Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. The market was a bit like a lazy afternoon of getting on and off the couch, hugging the line between slightly positive and slightly negative. Alas, the overindulgence meant that the market was lower at the end of the session, but it was not without trying hard towards the close. The financials led the decliners, with Old Mutual shares falling hard on being ex their hefty special and normal ordinary dividend, slightly cushioned by the share consolidation. Lending positive support were industrials, beverages (read into that SABMiller), construction found themselves in a very bad place, down another one and a half percent.

There is very little happening on the local companies front, I did mention that earnings season is going to be huge in the US, starting yesterday with a disappointment in earnings from CitiGroup, but the stock actually rallied after having been down in the pre market. There is a Spanish debt auction of shorter term debt today, just after a German sentiment number from the ZEW. But the big one for Spain is going to happen on Thursday. I laughed at John Robbie (or is it Robbie Johns?) when he said about Spain, "Things theem not thoow good". I think that the ECB will restore confidence and be participants here in the Spanish bond auction, just to lend a little bit of a hand and settle things.

SABMiller yesterday announced that they were going to be expanding into the rest of the continent (ex South Africa) and investing around two and a half billion Dollars. They plan, as far as my reading is concerned, to revamp existing operations, and build new breweries. Meeting growing beer drinking demand, remember that whilst beer for rich people is not necessarily a luxury, premium beer products amongst middle class folks show that they are upwardly mobile. Even if it is just the facade of being upwardly mobile, beer is a cheap luxury. And Africa as a continent is a growing market with a big growing (and better earning) population for many fast moving consumer goods businesses. Not an industry that we like in the long run, you can already see how the ban in advertising of alcoholic beverages is getting the brain gears moving.

But that is a separate story altogether, another one that we are watching is the Australian cigarette packaging ruling -> Tobacco Firms Challenge Australia Plain Packs. I can see how this is an issue for both sides, just where do you stop telling people what you can consume and what you can't. BUT, if you are paying for their healthcare at the states expense, perhaps you can tell folks what their consumption habits must be. Nannying? Or just simple economics? Whilst the tax revenues on cigarettes is still big, what is bigger is health related economic losses. Check this from the tobacco atlas piece titled New Tobacco Atlas Estimates U.S. $35 Billion Tobacco Industry Profits and Almost 6 Million Annual Deaths: "During 2000–2004, the value of cigarettes sold in the United States averaged $71 billion per year, while cigarette smoking was responsible for an estimated $193 billion in annual health-related economic losses."

Notwithstanding that, from the same document: "More than 43 trillion cigarettes have been smoked in the last ten years and cigarette production has increased by 16.5% in that time period, according to The Tobacco Atlas. Annual cigarette consumption has also increased significantly during this time period." WOW! That is amazing. So, whilst my long term theory remains intact, the share prices of the listed stocks, especially the one (and only one) that we have access to here, BAT has been a massive winner for shareholders. HUGE. But I have suggested that the stock looks quite expensive now, and perhaps will lose the defensive qualities in due course. But for the mean time folks still rate the stock a buy and better than all of their peers. I wonder what the Chinese government will do, as deaths directly attributed to smoking are going to rise to 3.5 million people per annum by 2030. So, that is enough to wipe out the whole of South Africa in 14 odd years!

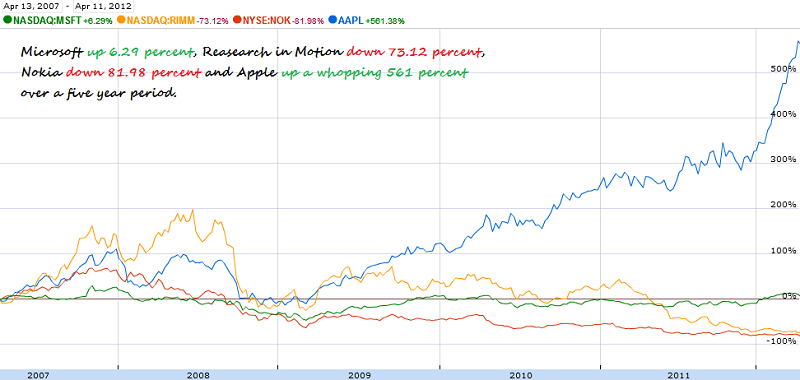

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Phew, there was major hand wringing around the Apple share price falling 4 percent in normal trade and one percent post market, the folks have been real nervous here. Real nervous that they did not miss out and now real nervous on the selling front. Amazing! The market cap went from 600 billion just a few days ago to 540 billion at the close of business last evening. That is like wiping Nokia and RIM out three times over. Sounds more dangerous when you say it like that. The nerds of NASDAQ sank three quarters of a percent, the broader market S&P 500 ended about flat, whilst the Dow Jones industrial Average added over half a percent.

Byron's beats takes a look at retail sales in the US yesterday:

- Yesterday we had retail sales figures come out of the US which showed some healthy growth. Sales grew 0.8% for the month of March which was way above the expectations of 0.3% thanks to a stronger jobs market. Most of the growth came from increases in building materials, autos, furniture and clothing.

This is great news for the global economy because we all know how important the US consumer is to the overall mix. It also shows that the US consumer has been very resilient to the increasing fuel prices. This has been a major concern for economies across the globe as disposable income gets sucked into transport costs rather than general consumption thanks to the elevated oil price.

I stumbled upon this interesting article from the WSJ which highlights a few factors explaining this consumer resilience. What interested me was the part about fuel economy. According to a study done by the University of Michigan the average vehicle sold in March got 24.1 miles to the gallon compared 20.8 four years ago. That is a 15.8% increase in millage per gallon. They also mentioned that alternate sources of transport are being used and people are actually driving less.

I may be going on a tangent here but this data makes me think of our situation in SA with regards to fuel increases and the e-tolls. We often forget or don't even know that we are consuming less fuel and that the cars we drive are much more efficient than in the past when fuel was so cheap. Yes inflation is certainly an issue when it comes to fuel increases but I do not think that the e-tolling and petrol increases will have too much of an effect on our strong consumer. People will find alternatives. Drive less, use lift clubs, use the Gautrain. It is human nature.

Retail sales locally grew by 3.9% in January year on year and I do not believe this trend will slow anytime soon. I really do believe consumption of the developing market will be the next big growth theme of the future. The fact that the US consumer is still strong is a great underpin. We continue to like stocks that play towards both the US consumer and the growing developing market base. These include Nike, Visa, Apple, Richemont, McDonalds, Massmart, Woolworths, Mr Price and African Bank.

Currencies and commodities corner. Dr. Copper last traded at 364 US cents per pound, a multi week low. We have seen some very average looking Rio Tinto production numbers and Chinese weaker FDI data which is not helpful for Dr. Copper's health. The Reserve Bank of India cut rates unexpectedly. That is an event which might be good for commodities. The gold price is slightly better at 1652 Dollars per fine ounce, the platinum price is ticking up, last at 1572 Dollars per fine ounce. The oil price is slightly higher at 103.68 Dollars per barrel. The Rand is firmer, at 7.85 to the US dollar, 10.37 to the Euro and 12.51 to the Pound Sterling. We are slightly better here, a "favourable" Spanish bond auction and a better than anticipated ZEW number is to thank for that.

Parting shot. Dumb, dumb, dumb. Stupid, stupid, stupid. Nobody I read so far this morning thinks that the Argentinean government taking a 51 percent stake in oil company YFP is a good idea. Let me rephrase, the Argentinean government in nationalising 51 percent of YFP and thereby taking control away from Spanish oil company Repsol. Repsol will now own just 6.4 percent of YFP, as they lose 51 percent. Argentina is going to throw a few Peso's in Spanish companies Repsol's direction. How many state owned entities are there in the USA? They helped the banks and the motor manufacturers only because they had to, the stock has been sold off, in some cases for a sizeable gain. But Argentina is not nationalising YFP because they need to help the company. They are doing this because their own internal finances are in a bad place. 100 years ago they had the world at their feet, but for various reasons, political wrangling and personalities, Argentina lost their way, and the USA won.

So why are Argentina scrambling? Well, since the incumbent won a landslide victory last year, as the FT reports, the countries macro accounts are worsening. So, they are in short looking for extra revenue streams. And in their view, Argentina, Repsol has just been milking a national asset. No guys, those dinosaurs and ancient forests were there long before humans were there, this is where the oil comes from. Bloomberg has this take: Argentina Seizes 51% of Oil Producer YPF to Stem Imports.

The imports of oil are as a result of the Argentinean government putting a cap on export prices, you can't get market prices. So naturally nobody is going to push the envelope from a production point of view. Another disaster in the long line of Argentinean economic meddling. Economists are not even allowed to question high inflation numbers. Yeah, good luck with this, I bet..... in the next half a decade, you will see another credit event, as once again governments prove that they are not able to control economies and resort to desperate measures. Buyers of Argentinean bonds? Venezuela! Crazy. This is going to end badly again for Argentina.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440