"Triple A? For a country that is basically always insolvent? Seems like a pretty cool outcome, and 32 years seems like a long, long time. As you can see, the concessions were made early, and in the time of another government. From Germany's perspective, it is around 700 Euros per man, woman and child of Germany."

To market to market to buy a fat pig. Whilst Serena seems sure to capture her 20th title in Paris over the weekend and hopefully Djokovic can break his duck, the action was happening a little further north in Brussels overnight. Not so much in Brussels, more to the South East in Athens as politics, more specifically the ruling coalition Syriza has elements objecting to the bailout compromises. And what this means is that the Greeks have delayed their 301 million Euro loan repayment. The country is going to use the "Zambian option" and bundle their repayments to the International Monetary Fund at the end of the month. And this comes less than 24 hours after Greek Prime Minister Alexis Tsipras said that they were going to make the payment. It turns out that being noisy and dealing with realities are two different things.

So pressure from back home has caused the crowd negotiating in Athens to back track a little. It is complicated, like most relationships. Angela Merkel says that everyone must be together on this. They are all Europeans and all want a solution. True story. Yet the Greeks reckon that everyone is asking too much from them, the rest of the European bargaining group suggest that more will be done. So now we are stuck with another stale mate and perhaps another uncertain week or two. I am afraid that is what it has come down to for the Europeans again. I can tell you that there are unintended consequences to this, perhaps not all bad, most especially for Mario Draghi. It might have for a short time put a cap on the rising yields of the German Bund. The reason why the Greek ten year (or an instrument acting for it) has not blown out is that the answer actually lies as to who Greece owes the money to.

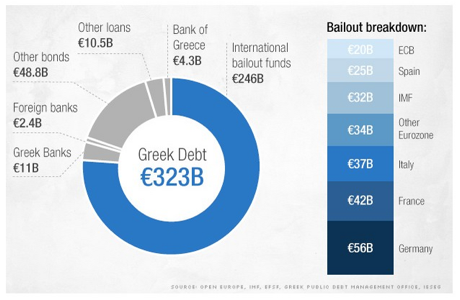

Here goes: Greek debt crisis: Who has most to lose? This is back from February this year. I can capture the CNN graphic:

This Bloomberg article has a long Q&A segment, after the Greek elections: Greece Seeks Third Debt Restructuring: Who's on the Hook?, which includes this nugget: "The European Financial Stability Facility, the euro area's original crisis-fighting fund, which has lent the country 141.8 billion euros, and hence owns about 45 percent of its debt. The average maturity of EFSF loans to Greece is just over 32 years, with the last payment due in 2053, according to the EFSF's website. Greece pays about 1.5 percent on those loans, comparable to what a AAA rated country would be charged. The rate fluctuates based on the EFSF's own borrowing costs."

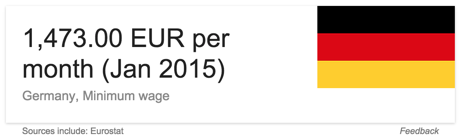

Triple A? For a country that is basically always insolvent? Seems like a pretty cool outcome, and 32 years seems like a long, long time. As you can see, the concessions were made early, and in the time of another government. From Germany's perspective, it is around 700 Euros per man, woman and child of Germany. From France's perspective, it is (at 66 million people) 636 Euros per man, woman and child. Italy? With a population of nearly 60 million, it is around 630 Euros each. The rest of the Eurozone (about 127 million souls) are on the hook for 270 Euros each. These are neither big, nor small numbers. In total (if all the debt was owned by Europeans) the number is closer to 1000 Euros a pop. So how much is that? According to the Google search function, this is minimum wage earnings in Germany:

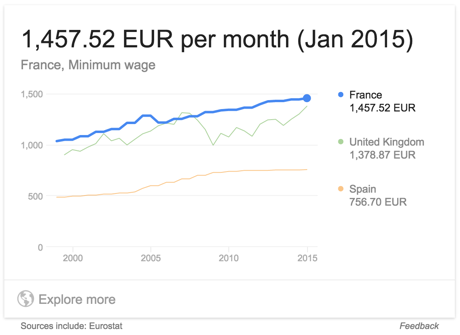

France? The UK? Spain is thrown in there for good measure. This of course is on a monthly basis, strangely the query that I stuck into the Google algorithm hunter was the same as before, i.e. I just substituted France for Germany and I got a different outcome. Here goes:

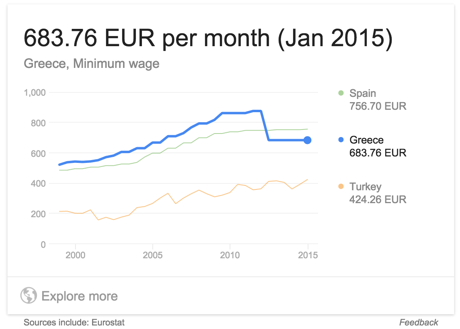

The question then comes, what is the moral hazard of excusing more debt? You must remember that the first restructuring of debt, 100 billion Euros were written off around 900 Euros per man, woman and child in Greece. What is that, in terms of minimum wage? It is about a month and a half, bearing in mind that not each and every Greek person works. Minimum wage in Greece?

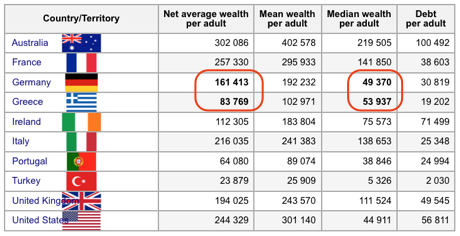

OK, do yourself a favour. Click on the following link to take you to an image that displays Median Wealth per Adult in OECD Countries (2013). What is astonishing about that is what we are about to show in this spreadsheet piece that I stuck together, for the purposes of this conversation, data from: List of OECD countries by wealth per adult, 2013.

Remembering that median is not average. I really hope that you were paying attention in Statistics class. My statistics lecturer was from Eastern Europe and like naughty young men (more like older boys) we giggled a lot at his pronunciations. Darn, we were childish. Median is the middle, as the name implies and average is well, the average. Which is not the middle, capiche? The problem is solvable, like many other problems, it certainly is not a binary situation where it is default or no default. Clearly Europeans are rich people who have the financial resources to sort themselves out. I would not worry too much, there will be a resolution, perhaps some more restructuring, perhaps buying of more time for everyone concerned. From all the articles I have read, from all of the interviews that I have seen with the people that count and have something to lose, they are looking for a resolution.

Fact of the day Whilst the first coins minted by humanity took place around the same time in India, China and Greece around 2700 years ago, what is the oldest coin still in circulation? It is a 10 Rappen coin, first minted in 1879 and still legal tender today. The Rappen is the coin of the Swiss Franc, not only are they officially used in their home country, they are also used in Liechtenstein, a country of 35 thousand people. On a per capita basis however, this tiny country is in second place.

The first bank note is older than you think, over 2000 years old, during the Han dynasty. Although it was not a note, it was made out of leather. 900 years ago Emperor Huizong of the Song Dynasty established government run factories to produce notes. There was a temporary use, three years. I guess they figured that the paper quality would deteriorate. Other Chinese dynasties (Yuan, Ming and Qing) established and used paper money.

A Yuan of course is the Chinese currency, according to Wiki the locals call it kuai, which means a lump. A lump of silver actually! If you think that the connection with the Dollar (the US one) is new, think again, the modern day Yuan originally (in 1889) was equated at par value to the Mexican Peso. All the Chinese have done is moved north, the Renminbi used to be pegged to the US Dollar until 2005. And moving further to the north, the next time you go to Zimbabwe you may be able to find the only other country in the world that uses the Yuan officially. Yes, Zimbabwe.

Linkfest, lap it up

I really enjoyed this video. It is 13 min long, so an age in a modern context but well worth the watch. The video highlights how people viewed the world in the 60s and 70s and how very wrong the predictions of the future were - The Unrealized Horrors of Population Explosion

The law of unintended consequences, here is an example of how things went in the opposite direction than intended - Perverse Consequences of Well Intentioned Regulation: Evidence from India's Child Labor Ban. The basic result was that a child labour band was not enforced across all industries, resulting in a higher supply of child labour moving to the non-enforced industries, driving their wages down and resulted in more children going into child labour in order to keep the household income at the same level.

Good coffee is starting to be a basic human right to many, the company (and man) who had a big influence on how the world consumes coffee is Starbucks - From the projects to a $2.3 billion fortune - the inspiring rags-to-riches story of Starbucks CEO Howard Schultz. His drive and determination has created a company that has rewarded its shareholders and its employees, These Are All the Awesome Benefits Starbucks Baristas Get.

This is a great article on what it takes to be a trader, from personal experience I can agree with the survival and success stats - LIVING ON THE EDGE OF A TRADER'S SEAT. We are not traders so we do not use leverage and try take advantage of short term swings. Investing is about long term wealth creation.

Home again Today is non-farm payrolls, that time of the month where we get a number from the BLS guesstimating what the number is. I am thinking that this is more important in the medium term than the Greece issues. I am not saying that it is not important, it certainly is, it is however consuming too much of our time. The market finally has a smattering of green across the screens today.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment