To market, to market to buy a fat pig. At face value the scorecard at the end showed that local markets barely budged, after having enjoyed gains for most of the day. Resources and in particular the gold stocks lagged the broader market, industrials were flat whilst the banks and financials led us higher. I saw some technical analyst on the box suggest that the industrial companies were locally based, quite clearly that person had not seen the list of companies by market capitalisation lately. Or ever. By my count 6 of the top ten companies in the index are industrial in nature (not financial or resource), and make up around 38 percent of total overall market capitalisation. The market as ever is led by a few majors, that is the way it will work.

Over in the US it was a good start and then slip sliding through the session, ending off the lows. There was some sort of strange ruling in the ongoing patent wars against Apple, see here: Apple Import Ban on Old IPhones Stokes Samsung Patent War. So, it is what it is, Apple for the time being cannot sell those products, but can of course sell the latest iPhone (the 5) and the latest iPad, which I suspect that most people want. Where this ends is anyones guess.

Also guessing are those people who are waiting for the sign that the Fed will back off. We think that is a great moment, the Fed thinking that they can step away, the rest of the market, well, they are not so sure. I have seen a couple of articles concerned about the Bond market: Hatzius: Explaining the Risk of Disorderly Unwind in the Bond Market. Jan Hatzius, a Goldman Sachs chief economist, who is both a German and American national, suggests that the Fed could announce their taper in September, with action by the end of the year. I for one am pretty relieved when I will be able to read that the Fed are no longer in the market. The few times that I have seen Hatzius, and it is mostly Bloomberg and mostly for the non-farm payrolls, I like him a lot. Him and Abby Joseph Cohen are my two favourites. The most unfortunate part of their job however is to predict the levels of the S&P 500.

Predictors. And the other prediction that I saw was that of "the Nouriel" and the levels of the gold price. Sigh. As if he needed some more haters. His words were that the gold price was going to sink back to 1000 Dollars per fine ounce in the next few years, and the yellow metal was basically an outdated investment. His predictions are poor at best, but perhaps I am just noticing the ones that all went wrong. I still think that crediting him with predicting the financial crisis is a little rich. I mean, nice to predict something over and over, better really to monetize it for you and your clients, not so? So, in my world, John Paulson, Michael Burry, Charles Ledley and James Mai, those guys monetized the financial crisis. For both themselves and their clients. In my world, they were the real predictors, how did they do subsequent to that, well, on that again they will be judged.

When humans motivate a new purchase or venture to their colleagues, their spouses, their parents, their kids, their extended family, their friends, there almost always is an element of economics involved. And it will differ, depending on where we are in history. Just yesterday Byron was telling me about the cost per gigabyte when he was at varsity, and we could see now that the cost had plummeted. I remember this graph and blog: A History of Storage Cost, that showed that per gig, the cost had decreased from 193 thousand Dollars in 1980 to less than 7 US cents in 2009. And I will have it as a guess that it might even be half of that now. And this is ironically in a world where the demand for storage grows exponentially. How were we to know that storage space now was a necessity and not a luxury any longer?

Just yesterday, well that was when I saw the report, Ericsson released their Mobility Report, which gave an overview of the mobile handset trends. I am still amazed that we are able to grow at the same rate that we still are off the increased base. The biggest change is the number of mobile broadband connections. It grew by an astonishing 45 percent year on year to 1.7 billion folks. And to cement the trend, more than half the handsets sold globally in the first quarter of 2013 were smartphones.

BUT......the amount of data per subscription continued to slow, indicating that as much as you use your handheld "friend" there is seemingly a limit to how much you can use it now. Part of it is cost, part of it is the service. If we all had amazing handsets that were all LTE enabled and data cost peanuts, we would use them a whole lot more, right? Well this report offers some useful insights into how that is going to look in half a decade or so, where the suggestion is that LTE coverage will be available for 60 percent of the globes population. Wow. That is pretty amazing. Now to think that 25 years ago, almost nobody had a mobile handset. Really. Now, according to this report it is not uncommon for people to have two subscriptions, one for your phone and one for your tablet. I am pretty sure that the new motor vehicles, fridges, washing machines, electric meters and so on will be fitted with sim cards enabling the smart devices to tell the network what is wrong, if indeed there is a problem.

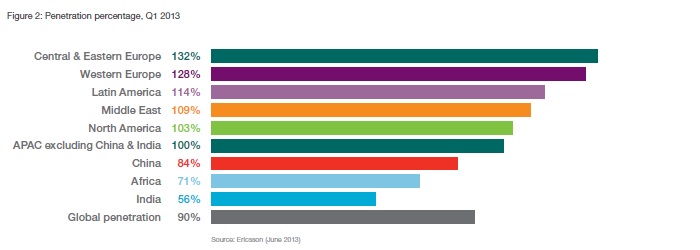

I was also amazed by the growth, and in particular the growth that still exists for our continents population, check this graph from the report:

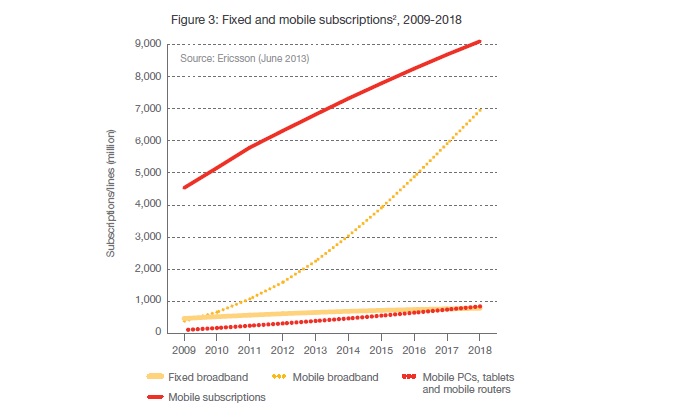

See how low connections are to population size in Africa and India? There is still a whole lot more room for growth, in terms of absolute subscribers AND the number. Remembering that it is possible for one customer to have multiple subscriptions, tablets, dongles and smartphones. This next graph is also a prediction of exactly what is going to unfold:

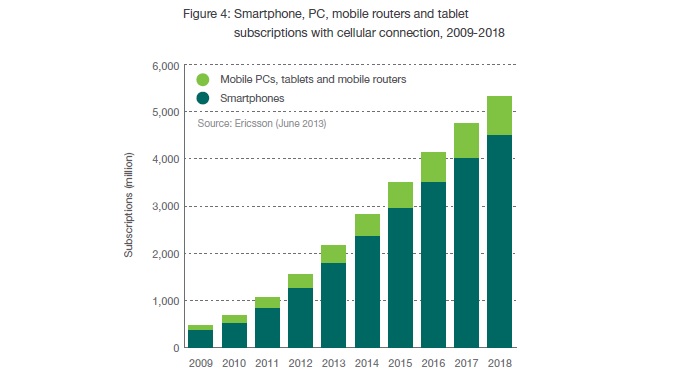

And then lastly, all the growth that we have talked about, this is where it is going to come from, according to this Ericsson report:

Amazing. And that is why we will continue to stay invested in MTN, because whilst margins will continue to come under pressure, the data usage will continue to grow strongly. Who knows, in ten years time we might all wear glasses or contact lenses, or helmets of have watches or implants, I don't know. All I do know is that it makes for a world that is more intrusive and for the purposes of corporate governance, that is good.

Last point I want to make is one about who will and who won't in our opinion, benefit. MTN is taking some heat today as people worry about how much they could potentially pay if they are recipients of a Myanmar mobile licence. But I suspect it would be great in the long run. Telkom on the other hand, well, you can read the statement yourself: Updated Trading Statement. Yech. "Telkom, in line with other fixed line incumbents globally, has for more than a decade, faced technology changes, competition from mobile operators and an evolving regulatory landscape which have contributed to lower investment returns from its legacy network assets." Yes, I see, so you mean people want more mobile phones and less rubbish service from a fixed line operator? Well, it sounds a bit like a sad admission of sorts, but they go on to say that they are investing heavily in changing that. Trying to keep up. Late? Time will tell, but if the Ericsson report is anything to go by, we could continue to see headcount fall at Telkom and fewer customers. We continue to avoid.

Home again, home again, jiggety-jog. Today is the day that D-Day, the Normandy invasions were actually set for. The fifth of June. But because of the foul weather, it was delayed to the 6th of June 1944. I am pretty sure that "things" in Europe were much worse than they are today, even though high unemployment and policy freeze seem like there is no progress. Mario Draghi was able to stand there last July, the 26th of July to be exact, and talk about doing everything to save the Euro. And that doing everything lowered the borrowing costs for the Italians and the Spaniards. No, no exit. Not from anyone. In fact........ just this morning the ECB Cautiously Says Latvia Can Join Euro Zone, according to the WSJ. So, stick that in your pipe and smoke it all you Euro haters. Where are the people now talking about exit this and that?

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment