"As the above image shows, the core business, Chinese e-commerce grew revenue by 42%. The number of buyers that visit Alibaba's sites is rather mind numbing. Over the last 12 months they grew their Annual Active Buys base 9% to 443 million people. A large chunk of buyers are accessing the sites via mobile, with Alibaba Group recording that 80% of their Chinese sales come from mobile devices. "

Attention: One of our sub-tenants is moving to Cape Town so we have some open offices to lease. There are 2 spaces available, one is 32 square meters, the other is 12 square meters. Fully serviced, in Melrose Arch. Please get in touch if you are interested.

To market to market to buy a fat pig We were doing a little low level historical research on matters such as immigration laws, stumbling across things such as Sicilian Americans and another nugget of history, as far as immigration controls are concerned, the Immigration Act of 1924. Josh Brown, the reformed broker stuck together a bunch of posters from yesteryear - To my Jewish, Irish, Asian and Italian friends. Enough said. Read the last two paragraphs.

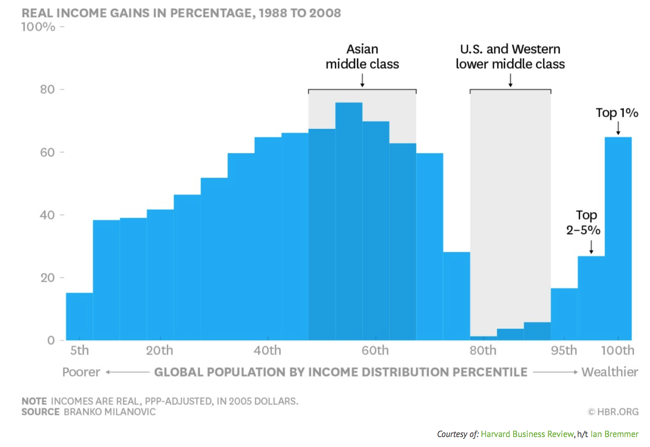

The reason why this is close to home is that my grandfather was a refugee when he was just a child, orphaned by an ideological war (that worked out for nobody) between communists and imperialists. If only they had been capitalists, and chasing the bucks, instead of each other and cursing each others dumb ideas. If only they had all adopted free market principles and the most efficient person would have ended up winning, bettering humanity. Capitalism may certainly not be the most perfect outcome, it certainly is the best system we have for now. We are all different, we are all the same. As an investor there is nothing that you can do about politics, know that it passes like the tides, it may consume your all and make you mad in the moment. Have a cool head.

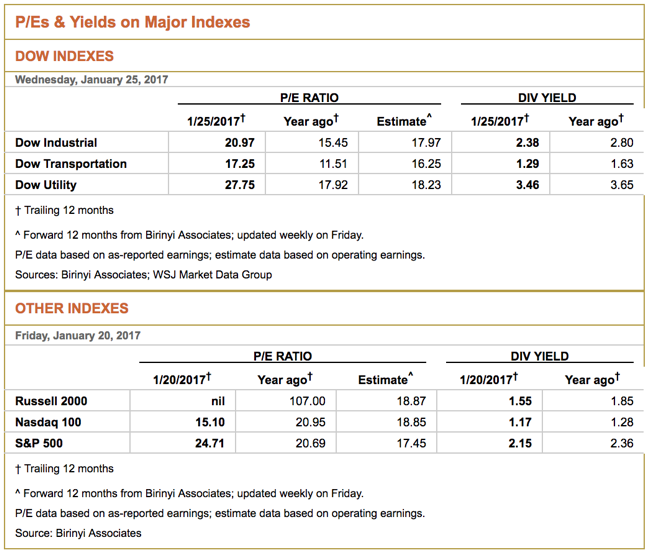

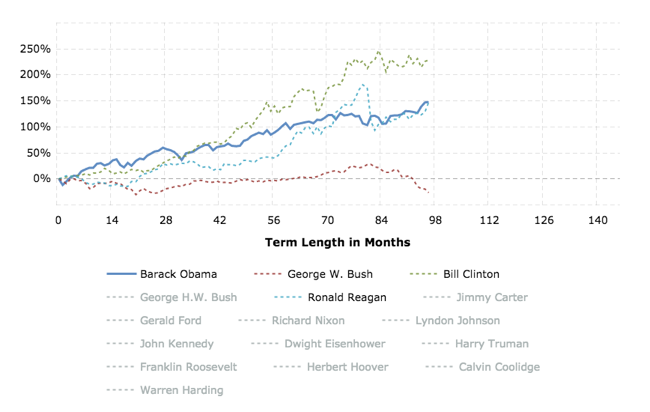

Stocks across the oceans and far away, in New York, New York, slipped hard at the beginning of the session, bouncing back in the last half hour of trade. The Dow Jones gave up just over sixth tenths of a percent to close below the 20K mark, now that the territory has been breached, fear not sports lovers. The S&P 500 fell by exactly six-tenths of a percent, the nerds of NASDAQ gave up over four-fifths on the day, energy stocks slipped heavily. Basic materials too. It was a pretty broad based sell off, a jolt for the happy go lucky attitude we have seen recently. The Fed are meeting this week, and there is of course non-farm payrolls a little later, Friday. Perhaps they will be YUGE, perhaps they will not be YUGE, time will tell whether employers are willing and able. Starbucks suggested that they planned on hiring 10 thousand refugees. That is ten thousand jobs, in America. Ah yes, great again.

Locally, stocks were still suffering from cabinet reshuffle anxiety. There was a ruling party press conference that ran in the background for a little. The sell off was pretty broad based, down nearly six-tenths on the All share, financials sank nearly one and a half percent by the close. Banks down heavily too. Gold stocks were the real winners on the day, up over three and a half percent, a stonker as they say in the classics. Afrox had a trading statement that exited the markets, in truth the share price is up only ten percent in five years. It has been tough out there for their products, which at some level are a proxy for the economy.

Company Corner

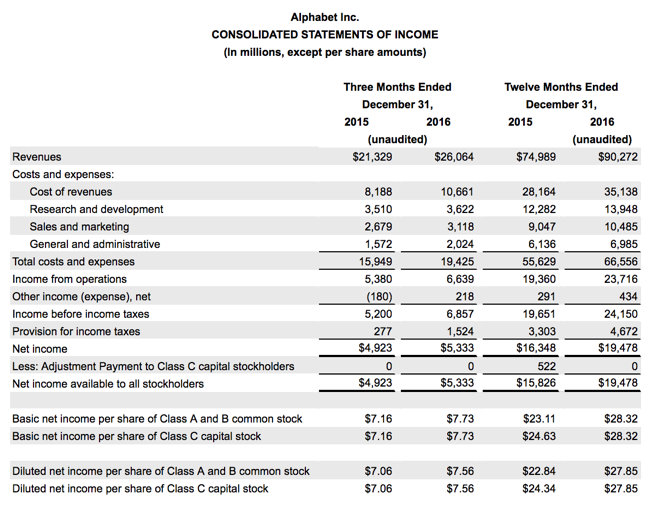

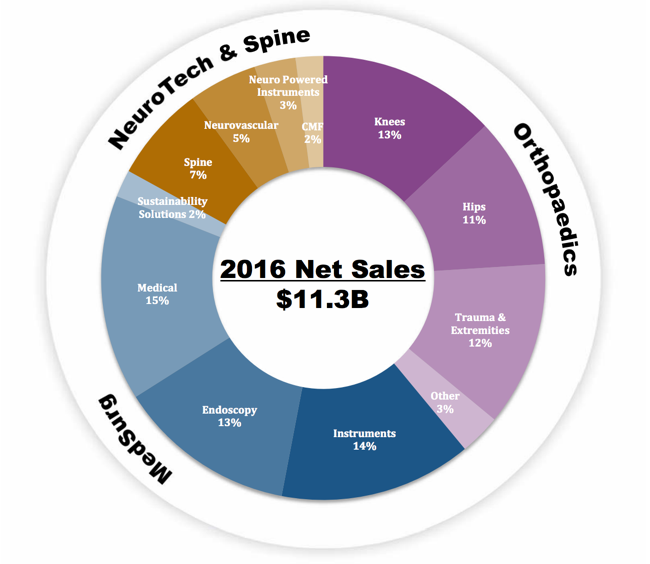

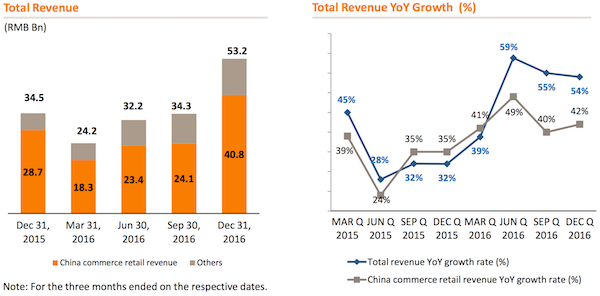

Last week we had 3Q numbers from Alibaba Group, the Chinese e-tail giant. The company is still growing like gang busters, with revenue up 54% YoY!. The huge growth is not coming off a small base either, with revenues for a quarter currently sitting around $7.7 billion.

As the above image shows, the core business, Chinese e-commerce grew revenue by 42%. The number of buyers that visit Alibaba's sites is rather mind numbing. Over the last 12 months they grew their Annual Active Buys base 9% to 443 million people. A large chunk of buyers are accessing the sites via mobile, with Alibaba Group recording that 80% of their Chinese sales come from mobile devices.

As fast as their core retail division is growing, their non-core assets are growing faster. The cloud division grew by 115% YoY but is still only 3% of the entire groups revenue. What is impressive is the number of users of their cloud operation with user numbers growing by 114 000 users in 3 months to 765 000 users. Despite all the growth the division is still loss making.

Their biggest non-core operation is Digital Media & Entertainment Segment, which grew revenue by 273%. The growth in revenue didn't translate into higher profits, the division made bigger losses for the quarter. Like other companies operating in the segment, spending on content is important. Increasing the spend now means losses upfront but the building of a base for the future.

All the top line growth means nothing if it doesn't drop down to the bottom line. Non-GAAP EPS grew by 38%, so still good growth but not in the league of 54% seen in revenue growth. Where were the increased costs? Alibaba group spent more on improving their logistics network, increased spend on content for their Digital Media & Entertainment segment and then good old share based compensation where there are now more shares in issue.

There is no doubt that e-commerce is here to stay and growth rates will continue to be double digits as internet penetration increases and as more people feel comfortable inputting their credit card details. Sales for their international retail division grew 288% but still only accounts for 4% of revenue.. As Chinese sales begin to slow the international division should carry the slack.

The concern with the company though is their complex holding structure, understanding it can be called murky at best. This structure has also resulted in a probe by the SEC which is still ongoing, SEC probes Alibaba accounting methods, shares dive.

Amazon is still our preferred company in this space, they have a better distribution network, better cloud division and better online entertainment division. The big thing that Amazon doesn't have is the big exposure to the Chinese market and for that a non-core Alibaba position in your portfolio might be worth it.

Linkfest, lap it up

Starbucks is always pushing the next technological boundary, as far as it can go, from a food ordering point of view. This is interesting - Starbucks Debuts Voice Ordering, Allowing Customers to Place Orders 'On Command'. Now if your daughter's name is Alexa and you want coffee, you may need to think differently about how you ask her if she wants a cup. The role of Chief Technology Officer is pretty new, from late 2015 to date, Gerri Martin-Flickinger has been in that role. Watch the associated video where the woman orders and pays for multiple items, pretty impressive.

Staying with Starbucks, nice message from Howard Schultz - Message from Howard Schultz to Starbucks Partners: Living Our Values in Uncertain Times:

"We are in business to inspire and nurture the human spirit, one person, one cup and one neighbourhood at a time - whether that neighbourhood is in a Red State or a Blue State; a Christian country or a Muslim country; a divided nation or a united nation. That will not change. You have my word on that."

It looks like the consumer wasn't too concerned about the VW emissions scandal. VW was crowned the world's largest car maker in 2016 beating Toyota, who held the title for the 4 consecutive years before that - It's Official: Volkswagen World's Largest Automaker 2016. Or Maybe Toyota. The numbers are a bit murky though and depending on how you define "largest automaker" Toyota could still be defined as bigger than VW.

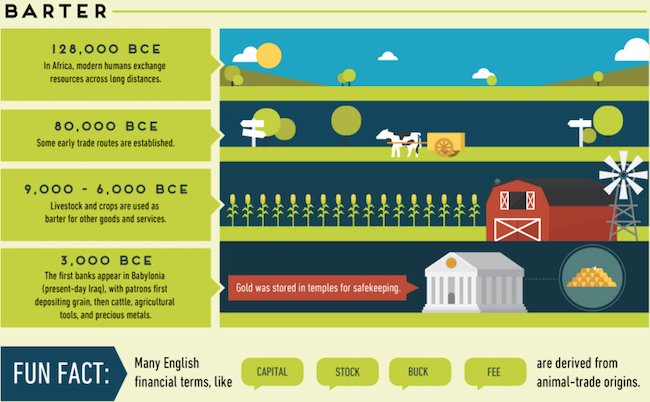

Money is just a tool to speed up the exchange of goods and services. Barter is slow and inefficient, money solves those problems by being a common medium. Due to money just being a medium of exchange it doesn't need to be backed by anything. Having it being backed by something like gold means that your currency fluctuates with the supply and demand of gold, which is very disruptive to an economy - The History of Money Explained in One Infographic

Home again, home again, jiggety-jog. Japanese markets have sold off heavily, stock futures are pointing to a lower start across the way, down around one quarter of a percent. I am guessing that we will be led a little later by these moves, Apple reports tonight, that is good, I am all for focusing on companies. This happens to be the biggest in the world, expectations are for 76 million iPhones to be sold.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063