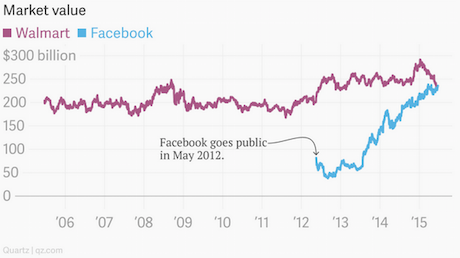

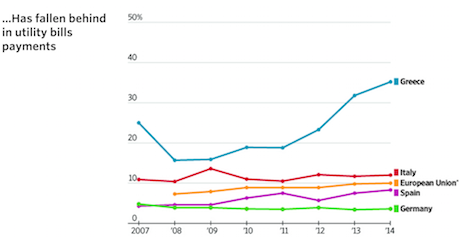

"With Greece having a large tourism sector, the financial crisis meant that less people could afford to travel which added pressure to the Greek economy. You know the saying, when the tide goes out you see who has been swimming with their pants off. Greece were starkers. Here is one of the six graphs."

To market to market to buy a fat pig. Another day and another update from the birth place of democracy. Markets all over the world were deep in the red with most markets down around the 2% mark! Most companies that were sold off yesterday don't even have operations or a link to Greece but were sold anyway. I suppose money managers are worried about contagion of the Greek crisis to other areas of Europe, where most businesses do operate or are at least linked to. It is a giant web and we are all connected. The big assumption and risk lies in the contagion from a Greek default. Having a look at the debt profile, only 12% of the outstanding debt is held by private individuals, leaving the majority to be held by the ECB and the IMF. Defaults or 'haircuts' on the debt held by private individuals is where the contagion can come from; the ECB and IMF are big enough to contain a default on their debt. I think the risk of default spreading to the rest of Europe is low.

Another reason why stock prices are falling is from the impact of uncertainty on earnings multiples people are willing to pay on stocks. There are a couple of factors that determine the earnings multiple investors are willing to pay for a stock. The base of your calculation is what the market's average P/E ratio is on all the stocks, then you factor in what the expected growth of earnings is likely to be (you are willing to pay more for fast growing companies) and then finally you look at how confident you are in your forecast of the companies earnings (the more certain earnings are, the more you are willing to pay for them). Looking at those three factors, uncertainty may result in people being willing to pay less for stocks in general (lowering the market's average P/E ratio), adverse economic situations may impact on the growth of earnings (lowering the premium you are willing to pay) and then finally uncertainty means that your forecasts of the future are in doubt (lowering what you are willing to pay). That is the theoretical reason for the short term moves in the share prices, remember though that you buy (invest) for the long term. The big questions for the long run is: "Will this company still be around in 10 years?" and "Will they be bigger and more profitable than today?". Unless the company has direct business in Greece, the happenings in Greece don't have an impact on the answers to either of those questions. How many people remember the last Greece debt crisis when talking about company profits? None! The last Greek debt crisis created a great buying opportunity for the shares of your favourite companies.

For most of us we don't have 'skin in the game' with the outcome in Greece. I chatted to a Greek friend of mine and this was their view: "Greece has to see that getting out of the euro zone, will be their best course of action, it will hurt like hell, in the short term, but it will be beneficial longer out.". Most market commentators are saying the opposite of this but they are not the ones voting in the referendum on Sunday or the ones that the current government represents.

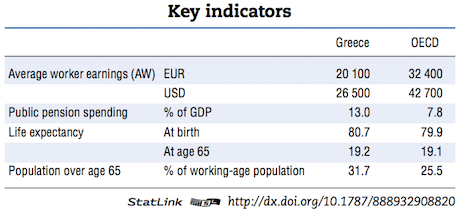

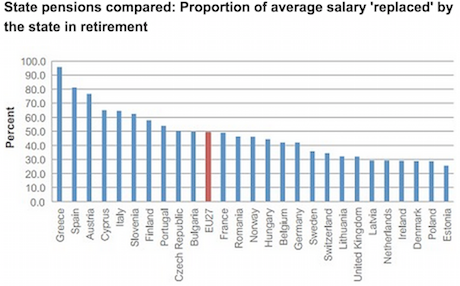

Why does the man on the street feel like they are getting a raw deal? These 6 graphs highlight how things have been going backwards for the average man - Greece, in Charts: How Bad Is It? With Greece having a large tourism sector, the financial crisis meant that less people could afford to travel which added pressure to the Greek economy. You know the saying, when the tide goes out you see who has been swimming with their pants off. Greece were starkers. Here is one of the six graphs.

image from the WSJ who sourced the data from Eurostat

Why do market commentates think that there is little chance that Greece will leave the EU? Here is why, Reverting to Drachma May Send Greek Currency at Least 40% Lower. Remember that all Greek assets will be valued in the new Drachma, so a 40% devaluation will result in an immediate state where your assets and cash are worth substantially less in Euro terms. It would be an ugly situation. The further result will be that any new loans that the Greek government would need to keep things running would be at interest rates substantially higher than the current interest they are paying.

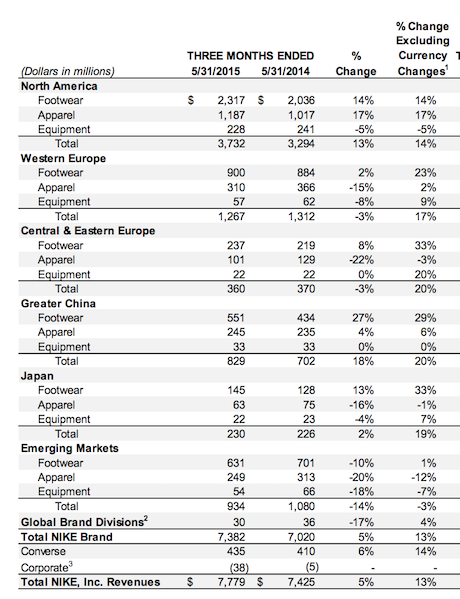

Company Corner

Telkom released a Joint Update Announcement: Acquisition By Telkom Of The Entire Issued Share Capital Of Bcx. The purchase of Business Connexion has been in the pipe line since May last year, ideally transactions should be concluded in the shortest amount of time possible.

Even though Edcon is not listed, they have bond holders who need financial information. They released their Annual report today. The company has had a tough time with comparable store sales declining by 1.6% (subtract inflation from that number and you can see it is even lower than that). There has been a switch from their biggest brand Edgars to other stores like Woolworths. Their other brand CNA has been on a steady decline as technology makes their stores irrelevant in the modern day context. Interesting numbers in the annual report is their Zimbabwean business, which grew by 13% and has gross margins of 45.9%, higher than their South African cousins. Yesterday Bloomberg had an article showing how stretched things are in the company - Bain-Owned Edcon Faces Day of Reckoning With Bond Payment.

Yesterday Steinhoff released a Strategic review update, which gives a nice view of their business and the timing of their Germany listing. The plan is to push to grow market share in Germany, push for supply chain efficiencies and cost savings and the listing should take place in the final quarter of this year.

Then a big one for us and the market given its size is Naspers who announced its results for the year ended 31 March 2015.. Byron is currently writing an in-depth look at the results which we will post tomorrow, here is a snippet from the press release. "On an economic-interest basis, revenue grew 26% to R132,4bn, driven by growth across the internet, ecommerce and video-entertainment (previously pay-television) segments. Core headline earnings, an indication of sustainable earnings performance, grew 30% to R11,2bn, mainly due to increased earnings contributions from Tencent and some profitable ecommerce businesses".

Linkfest, lap it up

Ever wonder where to get cheap beer? Now you know - Here's What a Beer Will Cost You, From Kiev to Geneva. It makes sense that it is cheaper in developing markets where rents are lower and consumers have lower disposable incomes.

The reason that we get higher returns on the stock market is because of all the volatility in returns and the higher risk (when compared to cash) of having our investments drop in value - The Struggle to Define Risk. Depending on your time frame, resources, need for cash and a whole host of other factors; risk will have a different definition.

I love the Airbnb and Uber concepts because of my economics background. They make the way we use cars and houses far more efficient and are creating waves in the areas where they operate - How Airbnb is Taking Over Paris. Uber is unfortunately at the other end of the spectrum in Paris - Uber France Leaders Arrested For Running Illegal Taxi Company

Home again, home again, jiggety-jog. Markets in Asia are up today with Shanghai up a whopping 5.5%, following extreme volatility that has been experienced in the market over the last 2 weeks. European stocks are slightly in the red this morning, down around 0.5% and on a local front we are down 0.2%. Mining stocks are suffering today with Gold stocks down 3.8% after their solid day yesterday, the wide gulf between what unions are demanding and what companies are offering might be part of the reason coupled with the gold price declining over the last 2 days.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

taken from www.xe.com

taken from www.xe.com

Image courtesy of Moreau Kusunoki Architectes/Guggenheim

Image courtesy of Moreau Kusunoki Architectes/Guggenheim