Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. Thursday. A long time ago. Mr. Market gained nearly a percent after having been much lower at Lunch time. The Jozi all share index closed out ahead of the long weekend 327 points to the good, 0.98 percent gained to 33732 points. Leading the steer were the resource stocks, which bounced back nearly one and a half percent. Banks added a percent. Retailers as a collective were slightly lower, Sasol was ex div dragging "their sector" lower, whilst general industrials were just a little better on the day.

Beijing central. 39o 54' 50" N, 116o 23' 30" E China post a surprise trade surplus is the headline this morning, I always ask myself, surprise from what? From expectations clearly, because it is not like QPR beating United, that did not happen, that would have been a surprise, this surprised economists expectations, because let us face it, I had none and I am guessing you had no expectations either. However, before you get excited about anything, imports slowed and exports are not that hot either. But hey, it was the month of March. The month that Europe finally got serious about dealing with the sovereign debt issues stinking up the joint, dealing with them with a bigger firewall and a bigger fund to help, should it be required. Time will tell if my theory is correct, for the time being we are still reminded that youth unemployment in Spain and Greece is 50 percent, as the king of pop said, you are not alone.

But, that does not detract from the fact that March imports were higher by only 5.3 percent. Now folks are talking about a policy response, the relaxing of the reserve ratio requirements of the banks. Just last week the Chinese said that they thought their own banks should liberalise themselves. That is almost like our government saying that the state should be less involved in the economy, and not more involved. Inflation beats expectations, but that was more likely higher energy costs weighing on almost everyone globally. So, policy response is likely to be muted for the time being. And the idea of internal consumption being able to offset manufacturing growth, we are a long way away from that. No need to speculate that, there is a Chinese GDP release for their first quarter as soon as Friday, well, late Thursday in China. Expectations are for 8.3 percent growth. Fixed asset investment is expected to grow 20.8 percent. Retail sales, those are expected to have grown at 15 percent. Those two numbers will be useful.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. The nonfarm payrolls data weighed on US markets last evening. Read that line again, the Americans were open for business yesterday. You know my feeling about public holidays, although *nice* they do very little for the economy. How about nothing. We have too many, stick them all on a Friday or a Monday, even better, celebrate the day on the closest Monday to the event. That way people know to work until Friday evening. From what I can tell, the Chinese have 11, with two sets of holidays (Labour day is three days and National day celebrations are also three days), whilst Germany has ten. There are also ten public holidays in the USA. We have twelve, not that many I guess. But disruptive ones are coming up here locally. My gripes aside, I don't want to be the Grinch that stole the public holidays, let us dive into the nonfarm payrolls number.

120 thousand versus the 200 thousand odd expectations, and as I have learnt over the years, the number on the day matters. Because if the number was so darn important, you would remember it much better than you do. Too much hype placed on a number that is too prone to revisions. Still, it should be noted that this is THE NUMBER that everyone looks at, employment creation in the US means that there are more consumers doing what they do best. Consuming of course inside of the worlds biggest economy. So, until we get similar data out of the Chinese on a regular basis, this will be the go to number for the short termers globally. The futures market was open and did not take kindly to the news on Friday. Here it is, straight from the horses mouth so to speak: Employment Situation Summary.

Retail trade lost jobs. Perhaps the online slash Amazon.com effect. You know the old line, Best Buy is a showroom for Amazon.com. Essentially you can get stuff online cheaper at Amazon, new or used, but check them out at your local Best Buy. Yeah, you wonder why people still have to buy at a physical store location in some geographies. In fact, general merchandise stores lost 32 thousand jobs, indicating exactly what I am thinking.

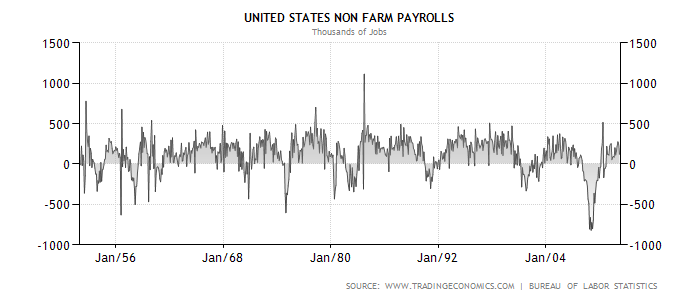

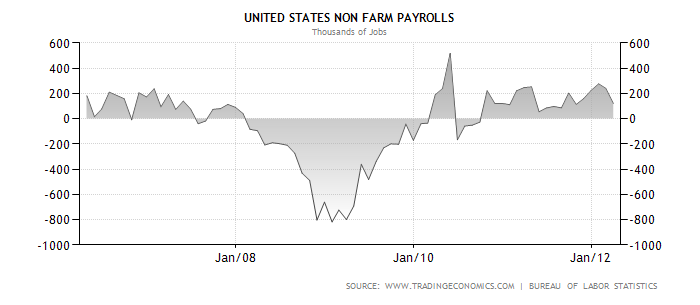

The average work week lower, that was because of manufacturing. That sector saw a gain of 37 thousand, but the sector that continues to outperform is actually leisure and hospitality, people do not lie about eating out. But, overall, a miss is a miss you say. Well, a bit of context is needed I always think. Take the last 60 years, from the beginning of 1952, post world war two and the beginning of industrialized America and their dominance that has spilled over into the worlds biggest economy that we know today. What I am trying to point out here, before the graphic grips and distracts you, is that this bloodletting and huge firing in 2008 and 2009 is unprecedented over this time period. Check it out, courtesy of TradingEconomics.com, thanks so much for all the data:

That is pretty telling. When you check out the last six years, from 2006 April onwards to this number, the real bloodletting is clear. And ugly.

Everybody wants to see job creation in the region of 200 to 250 thousand plus. I suspect that many of the old jobs are not going to come back, but that is the natural progression. People who had built horse carriages found themselves without jobs over 100 years ago. There are new jobs in the form of social media jobs that did not exist in 2005. The economy evolves, new jobs are created. Oh, and for the record, the collective revision upwards for January and February was 22 thousand better. That ought to help I guess. But like I said, this number is volatile, prone to revisions, but for better or for worse is taken as the number.

And on this basis, market sold off globally, the Americans were first of the majors, the Dow closed down 130 points to below 13 thousand points, 12929.59 to be exact. The broader market S&P 500 lost over a percent (1.14 percent), down to 1382. The nerds of NASDAQ lower by a percent to 3047. But there was action elsewhere.

Who spent (invested) the better billion? Three deals yesterday, around one billion Dollars each, all very different companies. Being bought and sold of course. First things first, AOL are either going to be selling or licensing their patents to Microsoft for 1.1 billion Dollars. 800 odd patents for 1.1 billion Dollars? Microsoft's investor relations pages don't have anything for me to snack on, AOL of course have a whole lot more information available here: AOL to sell more than 800 patents to Microsoft; Microsoft to license more than 300 additional patents and patent applications from AOL.

I really wanted to know what patents could be worth this much. It was not a surprise to me that someone had done that analysis already: Insight into AOL's Patent Portfolio. Borrowed the picture, here courtesy of EnvisionIP:

And does that leave you feeling a little wiser? I guess. AOL had some value after all. But the question is of course, what can Microsoft do with these important patents and what will become of AOL? AOL did buy Huff post, some peoples favourite website. Not mine, it is an occasional read. So, buying vanilla patents is my view of it.

The biggest one, the one attracting all the attention is Facebook to Buy Photo-Sharing Service Instagram for $1 Billion. WHAT? 13 employees. 76 million Dollars an employee. Not even two years old. WHAT? I have downloaded Instagram, but have only used it once. I was unimpressed, but that is probably because I post pictures using "the Twitter thingie" or Tweetdeck (using Twitpic). But as Paul said this morning, Facebook is all about pictures and sharing them with the community, or friends only. So, to buy someone who has an application for photo sharing, and as the last line of the article points out, Facebook is so much more in the mobile space with this acquisition. Whether or not they are taking the opposition out, this is a crazy amount of money to spend or invest. Google bought YouTube for 1.65 billion Dollars in October of 2006. YouTube had 65 employees at the time. The amount of money paid was nuts at the time.

In the press release at the time, Google had this to say: "The acquisition combines one of the largest and fastest growing online video entertainment communities with Google's expertise in organizing information and creating new models for advertising on the Internet. The combined companies will focus on providing a better, more comprehensive experience for users interested in uploading, watching and sharing videos, and will offer new opportunities for professional content owners to distribute their work to reach a vast new audience." Perhaps it is just a case of substituting Google with Facebook and videos with photos. The advertising or monetizing part of this transaction, that is tricky to ascertain. A tech mortal like myself scratches his head, but is not completely sceptical.

The last one which makes absolutely no sense is this one: AT&T to sell Yellow Pages stake to Cerberus. I can see why AT&T would sell it, but why Cerberus would want to buy it is beyond me. Unless they want to then on sell it to someone else in the digital era. I have not used the yellow pages for a search in a couple of lifetimes in a technology sense. I used it in the pre smart phone era. No need to pay the Yellow Pages when you can target your audience with Google ads. Right? Or am I wrong? I would love to know what you think about all of these acquisitions.

Currencies and commodities corner. Dr. Copper is last at 3.76 US Dollars per pound. Lower on the day. The gold price is slightly higher on the session, last at 1645 Dollars per fine ounce, the platinum price is lower at 1607 Dollars per fine ounce. The oil price took a drubbing last evening, 101.93 Dollars per barrel. The Rand is getting weaker, the old risk off trade I guess, 7.93 to the US Dollar, 12.57 to the Pound Sterling and 10.43 to the Euro. We started lower here at the beginning here today, but have turned higher here, banks leading the charge.

Parting shot. Whilst cricket season is finished my favourite season is about to start. Earnings season, which is kicked off with what always seems like the worst starting point, Alcoa. Probably the last stock in the Dow 30 that I would ever buy. OK, maybe HP too would be on the avoid list. And AT&T. Anyhow, earnings season starts, this is exciting, the rump normally comes in the coming weeks.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment