"Back to the Wien piece, in the part about China he points out that the country still creates 10 million jobs per annum. And as they balance their economy to shift to more consumer focus, less on capital expenditure, there will be hiccups along the way. He is positive on China and expects, like a lot of people, for growth to moderate somewhat, somewhere in the four to five percent region."

To market to market to buy a fat pig It must be tough to be a short term strategist. Imagine having to explain that a six percent fall in the Shanghai markets did not have an impact on global markets, and that a rising oil price supports stocks currently. That is the trade at the moment, stocks go up as a result of which way the oil price moves. Which is kind of nuts, if you think about it. Recent numbers from China have reaffirmed that there is no falling off a cliff, the more I read, the more consensus is forming that China is just going to be OK. A good piece from an old timer in the industry (I mean that with respect), Byron Wien in Barron's: There Won't Be a Bear Market.

Wien was once upon a time the most read analyst on Wall Street, according to Wikipedia, which also suggests that in 2000 most of his calls were the right ones. I guess there was, thinking back, only one call back then. Stocks, and in particular anything to do with the internet, is woefully overvalued. Wien releases a 10 surprises each year, a tradition that goes back 3 decades. Once something has traction, it becomes hard to either break or give up. Like the annual chairman letter from Warren Buffett, that is set to be released this weekend. For all professional and amateur investors who take themselves seriously, this is one of the most exciting events of the year. This is it, Buffett, the billionaire next door is going to tell us how it is. Human nature dictates that we love to hear from someone who holds the secret sauce, or at least we think that they hold the secret sauce. More on that letter Monday.

Back to the Wien piece, in the part about China he points out that the country still creates 10 million jobs per annum. And as they balance their economy to shift to more consumer focus, less on capital expenditure, there will be hiccups along the way. He is positive on China and expects, like a lot of people, for growth to moderate somewhat, somewhere in the four to five percent region. I guess as the base gets bigger and bigger, it does become harder for growth rates to maintain those eye popping numbers of yesteryear. I like the conclusion, stocks are not expensive, he thinks stocks may be a little oversold here, notwithstanding the recent rally. He also uses something called the "Ned Davis Crowd Sentiment Indicator" to determine whether or not people are beat up about stocks, currently we are at 2012 levels, not 2009. I agree. 2008/2009 was horrible, this feels a little more like the Europeans fumbling around in the dark about Greece.

Markets quick sticks, local stocks enjoyed a solid day of gains, all in all the Jozi all share index gained around four-fifths of a percent on the day. Resources and financials have been pretty volatile over the last 12 odd weeks, they certainly did not show any more signs of letting that volatility slip yesterday, in the plus column Anglo American and Shoprite were the big winners on the day, in the minus column (and we will come to it in a moment) was Discovery and AB InBev, both of those companies had results yesterday. On balance there were some pretty strong moves across the board, there definitely is a sign that some confidence is returning.

Over the seas and far away in New York, New York, stocks enjoyed another big day of gains, thanks to that oil price. And I guess returning confidence. "Things" are not finished, there was a very good read on durable goods for the month of January, that was double what the market expected. The headline number showed a 4.9 percent increase on the comparable number from last year, certainly Americans would not be buying/ordering washing machines and the like (aeroplanes in there too) if they thought the future was glum. Mind you, the December number was rubbish, down 4.6 percent, so perhaps you are dealing with a very volatile subset of numbers here. In fact, having a look at a long term graph tells you very little, if anything about this set of numbers. All I know is that the headline number is huge, enormous: "New orders for manufactured durable goods in January increased $11.1 billion or 4.9 percent to $237.5 billion, the U.S. Census Bureau announced today." 237 billion Dollars for one month? That is massive.

Company corner

Discovery released half year numbers yesterday morning, remembering that their trading statement had spooked the market a little earlier in the month -> Discovery Trading update. The numbers themselves at face value look a little unappealing, what they are doing here however is building a bigger global business and on the verge of a bank. What is still most impressive is that when Adrian Gore delivers, he speaks with the same enthusiasm and energy each time.

During the presentation (which we watched on TV here in the office), Gore displayed a couple of new initiatives, one included doctors inside of the network where the appointments could be made by finding one inside of your smartphone map, directions there, notification time of how long you're likely to wait when you get there, magazine suggestions on your smartphone, scripts sent directly to the pharmacy and delivered to your home/work and then lastly, an Uber-like star rating system for the Doc. You could see that he is genuinely excited about these products and innovations, I suspect that their core clientele will be receptive to this technology. Talking of which, their relationship with Apple and the Apple watch is pretty impressive, so far they have sold 170 thousand units, and as it is linked to the Discovery credit card, that definitely helps their business.

The company has been great at cross selling, selling you insurance, both life and short term if you are a medical aid customer, selling you investment products, they are simply great at getting you into their ecosystem. I for one know that their products are more expensive, Adrian Gore did say that they do not compete on price. It is about the quality of the product. We will have another closer look today and release a comprehensive look on Monday. For the time being we think that this current share price weakness represents a big opportunity, the business is in growth mode and is investing heavily in the future.

Linkfest, lap it up

Seeing as today is Friday we decided to give you pictures instead of links to blogs, enjoy.

More than half of the globes population is still not on the internet, which means that if you are reading this you are in the minority globally - 4 reasons 4 billion people are still offline

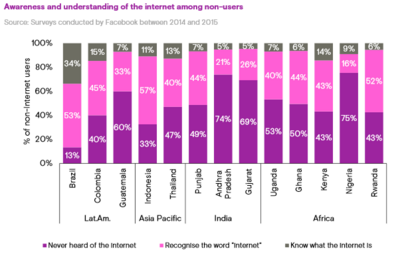

Of the people who are not on the internet here is how many have never even heard of it. I was amazed to see that 75% of the people not online in Nigeria, had never even heard of the internet!

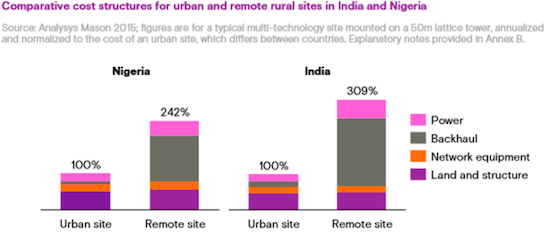

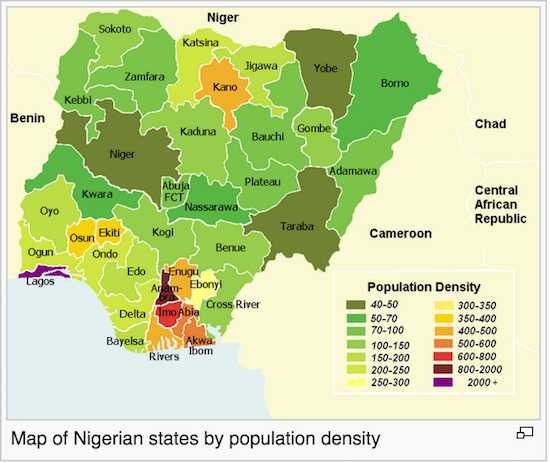

Here is the cost breakdown for remote station site costs, as you can see it is normally twice as expensive. The station costs twice as much and services far few people so on a cost per user basis it is far more costly than a station situated in an urban area. Note how Nigeria only has a few regions of high population density, which indicates the capital spend from MTN to help get the country connected.

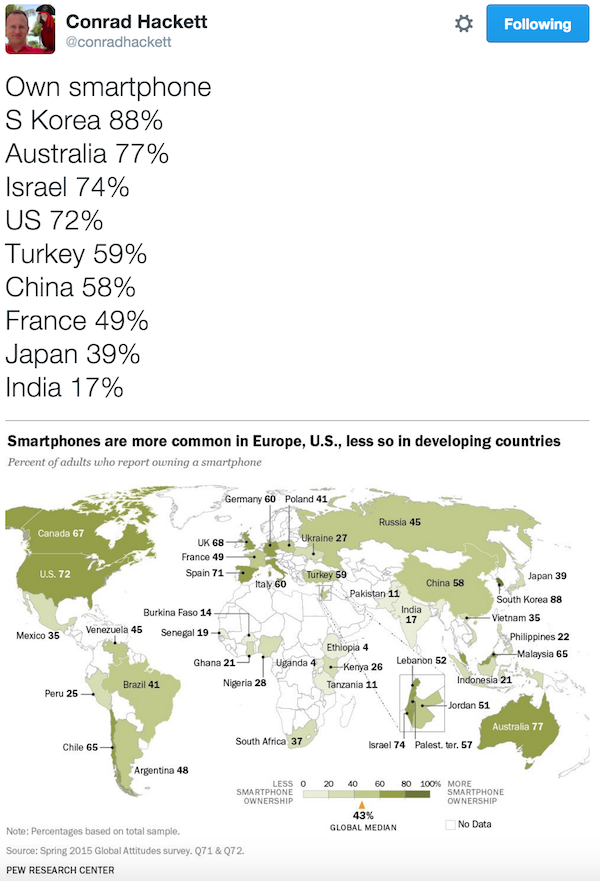

Then lastly, here is a great graph from Conrad Hackett, the stat man. Smart phones are data hungry machines, so the areas where there is low smartphone penetration offers high growth potential for mobile network operators.

Home again, home again, jiggety-jog. Markets across Asia are higher, Shanghai is up nearly one percent, Hong Kong stocks are up 1.6 percent, whilst Japanese stocks are up around half a percent on the day. I also saw after some good results that Baidu was up over ten percent after market, there is the small matter of the G20 meetings over the weekend in China, methinks Shanghai. Finance ministers and central bank governors, Minister Gordhan has had a pretty busy week, you would say. Expect a better start to the day.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment