"On Saturday morning Tsipras announced that on the 5th of July a referendum will be held and the Greek people will decide on what to do. The result is mass confusion as to what the future looks like. The first problem is that the referendum may end up voting on proposals that are no longer valid as the deadline to reach a deal is tomorrow."

To market to market to buy a fat pig. The big news over the weekend is still the developments in Greece. On Saturday morning Tsipras announced that on the 5th of July a referendum will be held and the Greek people will decide on what to do. The result is mass confusion as to what the future looks like. The first problem is that the referendum may end up voting on proposals that are no longer valid as the deadline to reach a deal is tomorrow. The second problem is that a referendum may not even take place as some policy makers are saying that it may not be legal. The third problem relates to what the referendum will state, there are many moving parts to a potential deal, where some people may be happy with a certain level of compromise but not another level of compromise. Or will the result be to stay in the EU at any cost? Tsipras is in between a rock and a hard place. He was elected on the promise of lowering the debt burden but at the same time you do not want to be the Prime Minister who was responsible for your country leaving the EU. A referendum will allow him and his party to put any fallout blame on the Greek people themselves, where you can say the Greek people spoke and we implemented what they wanted.

Uncertainty has lead to people taking money off the table so to speak. Asian markets were deep in the red, the Hang Seng is currently down 3%, the FTSE is down over 2% and our market is down almost 2%. In Greece the banks and the stock market are closed today and there is a limit on ATM withdrawals of 60 Euros. The banks will remain closed until at least next week, after the proposed referendum. The bank closures are needed because a healthy bank can very quickly go bust if people believe that it is no longer healthy or in this case when people think the country that the bank operates in, is no longer healthy. Until there is certainty of where Greece is heading, there is going to be pressure on the banking system; the situation does not need to be made worse by the collapse of banks.

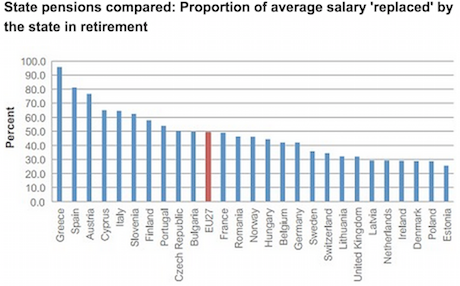

I don't think anyone wants to leave the EU but at the same time, having to cut back on government payouts will not be pleasant for the man on the street. Remember that one of the cut backs that will need to be put through is cut backs to pensions, the older you are the harder it is to still be working and it means you are essentially out of time to get a private pension going on the side. Here are some graphs showing how expensive it is for a state to fund a state pension.

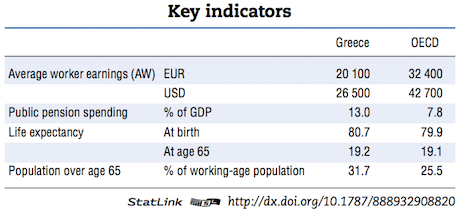

Numbers from OECD report on pensions

A number of figures stick out for me, the first is how much more than average Greece pays in pensions as a percentage of GDP (13% v 7.7%). The other is relative pension that is paid out by the state in replacement of salaries (over 90% v 50%), which is again high. It is now clear why pension cutbacks need to take place for the government to get its spending in a place to pay back debt. The other stats to point out though is the Average Workers Earnings, which is around half that of the OECD average (explains why pensions are so high relative to average salaries). The next stat is the the percentage of the working population over 65, which sits at 30%; higher than the OECD average. There is a higher pension burden on the taxes of those people under 65.

The big news out of the US on Friday was the announcement from the US Supreme court that same sex marriages were legalised in all states. Regardless of your views on same sex marriages, there are definitly better things to be spending resources on than fighting it. The interesting thing to note though is how quickly public opinion has shifted in favour of it. I have seen a couple articles talk about how social media has made it more of a central topic and probably had an impact on the shift in public opinion.

Moving to the East, things are very volatile in the Chinese stock markets. Over the weekend China cut their interest rates by another 25 basis points to 4.85% which coupled with the Greece developments resulted in a very volatile market. There was an intra-day swing of more than 10%, the market bounced between being positive 2.5% and negative 7.6%, finally closing down 3.3%. Volatility like this is definitely a symptom of leverage where people start selling because they have to and not necessarily because they think they should. The problem with buying stocks with borrowed money is that when markets go down you can loose most or all of your initial investment which means you need to sell to keep the shirt on your back. One persons selling pushes prices down further which means the next person needs to sell their shares to not 'blow up' and so the cycle continues.

Company Corner

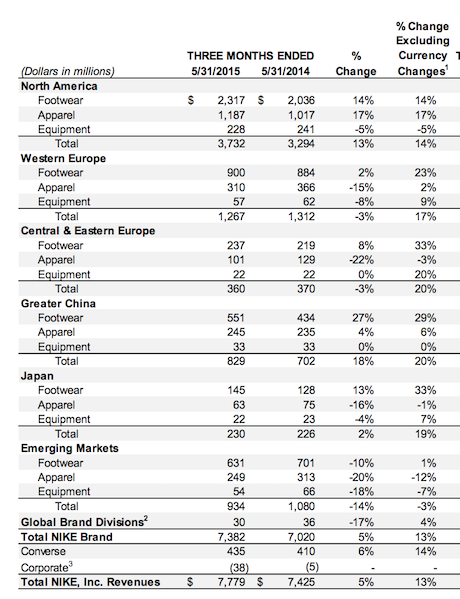

Last week Nike released solid fourth quarter and full year earnings which comfortably beat estimates, pushing the stock up 5% on Friday. Fiscal year revenues were up 10% to $30.6bn, this was up 14% if you exclude currency movements. Diluted earnings were up 25% to $3.70 per share for the year thanks to improving margins, share buy backs and of course solid sales growth.

The table below breaks down their sales by region, and then between Footwear, Apparel and Equipment.

For the full year footwear represented 58% of sales and grew by 17%, Apparel represented 29% of sales and grew by 10% while equipment contributed 5.7% of sales and was up 1%.

The stock price certainly reflects the growth and growth expected. Trading at $109.70 it affords a forward multiple of 26 times next years earnings. But with earnings growth of 25% the PE ratio to growth is close to 1.

Now we need to ask the question, will Nike maintain this incredible sales growth and what will be the drivers behind it?

First and foremost, brand strength is incredible. They are the Apple of apparel and footwear. They have just won sponsorship of the NBA and already dominate the NFL. They sponsor most of the major sports teams and personalities around the world. Here at Vestact we believe that not only will the adoption of sports and active lifestyles go from strength to strength but also the viewerships and following of professional sports. It targets our inner instincts for competition, rivalry and pride for club or country. In female sports this is also growing fast. The ladies Football World Cup is currently underway and receives huge media attention. There are huge global sporting events all the time and they are receiving more and more attention, especially amongst social media.

Participation rates are also growing fast. In the US there were 25000 marathon runners in 1976. In 2013 there were 541000. In 1976 10% were women, today 46% of the runners were female.

Nike have also embraced and to an extent pioneered the shift to athletics wear as a fashion statement, it even has a name, Athleisure. This shift has been huge for their apparel sales and we expect this to carry on growing, especially as it gets embraced in developing markets.

Our Investment philosophy at Vestact is to select stocks which are leaders in sectors which we expect to grow faster than what the market expects. Even though the market has high expectations we still believe it is underestimated amongst apparel and sportswear. We continue to buy Nike shares at these levels.

Linkfest, lap it up

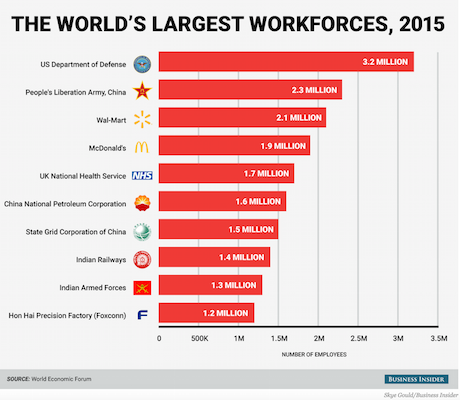

It makes sense that armed forces are some of the biggest employers in the world - These are the 10 biggest employers in the world. I was surprised to see the UK NHS on the list.

An attempt like this pushes man and machine - Swiss Pilot Begins 5-Day Flight Attempt in Solar-Powered Plane. I struggle to be in a plane for longer than 12 hours, I cant imagine doing it for 5 days!

Home again, home again, jiggety-jog.Markets are down around the globe. Greece is being smeared all over our screens. Uncertainty means sell now, ask questions later. We remain calm here.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment