"If your life insurance payouts don't happen (before they become more expensive to keep), then the company is more profitable. And all this they do by changing your behaviour, getting you to raise your heart rate 5 or so times a week, drive better and eat better. It seems so simple, and with all the data that they have collected recently, it is working."

To market to market to buy a fat pig The Oscar goes to ... OK, that is all good and well, if you haven't heard by now, Leo finally won. For a movie that he grunts in. I haven't seen it yet, I don't get out much, sorry. There are no investing Oscars, perhaps Buffett and Berkshire would have the most nominations and wins if there were. The Al Pacino, Jack Nicholson and Robert De Niro rolled into one. Or if acting was one category, gender neutral, Buffett would be the Meryl Streep of investing.

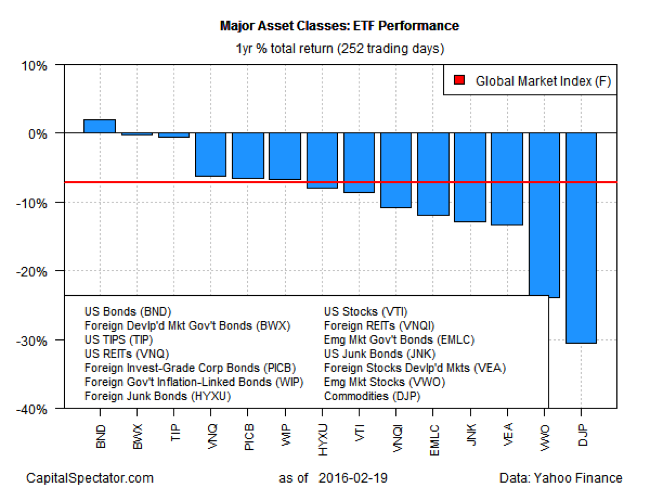

Perhaps the reason that there is no Oscars for investing is that the markets measure you, that is your award. Mr. Market is measured from year to year. The market decides on what the price a security or bond or level is supposed to be, relative to the risk assumed. The Rand has suffered from a bout of weakness recently as a result of political meddling, or seemingly political interference. I for one hope this is resolved quickly. There are some things that you cannot change, politics is certainly in that category.

On Friday in Jozi, Jozi, stocks closed much higher, up over two percent on the day. In large part thanks to a stronger finish on Wall Street the session prior, also the weaker Rand boosted some of the Rand hedges. Barclays Africa (which may need a name change) fell on the worst kept secret in town, that the parent company is looking to divest from their stake down here, as part of their global introspection. The announcement is supposedly going to come tomorrow, 1 March. Remember that this is a day that comes around once every four years, leap day. They (Barclays) own 62.3 percent of the locally listed entity. The only question is, who is the buyer? And what is the price? Eish, tough decisions in a tough time.

Stocks across the ocean, in New York, New York, were mixed, tech stocks ended the session marginally higher, whilst the S&P 500 closed down one-fifth (nearly) and the Dow Jones Industrials closed down a little over one-third on the day. Oil prices continue to be the goto for sentiment, Chinese markets are in meltdown mode this morning. Eish. Not to worry, read the Buffett note lower on optimism in general.

Company corner

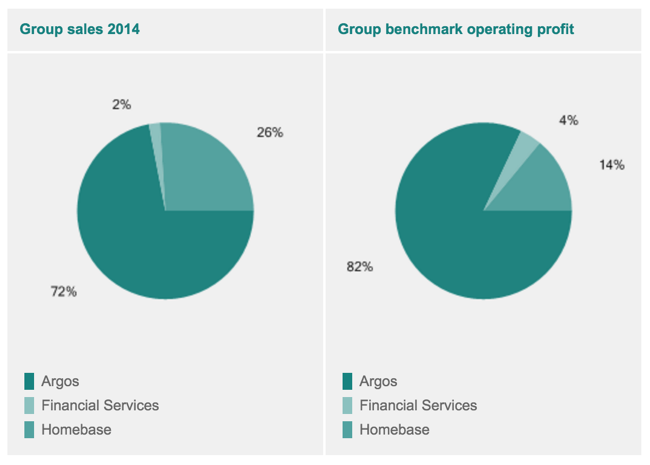

Discovery, that company that we had a short look at on Friday deserves a better look. Bright, our newest and best colleague, was supposed to go, time definitely got the better of him. He is young, and that is what you need in the industry, young people who understand and know the history of the stock market, yet their lived experiences don't include the big drawdowns. I suspect that as you go on, it becomes that you are more cynical, in general. That is why it is refreshing when older people become more optimistic as their lived experiences actually improve in time. Just an observation actually, I could tell through the Adrian Gore presentation of the results that they are very proud of their business and their achievements.

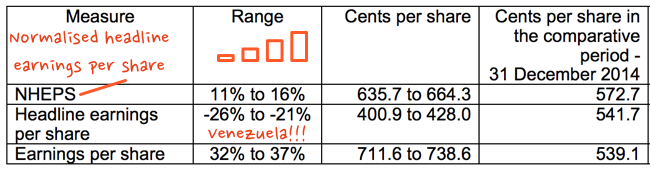

In this set of interim results, it became apparent that Discovery are investing hard in their business. An intent from their side to enter banking, 13 percent of earnings was spent in this last 6 months to end December. There is a banking licence application process ongoing, recruitment of quality staff and of course the building of the infrastructure for the fully-fledged retail bank. Thinking out loud here, the bank is going to possibly have the virtual branch model, not too dissimilar to Investec. I think.

The insurance business, short term that is, has flattened a little. As we pointed out Friday, Discovery chases quality business. What is also interesting is that through the broker network the quality of the business is better. i.e. they have a lower loss ratio when signed on by a broker network. Perhaps it is easier to terminate a relationship with an institution than it is with an organisation. You don't "know" the institution, you do the broker.

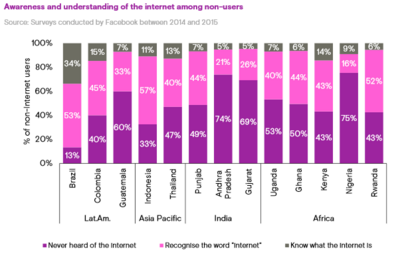

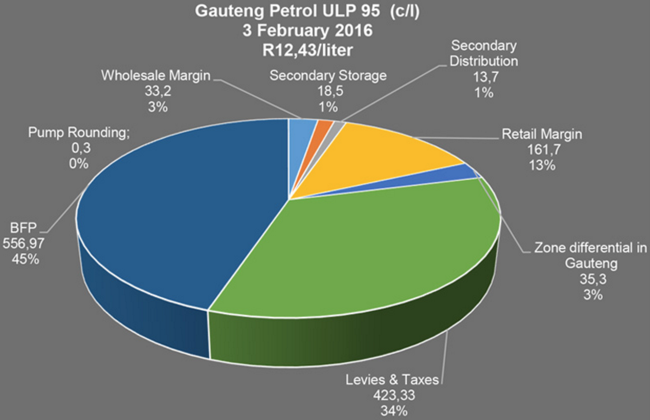

Discovery is a behavioural changing business, they try and take your habits and try and mend (and bend) them towards better behaviour. Better behaviour for your health, in terms of eating better and getting rewards back on your basket of healthy foods, better driving in terms of braking/acceleration/speeding/night driving, and of course the big one, exercise. The take up of the Discovery Watch is a testament to that, the fact that people are prepared to pair their health vitals with the company, that will lead to the business incentivising their members more.

The more sedentary you are, the more likely you are to have lifestyle dread diseases. If the company can (in the words of Virgin Active, a partner of theirs) make you "get off your arse today" and get you to exercise for small rewards, then it is in their interest long term. If your life insurance payouts don't happen (before they become more expensive to keep), then the company is more profitable. And all this they do by changing your behaviour, getting you to raise your heart rate 5 or so times a week, drive better and eat better. It seems so simple, and with all the data that they have collected recently, it is working. See the below image.

It is amazing at how quick they can tell that someone is changing their behaviour (12 months) and how people are being cross sold across the product lines. i.e. four-fifths of their insure products already had another Discovery product. Quite possibly the starting point is with the Health product.

I think that this is a business that hasn't even scratched the surface. The health and wellness theme is huge, I see more people buying sporting equipment than ever before, I see more people concerned about what they eat than at any other stage in history. The stock always looks perpetually expensive, it is however a growth company, and we are always prepared to pay up for quality. Discovery remains a buy in our book. At the full year stage we will have a look at the valuations in more detail.

Drop everything! Read the Buffett message over the weekend. First, go to the Berkshire Hathaway website. Per Dollar market capitalisation this must be the worst corporate website in the world. The worst looking of course. The information that you get from the Berkshire Annual Report is amongst the finest in the industry. The simplicity of the writing is genius. Thanks Uncle Warren for everything, most of the folks reading are not even shareholders. The shareholders over the 5 decades have been made very rich.

Berkshire does some interesting things. Rephrase, they have commitment, long holding periods, and more patience than most. They still remain true to their values, they are passionate about sweating the detail. Buffett points out the differences between his style and the fellows over at 3G Capital (the chaps behind the SABMiller buyout), suggesting that they (3g) sweat costs. 3G and Berkshire are partners in the Kraft Heinz investment. See what Uncle Warren says about their (3G Capital) "style", perhaps this is more insight into how they will integrate SABMiller into AB InBev:

"Their method, at which they have been extraordinarily successful, is to buy companies that offer an opportunity for eliminating many unnecessary costs and then - very promptly - to make the moves that will get the job done. Their actions significantly boost productivity, the all-important factor in America's economic growth over the past 240 years. Without more output of desired goods and services per working hour - that's the measure of productivity gains - an economy inevitably stagnates."

At the corner of everything is doing the same, or more, with less. Farming is a great example of how humanity uses the same amount of land to gain far greater yields over time. Same land and square area, more mouths to feed, far greater and better outcome. Last and only other point that I think is worth sharing about the US economy, Uncle Warren is ever the optimist (and realist). First the background, he talks about the average GDP per capita in the US being 6 times in real terms higher than when he was born in 1930. And then he suggest how commentators bemoan the 2 percent per annum GDP growth. Warren then sticks it into perspective:

"America's population is growing about .8% per year (.5% from births minus deaths and .3% from net migration). Thus 2% of overall growth produces about 1.2% of per capita growth. That may not sound impressive. But in a single generation of, say, 25 years, that rate of growth leads to a gain of 34.4% in real GDP per capita. (Compounding's effects produce the excess over the percentage that would result by simply multiplying 25 x 1.2%.) In turn, that 34.4% gain will produce a staggering $19,000 increase in real GDP per capita for the next generation. Were that to be distributed equally, the gain would be $76,000 annually for a family of four. Today's politicians need not shed tears for tomorrow's children."

Obviously, as he points out, those who have the skills will be better off than others, lobbying in the capital of the nation will always be a growth industry. Sad, true. And then lastly, for all the doomsayers, who keep pointing out that the US is finished, too much debt, too much crass consumerism and so on, a simple line still holds true: "For 240 years it's been a terrible mistake to bet against America, and now is no time to start."

So the guy is amazing. He, and Charlie Munger, continue to invest and grow the business as he has done for longer than most Wall Streeters have been alive. That in itself is an unparalleled record, perhaps some of the Hedge Funders of today may get close to that record should they avoid huge pitfalls over decades. The only question I ever have is the one that can never be answered. If Berkshire Hathaway over five decades had a three times dividend cover policy (i.e. pay out one-third of earnings as dividends), what would the long term returns have been? Obviously Berkshire wouldn't have been able to use the cashflows to acquire and bolt on complimentary businesses. Berkshire seem to love the people they work with.

The stock market has sold the stock off 10.39 percent over the last 12 months. Over five years the stock is up a staggering 55 percent. No yield. Ever. You get your upside if you sell the stock. And then pay the taxes. Don't ever sell is his message I think. Obviously you may have to at some stage. It is not a stock that we actively recommend. You could of course own the B class shares (131 Dollars apiece), unless you are in the business of buying one A class share, 198,190.50 Dollars apiece. At the current exchange rate that equals 3,195,798.82 Rand a share. Why, oh why, Grandad did you not buy a few back in the late 60's? More on reaction below in links:

Linkfest, lap it up

Over the weekend Buffett published his annual shareholders letter, here are a few bloggers views on the man and his letter.

Ben Carlson looks at peoples reactions to Buffett himself - The Buffett Backlash

Cullen Roche reminds us that one of the themes in Buffett's letters over the years is that the world is not ending and that the future looks bright - Warren Buffett's Greatest Strength. Cullen signs off with the following observation:

"In a period of global economic weakness and excessive short-termism, it can be helpful to be reminded that there will always be challenges in the short-term. And while it would be irrational to be excessively optimistic all the time, it's useful to remember that the greatest deterrent to most people's wealth accumulation remains their excessive focus not on what can go right in the future, but on what might go wrong."

Some fun facts from Business Insider - 14 stunning facts about Warren Buffett and his wealth

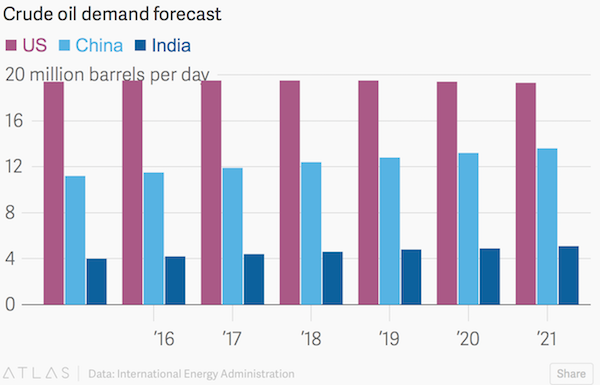

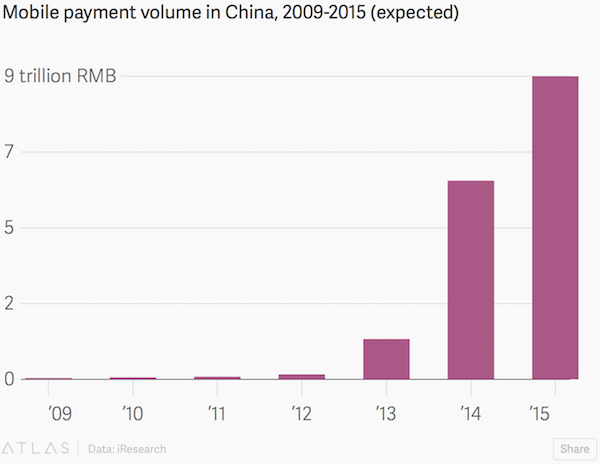

Home again, home again, jiggety-jog. The Indian budget is ongoing. This country no doubt has the ability to grow at a pace and use resources to an extent that China did in the last decade, being a democracy without the central planning capability (and possibly resources) on that sort of scale is just too hard. Talking about things that are too hard, the Chinese market has halved since June last year. Well, nearly, down 48 percent as we speak. Another large swoon today as the Yuan is weakened by the authorities.

And in the biggest news of the day, (for me at least) Starbucks is opening up shop in Italy. Yes, the country that Howard Schultz visited in order to gain insight into coffee culture, he is there and competing. It may be a war of the simple caffe against (and I found this online): "A venti, half-whole milk, one quarter 1%, one quarter non-fat, extra hot, split quad shots (1 1/2 shots decaf, 2 1/2 shots regular), no foam latte, with whip, 2 packets of splenda, 1 sugar in the raw, a touch of vanilla syrup and 3 short sprinkles of cinnamon." What the hell? Just throw some milk with my espresso, that is it!

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063