagnation in May. See the global picture:

Is all of this important? Well...... I suppose yes, companies answering surveys without committed and pointed answers with a better, no change and worse. If I presented you with the same questionnaire each and every month, I am not too sure how much differently my answer would appear on a month by month basis. Yes, important, very important, I guess so until next month!

Istanbul, as the crow flies, is 7469.51 km from Johannesburg according to the mapcrow.info website. The distance from Wall Street, OK, New York to Istanbul is 8062.30 km's according to the same website. Roughly, New York is closer to Istanbul by about the distance from Johannesburg to Durban (just shy of 500km). But tell that to the people that sold off emerging markets yesterday. The Turkish stock exchange ended the session down 10 and a half percent! Nobody likes to see burning buildings and If you had an emerging market flavour, you were punished yesterday and that included the local bourse. The Rand ironically bounced hard from the pasting Friday, and that did little to help keep the bears at bay, the feasting continued through the day as the sell button was pressed harder and harder through the course of the day. After all was said and done the Jozi all share index had shed two and a half percent to close below 41 thousand points. Goodbye 1000 points and some change, that is not something that happens too often.

Banks were bashed down three percent, but unfortunately the real action was with the platinum stocks that sank another 5 percent and some change as news started to filter through that a NUM shop steward had been shot dead on the Lonmin Western Platinum mine. And this morning, driving into work I heard on the wireless that John (other name Robbie) Robbie said that over 60 people had been killed in violence on the Impala and Lonmin mines and nobody had been prosecuted for these crimes. No wonder they seem to happen, life is seemingly cheap and there are few consequences when there are such actions. Sad. Very sad. Lonmin stock sank over 7 percent yesterday. Union recognition is seemingly more important than building new mines and new jobs.

The worst news is that Glencore Xstrata have laid off 1000 folks who embarked on illegal strikes over the last week. AMCU workers, who probably are not too fond of NUM. And I suspect the NUM fellows are not too fond of AMCU chaps either, that much is evident. Coal of Africa have in a press release yesterday announced that they are going to place Mooiplaats Colliery on care and maintenance. Not profitable and losing 20 million ZAR a month at these current coal prices. Poor operational performance and "challenging" geographical conditions were cited. Over 500 people are set to be affected, half of them contractors and the other half full time staff. The unfortunate truth is that when prices go against you, both the commodity price as well as fixed costs, you can have as many union turf wars as you want, there are just no jobs left for anybody after a while. And that is the stark reality.

Thermal coal (like the stuff produced at Mooiplaats) prices are roughly 85 US Dollars per ton. In July of 2008 prices were roughly double, around 167 Dollars per ton. Ten years ago prices were around 23-25 Dollars a ton, those prices were the average for the prior twenty years to that. In fact just below. So thermal coal prices are better than 10 years ago, a lot better, but a whole lot worse than even two years ago, where the price was roughly 50 percent higher than now. Now if you know your geography, you will know that Camden coal power station is right there, and was re-commissioned from 2006 through to 2008.

It, Camden, is 35 years old and was refurbished at a considerable cost Paul tells me, and now the closest coal mine, with thermal coal is closing. I wonder where Camden gets their coal from? I could not find it on the Eskom website, but finally through some digging and scratching found that in March of this year, Eskom signed a contract with Ichorcoal subsidiary, Vunene mining to supply coal to Camden. So I guess that is how it works. A German coal company, Ichorcoal, a listed entity, new it seems! The little that I read of the annual report suggests that Ichorcoal seem to think that thermal coal prices have bottomed, so perhaps the closures are fairly short lived:

- "Coal prices fell in 2012 about 16 %, compared with the peak in 2011 prices fell by nearly 50 %. One reason was the weak economy in the West and slowing demand growth in the East. Another reason was the boom in shale gas in the United States."

Oh dear, but fear not!

- "We are convinced that coal prices have reached the bottom in the beginning of 2013 - the long term positive trend is intact. Coal is the most accessible source for the production of electricity worldwide. Coal has the most transparent, most effective and most stable world market of all energy resources."

I remember that NOT long ago, in December when I dug up the archives, Byron had written a piece about BHP Billiton not that bullish long term on thermal coal. I guess that is what ultimately makes a market. What we should also factor into the equation is that we continue to need to supply the local market (approximately 90 million tons per annum), Eskom, but the external market won't necessarily disappear, but will not grow at the same rate. The reason being that current build is focused on wind, solar, tides, renewable are all the rage. Still, the one that amazes me is the three gorges dam, that at full installed capacity (not sure it ever gets there) is roughly 55 percent of our entire grid. One dam. Three gorges. Chinese engineering. Where to next? Well, I guess we continue to be held sway by the international commodity prices. Gas turbines? Well, we have existing capacity, with only one future one suggested in Durban.

Byron beats the streets

-

One of the greatest debates in our industry is whether to invest passively or actively. Although we stock pick like an active investor, once we hold the shares we do not try and sell them at the peaks and buy back in the troughs. In other words we hold the stocks passively. Having analysed the retail sector very closely this year I can almost guarantee that sales are going to be slow. The retail stocks which have been quite expensive over the last few years are going to pull further back in my opinion, equally that might not happen at all. Does that mean sell the shares and buy later? Certainly not.

This article by my favourite finance blogger Josh Brown explains it well. It is titled Smart and Stupid Arguments for Active Management. If you are interested in asset management it is a great read.

"The passive investor absolutely does not see "clear skies ahead" at all times. Rather, this investor recognizes that most managers will not be able to detect and react to the thunderclouds in a timely, consistent way. In addition, many of them will be so hyperactive that every gray cloud will appear to be a hurricane, and so a lot of buying and selling (churn) will be the result - leading to higher taxes, trading costs and potential for missed opportunities."

I think that statement is important to note when looking at our investment style. We are not eternally bullish, we are just confident that the stocks we have picked, in sectors that we like, will be able to navigate through both good and tough times and give you superior returns over the long run. This piece also reminds me of an important lesson I have just learnt when it comes to managing portfolios. It involves African Bank and the power of compound growth versus compound deterioration.

Let's use a real life example. Almost exactly 2 years ago in March 2011 we had client who brought in R5mil which we put into our recommended portfolio. The timing was good and with no extra additions, reinvesting dividends and after fees the portfolio is now worth R8.58 million. When we bought the portfolio we put R600 000 into Aspen and R500 000 into African Bank. Today the Aspen position is worth R1.6 million, nearly 19% of that portfolio and African Bank is worth R222 000, 2.6% of that portfolio. With that allocation, when African Bank drops 15%, a 2% increase in Aspen will cancel that out.

What is my point here? I have a few. Firstly, you cannot get them right all the time but having a good diversified mix means that the good performers easily carry the bad ones because they become more significant over time. Secondly, had we been active we would have cut back on our Aspen position to rebalance. Instead we prefer to allocate dividends to underrepresented stocks rather than create unnecessary trading costs and tax implications from churning. Thirdly, it is important to look at this portfolio as a whole. Yes, each individual stock is important to analyze so as to get the best possible return but when looking at return, you need to look at the return of the entire portfolio. Sometimes the transparency of it all makes it difficult to do this.

Lastly, it emphasises the importance of patience and sticking the course. It is easy to bring up this example because Aspen is at the top and African Bank is at the bottom. But this may change. Just like we have been sticking to the Aspen position, we will keep the course with African Bank. Because doing nothing is most often the best call at times like these.

Home again, home again, jiggety-jog. Mixed markets here, in part the Rand is finding buyers and has strengthened significantly over the last two to three days! Commodity prices are lower though, that is not good news for us. We are moving our TV's here, it is quiet without the noise, other than the !

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment