"Not only are the company a coffee experience destination, by adding rewards members via their excellent technology platforms, they lock you into the daily routine, they aim to continue to stay abreast with the changing patterns of consumption. Having partnered with WeChat (TenCent owned platform) in China, more Chinese customers can gift each other, or pay, using their existing infrastructure. This is key to finding the right partners and speeding up the payment process, which means getting your coffee quicker. Productivity gains through technology enhancements. "

To market to market to buy a fat pig Stocks in Jozi lifted marginally, up by nearly three-tenths of a percent at the bell. Resources were a marginal drag, down a percent in total, although Kumba topped 200 bucks at one stage, up 4 percent on the day. One year, up 512 percent, three years, down 54 percent. Amazing to think that the stock has delivered those types of returns and once again goes to the core of the cyclicality of the mining business, and how hard it is to call.

Amongst the majors, the Sasol share price was sold off more than a bit, perhaps the idea of a "steadier" Rand and oil prices hovering here for the time being point to a re-rating of some sort. Although as a veteran journalist said to me yesterday, Sasol are always at pains to say that they are a chemicals business. Some negative commentary around the banks saw the share prices fall, Nedbank down one and a half percent. a Lonmin output report saw the share-price shaft sunk, down 23 percent on the day. The stock is down 95 percent plus (plus a heavy and very deep rights issue), and whilst the near death experience has been averted, it remains to be seen how long the company will take to return to profitability.

Across the oceans vast and wide, stocks in New York, New York were mixed by the close. The Dow set another all time record, 20100, up 0.16 percent on the day. What is in an index that is calculated and not led by market participants? Well, the WSJ weighed in with an interesting one yesterday - We're Already at Dow 30000, You Just Don’t Know It. Does that mean that my Dow 36 thousand hat is in a "better" place. Or does it mean that we should (and often discussed) pay more attention to the S&P 500.

That index (the S&P 500) closed down 0.07 percent, whilst the nerds of NASDAQ nearly squeaked out a gain, coming up a point and a bit short of break even. Hopefully we will be driven by earnings through this period in the market and not distracted by rhetoric, see Trump's Economic Approach Starts to Take Shape by Mohamed A. El-Erian. Talking of earnings, let us dive straight in here, GOOGL and SBUX!

Company Corner

The company formally known as Google, Alphabet, reported their numbers for the fourth quarter and full year after the market closed last evening. Google still exists, it is just a business division. For the time being, the other businesses (aptly named "other bets") which includes a whole host of interesting opportunities, is unprofitable and contributes next to nothing on a relative basis to revenues.

It may sound a little strange, and I was having this conversation with a client yesterday about this very point, if you can find an investment that has a founding principle of doing good in the world, that venture may well be staffed with exceptional people that offer an amazing product, and by extension the profitability of such a business will be a foregone conclusion. You will obviously recall the "An Owner's Manual" for Google's Shareholders, which was released at the IPO. You can access the archive of Founders' letters

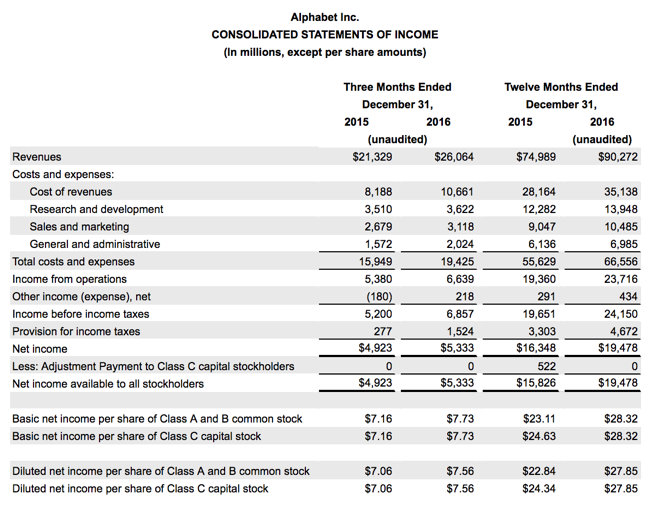

That letter is always worth reading again, at least once a year. Remember that the same fellows write a similar letter each and a every year. They (Larry and Sergey) suggest that the time horizon for judging whether you are onto something is three to five years. I think that is a fair shake of how one should see any of their newer investments, the "other bets" segment. Herewith the whole group for the full year revenues and income (money received):

Ruth Porat, the CFO who returned to California after some time on Wall Street, said (for the quarterly part) that "revenues (were) up 22% year on year and 24% on a constant currency basis. This performance was led by mobile search and YouTube. We're seeing great momentum in Google's newer investment areas and ongoing strong progress in Other Bets". For the quarter, non-GAAP diluted earnings per share clocked 9.36 Dollars a share, up sharply from a year prior, shy of the street estimates though, the street had pencilled in 9.64 Dollars of earnings per share.

Reported revenues for the quarter were much stronger than the market had anticipated. To put into perspective that this is primarily a "Google" business (all the advertising revenues via the web), that division clocked quarterly revenues of 25.8 billion Dollars, other bets in total increased markedly from last year, still a small contributor, 262 million Dollars for the quarter. That "other bets" sucks so much cash that the operating loss amounted to 1.088 billion Dollars, down from the 1.2 billion for the comparable quarter last year. The core Google business reported operating income of nearly 7.9 billion Dollars.

The market is not too "impressed", the stock is down just around two percent after hours. The long term story remains intact, expectations are for revenues to increase in the high teens this year, to top 90 billion Dollars. In all likelihood, 2018 could see revenues top 100 billion Dollars for the first time. Earnings growth is likely to be in the low twenties percent for this year, EPS may clock somewhere in the region of 41.5 Dollars a share (Bloomberg has 41.26 Dollars), meaning that the multiple (price-to-earnings) is around 20x forward, the PEG ratio is around 1.25 times. That is certainly good value for a company of this magnitude. We remain buyers of what is a business that is always at the cutting edge of innovation, I suspect that "other bets", which may top revenues of 1 billion Dollars this year, is just starting.

Starbucks is another business that reported numbers after the bell yesterday. The headline says it all - Starbucks Reports Record Holiday and Record Q1 FY17 Results. Revenues rose 7 percent to 5.7 billion Dollars, a strong showing in both China and decent enough in the home market. What is also being highlighted is the number of US rewards memberships, which rose 16 percent to 12.9 million folks. Earnings per share grew 11 percent to 51 cents, margins increased by ten basis points, which is always good to see as a shareholder, moving in that direction. The company has a fairly generous dividend policy, 25 cents a share is the current quarterly dividend payment, up from 20 cents previously.

251 stores were opened during the 13 week period in North America alone (currently 5415 stores in total), 303 more in China! Across the rest of the globe it was 95. The expectations across the group are for 2100 new stores to be opened. On a longer dated look, the company expects that by 2021 another 12 thousand net additions, by that time the network would top 37 thousand stores. Currently it is 25,734 as at January 1. That is pretty sizeable, the group are up to over 1000 stores in South Korea (I am guessing 0 in North Korea), over 2500 stores in China (in 118 cities) and now 1245 stores in Japan.

The business in China will be their largest business in the coming decade or so. What is quite amazing is that there are fewer stores in the traditional coffee drinking countries than you may think, 58 in France (the whole country), 161 in Germany, 101 in Spain and of course, zero in Italy, for now. I don't feel so bad for the 3 that we have here, Taste Holdings are doing a good job!

Not only are the company a coffee experience destination, by adding rewards members via their excellent technology platforms, they lock you into the daily routine, they aim to continue to stay abreast with the changing patterns of consumption. Having partnered with WeChat (TenCent owned platform) in China, more Chinese customers can gift each other, or pay, using their existing infrastructure. This is key to finding the right partners and speeding up the payment process, which means getting your coffee quicker. Productivity gains through technology enhancements.

The flagship roastery in Seattle (Paul visited it recently and sent us some pictures) looks absolutely beautiful, a true destination of sorts, see the pictures - Roastery & Tasting room. Coffee truly is a global drink, one that is multicultural, whether you are loading up on an espresso in Italy or drinking condensed milk infused coffee in Vietnam, the social interactions and friendship building (or you quick caffeine fix) at a place that feels homely, is important.

The product is quality and really appeals to the up and coming (and established) middle classes across the globe. In a way it is the same experience whether you are aboard aircraft carrier USS Harry S. Truman (staffed by sailors), or in the Louvre (missed that one) or at the Tower of London, your fix is almost always around the corner. Aircon and Wi-Fi too, right? Their in-home reserve business (bring your beans back home) will no doubt grow over time too, with more "home" solutions. A consistent in-store experience is key to customer retention, as are the prime locations. And of course the rewards program, which is real.

It is always worth noting that Howard Schultz, the current CEO and founder steps into an executive chair position, Kevin Johnson steps into the CEO role; you will recall that we wrote about it in December - Schultz shuffles over, COO holds the coffee cup now. The company announced two days ago that they have strengthened their non-executive management team, the executive chairman of the LEGO brand group, Jorgen Vig Knudstorp joins, as does President and Chief Executive Officer of Sam’s Club Rosalind Brewer (name made for the job) and Satya Nadella, the CEO of Microsoft. Wow. That is a pretty strong team. Technology, logistics and distribution and global brands, all there, dare I say it .... Like a boss.

The company is still around 110 million shares away from completing their buyback program, having acquired 7.6 million shares in the last quarter. There are 1.46 billion shares in issue, that is a buyback of 7.5 percent of all the shares in issue. Over time, of course to a certain extent that is diluted by stock based compensation. Starbucks is a great brand, the guidance may have disappointed to the downside, hence the stock has sold off nearly 4 percent after-hours. We continue to favour (in this space) what we think is an exceptional brand with superb products that consumers are desperate for. The stock trades on a pretty demanding multiple, 27 times forward and we are confident that they can meet the lofty expectations of the investor community. We definitely accumulate on weakness. If congestion is a big problem (as reported), solving it with technology is a huge win in the future.

Linkfest, lap it up

I can associate with this. My little girl has a name similar to the Amazon Echo speaker assistant, Alexa. What happens when your name happens to be the same as the "assistant, Alexa? According to the WSJ, the 39th most popular name in the US. Alexa, Stop Making Life Miserable for Anyone With a Similar Name! You now know why Apple called their assistant Siri, it sounds like a real name, yet I have never met or seen the name.

Does your Wi-Fi stink? I mean the speeds and the ability to access at "all angles" in your office or home. Here are some devices and tips from an exceptionally detailed Bloomberg piece: The End of Terrible Wi-Fi Is Near. I want you all this weekend to stick your wifi in the middle of your house now!

We will have more on this in the coming days, a major deal announced by JNJ yesterday - J&J to spin off Actelion R&D unit into new biotech in major M&A deal.

Real life usage turning into the conversion of a sceptic is not new for Apple products, it is *nice* to see this type of write-up though - Comment: Going from a skeptic to an every day user with Apple Watch Series 2. Battery life is key here, I am very sure they will get it right.

Home again, home again, jiggety-jog. Stocks across Asia are a mixed bag, Hong Kong markets off a little, Japanese markets up. The futures market is marginally lower. Forget the wall and who is going to pay for it, who eats the strawberries, the avos and who drinks the tequila? Who goes where for holiday?

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment