"Bill Gates of Microsoft started a business out of his garage, Phil Knight of Nike sold another business's shoes out of the back of his car, more recently Mark Zuckerberg founded Facebook in the more comfortable surrounds of his university dorm room. Really? Probably more comfort for the Zuck, better aircon and of course he had the internet already. Amazon, Apple, Disney and Google were all apparently hatched out of their founder(s) garages too."

To market to market to buy a fat pig Financials and retailers on the local front took some heat, I suspect that at this time of year jostling takes place amongst money managers and perhaps we are in the crosshairs of an EM and South Africa specific selling. Time Magazine, for what it is worth, cites South Africa in amongst their top ten risks for the year of 2017. Moody's (via a Reuters article) had South Africa (and the UK for that matter) on the list of potential downgrades to another credit rung this year, in our case the word junk will mean non-investment grade. There was also a story about poor December sales for the retailers, the local ones, those results will hit the streets and screens over the coming weeks. Colloquially it was too difficult to tell, the shops always look busy to me.

By the close of business in Jozi, where the streets are still relatively quiet (for Joburg), stocks as a collective reported a little more than a half a percent slide. That move included resource stocks that rallied nearly three-quarters of a percent, general retailers were smoked over two percent whilst banks slipped two and one-quarter of a percent. Industrials, which form a large part of the overall mix slipped one and one-quarter of a percent. Steinhoff, RMB Holdings, Barclays Africa and FirstRand led the charts in amongst the losers, winners included Amplats and AngloGold Ashanti, as well as Glencore and BHP Billiton.

Despite the relative carnage, there were some impressive new 12 month highs for Nedbank (before they sold off heavily), Imperial (ditto) and Astral which managed to cling to their gains. Banks, trucks and chicken, yip, everything is in some way or another connected. No trucks to transport the chickens means consumers never eat bird, no finance for the trucks, the chickens may as well fly to the consumers plates. Brait slipped to another 12 month low, the sales update from UK retailer Next, two days ago is dragging the whole sector lower across in Europe. We are going to have to continue to be very watchful and patient here.

Across the seas and over the oceans vast (only ten percent of the entire planet is arable land, whilst 1.15 percent is permanent crops), stocks in New York, New York were mixed by the close. A good day in some parts, in particular with tech stocks, the nerds of NASDAQ closed up one-fifth of a percent by the close. The broader market S&P 500 ended the session a smidgen lower, whilst the Dow Industrials slipped just over one-fifth of a percent.

I know it is too soon to say, there seems to be a shift away from the so called Trump trade, less financials and more technology. What is happening is that it is becoming increasingly apparent that Amazon is eating the lunch of traditional, old brick and mortar businesses. Macy's and Sears are cutting store frontage and jobs, Amazon is growing fulfillment centers on the other hand. You do not need to be a genius to figure out that the consumer is shifting shopping patterns in a hurry. Yet .... Amazon is opening a bookstore in Columbus shopping centre, in the Time Warner Center. Right on the bottom left corner of central park in Manhattan.

We are now two weeks away from the Trump inauguration. There is a Wikipedia page for that already with a smiling fellow, the 45th president of the US. What happens with policy and action in the coming months will be closely watched, remember the saying, it is not what I say, it is what I do that counts.

Often when we make investments in a specific company we tend to get lost in the size and scale of the business. When looking at the current size and scale of a business and we sometimes fail to fathom how something so big as a Giant sequoia was once a seed. Wiki tells me that the Hyperion is the tallest tree, the cypress and baobabs have greater diameters and the oldest is the Great Basin bristlecone pine, you get the drift and the reference to trees and seeds though!

Bill Gates of Microsoft started a business out of his garage, Phil Knight of Nike sold another business's shoes out of the back of his car, more recently Mark Zuckerberg founded Facebook in the more comfortable surrounds of his university dorm room. Really? Probably more comfort for the Zuck, better aircon and of course he had the internet already. Amazon, Apple, Disney and Google were all apparently hatched out of their founder(s) garages too.

The story goes that Larry Page and Sergey Brin actually rented a garage from a mate. Don't feel bad for her, Susan Wojcicki is now the CEO of YouTube. If your friend has an idea and you back them ..... you never know. Sergey Brin ended up marrying Susan's sister (Anne), that ended recently, in 2015. Anne in her own right is an amazing person, once a Wall Street analyst (healthcare sector), she unsurprisingly runs a biotech company called 23andMe. Anne, the next big thing? Maybe.

I suspect the point that I am trying to make, having read many books about founders of businesses and their trials and travails over the years and decades from the formation of the business to the present size is that there are many times that they could have thrown in the towel. Perhaps fame and fortune came a lot easier for the Zuck, which is why he is able to enjoy the annual goals more than say, Walt Disney. Not only did Walt invent Mickey Mouse, he was also his voice in the early days. He won 22 Oscars and was nominated 59 times.

He (Disney) has been departed a long time now, in fact Disney died when our own Paul Theron was a mere two days old. That is right. Yet .... the enduring nature of the brand and the content that still continues to flow boggles the mind. I was chatting to Michael the other day about the Disney movies he saw when he was growing up, he hardly missed one on the list that I read out. The company has the legacy and ability for the business to continue to adapt and evolve with the rest of us.

Mattel originally sold picture frames, the left overs were turned into doll houses which sold better than the frames. A toy company was born. Jeff Bezos sold and delivered books from his garage, changing the name of what is now know as Amazon from Cadabra (it sounded too much like cadaver he said). The rest as they say, for all these businesses, is history.

I think that very often we get lost in the mists of pricing, blaring TVs, large swathes of paper and online content that is produced about the potential or past returns of the businesses that we hold, and we often forget that we hold a part of a company. A company that employs hundreds (if not millions) of people across the globe. A company that has loyal customers consuming their products and services day in and day out. That company operates day in and day out, working essentially for you. Your holding in that company is a slice of future profits and the growing of the business through the reinvesting of another slice of profits. The value of those future profits is reflected in the daily share price movements, be they swayed by actual real news on the business (less of an occurrence) or more likely some piece of economic news.

Heck, I bet if company management listened half the time to the talking heads telling us how gloomy it is out there, they would shut their factories, store frontages and immediately cease business. That bearish news sounds so clever, we are drawn somehow to bad news thanks to survival instincts. Lucky for us stock holders, the people that make the money decisions and have business ideas are optimists. They take chances. They make calculated decisions. And we can continue to prosper off their ideas and inventions, long after they are gone and long after they leave their respective businesses in the hands of the next generation. Ignore the same people who continue to make wild predictions, they may be "right" for a while, in the end they will drive themselves crazy, chasing their tail like a mindless, seething mad Jack Russell terrier.

Oh, and by the way, it happens to be non-farm payrolls today. A massive number in the lives of headline chasers and traders. This will be the most important number ........ since the last one.

Company corner

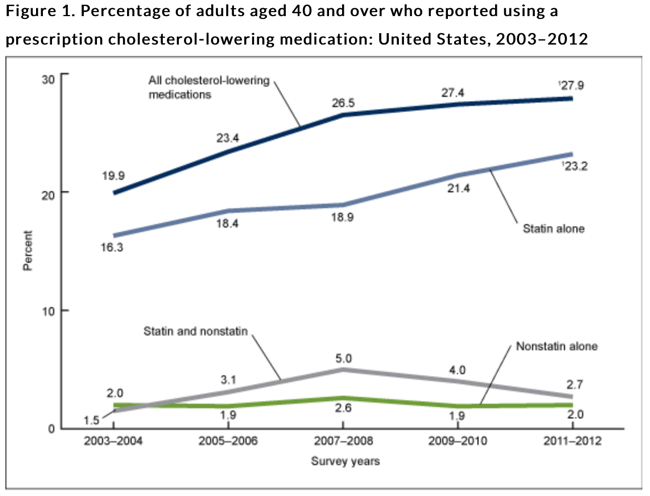

It is not often that one has to watch legal judgments with your stocks, you would hope that the companies you own stay out of the courts. That is nigh impossible in the modern era though, there is always much open to interpretation. See the story that concerns one of our stocks - Amgen Wins Ban on Sanofi's Praluent Cholesterol Drug Sales. As you can see from the story, Regeneron and Sanofi will appeal this ruling.

As the Bloomberg article points out, this is a big deal for everyone. A big deal for consumers and all the companies concerned. Of course consumers would like alternatives and more choices and definitely cheaper drugs to treat their aliments, over one in four Americans over the age of 40 suffer from high cholesterol and take medication. As such, these are very necessary drugs to reduce the risks of hear disease in later years. See the associated graphic (the usage is rising) from Prescription Cholesterol-lowering Medication Use in Adults Aged 40 and Over: United States, 2003-2012

These drugs in question however are for people who do not respond to the normal treatments, these are for much higher (bad) cholesterol readings. The fewer preventable diseases out there, the better for humanity. The cost is always the issue though. It is a weigh off against the ethics of charging high prices in order to recover the costs of research and development, to fund future development, to cover the costs of failed developments and then of course to make a profit too. The one thing that this business has taught me is that those with free reign are always dictated to by the consumer. If the costs are too high (you may think that an iPhone is too expensive or a Starbucks cappuccino is too excessively priced, the consumer decides that), the product won't be appealing and the company won't pursue that avenue. It will not be long before we hear more on this case.

Linkfest, lap it up

A fun article from the BusinessInsider, you may be looking at or for a new job, these are useful tips from the Oracle of Omaha for his character traits - Warren Buffett looks for these 3 traits in people when he hires them. I think that the three are pretty simple and speak for themselves - Intelligence, Energy and Integrity.

This is pretty interesting, from the FT (subscription), where Barclays considers Elon Musk delivering timeously on the Model 3 and the power walls (the storage devices) as a black swan event for oil prices. See - Barclays considers Elon Musk a potential commodity 'black swan' of 2017

We talk a lot about these points all the time, it is sometimes gratifying to see someone else make these points - Profitable New Year's Resolutions for Investors. Charts are for the birds, they tell you nothing about the future and are only good for historical context.

Whether or not you saw this, or not, here goes - It's official: A brand-new human organ has been classified. It is always fun to wake up (humanity as a collective) with an extra part each. How does that make you feel?

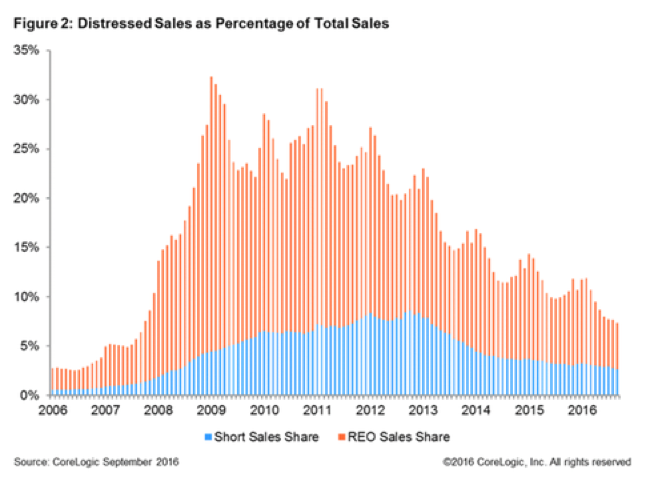

This amazed me. It was a graphic on the number of forced sellers back in the day when subprime mortgages imploded, that was in the US. What then arose was distressed sellers and more importantly for the financial system, there is a person on the other end of the transaction who is willing to take on the risk and be patient for years, or a decade plus. You will still be pretty surprised that in the land of the free (and the American dream of owning your own home) that Distressed Sales Make Up 7.3 Percent of All Home U.S. Sales.

Home again, home again, jiggety-jog. Stocks are trading mixed to begin with, some up and some definitely down. I suppose that much of the day will be dominated later in the session with the non-farm payrolls, stand by around three thirty local time for the number.

Sent to you by Sasha, Byron and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment