"Adrian Gore, the CEO of Discovery is one of those people. I know that as a significant shareholder he sweats the small stuff, lives the companies ambitions alongside the shareholders."

To market to market to buy a fat pig Loads on the go yesterday! It was also really warm here in Jozi, pushing the mid thirties, a friend of mine in the UK said it was minus 4, I wasn't sure who was having a worse time of it. I suppose it is always "nicer" to be in the warm. Stocks were warmer too, here in Jozi we were enjoying a global rally, that sent the all share index closing above 50 thousand points, up one and one-third of a percent on the day. Glencore stock was suspended in London as the circuit breakers triggered on the way up. The stock ended the day here up 11.73 percent.

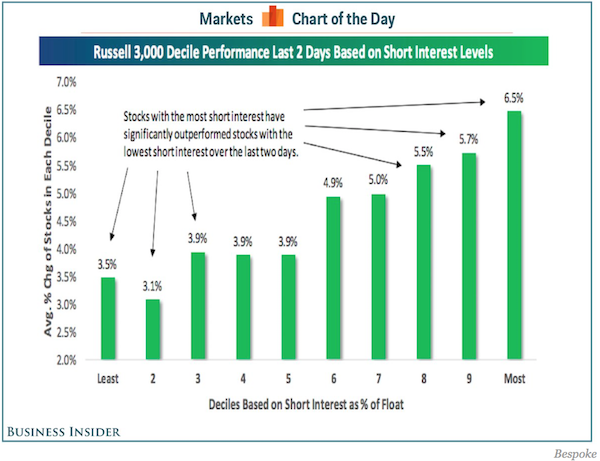

Anglo American wasn't too far behind, up 9.44 percent on the day, nearly back at 100 Rand a share. Over the last month, (that is a period in-between pay checks, right?) the stock is up an unbelievable 70 percent. Read again, and then try and remember that this company was synonymous with South Africa and business. The volatility must have everything to do with a) the huge short positions built in which increases volatility significantly and b) the market is trying to figure out the restructuring plans and figure what next. For the time being, the shorts have been beaten to a pulp. Perhaps Anglo should have kept the pulp? On the losing end was Discovery, the company released an updated trading statement for the six months to end December. See below in the company corner. The stock ended the day down 5.21 percent.

There were a whole bunch of things happening over the last few days that have resulted in markets going higher. Chinese intervention in their markets has led to a little relief rally. I find it hard to see anyone who understands what is going on in the market there. Even Neel Kashkari (who I think is so awesome that he may be US president one day), who is part of the Federal Reserve know, when asked about China yesterday on CNBC, he was just as stumped as the next person. I did see an old and new BusinessInsider article that may offer perspective, if nothing else. Currently, there are 1.3 trillion Yuan, or 200 billion Dollars of non performing loans in China currently. That is enormous. As a percentage, as credit extension has been pretty strong, it is nothing alarming. Yet this is what the naysayers are all of course trumpeting. The only "good thing" from the rest of the globe is that banks outside of China are not exposed to this. It hardly makes the situation "better", as money has the same colour no matter where you go.

When digging however for size and scale of the Chinese housing market, I found an interesting statistic. According to an article that I read on Chinese mortgages, in the middle and lower income segment, total property values are around 15 trillion Dollars. Which is actually about the same as the US, such is the size and scale of middle and lower incomes China. The massive difference however is that in the US, those properties were around 80 percent mortgaged, whereas in China it is zero. In rural areas in China, the houses and dwellings have been passed down generation to generation, and whilst they are worth a lot, due to communism and property laws, that segment of housing is completely un-bonded. In the urban areas that differs hugely of course, property purchases and speculation have risen sharply. It just offers some perspective that may enable Chinese rural property owners the ability to leverage up and buy distressed properties in the cities, if the government wanted to enable this. Problems all have solutions.

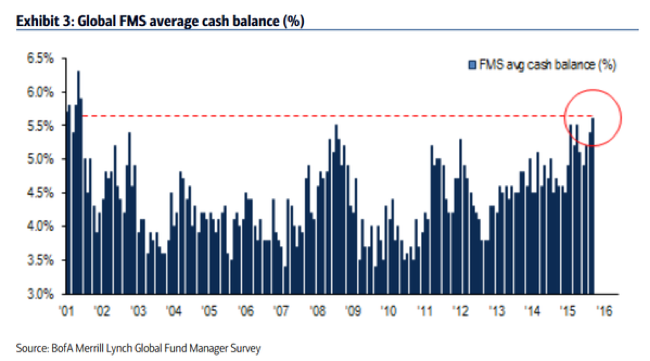

And then I came across a set of some interesting graphs yesterday, one is related to the links segment below, about the huge number of shorts, in part also the volatility of Anglo American. This is however related to the amount of cash that investors have built up in cash positions. See that the amount of cash built up now is higher in percentage terms than it was in 2008. And is the highest that it has been since the aftermath of the dot-com bubble bursting. Valuations? Better now than then? You would have to definitely agree with that, and this may well be one of the best contrarian indicators that I have seen in a while.

There are loads of other indicators that are not that good, Brazilian Credit Default Swaps rising (they are not alone, the FT writes: Oil exporting countries hit by downgrades), Venezuela might be sitting on a humanitarian disaster as they are more likely to default, or so says the market. Byron informs me however this morning that ecommerce sales for the last quarter of last year had the biggest increase in market share in the US ever. Off undoubtably the biggest base ever. So there are conflicting views here. To add to the pot, January sales of motor vehicles in Europe increased 6.2 percent, that seems like an excellent outcome to me. Europe on the mend.

Over the seas and far away, stocks rallied sharply, tech stocks were on another tear, the nerds of NASDAQ added 2.21 percent on the day. The broader market S&P 500 added one and two-thirds of a percent, the Dow Jones industrial average added 1.59 percent. The WSJ reports: Fed Seeing More Cause for Pause on Rates. Stay put for longer. Do nothing, that is seemingly good for stocks! The last three trading sessions have seen the S&P 500 up 5 and one-third of a percent, pretty breathtaking!

Company corner

Discovery trading update. At face value I can understand the market reaction, sending the stock lower by nearly nine percent in the first hour of trade. Normalised headline earnings per share are likely to be between zero to five percent more. Huh? And Headline Earnings per Share and Basic Earnings per Share are likely to be 45 to 55 percent lower. What? Why? first, let us look at the company measure they like to use, Normalised headline earnings per share were impacted by two factors. In their words:

"An increased investment in new initiatives, including the recently awarded Bankmed medical scheme administration and managed care contract, the expansion of the business model into banking and increased costs arising from growth in Ping An Health and other International Partner Markets; and Higher than expected costs associated with moving VitalityHealth in the UK onto its own system infrastructure."

I don't mind if a business spends a lot of money on ramping up their new businesses. Amazon is a great example of a business that has significantly increased their market share through heavy investment. Profitability is almost secondary to Jeff Bezos, one of the most amazing people in the known universe. Adrian Gore, the CEO of Discovery is one of those people. I know that as a significant shareholder he sweats the small stuff, lives the companies ambitions alongside the shareholders. And the major fall in HEPS and EPS? What is that all about. Again, the company explains:

"Headline earnings per share and basic earnings per share for the prior period were positively impacted by the once-off accounting treatment resulting from the lapsing of the put options Prudential held in respect of its interest in the UK joint venture - this was due to Discovery's purchase of the Prudential's remaining 25% of the joint venture in November 2014. As this once-off increase in profits occurred during the Company's 2015 financial year, all results announcements relating to the 2015 financial year will be affected for comparative purposes, as previously advised in the results announcement for the year ended 30 June 2015 released on SENS on 10 September 2015."

The results themselves are a week today. We continue to recommend this fast growing innovative business as a buy, and are using the lower prices as an opportunity to add, most especially if you are underweight the stock in your portfolio.

How hard is it to start a business and become successful? Very hard. It can however be done. Have you ever heard of Alan R Burke? Maybe. He is the founder of ARB Holdings (his initials are the name of the business), which he founded out of a container in Richards Bay, back in 1980 at the age of 26. He had a single employee and a bakkie, as an electrician, he saw a gap in the market. He owns 53.22 percent of the business, mostly through entities. At a closing share price (after results) last evening of 5.27 Rand, his share in the business (total market cap of 1.238 billion Rand) is 658 million Rand.

Not bad for an electrician from Richards Bay! He is still the chairman and hardly is old by business standards. The business had results yesterday and whilst the growth trajectory is muted and we are unlikely to ever own the shares, I thought that the story was certainly worth sharing. And if you ask him, it probably isn't about the money. Anyone can build a massive business, it takes a very long time, a lot of perseverance, many mistakes along the way and never say die attitude. Yet in the bigger picture, 36 years is not that long to end up with a business of this size. Start early, that is the message.

Linkfest, lap it up

Here is a list of the worlds most innovative companies, great to see a number of Vestact core holdings sitting in the top 10 - The Most Innovative Companies of 2016. One of the most interesting write ups is for Amgen, where they say:

"The company's competitive advantage in 2016: First virus-based cancer drug on the market."

One of the reasons that the market has been so volatile recently is due to the ability to short stocks. Shorting stocks also normally involves taking on debt to juice up the size of your short position, the result being that if the stock ticks up slightly you start losing large amounts of your invested capital. All the shorts then run for the same door, pushing the share price even higher and you then have what is called a short squeeze - Short sellers ducking for cover has sent stocks ripping higher The graph below shows how the most shorted stocks have performed the best recently.

Research in a fairly new field called, Behavioural Economics has shown that losses hurt more than equivalent gain feels good. Ben Carlson puts the number of losses hurting twice as much than gains feel good - Why Bear Markets Are So Painful. What does that mean for your portfolio? The more often you check it, the more it will hurt and the more likely you are to make poor investment decisions. The article says that following:

"As in the previous experiment, the subjects had only two investment options, a riskier one with higher returns and a safer one with lower returns. In this case, what we varied was how often the subjects got to look at the results of their decisions. Some subjects saw their results eight times per simulated calendar year of results, while others only saw their results once a year or once every five years. As predicted by myopic loss aversion, those who saw their results more often were more cautious. Those who saw their results eight times a year only put 41% of their money into stocks, while those who saw the results just once a year invested 70% in stocks."

Home again, home again, jiggety-jog. Japanese stocks are on fire, in Tokyo stocks are up two and one-quarter of a percent. Chinese stocks are mixed, Hong Kong is up sharply, up 2 percent. Shanghai is down a little. The US futures market is up slightly. I suspect we will continue along these lines today.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment