To market, to market to buy a fat pig. Yesterday all eyes were on the really witty and suave Mario Draghi, the head of the European Central Bank. He lowered his projections for the European recovery, I guess that is about right. All the numbers that I have seen in Italy for instance have suggested that lower economic activity has not exactly bottomed out yet. I suspect that in the next month or two we will see both the unemployment rate taper off and PMI bottom in Italy. Silvio Berlusconi was up to his old nonsense again in Italy, but existing Prime Minister Mario Monti survived a vote of sorts related to economic policy. Berlusconi has withdrawn support for Monti's government as it exists now. Bother. Well, we didn't get that face by being someone who doesn't love himself. Berlusconi that is. He is 76, extremely rich and extremely opinionated. I remember him keeping Angela Merkel hanging whilst he took a telephone call, check it out, priceless: Berlusconi keeps Merkel waiting by taking phone call at NATO summit. He must have been organising another one of his weekend "meetings".

Back to Mario Draghi. The ECB predicted that the zone would contract in 2013, revising down from half a percent growth in 2013. Inflation expectations were also lower for both next year and the year after that. Growth anaemic, inflation no problem and outlook more than foggy. But, as the ECB chief said, they had done a lot. And were ready to do whatever was needed of them, now that the programs are in place. And of course, the countries wanting to participate, they now know the conditionality clauses. I suspect, like the Italians and the Spanish, with someone waving a giant stick, the bond vigilantes will stay away. This is almost like a leopard warding off a few hyenas.

Back home in Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E we managed to end another day at a record high. Not quite near the all time highs, which were set intraday yesterday, but closing at another record high, I guess that is very pleasing from our point of view. And believe it or not, I have seen several notes in recent days from brokerage houses suggesting that some South African retailers, which have dizzying valuations for the locals, have been called buys. Yes, don't stress about the 25 times multiple, the growth rates over the coming years look appealing enough for us, thanks very much. And you can't fight or perhaps even fault that. In the same way that we sit here and think that the prospects for both East African and West African retailers are very good. Using the generic Mark Mobius type commentary, check this one out, from October this year, a guest post on his blog: Will South Africa's Struggles Overshadow its Potential? We often have a chuckle when we do a Mark Mobius here and say stuff like: "Big population, low base, lots of mineral resources, steady democracy, lots of potential". That is possibly the same line that international investors take on our retail sector in the same way we would, for instance look at Nigeria's retail sector.

The biggest news on our market by a country mile was the announcement by Barclays and ABSA, as per the Barclays website: Barclays and Absa agree strategic combination of Barclays Africa operations with Absa. By combining the rest of the African operations with ABSA locally, there is a headquarters and a strategy from one place. Which I personally think is awesome for both sets of shareholders, which is why I suspect that is the reason that ABSA rallied 5.5 percent yesterday. In London, Barclays rallied 1.63 percent to close at a 52 week high, which I guess is pleasing for that long suffering set of shareholders. Over a five year period Barclays shareholders are still down 55 percent. Eish. Over ten years they are down 38 percent. Eish indeed, that has been a rather awful time, no thanks to the period of great pity of late 2008, early 2009.

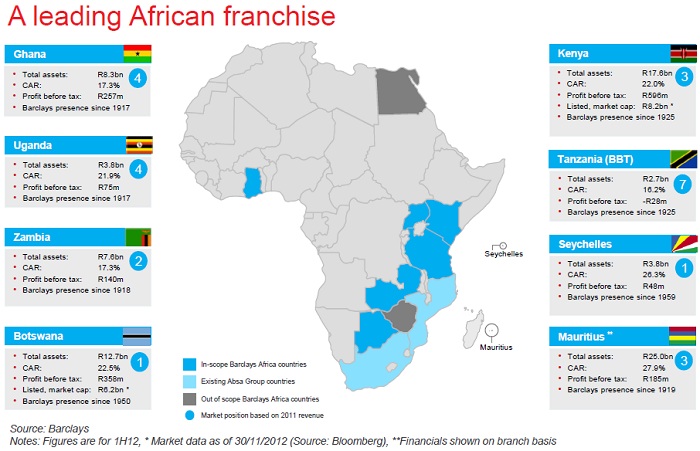

But what does this mean if you are indeed an ABSA shareholder? Well, I suspect that you got a pretty good deal, that was my initial thoughts without having done too much of a detailed analysis. I was gobsmacked at how small the ATM infrastructure actually was, which means that mobile money has a brighter future than I even thought. So what will ABSA shareholder hold now? Well, as per the release: "Botswana (67.8%), Ghana (100%), Kenya (68.5%), Mauritius (100%), Seychelles (99.8%), Tanzania (100%), Uganda (100%) and Zambia (100%), as well as the Barclays Africa Regional Office in Johannesburg (100%)" Kenya and Botswana have minorities through the local listings. ABSA will continue to "own 100% of Absa Bank Limited, 95.8% of Barclays Bank of Mozambique and 55% of the National Bank of Commerce in Tanzania." As you can see there is a strong focus on East Africa here, with only a base in Ghana in West Africa. Zimbabwe and Egypt are considered basket cases are excluded from the deal. The combined new entity will be known as Barclays Africa Group Limited. The ABSA brand will be continued to be used locally in their retail banking and card division. I am guessing just for now. Here is a slide (which I messed with a bit to fit my page) to explain which businesses they are buying:

So, what did ABSA pay Barclays for this transaction? 129,540,636 ABSA shares valued at roughly 1.3 billion Pounds Sterling or 18.33 billion ZAR, based on two things, a) an exchange rate of 14.10 ZAR to the British Pound and b) Based on price of 141.5 ZAR per ABSA share. As of last evening that was 149.5 ZAR. Still, before you get excited, the 52 week high is above 160 ZAR a share. The 3 year performance at this point is a 17 percent gain. More on that a little later. Paul said for a second, who did the independent analysis here? Was it the same people that valued Autonomy at 10.1 billion Pounds? I laughed and said no, I suspect not, and when I got a chance to look closer found that it was Goldman Sachs International who acted as the financial advisor on this deal. If ever you needed a rubber stamp.

In case you wanted to know who the HP/Autonomy advisors and banks, lawyers and accountants are/were: H-P's Autonomy Deal: Here Are the Advisers. On HP's side there was none other than Barclays! And on Autonomy's side there was Goldman Sachs along with 5 others, including UBS, Citi, JP Morgan Chase and Bank of America. But that is another horrible chapter in deal making, HP, what were you thinking? Awful.

Back to the price paid by ABSA for Barclays Africa, 1.3 billion pounds is a lot of money. It represents a little more than four percent of Barclays entire market capitalisation. By adding another 129 and a half million shares, Barclays ups their stake in ABSA to 62.3% percent. As ABSA shareholders, you get diluted by as much as 18 percent. In the presentation, titled Barclays Africa transaction Investor presentation, there are a few highlights worth pointing out: "Price to book of 1.7x and 10.1x historical PE (1H12), no control premium as Barclays remains majority shareholder" AND

Basically, ABSA paid a ten multiple based on annualised profits after tax for the rest of the African operations, which were 1.8 billion Rands. Is that cheap? Well, yes and sort of. I did a quick back of the matchbox calculation for Barclays Kenya, which earned 0.67 shillings per share for the half year (Barclays Kenya Posts a 13 per cent Increase in Profit Before Tax), and last traded at 14.30 shillings (Barclays Bank of Kenya Ltd – Bloomberg price). That is an about 10 and a bit multiple. So, to be fair to this cheap transaction price paid by ABSA and the rest of their shareholders, this was market value. Which explains why there is no premium paid, because not too much changes for the gorilla shareholder Barclays.

I shall leave you with the not so good news for ABSA shareholders, but the past is the past. Over the last 12 months ABSA has returned 2.25 percent for their clients. Not great, bearing in mind that there was a big 5.5 percent move yesterday. FirstRand over the same period has returned a mind boggling 48.55 percent over 12 months. Standard Bank a more muted 8.8 percent gain. And Nedbank a very acceptable 23.9 percent return over the last 12 months. Year to date the banks have returned 21.5 percent as at this morning. Astonishing really that ABSA have lagged their peer group by so much over the last year. Over five years however, to be fair to ABSA, which have returned 24.6 percent have lagged the broader index, but not by too much. The banking index over five years has returned 30.4 percent. Last year, not good, five year, just lagged. The good news is that ABSA are up another two and a half percent this morning, so far.

In New York, New York. 40o 43' 0" N, 74o 0' 0" W Apple bounced back after a big fall the session prior to that, perhaps the stock was too juicy to ignore. Check out this subscription only WSJ article: Apple's Power Within. It basically suggests that because Apple is both a hardware and software company, that is quite a good thing. Phew, insightful. No really, it is a good read, check it out. All this of course ahead of the non-farm payrolls number, a much lower number expected this time around, no thanks to the Hurricane named Sandy. Sandy of course is also ironically the squirrel that lives at the bottom of the sea in Spongebob, and is always trying to keep dry. See the connection? Hopefully there is no need to mop up the floor when the non-farm payroll number comes through at around three thirty this afternoon.

Crow's nest. That will be about all that Mr. Market is focused on for today that is. Word on the hill is that both sides have committed to not going home for Christmas, I can remember saying that was almost the best thing about these negotiations. Of course nobody wants to spend time with their colleagues over Christmas and in particular in this case, the opposition. So I am guessing that a deal will be forthcoming soon, with concessions on both sides. We shall see. I, myself am off early, I shall be back on the first working day of the year. Byron and Paul are here right up to that week between Christmas and New Year. We are of course always online and available through our emails if you need us! Oh, and Gangnam Style just clocked 900 million views, you must try and get PSY to one billion!

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440