"We saw the Steinhoff news on Friday, there is confirmation this morning that the company is offering the Home Retail Group (HRG) shareholder a total offer of 175 pence a share. The Home Retail Group website says on the Investor Relations page: "Despite challenges in our markets, we’ve maintained our multi-channel leadership position and continue to be the UK’s leading home and general merchandise retailer.""

If you missed the Business Blunders on Friday, catch it here -> Blunders - Episode 2. Sign up, so that the email is delivered to your inbox: Blunder Alert!

To market to market to buy a fat pig Phew, we took a proper beating on Friday. Inside of the ALSI 40 I am afraid the winners were sparse, only two precious metal stocks in the form of Amplats and AngloGold Ashanti showed any gains, MTN was at the bottom of the pile by a country mile, the stock ended the session 18 percent lower than where they started. There were and are serious concerns around Nigeria, their largest operating territory in terms of subscribers, results next week will reveal a little more on what they can do around the regulatory environment. I am afraid that until we get some sort of resolution, the overhang will continue to weigh on the stock. Meanwhile the regulatory environment is starting to impact on their profitability, it has been more than a little tough, it has been plain horrible.

There was also selling in the financial and bank stocks, with inflation outside of the band for the first time in a long time, the Reserve Bank has shown their willingness to hike rates as and when they see fit, it is not the best news for what is an already distressed South African consumer. I suppose it is all part of the cycles, growth and lack thereof, interest rates heading in the wrong direction for those people who have cash on hand. Do you remember that ABSA (I think ABSA) advert from the late 90's, where the family were trying their best to hold onto their home as interest rates rocketed. A husband and wife, with their two children had a home lassoed, and it was drifting into the sky, a bit like that movie UP. Michael sent me the link, courtesy of TradingEconomics, here is a history of South African interest rates since 1998 (all the data that they have):

Remember when the Repo rate was over 20 percent? No wonder that advert was talking about holding tight to your home. The cost of debt back then was exorbitant. To service a 1 million Rand mortgage, over twenty years at a prime interest rate of 25 percent was nearly 21 thousand Rand a month. Fast forward to 2012, at prime of around eight and a half percent, the same repayments over twenty years per million Rand would be just over eight and a half thousand Rand.

Present day, with prime being 10.25 percent, repayments per 1 million Rand of home loan debt equals just shy of 10 thousand Rand. So whilst you can be forgiven for thinking that it has gotten tough lately, in a context of a pretty volatile (and a period of much higher inflation in the past) environment, is still historically low. We also forget that inflation was in excess of 8 percent in 2009. Remember? Forgot? So I guess these are just natural cycles, emerging markets are not in favour (again) and as such we, along with Turkey, Russia, Brazil and Indonesia, all of those countries are out of favour. The EM vortex.

Over the seas and far away, stocks in New York closed the session much higher than where they started, the S&P 500 closed the session out almost flat, a fraction of a point lower. It was still enough for the best week of the year so far and the rally over the last 7 or so trading sessions has been enough to pare back half of the losses of the year so far. The nerds of NASDAQ had a good session, up nearly four-tenths of a percent on the day, energy stocks continue to take a little heat, US inventories at a nearly 9 decade high. We are awash with oil.

Not only is there loads of it around, I read a pretty interesting article over the weekend: Commodity Slump Puts Dry-Bulk Shipping on Hold. Wow, if you can't read it (subscriber paywall), shipping brokers estimate that 7 percent of the global fleet (nearly 700 ships) are currently standing idle. Going nowhere. Not doing anything. And the Baltic Dry Bulk Index is trading near a multi decade low, the index was down 12 days ago at a 31 year low. It is up over two percent since then, 315 is where the index is now. Over one year the index is down nearly 40 percent. It is not surprising then I guess that Grindrod is down 52 percent over the last 12 months. AP Moeller Maersk is down 41 percent over the last 12 months. You get the picture. Whether it has turned the corner or not, that remains to be seen.

This week the Saudi oil minister and the OPEC chief speaks today and tomorrow, we should get some insight into what the course of action (if any) from them is. There are results from some heavy hitting US retailers, that should again give some useful insight into the health of the US consumer. I am looking forward to that! And then, on the local front of course we have the budget speech, that is possibly the most exciting thing to talk about.

Company corner

We saw the Steinhoff news on Friday, there is confirmation this morning that the company is offering the Home Retail Group (HRG) shareholder a total offer of 175 pence a share. The Home Retail Group website says on the Investor Relations page: "Despite challenges in our markets, we’ve maintained our multi-channel leadership position and continue to be the UK’s leading home and general merchandise retailer." I see. It is a sizeable business, in terms of its depth across the length and breadth of the United Kingdom, over 1000 stores employing 47 thousand folks and selling 90 thousand plus products.

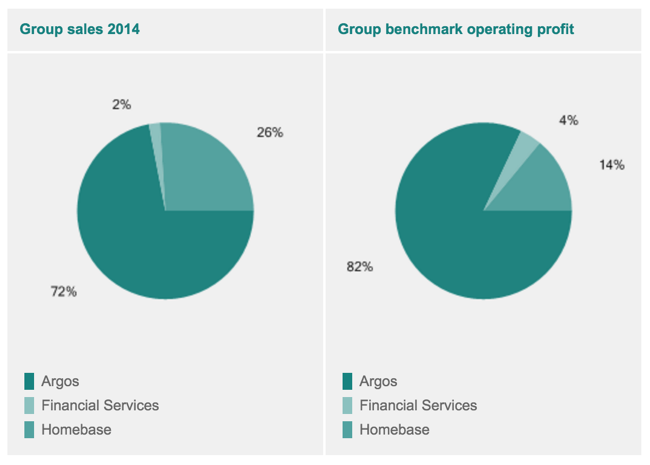

They (HRG) have two brands, Argos, which sells anything from hair dryers to Jimmy Choos and Homebase, which sells everything from paint to plumbing equipment. Homeware and retail, that sounds about right up the alley of Steinhoff. Added to this is a pretty sizeable Financial Services arm, that offers credit to their shoppers. According to the HRG website, they have 1.5 million active card holders and this is the UK's biggest store card business. This is the split of sales and profits:

So how much is 175 pence a share? It is roughly a 15 percent premium to the current share price, 1.4 billion Pounds. The stock is up over 50 percent year to date on the fact that Sainsbury are also bidding for HRG. Steinhoff's bid is 111 million Pounds more than Sainsbury's, around 8.5 percent higher. Also ongoing in the background is the fact that HRG is selling Homebase to Wesfarmers. Complicated. What is also interesting to note is that whilst the Steinhoff offer is higher, it is all cash, whilst Sainsbury's bid is a mix of cash and scrip. In terms of UK company law, Sainsbury have to "put up or shut up" by the close of business tomorrow.

How big is this in terms of Steinhoff's market cap? 1.4 billion Pounds = 1.8 billion Euros. The Steinhoff market cap is 18 billion Euros in Frankfurt, this is one-tenth of their market cap, a sizeable deal by any stretch of the imagination. This signals that Marcus Jooste is really intent on growing and building this empire. We watch and wait to see firstly whether or not Sainsbury will counter, what is most important to remember is whether or not the HRG shareholders WANT this deal to happen. The shareholders have been long suffering, down 38 percent over ten years, down 34 percent over 5 years. Down 15 percent over 2 years. With the 50 percent uptick year to date, this is very tempting.

Linkfest, lap it up

Business Insider did a great experiment, what would your portfolio look like if you invested monthly from the market peak in 2007 - Here's the smartest way to invest in stocks if you're convinced the market will keep crashing. If you assume that you can not predict short term market movements and that over the long run the stock market will continue to rise due to human innovation and population growth, then dollar cost averaging is the best way to invest. If you are not investing monthly/ quarterly in stocks then you are missing a trick.

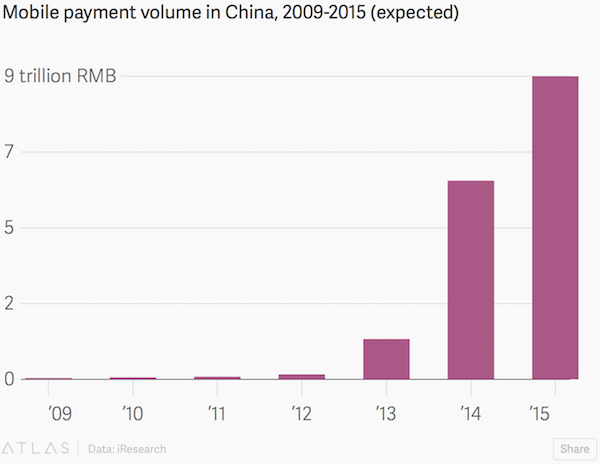

This seems to be a step backwards from the Chinese government, new regulations for mobile payments industry will be a huge knock to growth rates - Alibaba and Tencent’s booming mobile payments businesses could hit a speed bump in China

Home again, home again, jiggety-jog. Congrats to Paul for setting a PB over the weekend, 3h11 for a marathon or in layman terms running 42km at around 4:30 /km! Stocks are up smartly this morning, commodity stocks are up the most. Shanghai stocks are up sharply, stocks in Hong Kong are "doing well", as are stocks in Tokyo. Saved? I guess most of the issues remain, I am guessing that as we lead into June the 23rd, and with the Brexit scenario raring its head, we may get some market pushback. In market terms that is light years away however.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment