Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. Well, the mood improves globally notwithstanding the same old problems globally, Spain and Italian bond issuances coming in at higher yields than the last auction, there was also a weekly jobless claims number that was higher than anticipated, there went my theory, but the one thing that got the bulls going was a narrower than expected US trade deficit. That was the single event that for me anyhow saw the futures go higher, although what I read suggests that it was the repeated approach from Fed officials who said that they did not see any chance of rates changes until that official 2014 target. So why get excited about something that you know already? Strange, I am confused. There was on the local front some better than anticipated tourist arrivals in South Africa, growing at 3.3 percent I think, that is good news! And then building confidence is picking up according to an FNB construction survey, but the truth is that two thirds of respondents still think things are not better, but this compares favourably to a few months ago where eighty percent of respondents thought "things" sucked were not good right now. Moving in the right direction I guess.

Session end we closed 184 points better or 0.55 percent up to 33817 points on the Jozi all share. Retailers slipped. Gold miners slipped. Resources were the real drivers, up nearly a percent and a fifth, but are still as a collective down nearly four percent this year. Banks were flat on the day and industrials were around one third better in the session. There really is a lack of local company news at this time of the year sadly. So we have to resort to making sure we scratch around for economic data, and I guess luckily from a news flow point of view there are anxieties about Spain, I know that the Italians are irritated at having to be lumped with the Spanish problems. But there was and is a small matter of the North Korean rocket launch which failed! Hah-Hah.

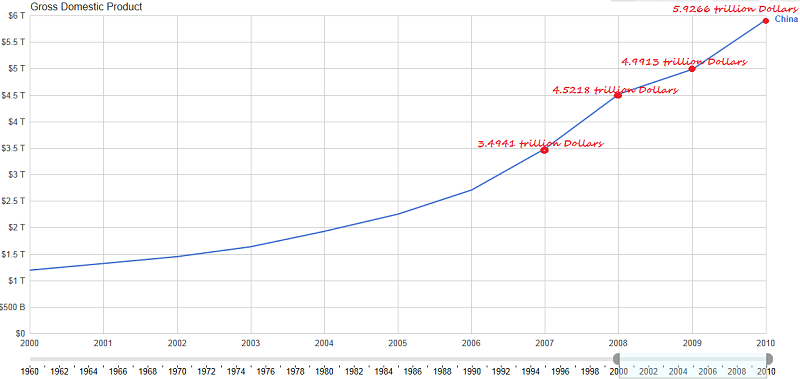

Beijing central. 39o 54' 50" N, 116o 23' 30" E You are going to read the headline today, China growth slows to 8.1 percent. And in fact misses the expected growth rate of around 8.3 percent. So this is bad news, yes? Well, yes and no, I am of the opinion that anyone you talks about a landing of any sort never did any physics of any sort. Let me be clear, Spain's economy contracting by around 1.5 percent this year, that is a landing and in fact going deep into the underground bunker for a while. Growing at 8.1 percent means that you are still maintaining an upward trajectory, albeit at a lower rate. In fact this is the lowest recorded growth since the first quarter of 2009. BUT, before you take the rest of the day off biting your nails and hiding under your desk, with your stomach full of knots (yes, he will ask you out and yes, she will say yes), check out this graph here, because this really does put it into perspective:

See? You missed 2011 in this graph, 6.98 trillion Dollars, that is the estimate. So, if the Chinese economy grew by "only" 8 percent this year, the size of the economy at the end of 2012 would be roughly 7.5 trillion Dollars. An addition of around half a trillion Dollars on last year. Which was the entire economy in 1994. The whole economy 18 years ago is expected to be added this year. So my simple take on it, is that the Chinese miracle continues, now we want it to morph into something different. And there are signs that it is happening. Because in our view, internal consumption and a lower savings rate would indicate that the economy has made the shift to a more consumer based economy which helps expand the service sector too.

But there were some metrics that we set out at the beginning of the week that I thought was key here, firstly fixed asset investment which clocked 20.9 percent year on year growth rate, beating expectations ever so slightly. And then there was retail sales that we also thought was important, that beat expectations too, coming in at 15.2 percent growth rates. Lastly, industrial production clocking 11.9 percent growth year on year, also beating expectations. The property sector was what weighed on the overall number, but for a while now many have been suggesting that the air should go out of some of the key real estate markets in China. Nothing like a bit of a softening in that sector to put it all back into perspective, for individuals at the moment. As ever, my line is going to be that you cannot grow at that same rate forever, there will be a quarter in the next decade when Chinese growth moderates significantly, we could be seeing percentage numbers with fours and fives in them. But I can assure you that the Chinese economy would be far bigger than it is now, so a five percent (or four percent) growth rate would be acceptable. Or not, I am happy with that too.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Stocks rocketed for the reasons mentioned above in the opening segments, markets interpreting other Fed officials saying that rates are going to be low for a while as a good thing. Again, forgive me from being stupid here, but in the VERY recent minutes release of the March minutes of the FOMC, all voting members bar for one voted in favour of low rates all the way through to 2014. So, what is new? Stocks as a collective were up just a little more than one and one third of a percent, basic materials (commodities) and Energy stocks ramped up 2.69 and 2.09 percent respectively, I guess maybe some of those gains today will be unwound. All major sectors ended in the green, that was pleasing I guess.

And then earnings after the bell from Google inc. This is a company with a market capitalisation of 211 billion Dollars, incorporated in September 1998. So, if Google were a person, they would not be able to get a drivers licence or enter into any legal agreements without consent of their parents/guardians. There is to be a stock split and the control aspect by the founders (Larry and Sergey) and major shareholders leads me to believe that they think they are the parents. Which means that the shareholders are the kids right?

Felix Salmon has this take -> Google's evil stock split. I suspect this is a bit of a problem. BUT, don't cry foul here, in the founding Google document there is a line that suggests that investors will have little ability to give strategic direction to Google with voting rights. In other words, you should have known that all along.

Here are the results release after market: Google Announces First Quarter 2012 Results and Proposal for New Class of Stock. Sales up 24 percent, international revenues were stronger than before and now represent 54 percent of group revenues. Costs have risen again significantly, but that is because the Google machine is getting bigger. GAAP operating income was higher (32 percent) as a percentage of total revenues in the first quarter this time around when measured against last time, 27 percent, BUT were lower than the prior quarter (33 percent). Total costs and expenses as a percentage of revenue fell to 68 percent from 73 percent in the corresponding quarter. Non GAAP EPS clocked 10.08 Dollars per share, well ahead of the expectations of 9.65 Dollars. Total cash and cash equivalents, and short-term marketable securities? Hold your breath, 49.3 billion Dollars.

They could buy Nokia and Research in Motion and more than half that left over. 49 is to 211 as a percentage is just over 23 percent of their share price in cash alone! So, excluding that cash portion (I know you shouldn't), you come to a share price of roughly 500 Dollars. So, annualise this current quarter and you get above 40 Dollars worth of earnings. Ex the cash on hand the stock then trades at 12 and a half times earnings! Hardly expensive, is this about as cheap as I have ever seen the stock price.

But what are the key risks here? Well, some folks have pointed out, a lack of being in the tablet space and what are they going to do with the Motorola asset now? On the conference call apparently Larry Page told someone to be patient about the whole phone thing! And the long term development stuff? Ads online? What about Facebook? I suspect all things considered Google has stayed true to their culture, they still have the energy to explore new and exciting concepts (virtual reality and driverless cars amongst other things) and they still should get more traction on their adverts, the core of their business. Even though we are all familiar with Google ads and how they work, not all of use the new methods enough. I am going to say that the company should still be accumulated, the base is very low outside of their two main territories which are the US (46 percent of all revenues) and the UK (11 percent of all revenues). We continue to accumulate the stock.

Currencies and commodities corner. Dr. Copper is last at 370 US cents per pound, the gold price is better at 1675 Dollars per fine ounce, whilst the platinum price is flat at 1596 Dollars per fine ounce. The oil price is a tad lower at 103.34 Dollars per barrel. The Rand is firmer, 7.87 to the US Dollar, 12.56 to the Pound Sterling and 10.38 to the Euro. We have oscillated between positive and negative territory for much of the trading session.

Parting shot. I saw something via my Tumblr feed (get with the program people) this funny take on the failed North Korean missile launch from a user that I follow called inothernews. Here goes:

- North Korea's missile and satellite:

1) stopped halfway through the ionosphere to ask for directions

2) is called "Kim Il Sung Looking At You"

3) is actually an import

4) accidentally had its gas tank filled with ketchup

5) was the last official project of the Palm Pilot team

6) runs on Windows ME

7) knows what's in the suitcase

8) urged Rick Santorum to stay in the race

9) drives a Buick

10) thought it was heading into mySpace.

My favourite is that last one, and Windows ME, remember that operating system? The closest that you might come to a nightmare today is watching a scary movie later, or the power of Kim Yung Un, I did see some live footage of him dealing with the birth of his grandfather celebrations. What a bore, North Korea, what a tragedy for the people, who have no way of knowing how much better the lives of their flesh and blood is, just to the south. That is no laughing matter. Kim Yung Un could get a Nobel peace prize if he changed the course of history. But I bet he won't.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment