"So why did stocks suddenly click into action? What changed? Stocks have been closely tracking oil prices, for some reason. Perhaps being viewed as a proxy for global growth. There have been and are worries around negative interest rates. And of course the Fed are standing still for now on rates. Oil prices however enjoyed their single biggest day since 2009, roaring around 12 percent in the session Friday"

If you have not checked out the Business Blunders on YouTube yet, you are missing out. Watch the first of many editions of the blunders on the YouTube news channel: Blunders - Episode 1. Go and sign up for the video link to be delivered to your inbox: Blunder Alert!

To market to market to buy a fat pig Someone flicked the switch. Deciding that the market selling had been overdone and that there was scope to move higher off these depressed levels. Locally there were some unusual and epic moves, moves that I think I may never have seen. If I have, I can't remember them. Once upon a time the biggest company in the South African business landscape (now 19th as of Friday close), Anglo American tacked on a whopping 14.86 percent on the day. There were only three stocks out of the majors that ended the day in the red, lagging the rest of the market, which was soaring away. We closed up nearly two and a half percent on the day here in Jozi, the resources sector added an eye watering 5.33 percent. As for the weekend, the Proteas were burnt and finished on Friday evening, I have one thing to say to that, Chris Morris.

So why did stocks suddenly click into action? What changed? Stocks have been closely tracking oil prices, for some reason. Perhaps being viewed as a proxy for global growth. There have been and are worries around negative interest rates. And of course the Fed are standing still for now on rates. Oil prices however enjoyed their single biggest day since 2009, roaring around 12 percent in the session Friday. Why? Hopes of production cuts. Whilst that hardly isn't an endorsement for global growth, as humans we continue to drive down the cost of production, plus more importantly, we use less of the same resource. Even in your lifetime, try and think of all the efficiencies that motor vehicles have shown.

I owned the same model car 8 years apart (the other one crashed, otherwise I would still drive it), the differences were astonishing. More composites, lighter, greater fuel savings = less resource utilisation. That trend will continue, humans will do more with less. Which is why we believe that an investment in commodities long term is at the fringes a bet against human ingenuity. And I am not sure about you, I for one won't bet against any form of human progress or ingenuity. If you are looking for the WSJ article, here it is: Oil Prices Soar 12.3% on Hopes of Production Cuts.

Whilst you have all these crazy moves and they seem rather wild, the session prior had seen the oil price hit a 13 year low during the session, we are still near the low end of the price range. Year to date, oil futures are down 23.5 percent, over the last twelve months, the price has more than halved, down 53.24 percent. The medium term outlook has changed to suggest a price around double here, that is what I am reading and watching. I guess almost anything could happen.

Stocks were led higher by the energy sector Friday, the Dow Jones up 2 percent exactly, the broader market S&P 500 added nearly the same, whilst the nerds of NASDAQ added one and two-thirds of a percent on the session. That tech heavy index, the NASDAQ is down 13.4 year to date. Nearly 7 weeks into the year and we are staring at these types of drawdowns. And last year for the broader market S&P 500 was a marginally down year, that broader market measure is down 8.77 percent year to date.

Methinks that with policy makers standing by, doing whatever they can or will, within their particular mandates, it is going to be quite hard for equity markets to take a steep swoon from here. Just my opinion. As Eddy Elfenbein pointed out Friday, stocks are yielding double the ten year treasury at the moment, there are some big ticket stocks that look appealing. And that is the point that I often make with our real clients owning real companies (and not the market), your portfolio does to a certain extent get dictated to by the market moves as a collective, it matters what you own. In other words, you don't want to own the market as an ordinary stock investor, you want to own specific companies that have better prospects than the broader market. So what the market moves are in the short term, is pretty irrelevant to what you are trying to achieve. Still, when your positions are showing a negative in the P&L column, you start doubting. Don't.

Stocks across Asia are mixed, understandably. Mainland China stocks have reopened over the week long holiday, and I guess you could say being "only" down 0.79 percent (as we write this) is not a bad outcome. Stocks in Japan are roaring ahead, they are up nearly 7 percent for the session. In Hong Kong it is nearly three percent. Wow. The Nikkei in Tokyo is, even after these heroic moves, down a whopping 16 percent year to date. News this morning -> Japan's Economy Shrinks Again in Fourth Quarter. I can't remember such a bad start for stocks globally for a long time, normally the "bad stuff" starts a little later in the year. Stocks in Shanghai are down nearly one-quarter year to date. It is the Wild Wild East there! One day the capital markets in China will mature, the size and scale will have to get much bigger I think, there are too many individual investors with seemingly too few options.

Company corner

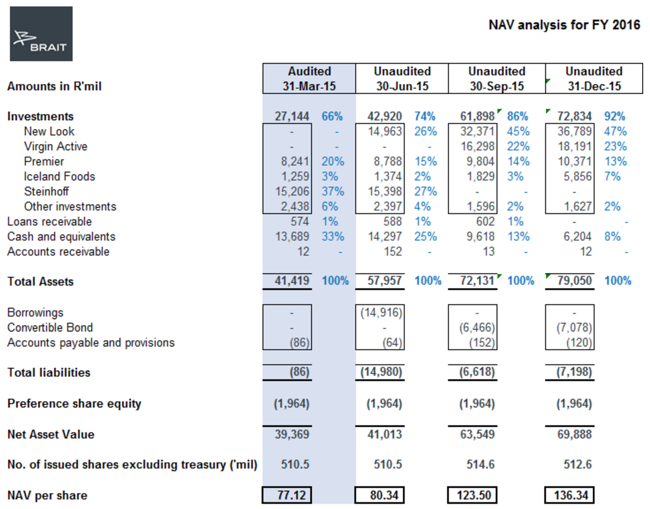

Brait, the investment holding company, released an NAV update for their third quarter to end December last week. New Look, the relatively new and huge investment for the company, represents 47 percent total assets. Their stake in Virgin Active represents 23 percent of the total assets of Brait. 13 percent is made up via Premier Foods, the local food business, whilst Icelandic Foods represents 7 percent of the total assets. Effectively this business is one quarter health and wellness, half fast fashion and the other quarter food processing and retailing. I guess whilst all businesses are 100 percent exposed to consumers, some are a little more sensitive to inflation and moves in interest rates.

Herewith the NAV analysis, and how the company has quickly shifted away from Steinhoff (and cash) to become New Look and Virgin Active. All in a rather big rush and catching Mr. Market off guard I think.

The share price has nearly doubled in 12 months, thanks to the share price movement in Steinhoff and then the depreciating currency. What matters from here is the movement in their two core newer investments, New Look and Virgin Active. I suspect that the outlook for both those businesses are really good. Chinese expansion continues at a breakneck speed for New Look, with the shift to a consumer related economy, I suspect the timing will be excellent. Equally, and I have stuck my neck out here several times, I think that the European recovery is going to take hold this year, this will be the year of Europe. The canary in the coal mine remains the "Brexit" scenario, the British economy being ejected by the will of the people in the United Kingdom. I think that whilst the socialists may think it s a good idea, common sense will prevail. Premier may be under pressure with input prices rising, whilst Icelandic foods is a slow mover. We continue to accumulate this company on weakness!

Linkfest, lap it up

This piece is from January 2012. It came out at the height of the argument of what Facebook was worth (pre-listing days) - Facebook's $100 Billion Valuation. Facebook's market cap today is around $290 Billion. The four points made as to the value of Facebook are still valid today, great insight from the team at Business Insider.

The top performing stock in the US over the last 20 years is Monster Beverage. If you bought the stock 20 years ago though you probably are not holding it today - The Agony of High Returns. How many people would have been able to hold the stock during the four 50% drops in the stock price, or the two 66% drops or that time the shares dropped 75%? As Charlie Munger says:

"In fact, you can argue that if you're not willing to react with equanimity to a market price decline of 50% two or three times a century you're not fit to be a common shareholder, and you deserve the mediocre result you're going to get compared to the people who can be more philosophical about these market fluctuations."

In a world where there is even more information bombarding us being able to effectively filter out the information that we don't need is important - Our Brains Are Built To Ignore Things. Here's Why That's Great News.

Home again, home again, jiggety-jog. Japanese stocks are up around 8 percent now! The Chinese Yuan has had their best session since 2005. Stocks are rocking, US futures are up a lot. One percent better for the time being, on top of the big moves last week. Expect to start a whole lot better today.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment