"So how is this going to work? Remgro, through a subsidiary in Jersey (Remgro Jersey, strange that, hey?) will buy the 29.9 percent stake for 8.6 billion Rand. Now you must remember that Remgro are the largest shareholder in Mediclinic, they own 41.3 percent of the business. Mediclinic, and this is the important part for us as Mediclinic shareholders, will then look to raise 10 billion Rand by offering 111 million shares at 90 Rand a share."

To market to market to buy a fat pig. There was a pretty big swing in markets here locally through the afternoon, the only stocks as a collective that managed to end in the green were the industrials. And that was just. US markets were having their equivalent of futures close out, triple witching is what they call it. As a holder of stocks and not a trader, this event has very little impact on you. All that it means is stock indices futures, stock futures and stock options all expire on the same day. File it in the drawer of events that happen, yet they do not impact on your life specifically. Things like a massive amount of sport on the weekend, if you are a Stormers fan then think about the free time you are going to have over the next two weekends rather than having to be somewhere, that sort of thing.

Whilst the Greek issue remains front and centre, somehow people are mystified at how this is not impacting the markets more. It is small, that is why. The total economy is less than 2 percent of the overall European Economy. It is solvable, that is why. I wonder if the government ever thought about asking the diaspora to lend a hand? According to wikipedia, there are an estimated 3 million people of Greek descent living in the US, 700 thousand in Australia and 400 thousand in the United Kingdom. In South Africa there are around 50 to 60 thousand, in Canada there are around 720 thousand, Germany, around 320 thousand. Add those all up and you can get to around half of the current Greek population. As I scroll right down the list I get to Mozambique and see that the estimate is 20. I remember that there was actually a Greek Orthodox church in Maputo, a woman that worked with my dad was Greek, so I guess I knew 5 percent of all the Greeks in Maputo. Here in South Africa, well, much less.

There seems, as we thought there might be, concessions from the far left. Which means that the Greeks may get the money in order to pay for the IMF portion of the loan, perhaps we should update it to getting (rather than rob, that is mean) from Petros to pay Paulos. I still think that the base case is that the Greeks concede and stay inside of the European Union, why would people be drawing money out of the system on masse, otherwise? Greek deposits are at an 11 year low.

As far as I can understand it, from the current withdrawal mode (around 1 to 1.2 billion Euros being pulled a day), reserves would be exhausted inside of the next four weeks. And then that would constitute a bank run. So all rich Greeks are telling you is that they want to still be inside of the European Union, otherwise they would gladly accept the alternative. As important as it is, it really is not the only story in town, it is just being made to seem that way as it is the most newsworthy. File it in the same drawer as options expiry day, it happens, yet as a longer term stock holder it has little or no bearing on what you are trying to achieve with portfolio construction. Even Bloomberg this morning asked if it is a sideshow, a very important one I would say, not the news that should make headlines every day.

Company corner

Whoa! This is huge. Mediclinic are going to buy a 29.9 percent stake in a LSE listed business called Spire Healthcare Group from Remgro, who will acquire it first from a crowd called Cinven. The exiting shareholder, Cinven, is a private equity business who initially bought the whole business, which consisted of 25 hospitals back then from BUPA in June 2007 for 1.44 billion Pounds. The business, Spire, was listed in 2014, Ciniven's holding went from 98.6 percent to around 54 percent. I am not entirely sure whether or not they will still hold stock after this, Cinven that is, in Spire. In April this year, JP Morgan placed 40 million shares with institutional buyers to see the Cinven stake reduce to 38.3 percent. They had previously done almost exactly the same number of shares in January of this year, clearly the stake was there to be exited and this probably serves the Spire Management really well.

So who are Spire Healthcare? They are one of the leading private hospital groups in the UK, operating (as per the prospectus): "39 private hospitals and 13 clinics across England, Wales and Scotland. The Group delivered tailored, personalised care to more than 236,000 in-patients and daycase patients in 2013, and is the leading provider by volume of knee and hip operations in the United Kingdom. The Group estimates that it also had more than 1.7 million out-patient episodes (including consultations) in the same period." They are specialists in orthopaedics, one of the majors in the UK. So, older patients being more active and getting paid by the NHS, that sounds like a good place to be invested? Yes, the short answer is definitely yes.

So how is this going to work? Remgro, through a subsidiary in Jersey (Remgro Jersey, strange that, hey?) will buy the 29.9 percent stake for 8.6 billion Rand. Now you must remember that Remgro are the largest shareholder in Mediclinic, they own 41.3 percent of the business. Mediclinic, and this is the important part for us as Mediclinic shareholders, will then look to raise 10 billion Rand by offering 111 million shares at 90 Rand a share. The number of shares in issue currently is around 865 million shares, around 1 per 8 shares you have right. I guess we will know in the coming weeks how it all works out. For the time being, all you need to know is that Remgro have the money to purchase this stake (which they need to get as a matter of urgency) and secondly, Remgro are the main shareholder, who will get their own back here by underwriting the rights issue.

What are Mediclinic ultimately buying? Well, for 8.6 billion Rand, for the 29.9 percent stake, you are getting 22 million Pounds in earnings on a pro-forma adjusted basis. As per the release. At the current exchange rate, that amounts to 424 million Rand, which means that this was bought at a pretty lofty valuation, around 20 times. That is however less than the Mediclinic rating currently. The share price of Mediclinic initially sank, it is however higher, along with the rest of the market, it is up around half a percent. What they are buying, Spire Healthcare, is 9 percent higher. It is however, below the price that they are paying, 360 pence is the purchase price, currently 349 pence.

Is it a big deal? The current market cap of Mediclinic is 86 billion Rand. The purchase consideration is around 10 percent of the current market cap, there is of course going to be a dilutionary impact in time. From a profits point of view, marginally more, the business is new to the market (even though the Spire assets are older). Opportunities finding their way through the developed market, Mediclinic is evolving faster than most would have anticipated. We certainly view this as a positive, remembering that the share price performance has been awful, since it peaked at 133 Rand a couple of months ago. We continue to recommend buying this company on weakness, at and around 100 Rand a share.

Taylor Swift is peeved at Apple and perhaps rightfully so, I can see it from her perspective. She reckons that many artists are too scared to speak out against the giant as a result of their clout, this time it is as a result of a three month free service for people using Apple streaming. Swift does not want her album there, she obviously can afford to be picky I guess, she hardly had a ghetto upbringing. That is not fair, you know what I mean though. So here is the letter: To Apple, Love Taylor. As she says, she is just doing this for the new artist, who cannot look out for themselves yet. She just reckons that Apple should start charging people from the beginning. I guess that might well be right, as she points out, she did not get a free iPhone, why should people get free music?

Apple caved. Eddie Cue, a big deal at Apple tweeted a series of tweets to confirm that artists will be paid for the three free months, read tweets from the bottom up of course:

No Apple "stakeholders" (I don't really like that term), rather shareholders will pay Apple Music streaming artists for three months. Bravo Taylor and bravo Apple for sorting this out so quickly.

Staying with Apple for a second and then shifting gears, the Lex column in the FT pointed out, sales from Apple watches alone may fetch around the same that Swatch might do for the full year. That is pretty astonishing that a new product can do as much in sales alongside a company that has been around for three decades plus. Of course the precursor to the Swatch brand and the group was Omega and Tissot, as well as Longines. And just recently they, Swatch, bought Harry Winston, which has been around since the 1930's. Omega is more than 110 years old, Tissot is 150 years plus, Swatch itself is "new" by watch standards, a dinosaur by internet standards.

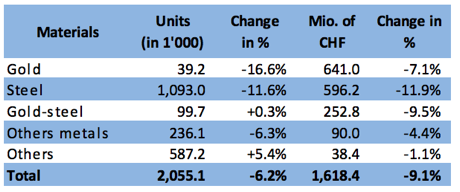

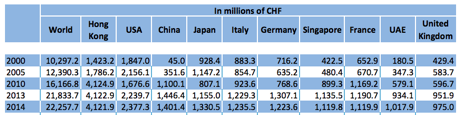

Staying with watches for a moment, the Federation of the Swiss Watch Industry (FHS) pointed out that May sales saw the total Swiss Franc amount for the year (versus last year) come in flat. You can check out the sales numbers year to date, World distribution of Swiss watch exports. What is most interesting from that .pdf document is that whilst the biggest market in the world is Hong Kong, mainland China, the US and Italy all bounced back sharply. And I think that you want to know this too, how many watches a month are finished and sold. Roughly 2 million a month, around 25 million watches a year. See from this table: Wristwatches by materials:

They sell, as you can see, a lot of steel watches, half of the watches sold every month are stainless steel. Gold, not so many, around 2 percent of total sales. What is however more amazing is the following longer term Swiss watch exports by country, over a 15 year period, you can see how the value has exploded in China and Hong Kong. Equally the UAE experienced a whole lot of new watch sales, in 15 years, the most astounding is clearly mainland China. Who went from 45 million Swiss Francs in sales to 1.4 billion Swiss Francs. Whilst China is still a way off the biggest market in the world (Hong Kong), they are catching them fast:

What is more amazing is that the top five countries in the world (if you count China and Hong Kong as one) account for half the watch demand globally, the USA, France, Italy and Japan make up the balance of that list. The Germans obviously like German watches and not Swiss ones, even though in terms of proximity and access, it is the "closest". Perhaps the Germans are just less flash and more about functionality, then again, one hates to generalise. Any thoughts on that?

Linkfest, lap it up

Having a look at one of South Africa's best companies - The Steinhoff story - revisiting the humble roots of today's R260bn giant. I always enjoy reading about where companies begin. This piece is from 2006 which is before they become the power house they are today.

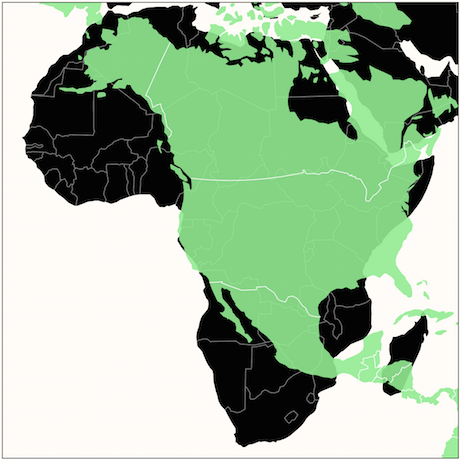

Given that most of the maps we see are flat; our view of relative size is distorted - Is Africa bigger than North America?. This web page allows you to compare different part of the globe with other parts.

Data consumption in South Africa is soaring and it is using mobile connections thanks to Telkom dropping the ball - Demand for online video soars in SA. Here is the reason to own MTN and Vodacom, "That number puts internet traffic at 24.5 Exabytes per month by 2019, a 10-fold increase over 2014 numbers."

Our lives are very busy and fast paced, so if I can get an extra hour or two out of a day because I sleep less then that is great - I once tried to cheat sleep, and for a year I succeeded. The conclusion is that we can't cheat sleep for the long term but the writer gives some good insight in their journey to changing their sleep patterns. I liked the concept of having power naps and being refreshed when you wake up (my most productive time is in the morning). I'm not sure taking a nap at my desk will go down well though.

Home again, home again, jiggety-jog. It is a holiday in China today. So at least their market cannot go down again, it has certainly been a lesson for the millions involved in the equities market there. I guess the important "thing" is that investors learn that there is no such thing as easy money. And this notion that there is free money, nonsense, each Rand/Dollar/Pound is hard earned. I can't ever remember the last Rand being easier to earn than the next one, no sir.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment