"So the market did not cheer the higher number than anticipated, the market did not cheer the fact that there were more people in the workforce, the labour participation rate increased causing the unemployment rate to increase, the market did not cheer the fact that average hourly earnings were higher than anticipated. The market in New York, or Mr. Market, viewed this as a negative. Why? That means rates in the US may go up soon."

To market to market to buy a fat pig. When is good news interpreted as bad news? Equally, when is bad news interpreted as good news? Or is it just a case of when the news is bad, it is bad, when it is good, it is good? That is the camp that I fall into. However, the market and the broader participants in determining what the prices should be today interpret the incoming data in a different way. The balance of all the prices that we see today reflect what the sellers and buyers are willing to pay.

Why is this important? Watching the data that is? I often ask myself as stock investors, trying to identify the very best possible opportunities, do we need to watch each and every economic release and then pick it apart? The monthly non-farm payrolls number released at 15:30 Jozi (Jozi) time on Friday can be found at the Employment Situation Summary. This is the number of jobs added in the US economy, according to the Bureau of Labor Statistics from Washington, DC. DC is of course the District of Columbia, it is not a separate state. The residents do not elect any person to Congress. There are calls to return the district to Maryland so that citizens can send someone to represent them. Strange, for a reason however, to be independent.

So the market did not cheer the higher number than anticipated, the market did not cheer the fact that there were more people in the workforce, the labour participation rate increased causing the unemployment rate to increase, the market did not cheer the fact that average hourly earnings were higher than anticipated. The market in New York, or Mr. Market, viewed this as a negative. Why? That means rates in the US may go up soon. I suspect that if we had a Rand for every time that I said that (and every other person), then we could retire and live off the interest. Rates will and have to rise inevitably. Do not however let it impact on the way that you invest in the equities market, I am sure that whilst interest rates go up it has to impact on companies and their ability to raise money at cheaper rates, no doubt about that, historically however we should expect rates to stay lower for longer. Interpreting from the incoming data what the Fed is likely to do next should not be part of your investing strategy, that is best left to people with shorter term time frames.

Fact of the day George Orwell's 1984 was published on this day in 1949. It was supposed to be a look forward into a world in which the stage controlled everything, even your thought processes, doublethink, thoughtcrimes, those were some of the ideas that Orwell put forward, in what painted a bleak picture for humanity. In reality, communism existed in Eastern Europe for a little under 50 years, the whole idea that we are all the same does not exist in reality, you can try, yet you will never suppress the human spirit. The will to survive and trump our fellow human being is hard coded.

Is there an example of 1984 anywhere in our world? I suspect there is one obvious case. North and South Korea were separated after the Second World War. For a while, "things" were so good in North Korea that families of Korean ethnic origin in Japan moved to the North, life was obviously better during the 1960's. Working for the collective good of everybody is good for a while, then greed and complacency sets in, that is just the way that humans work. Which is why counterbalances such as democracy are there to keep the powers that be on their toes. However, the North is hardly a society of equals, there are apparently 51 different social categories of people, ranked by their loyalty to the regime, or the Juche. The irony is that the Juche actually says that individuals are masters of their own destiny. You do have choices, 28 government approved haircuts are the choices given to women, although in reality these are just a rough guideline in a conservative society. And clothing choices, jeans are a no-no, although recently women can wear pants. Recently.

According to the stats, the individual in South Korea is better off than the individual in North Korea. They shared the same history for thousands of years, how could there be too many differences over the last 70 odd years? For starters, the average Northerner is shorter than the average Southerner, as a result of malnutrition. The average GDP per capita (PPP) (if that is a measure of success) is estimated to be 1800 US Dollars per individual, whereas in South Korea it is 36600 Dollars (PPP), 20 times more, i.e. the Northerners are 5 percent to the Southerners GDP per capita. Average life expectancy in the South is ten years more than the North. The population in the South is double that of the North. When the German integration happened, the Easterners GDP per capita was 40 percent of their Western counterparts. Any integration is going to be very hard.

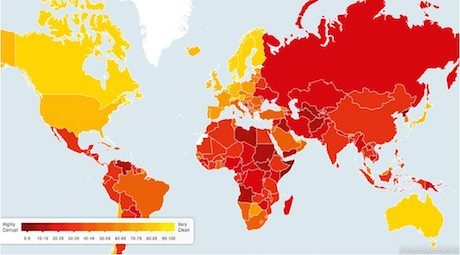

Perhaps my obsession with North Korean society comes from my family having been booted from Russia in 1917, having lived and seen ordinary people suffering in Mozambique in the 1980's and never wanting ordinary people to experience the "ordinary" of socialism. Capitalism might not be utopia (the rich stay rich and protect their own), yet it rewards smart and hard work. It rewards society in return, many people who make money then in turn donate large pots of it. The living pledge for example is not a North Korean initiative. That country is the most corrupt in the world, coincidentally. Richness, wellbeing, longevity and so on are closely linked to democracy, check out this map, taken from the BusinessInsider article: The 17 Most Corrupt Countries In The World:

We have only ourselves to blame, democracy is where change can be affected at a grass roots level. You get what you vote for, always. Talking of which, a marginal change is afoot in Turkey, the incumbent being trounced, their support base is down 20 percent. The Deputy Prime minister in Turkey is suggesting that they can form a coalition, it is going to be tough to push through the "reforms" that the ruling AKP thinks the country needs. This is the country telling the leaders no thanks.

Linkfest, lap it up

Will investors shifting away from fossil fuels make a difference? The way I see it, if less people are willing to invest in fossil fuel type companies, the value of capital will be less so you will get less when/if you decide to sell. The big but is that you will be able to buy these assets at much cheaper earnings and dividend ratios, which is great news for people who don't intend to sell the assets but use its cash flow for further investments. My conclusion is that shying away from fossil fuel investments won't kill the industry; the only way that things change is if there is a cheap and reliable alternative and consumers change their spending habits - Norway confirms $900bn sovereign wealth fund's major coal divestment.

If you go back a couple decades; the higher you were paid, the more leisure time you had - THE HIGHEST-PAYING JOBS OF THE FUTURE WILL EAT YOUR LIFE. Given all the time people will spend working, they won't have time to spend the money. The result may be that people tend to semi-retire at a young age.

What is the reason for the discrepancy in the results and reality? - Americans claim to love craft beer, but they actually buy Bud Light. The first problem could be that not enough people were sampled or the American demographics were skew. Another reason could be that there is a very limited distribution of the more "premium beers" or people have their daily beer and then a beer for special occasions. I suspect all three reasons play a role. The study highlights though how reality can differ widely from what surveys say.

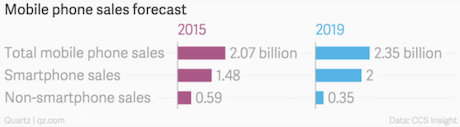

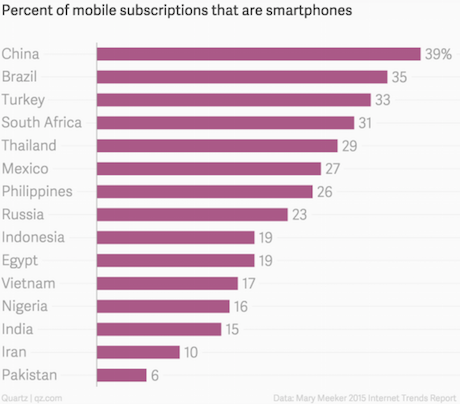

590 million dumb phones will be sold this year; if I had to guess, the number would have been half of that - There's still plenty of money in dumb phones. Given poor internet connectivity and limited access to electricity, it does make sense that so many people decide to go with dumb phones. Having a look at the following graphs, there is still huge growth potential for the likes of Apple and then MTN on the data front.

There are 200 million brokerage accounts in China. This is awesome: Unprecedented levels of activity in China's equity markets. Who knows where it stops or ends, I am pretty sure that many stocks are overvalued, that is no different to any other bad behaviour that humans have shown in the past.

Home again The Apple Developer conference starts today, you can follow everything via their website: WWDC15. The 5000 tickets were sold out in less than 2 hours, developers who were asleep after two days of binge coding, five pizzas and seven cans of energy drinks missed out, sorry. Is this conference in any way different from the annual Berkshire AGM, or is this a place where the company showcases the future, as far as they are concerned? The expectations are for new software, perhaps even explaining some new hardware, or a combination of both. Even a television service. We will see. Locally the market is down one-third of a percent, the Dax has entered "correction" territory, which means it is down 10 percent from the recent highs.

Sent to you by the Vestacters, Sasha, Michael, Byron and Paul.

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment