" I think that unless the fellows from Sainsbury can stick their neck out further and find more cash (and no shares) in order to beat the Steinhoff offer, the Frankfurt listed company will win this bidding round."

Blunders, Episode 2 watch the latest instalment. If you would like to get an email delivered to your inbox, then sign up here: Blunder Alert!

To market to market to buy a fat pig It is and was all happening yesterday. Another day of strong gains for oil prices saw stocks up smartly, I am not too sure how that correlation works. I for one think that it is a massive blessing for global consumers to have a glut of oil and much lower prices. Remember that report from late January (The Oil Crash Is Kicking Off One of the Largest Wealth Transfers in Human History), where Bank of American Merrill Lynch analyst Francisco Blanch suggested that there is a 3 trillion Dollar transfer of wealth a year from the oil producers to the consumer. That cannot be bad, right? So when oil prices go down, and people spend less on energy and have more money to spend on other things, that bodes well for consumer related activities?

Believe it or not, the SAME fellow stuck out a note last Friday, covered here by the BusinessInsider: A deadly combination of 2 things has wiped out $3 trillion from stocks. That sounds like a terrible thing. Whilst the 3 trillion Dollars transfer of wealth is a yearly thing, stocks losing their value by this much has an impact on retirement savings. The inability of companies to pay higher dividends (or some, none at all) means that pensioners with some of their savings in oil and gas companies have less to spend as their income is diminished, even if their gasoline bills are lower. It is of course a double edged sword.

It still puzzles me when I read headlines like this: U.S. Stocks Rise With Oil as S&P 500 Rallies to Six-Week High. Energy stocks as a whole in New York, New York, rose over two and three-quarters of a percent, basic materials stocks rose over three percent on the day, propelling the broader market S&P 500 to 1945, up 1.45 percent on the day. And back at levels last seen in the first trading week of the year. Stocks are now "only" down 4.8 percent for the year, and most of that was the first three trading sessions of the year, the opening week of January was particularly brutal. Tech stocks have been beaten up more, and notwithstanding a great 10 days, the nerds of NASDAQ are still down nearly 9 percent year to date.

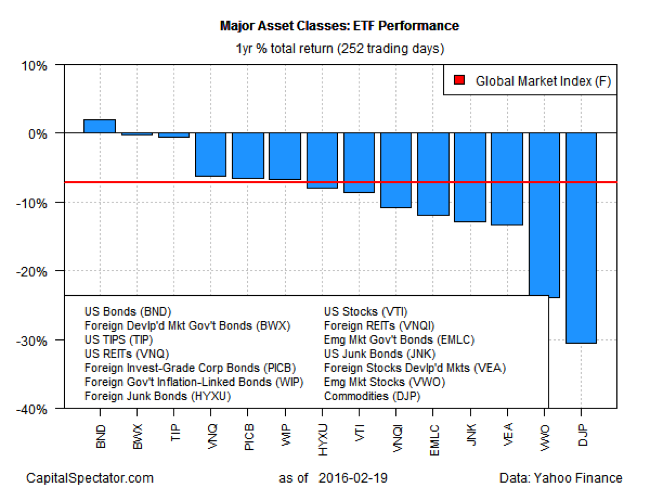

Phew, January and the first half of February have been heavy going. And as a result of global warming the Santa Claus rally was cancelled, the S&P over the last 12 months is down nearly 8 percent. It hasn't been easy to be a stock investor, in fact, as the Capital Spectator points out, over the last year of trading days (252 days), the only asset class that is up are US bonds. See via this article, Will Last Week's Rebound Make It Two In A Row This Week? there is a nice graphic, showing this:

The two asset classes that have been smashed out of sight are both emerging markets in Dollar terms, down nearly 25 percent and the commodities basket which is down over 30 percent. Foreign stocks, the index that is named VEA is the third worst performing asset class, WORSE THAN US JUNK BONDS!! I had to put that in caps. Do you think that it is that bad in Europe? I personally don't, I still believe that this is the year of the comeback in Europe.

Onto local markets, in Jozi, Jozi, yesterday stocks closed up just over one-third of a percent. Glencore and Anglo American were at the top of the leaderboard, BHP Billiton and South32 not too far behind them. On the flip side were stocks that either had businesses in the UK or were listed there, SABMiller and Discovery feeling the heat from a potential "Brexit". I suspect that as we near the date and the vote is seemingly tighter, stocks will retreat a little. The risks of Britain leaving the zone I guess are around even odds at the moment, I don't see how it can be helpful for the country in the medium to long term, or the short term. I guess the government just needs to ask the people. Such is life.

Relevant for Steinhoff shareholders here, Sainsbury applied to the Takeover panel for an extension to meet the Steinhoff offer, rather than rushing anything, to which they (the Takeover panel) obliged. Both companies have until the 18th of March to table their final offer. I think that unless the fellows from Sainsbury can stick their neck out further and find more cash (and no shares) in order to beat the Steinhoff offer, the Frankfurt listed company will win this bidding round. In other news, Sainsbury has a market cap of less than 5 billion Pounds, which is 6.98 billion Euros. So a 1.4 billion and some more premium for Sainsbury is a lot bigger bite than for Steinhoff, which has a market cap of nearly 19 billion Euros. You read right, Steinhoff is three times bigger than Sainsbury. Sainsbury have brought their Sopwith Camel, whilst Marcus Jooste has a F-16.

Linkfest, lap it up

We are 5 years into 4G being rolled out globally and now the talk shifts to 5G - Ericsson, Nokia offer contrasting timelines for 5G network upgrades. The timeframes seem to be around 5 years until 5G rolls out on large scale.

Cullen Roche has a look at us incorrectly focusing on doom and gloom due to our survival instinct instead of looking at what the longer term holds for us - Let's Talk About the Bubble in Catastrophizing

Wearable tech is now an established consumer segment and Apple stores are now competing with the likes of Swatch - Smartwatches Push Past Swiss Watches for the First Time.

You will find more statistics at Statista

Home again, home again, jiggety-jog. Stocks are lower across Asia as oil prices have fallen. There have been results this morning from Imperial, BHP Billiton, AECI, Aveng and Curro, as well as Wilson Bayly. There is no doubt going to be a huge wave of results over the coming weeks, many of the December year end (and half year) companies are going to be pushing it hard here. We should start mixed today.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment