Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. We got trounced here yesterday, stocks lost nearly a percent in a pretty broad based selling exercise, with a slight beating on the resources front. The gold stocks in particular were hard hit. This morning there is however good news for the long suffering shareholders of Gold Fields, the company has decided to split the businesses into two. More on that a little later in this message, I think that this is the first of what might be many geographically diverse mining companies looking at making these types of decisions. We shall see, not everyone has the scale to be able to do such things.

I made a mistake yesterday, apologies. In my MTN piece I said that Shanduka had bought the stake in MTN Nigeria from MTN International, that was not the case. In fact Shanduka bought the stake from a private equity crowd called ACA that were exiting the investment. The annoyance was not that Shanduka had bought it, but that MTN International had not. Sorry for that, clarification! Now the one part that we are struggling with in the office is the part in which Phuti Mahanyele (she is the CEO of Shanduka) says that this transaction was done at an arms length from MTN. Implying that Chairperson of MTN, Cyril Ramaphosa, did not take part in the negotiations. MTN in fact had a pre-emptive right to buy that stake, but did not. I wonder why? That is still an irritation for us. And I suppose that Ramaphosa's family interests, his family trust which owns a little more than 30 percent of Shanduka must have known that this deal was taking place. Surely. But I am guessing that it is very plausible that Mahanyele could have briefed Ramaphosa after the deal had actually happened. No need to speculate. This is a massive deal for Shanduka, the WSJ suggests that their (Shanduka) enterprise value is 1.58 billion Dollars. So 335 million Dollars is a big deal.

There are some clues around valuations were given away by Mahanyele, where she says in this interview, Shanduka denies confict of interest in buying MTN Nigeria stake: Phuti Mahanyele - CEO, Shanduka, with Hilton Tarrant of Moneyweb that "We haven't disclosed that figure just because we don't want to give rise to an indication of what the entry price was, given that the group is listed. So ja, we deliberately left out that number. But we would become the third-largest shareholder in the business." That last sentence is the clue, the third largest shareholder. But for the life of me I can't seem to find that list. All I know is that MTN own more than 78 percent. And I did in my scouting come across a valuation at the height of the market of MTN Nigeria of around than 10 billion Dollars. So, you might well find that this 335 million Dollars might be for a stake of around 3 percent.

What exactly have Gold Fields announced this morning? Well, it seems that they are proposing that the company split into two parts, an "international" business with the only South African asset being South Deep and then a purely South African business called Sibanye Gold (Xhosa for "We are one", I wonder if the SABC has dibs on that?), that will comprise of KDC and Beatrix. Subject to approval, the release says, Sibanye will be listed on both the NYSE and the JSE, with both primary listings remaining here. Neal Froneman will run the business, that is a bit of a shock. The remaining executive team at Gold Fields will continue to run that business. The reason why South Deep is included in the business to be kept under the name Gold Fields is that it really is the swing mine.

Let me explain. According to the GOLD FIELDS UNBUNDLES GFIMSA release: "Gold Fields' production (excluding Sibanye Gold) for the 12 months ended December 2011 was 2.2 million gold-equivalent ounces and its mineral reserves, as at 31 December 2011, were 64 million ounces, comprising 40 million ounces at South Deep and 24 million ounces at the international operations." So, with regards to the reserves, South Deep represents 62.5 percent of the new Gold Fields which is ex Sibanye reserves. As for Sibanye: "The mineral reserve positions at 31 December 2011 were 22 million ounces for Sibanye Gold". You can quickly see how important South Deep actually is. So of the combined old Gold Fields as we knew it, South Deep was 46.5 percent of their mineral reserves. See, it was simple for Gold Fields.

OK, so what is the rationale of this deal? Will the new Gold Fields part get a higher valuation? Especially when you think that 62.5 percent of their reserves are still actually in South Africa. Well, I guess more clues could lie in the production numbers, I am going to jump back a quarter to the June quarter, because that excludes the recent strike action. KDC produced 279.6 thousand ounces of gold at a cash cost of 242.6 thousand ZAR per kg. Or 936 Dollars per fine ounce, much lower than the quarter prior to that. At Beatrix, gold production reached 79.2 thousand ounces for the quarter, with cash costs of 273.4 thousand ZAR per kg or 1342 Dollars per fine ounce. So the combined entity would be able to produce roughly 320 thousand ounces per quarter or somewhere close to 1.3 million ounces per annum. Operating costs for KDC are in the region of 2 billion ZAR a quarter, whilst at Beatrix that is closer to 675 million ZAR. Combined, operating costs for Sibanye will be roughly 10.7 billion Rands a year. Operating profit at Beatrix was 374 million Rand for the June quarter, and 1.59 billion ZAR at KDC over the same time frames. So, less than 8 billion Rands worth of operating profits for the year, that sounds decent.

I did not actually have to do the math, the second release, the SENS announcement had what I was looking for: "Based on the results for the 12 month period ended December 2011 Sibanye Gold's gold production was 1.4 million ounces making it one of the largest domestic gold producers in South Africa. Sibanye Gold's unaudited revenue for the 2011 financial year amounted to R16.6 billion with unaudited earnings before interest, tax, depreciation and amortisation ("EBITDA") of R6.8 billion ... "

And at Gold Fields? Well, again the SENS release spells it out: "Gold Fields' production (excluding Sibanye Gold) for the 12 months ended December 2011 was 2.2 million gold-equivalent ounces.... Gold Fields' unaudited revenue for the 2011 financial year (excluding Sibanye Gold) amounted to US$3.5 billion with unaudited EBITDA of US$2.0 billion ..." Notice how the numbers are displayed in Dollars, I think that the key lies in that presentation to their investors. The plan is actually quite simple, to ramp up South Deep production to 700 thousand ounces per annum, gold produced was only 77.8 thousand ounces for the June quarter. So, there has to be a ramp up of roughly 125 percent from these levels at South Deep. And the final Gold Fields after much of this expansion might have most of the reserves, but will only be around 30 percent of total production. That is the key I think for the new set of shareholders will be them knowing that they have divested from South African production by around 1.4 million ounces. Tarkwa in Ghana and St. Ives Down Under (where Ricky "Punter" just called it quits) are the most important international assets.

But don't let me tell you what it is, or isn't, see what Nick Holland in a Gold Fields explanation video says about the deal. He says that he wants people to return to the gold stocks, away from the metal, so that they can enjoy their "time in the sun". He calls Sibanye a "gold champion" and refers to the assets as mature. 70 years old is a little more than "mature". What he says is a little chilling, suggesting that gold production in South Africa has halved over the last seven years. Halved!!! From 360 tons per annum to 180 tons per annum. Well, good luck to the repackaged assets. Shareholders are cheering this, the stock is up nearly 7 percent. Am I excited? Well, in my mind very little changes rather than some shuffling. If production locally and productivity does actually improve, or stabilize, then perhaps this will work. There are some big plans afoot locally both at South Deep and then at Sibanye to be able to build sustainable living for their workers. Perhaps the better morale alone of the workforce will actually boost productivity. And perhaps this will become a model for South African mining. I wish them well. We will not be buying either the old version in anticipation of the unbundling or the two new versions, post the split.

The thoughts around this next piece were inspired by the piece that I read, that was hyped up: What the Greece Deal Means for German Finances. Eeek. 730 million Euros, that is awful. But then I thought to myself, well, what does that mean for every man, woman and child living in Germany. Well, it turns out that is 8.92 Euros per German, or per person living there. Is that a lot? Not really for a European I would think, for 4.99 Euros you can get a big Mac, medium fries and a medium soda in Germany. 'Tis true, I checked the McDonald's menu: McDeal Menu. I was just trying to quantify what the delayed payments from Greece to Germany was actually. Perhaps next time a German citizen is visiting Greece, they could get a discount on their coffee. And a lot of Germans actually do visit in Greece, as many as 2.2 million visited the country in 2011.

You have often heard me suggest that the problems of Europe are rich people problems. I struggle to try and quantify it, because it is not that easy to get across. So I tried to put together a list of little factoids of the European Union. 27 countries, 332.839 million people. Total GDP in 2011, 17,578 trillion US Dollars, total government debt at 82.5 percent is 14.501 trillion Dollars. OK, now you are frothing at the mouth, but before you get your blood pressure too high, just remember that a loan is also an asset in someone else's book. Even though the total debt outstanding exceeds the Maastricht treaty, which says it should not exceed 60 percent. Back to the loan part. Banks extend loans to their customers, that loan book then becomes their asset, that is the absolute simplest way of thinking of it. Therefore all the government debt outstanding, which is collectively owned by amongst others pension funds and financial institutions is an asset in their hand, and by extension to their retirees and the like. The chances of default in Europe are low. Although the Greek restructuring exercise did prove that it is not impossible.

The outstanding government debt has maturities of anywhere between 3 months to 30 years, perhaps even longer dated. According to this very useful page from Eurostat, Structure of government debt: "The outstanding debt issued on a long-term basis accounted for between 74.6 % and 98.9 % of the total in 23 EU Member States, revealing a common pattern." So, it is fair to say that there is time. But all of this has yet to answer my burning question, how rich are the Europeans actually?

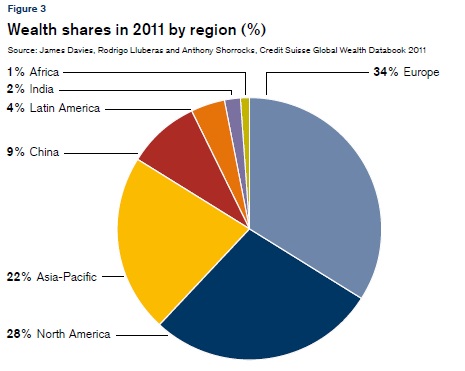

From the same source, Eurostat, Household financial assets and liabilities presents us with a fairly good picture. But the one that I really like after having been trawling for this piece was this document, a real goodie: Global Wealth Report 2011. Wealth per adult in Western Europe exceeds 100,000 US Dollars. Check out this out, a pie graph that probably illustrates my points best of all:

The key part here is the absolute number, according to this report, it is 231 trillion Dollars in total as at the middle of last year. This is total global wealth. Let us presume that between now and then, the middle of last year, that there has been a modest five percent rise in global wealth. The number would be closer to 243 trillion Dollars. The European portion of that would be "only" 82.5 trillion Dollars. If "things" improve further, it is not too much to suggest that that in five years time, it might have increased by 15 percent. That would add 12.37 trillion Dollars worth of wealth. With outstanding debt of 14.5 trillion Dollars, the impact of increasing wealth could more than offset the problem. Rich peoples problems, I am still convinced.

- Byron's beats

Here at Vestact we are forever looking for new opportunities, it's what makes this industry so exciting and by managing money in New York the avenues are endless. Over the last month or so I have been looking at a company which fits a massive growth theme around the world. The company is huge with 20.3billion Euro's in sales last year, this is certainly no secret but I think it is a great addition to our New York portfolios.

L'Oreal has a century of expertise in cosmetics, has 27 global brands in over 130 countries and filed 613 patents in 2011 alone. Brands which you may have heard of include L'Oreal, Garnier, Maybelline, Redken, Matrix and The Body Shop. These range from makeup to shampoos to anti aging creams. I can't say I am the biggest expert on the use of these products but I know that people love them. On top of these brands they also own the cosmetic rights to big global brands such as Giorgio Armani, Yves Saint Laurent, Ralph Lauren and Diesel. You can see how this company fits right in with our aspirational consumerism theme.

Looking at the financials from last year, as you can imagine, the margins in this business are huge. From sales of 20.3bn Euros operating profit of 3.3bn Euros was realised. The share trades at 104 Euro and earnings for this year are expected to come in around 4.88 Euro. A multiple of 21 certainly is not cheap but I never expected it to be. This company is experiencing double digit growth.

What I really like about this company is its growing exposure to the developing world. Last year North America was responsible for 23.3% of sales with 5.5% like for like sales growth. South America, which is a huge cosmetics market, was responsible for 8.9% of sales with 13.2% growth.

Africa and the Middle East saw 10.5% growth and is only responsible for 3.1% of sales, while Eastern Europe which is responsible for 7.1% of sales saw a slight decline of 2.8%. Western Europe is still its main market with 38.4% of sales, as expected sales were slow, only growing 0.6%. But Asia Pacific which is now 19.2% of sales saw massive growth, up 13% and becoming more and more significant.

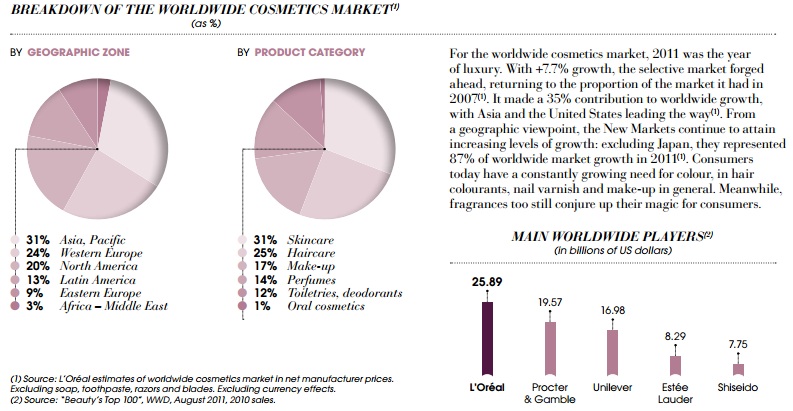

That is L'Oreal's breakdown of sales but the breakdown of global sales for the entire industry is slightly different. I hacked this picture from the 2011 annual report which shows us where they can grow market share, which cosmetics are the biggest sellers and L'Oreal's biggest competitors.

So that was last year's figures, the big question is whether they can maintain this growth? As you can imagine, there is a lot of room for innovation in this industry. The company has 19 research centres, in 5 regions, 16 evaluation centres and 50 scientific and regulatory departments.

Last year they dedicated 721 million Euros to research and development. This gives me no doubt that they will carry on releasing products which they can successfully market to the public at a 65% mark up.

What most excites me though is the macro environment. People love to look good and hate to look bad. Aging is a reality that everyone has to face. As women become more liberalised in developing nations their demand for these products will fly. If your best friend starts attracting all the boys with her new look you are definitely going to follow suit, it is human nature.

Society is becoming more and more vain and from what I hear this materialistic culture in Asia is becoming huge. The industry is growing just as fast for men who have realised that it is not so bad to look after your self thanks to metros like David Beckham and George Clooney making it socially acceptable.

Because of all these factors mentioned above a think this is a great addition to any portfolio. If you have spare cash in your account give us a call and we will get you some. Because You Are Worth It! (sorry I had to throw that in somewhere).

Crow's nest. Markets are cooking, we are up a percent. It seems that all you have to do nowadays is replace the words in the following sentence. Markets (falls/rises) as Washington DC is (closer/further away) from deal on fiscal cliff. And another favourite, Markets (falls/rises) as fears (ease/rise) on next Greek bailout package. You can interchange those on a day to day basis. What nonsense. Buffett, bless him, the man said yesterday that come 2 January, if the "fiscal cliff" event had happened they would not be laying off a single employee. See.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment