"And of course that is true, as of the close last evening Apple had a market capitalisation of 539 billion Dollars (the trillion Dollar curse), whilst Alphabet, and this is knowing your ABC's, was at 517 billion Dollars. In the aftermarket however, Google is up just over four percent, which means that it is touch and go as far as to which company is bigger."

To market to market to buy a fat pig. A mixed bag of a day here in Jozi, stocks started on a firm footing and then slipped away during the day, ending a little better at the end of the session. Resources were the strongest of the lot, the main story of the day undoubtably was MTN. Again and not for the right reasons. The stock had gradually been creeping higher, in part a return of confidence in emerging markets, an improving outlook for the local currency and then, for the benefit of two of their operating economies, namely Iran and Nigeria, an improving oil price. There of course was a Nigerian Monetary Policy Committee meeting last week, where rates were kept on hold.

Remember that there has been some political interference in their Central Bank, with possibly the finest Reserve Bank governor on the continent, Sanusi Lamido Sanusi being removed from his post, accused of negligence. Not long after Sanusi suggested that 20 billion Dollars in oil revenue had evaporated, in other words, he was fighting corruption and someone did not like it. I think that the man has political aspirations, he looks like the real deal and is a stickler for detail.

In short, the story that we saw via Twitter was pretty simple: MTN Threatens To Shut Down In Nigeria Over Government Harassment. It seems like all the operators are suggesting that the government is making it impossible to work in specific states. The story came via another website that is currently unavailable.

At the same time, the chairman of the Senate Committee on Telecommunications, i.e. a politician, urged the NCC and MTN to work together in order to resolve this impasse -> Senate panel moves to resolve NCC, MTN discord over fine. It seems from the quote at the bottom that at least he gets it: "The matter has become very embarrassing, but with dialogue, the matter will be resolved. We don't want to hear that we are looking for foreign investors in the country and in the other way round, we are chasing them away, we can't allow that to happen"

The long and the short of it all is that the MTN share price was smashed and kiboshed, down just under 9 percent on the day. The situation continues to be difficult at best, it is hard to keep the faith when the news flow continues to be poor, and definitely not in the favour of the company. I am pretty sure that they are working hard to achieve a favourable outcome for the long term operations in that country, remembering that the best person currently for the job has the top job, former and now acting CEO Phuthuma Nhleko has more to lose than most. Whilst he has significant other investments, I suspect he has more than enough MTN's to keep him interested.

In other news, a crowd called Dodge & Cox became the third largest MTN shareholder, now owning 5.02 percent of the stock, announced yesterday. The company is privately owned by the employees, their returns seem pretty good -> Average annual total returns. Sticking their necks out no doubt here. The US based company overtakes Coronation, which also own a little over five percent of the stock, that company yesterday stuck out a glum Summer note, not so long ago: The Coronation Fund Managers Personal Investments Quarterly.

Over the seas and far away (I am going to try my darndest to keep the grammar and vocabulary police at bay today) in New York, New York, stocks came back from the dead. Well, not really, it does however sound like they were buried, and you know that pessimism always sounds a great deal smarter than optimism. Our species has a morbid fascination with the bad, rubber necking at everything from car crashes to plunging stock prices. I suppose it is hard coded to learn from these events, the same applies no doubt to the stock market. The broader market S&P 500 closed almost unchanged, down 0.04 percent on the day, whilst the Dow Jones Industrials sank one-tenth of a percent. The nerds of NASDAQ buoyed by another favourable session by Facebook (up two and a half percent to an all-time high), closed higher on the day, up around one-seventh.

Stocks across in Asia are mixed, Hong Kong and Tokyo lower, news of more stimulus pending ahead of the Chinese holidays is sending the Shanghai stock exchange much higher! Up, up and away. Over two and one-third of a percent better at the moment, that is a very volatile market, almost anything can/could happen there. Chinese new year next week sports lovers, expect some shake ups, I at least am.

Company corner

Alphabet, the company formally known as Google reported numbers after the market close last evening. I am pretty sure that you have read the headlines already, Google overtakes Apple as the most valuable company in the world is what they read. And of course that is true, as of the close last evening Apple had a market capitalisation of 539 billion Dollars (the trillion Dollar curse), whilst Alphabet, and this is knowing your ABC's, was at 517 billion Dollars. In the aftermarket however, Google is up just over four percent, which means that it is touch and go as far as to which company is bigger. Of course this is always on paper, the stock, Google that is (we will continue to use it interchangeably, Google and Alphabet), is in unchartered territory. And I remember not so long ago that the chattering classes were referring to Google as a one trick pony, they were losing their mojo, and, and, and .....

Well, the company has certainly proven their critics wrong. This time (this very day) last year in an analysis titled Google 4th Quarter and full year results, we were bemoaning the fact that the company had significantly underperformed the index, notwithstanding being trounced by their peer grouping. The company was really about as cheap as it ever was on a fundamental basis, trading at around 22 times forward, the current multiple (historical) is comfortably over 30. Some may argue that is pretty expensive, and it is on a relative basis. On a price to sales basis, the stock trades at half the same multiple, when applied to Facebook, certainly Mr. Market is applying a significant premium to Facebook over even Google.

Here we are, the Fourth Quarter and Fiscal Year 2015 Results from Alphabet. There is a certain quirkiness to this business and their reporting, they certainly do not conform to most standards, perhaps the business is trying in their own way to break the mould. They present the core business and then the "other bets" revenues which is a mere 0.6 percent of total revenues, yet incurs a sizeable loss.

Other bets means businesses not named Google and therefore refers (and this is the way that it is interpreted) as Fiber, Nest (home automation) and Verily (the health business). Total revenue from those three is less than half a billion Dollars, yet collectively the cash burn there is astonishing, these businesses as a collective recorded a 3.6 billion Dollar loss. The Google core business can certainly carry the "other bets" for a long time, the core Google business generated 74.5 billion Dollars in revenues, operating income was an equally impressive 23.4 billion Dollars.

The results at face value seem to have pleased the market a lot, they are now, as we said, the biggest company in the world. We will revisit and continue to do some analysts on the business over the coming days, we continue to accumulate was is an amazing opportunity, the stock may look a little pricey, I suspect that the opportunities for them to morph into a multiple trick pony still exists. Deeper analysis will confirm that we are still conviction buyers at these elevated levels.

Jeff Bezos announced another stellar year of growth for Amazon.com on Thursday. As Sasha wrote yesterday, the market was expecting more. Headlines on Friday morning were along the lines of "Amazon disappoints". I think sometimes people get too focused on the expectations and lose sight of the bigger picture. Full year revenues grew by 20% to $107 billion, putting them into an exclusive club of companies. To put their revenue growth into perspective, the revenue growth of $18 billion last year was more than the total revenue of Visa for 2015.

Thanks to the 122% growth in net income, the company now only trades on a P/E ratio of 460! Based on that metric the stock is wildly expensive but having a look at the following graph, it is clear that all the capital expenditure is paying off and owning this company is a long term play.

You will find more statistics at Statista

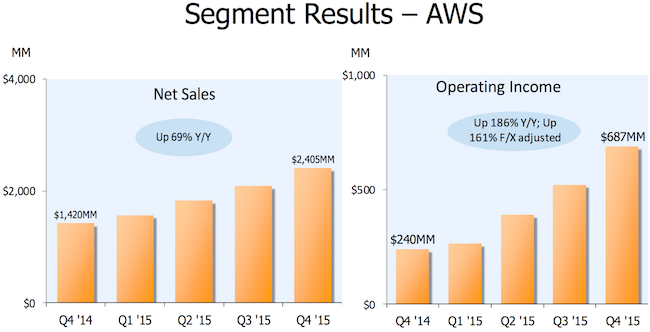

The big profit driver is still Amazon Web Services (AWS), a part of the company that many people forget is there. Even though it only contributes 7% of the revenues it is the bulk of the profit. AWS is the profit centre that allows the e-commerce division to have very thin margins, which brings in customers and has allowed amazon.com to be the dominant online retailer.

Amazon Prime, is where Amazon locks in customers and once they are locked in as a Prime customer, they spend more. Prime membership is up 51% for the year. The service that is putting daylight between amazon.com and their rivals is Prime Now. There are 25 cities around the world where you can sign up for Prime Now, which means that your goods will be delivered with in an hour of you ordering them!

For the quarter ahead the company expects to grow net sales by between 17-28%, all the top line growth is forecast to trickle down to the bottom line. The 2017 forward P/E ratio is currently sitting at 62, which is still very high but does highlight how quickly profits can grow and the P/E unwind to levels more comparable to traditional businesses. There is still huge amounts of growth left in the amazon.com tank and will probably be competing soon for Googles newly acquired crown of "world's largest company". Buy

Linkfest, lap it up

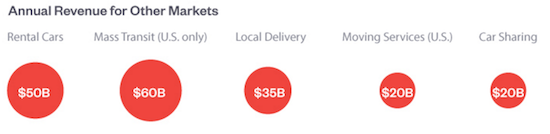

Here is a look at the size of each market that Uber is disrupting and gaining market share in - How Uber can Uber be?

When considering that some people going forward will opt for taking Uber on a regular basis instead of buying a car, the potential market could then increase by another $750 billion!

The wonders of engineering - China is building its most terrifying glass-bottom bridge yet. Would you walk across the bridge? I know people who avoid the glass bridges in Menlyn shopping centre and that is only two stories high.

A good barometer for how the consumer is doing is to have a look at spending habits. When a company like Porsche sells a record number of cars in 2015 and sells 24% more cars in China, it is a good indicator that there are still parts of the economy doing well - In 2015, Porsche delivered more than 225,000 cars world-wide.

Home again, home again, jiggety-jog. It's a mixed bag on the JSE. More direction expected from results pumping through in New York. So far that seems to be beating expectations.

Sent to you by Sasha and Michael on behalf of team Vestact.

Follow Sasha, Michael, Byron, Bright and Paul on Twitter

078 533 1063

No comments:

Post a Comment