Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. We settled lower here yesterday, in part the stronger Dollar sending commodity prices lower was weighing on the heavyweights. Why would the Dollar get stronger? Well, as we know, in times of uncertainty with a pending and using the cliché "too close to call" US presidential election, folks go with what they know. And what they do know is the Dollar, the Benjamins, the bucks, beans, bones, the dead presidents, large ones, the big ones, the greenbacks, the G's. The US Dollar. So the flows have been back into the worlds most used and trusted currency and out of most other things.

Remember this rather old table that we loaded up about a year ago, titled Financial assets by country, which is worth visiting from time to time. What it shows is that Japan and the USA, with nearly 15 percent and 37.3 percent respectively, they hold the key to asset price movements. Add in the UK, roughly 5 and one third of a percent, and the Germans, at roughly 5.2 percent and you get to 62.7 percent of global assets being owned by four countries. So, who cares about everyone else then? It matters about the US flows more than anything else, and until that changes, it will hold true.

The Chinese on that older list (it comes from 2010) control less than five percent of all global assets. If you are looking for the note and the Allianz piece from where that table was hacked, then head back to late September last year in our note titled: Who owns the global pot of money? The Dollar is the global tiller. In other words, if my physics doesn't evade me now, the Dollar direction will apply the necessary leverage to steer the global pot of assets in one direction or another. It is not going to be, with all due respect, the Malaysian Ringit, or the Rand. Talking Rands, who is getting excited about new Rand notes, or the Randela's as I have heard them nicknamed?

- Byron's beats

On Friday Naspers confirmed the acquisition of a stake in a Dubai-based online retailer called Souq.com. Naturally I went and checked it out. Specials for Canon camera's and iPad mini's popped up while categories which include electronics, fashion, watches and jewellery, games and books also have lots of specials on offer. Souq of course is loosely a term for a market in the Arab speaking world.

This article from Zeenat Moorad, retail specialist at Businessday, delved into the details. The acquisition was too small to force a SENS announcement. In fact it doesn't even appear on the website. According to the article Souq.com was founded in 2005 and already has 8 million users a month.

This from the CEO of Souq.com: "We will use the capital from this investment to offer our customers even more choice with a best in class online shopping experience, expanding into new categories such as fashion and lifestyle and opening our own logistics centres in United Arab Emirates, Kingdom of Saudi Arabia and Egypt."

Although it is small these announcements constantly reminds me that the high flying Naspers is still out there seeking opportunities. I say highflying because the stock has had a great year. It's up over 50% this year, now trading at all time highs of R567. In March 2009 it was trading at R142. That is a 4 fold return in less than 4 years. Amazing. It also reminds me that big companies can still experience these kinds of returns. Even back then the company had a market cap of R60bn.

I am encouraged by Naspers growing into online retail. Especially in the developing world. The Middle East has lots of money with people who love to consume. And I really do think online retail is going to become a way of life more and more. People are working more hours, online retail saves time and often money. Here in South Africa if you work during the week and hate the absolute chaos of Saturday morning shopping then this is your only option. I am sure it is like this all over the world.

Much of the company's growth this year has come from the good performance of Tencent in Hong Kong of which they own 34.26%. But I wouldn't underestimate Naspers eye for a good deal and finding a potential new Tencent type whopper. But even if that is not the case, adding good solid online businesses in the developing world to their portfolio will certainly bode well for the future. We are glad we have been fully invested during this great run but would still be adding at these levels.

What is cheap and what is not cheap? You know, I struggle always with this argument and I am sure that all the participants wrestle with this on a daily basis. For each and every seller on a trade that is matched there is a buyer. People sell because they have had enough, one way or the other. People buy because they think that the stock is going to go up from this point. So the selling part could be for a number of reasons, even rebalancing of portfolios because one particular stock has done better than its peers amongst all your positions. You should be so lucky to have that problem. Some people don't care too much about owning one specific stock, the old story of Bill Gates had no diversification because all of his wealth was in Microsoft. So what, I thought? If Microsoft is on a 3 percent yield, he would be diversified in a matter of half a decade by around one fifth.

But he is a philanthropist, he likes to give the money to various foundations. He sure lives a little, but he gives a lot too. We once commentated here in the office that you might never catch Larry Ellison (the Oracle CEO, who pays himself like crazy) in a shack in Khayelitsha speaking to a disabled person about their daily struggles. Nope, but you found Bill Gates there. As Byron said though Larry gives a lot to charity himself, perhaps I am being too unkind here.

But I am getting distracted here, what I am trying to answer is whether the market is expensive or not. Let us use a few metrics, first, book value. What is the book value of the S&P 500 right now? That was easier to find than I thought, S&P 500 Book Value Per Share equals 639.44 USD. With the index trading at 1417, as per last evenings close, the index is trading at 2.2 times book. I guess as a deep value investor you would hardly say that the broader market looks cheap.

But it is not expensive either, and historically this is quite cheap. In Q4 of 2007 when the S&P 500 topped out at 1560 plus, Q4 2007 book value was 529.59. So that ratio was then closer to 3 times. It would have of course been much better to have bought the S&P 500 at the bottom (early March 2009), at a level of 666 on the S&P (ohhhhh spooky), the Q1 2009 book value of the S&P 500 at 449 puts the price to book ratio at less than 1.5 times. You are hardly going to see that cheapness in a hurry again. We are in the middle of that range.

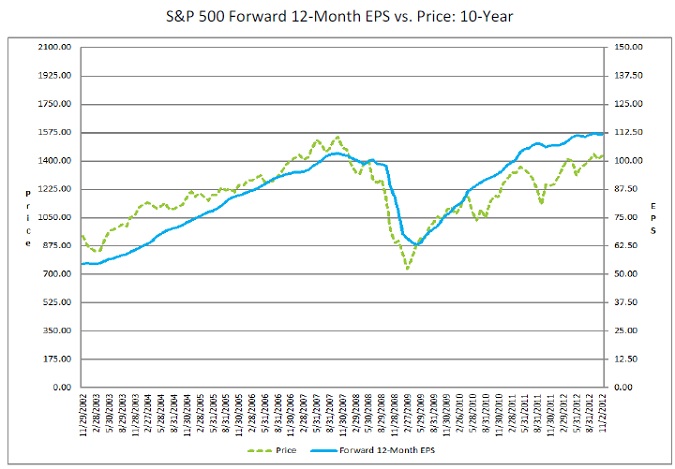

The other measure of course is price to earnings, how many years worth of earnings are you willing to pay for the S&P 500 price. The thing is, that measure is too easy to use. You could argue that for the next year, 2013, the aggregate earnings on the S&P 500 could be as much as 111.78 US Dollars. Those are measurements from a recent document titled: EARNINGS INSIGHT. Recent and very detailed, that suggests that the market is cheaper than the ten year average. The 10 year average (which includes both overvalued and undervalued extremes) is 14.3 times. The 12 month forward measure is closer to 12.6 times. But that is splitting hairs I guess, you might be mistaken for thinking. No sir, a simple rerating to the "norm" could see the S&P 500 at 1600 presently. Which is a monster 13 percent increase from here. The graph below tells you that stocks are cheaper in recent years relative to earnings than they were back before the crisis.

However. However. There are loads of hurdles in the way here, the fiscal cliff which is also part of the longer argument around the sorting out of the US fiscal issues or mess, use whichever one you want there. More compromise is needed, benefits have increased substantially, people enjoy their first class medical coverage. The wars are also an "issue". So if the automatic cuts and increases kick in, there will be earnings contractions for sure. But I suspect that the Americans will "kick that can down the road" for now, whilst the recovery is still gentle.

Not everyone however shares this view, that stocks are cheap. Buffett of course would be more active, but perhaps he is waiting for the brinkmanship of another possible ratings downgrade and potential breach of a debt ceiling type scenario. I saw an interview with the old guy, and he said that he thought stocks were neither expensive nor cheap enough for him right now. But that is not to say that he is not looking. On the contrary: Berkshire Cash Nears Record as Buffett Extends Deal Hunt. Always looking.

But this fellow, with a whole host of reasons thinks stocks are not that cheap. But just the nature of the blog might give it away. The fellows name is Tiho and the blog itself is awesome. But check out this post: Sign Of Capitulation: Are We There Yet? So he thinks, like many almost all of the time that stocks are due for a correction. This piece suggests stocks, by another measure are not cheap at all: Shiller P/E – A Better Measurement Of Market Valuation. And that, friends, is what makes a market. Different points of view. Of course, and I will leave you with this, we buy individual companies, and not the overall markets.

Digest this.

Election time. Every person seems to have their view, the dogs don't care, they just care about being fed. And somehow their stomachs know when they should be fed, my creatures wake me up early on weekends. So I never sleep in. You have got to follow a few links to know that people are divided on this one, always deeply divided. Joe Weisenthal called it last evening an Obama victory: PREDICTION TIME: Why I Think Obama Is Going To Win The Election.

And a few hours later, I read the WSJ article (subscription only) Obama and Romney Battle Down to Wire. OK, so close of course!! But not according to this free market fellow, who is a staunch republican: My 2012 electoral vote map and popular vote predictions. Romney will win both the popular vote and win key states which will mean that he will crush it by a country mile. For the author, Pethokoukis of course. The results of course could be with us around 4 to 6 in the morning South African time. I suspect that Obama could get it.

I had to laugh out loud when I read the headline, with the word "investing" put in inverted commas, because that is exactly what Josh Brown wanted you to think about. Commodity "Investing". I can't say with a straight face that you should not buy anything that does not pay you a dividend, because the underlying Berkshire investments pay dividends to their shareholder, but Berkshire itself does not pay a dividend. But has returned eye popping numbers to their investors over the decades. I often wonder to myself, if Berkshire had paid a dividend over the last 45 years would the performance have been as good? Of course compounding interest is the 8th wonder of the financial world. And to calculate it, if you have time, check this out: Continuous Compounding. Any person out there even care to want to work it out?

Crow's nest. Markets were a little higher, but still, we reached another record earlier in the morning part of the session. The Rand is firming, that is good news. German factory orders registered a massive miss. Most of European PMI data from this morning seemed to be a wide miss too.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment