"With all the information available to all of us as a collective, you would expect prices to be more stable and you would expect price discovery to be more "swift". Yet there is often scrambling and flopping all over the show, only with markets to recover and the last "event" that was so important become less so. The big ones we all remember, the shorter term ones fade into obscurity over time."

To market to market to buy a fat pig Done and dusted, 2016 that is. We (humanity) love patterns. It helps us survive, recognizing what may or may not happen next and then makes us cautious. We needed this for survival in a deeper and darker world when we competed head on with animals for resources. As a result of this wonderful interest in patterns, we tend to measure things inside of defined patterns, be they calendar years or halves or quarters. One has to measure comparable somehow, and a trip around the best energy source, the most underutilized energy source, the sun. 2016 will show that for the local equity markets that we fell, in a time that the inflation number topped 6 percent. In real terms (and the feeling too on the streets), it was a very poor year for local equity markets.

For stocks of a Greenback flavor, the S&P 500 nearly added 10 percent in a year that saw Leicester City win the Premier League, the British people vote to extricate themselves from Europe (how and when, nobody is sure), and the Americans voted for a TV reality star as leader of the Western World. It is what it is, ironically the Trump picks may well be good for business and stocks, the market has pre-empted all sorts of rules and tax codes being shuffled and repealed. This may be positive for tax code and the first three to four months is key in what policies we are likely to see. Brexit, who knows. That remains a bad idea, trying to pull yourself away from globalisation. In the end, cheaper labour will force you to change the way that you do business. I am sure that during the industrial revolution the world was going to hell in a hand bag, as the uneducated masses stormed the urban areas, which could not cope with the shifting dynamics. Perhaps there is much of that happening in other places across many developing markets.

We have more information each and every day than at any other time in humanity. I am painfully aware that more than half of the world still needs access to the internet, whether it is quality or not is another story altogether. Those making big money decisions will have access to everything they need, the average investor can access almost everything they need, what they may not need (for big policy decisions) may come at a price. And may not necessarily be useful, as Michael and I were discussing this morning, it was Peter Lynch who famously said "The way you lose money in the stock market is to start off with an economic picture. I also spend fifteen minutes a year on where the stock market is going."

As a stocks guy, I tend to agree with him. At one stage I used to get wrapped up in the nitty gritty of economic news, I used to get wrapped up in the political discourse. I used to write about politics ..... a lot. And then it struck me that as holders of equities that we do not hold politicians or economies. We hold stocks that wrap business across multiple economic policies and geographies. So whilst we may believe that what happens between Germany and Greece, Chinese official figures (who nobody seems to believe) and the US (constant anxiety over rates and the state of the economy) may be the most important thing in the world (wall to wall coverage and writings), it may be a waste of energy and precious time to focus on this entirely.

Lastly, in this shorter back to work piece, prices change and you and I have absolutely zero ability to control stock prices. It is a little bit like flying in an airplane, statistically people know that flying is one of the safest forms of transportation, that does not stop the "fear" factor. Yet, they will jump in front of the wheel, with no worries about a motor vehicle screaming down the road in the opposite direction that is completely unroadworthy. The road more travelled (with motor vehicles) is dangerous, yet we think it is "comfortable". Flying, that is safer and quicker. And did I mention safer?

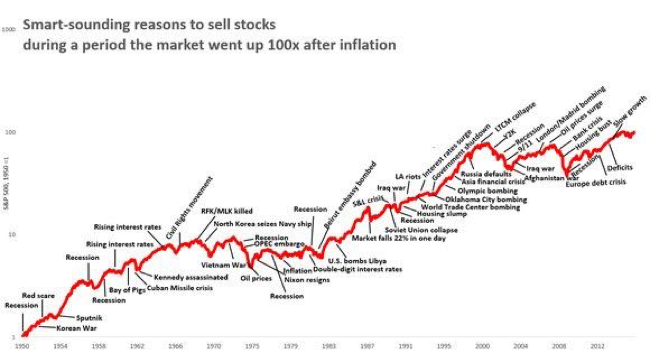

We also live in a credit card world, where if you have access to resources, you can get anything from anywhere in the world delivered to you, at a cost of course. With all the information available to all of us as a collective, you would expect prices to be more stable and you would expect price discovery to be more "swift". Yet there is often scrambling and flopping all over the show, only with markets to recover and the last "event" that was so important become less so. The big ones we all remember, the shorter term ones fade into obscurity over time. Check this out:

We will revert shortly with a "welcome back" message and review what wasn't really a good year for some equities, some had a fabulous year. And that is the way that sometimes the mop flops with owning direct equities, there are good years and bad years. Do not let a calendar determine whether or not you should own some of that, or some of this, as a result of what has happened already. Remember that regardless of whether it is on the 31 December or 2 January, companies sell the same "things". You should invest in that manner too.

Linkfest, lap it up

Morgan Housel was done with the Motley Fool last year, he moved on. These guidelines are Investing Is a Fascinating Business

Don't like athletic wear as general wear? I have bad news for you, you had better get used to it. Fashion trends change over decades, years pass before we recognize them as every day life. Fast company reckons this (and more) is likely to become themes in fashion in 2017 - No More Athleisure, Brick And Mortar, Made in China? How Fashion Will Change In 2017. In this category we own Nike.

This is amazing, and I think the driverless technology has happened far quicker than most would have noticed. See this - Watch Tesla Autopilot Predict a Crash Seconds Before it Happens. Tesla remains an interesting opportunity, it often seems binary. I suspect that Musk will prove the naysayers wrong, even in light of an energy policy that may change.

Home again, home again, jiggety-jog. Stocks have started well. Like Dean Elgar and David Warner. Welcome back, if you are back, I hope you are all well rested.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment