Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. Gold miners took an absolute pasting, down nearly three percent on the day, platinum stocks collectively sank nearly two and one quarter of a percent, whilst retailers sank by roughly the same amount. The overall market was lower by 0.41 percent to end the day off at 37242. We were at some stage during the day 100 odd points higher. Not the greatest performance lately. The currency weakened, the violence in the agriculture sector which has spilled over from the mining sector seems to be weighing on sentiment again. We forget that an equally worrying truck drivers strike was resolved timeously not so long ago.

The mine workers strike at Amplats is still not resolved, we have seen another extension of the offer from Amplats. The first return to work offer was tabled on the 27th of October, the talks had started with the workers, the company and the represented unions. There has since not been an extension, but according to the Anglo American Platinum update on 9th of November, workers were to return by 12 November, or the offer would lapse. There is a MiningMx story from last evening which suggests that the strike could actually end today: Amplats breaks 8-week strike with new offer.

That last part: "The strikes have cost Amplats close to 170,000 ounces in lost platinum production which would fetch around $250m at current spot prices, Reuters said" was highlighted in a trading statement from Aplats yesterday. The company said that they expect to make less than 20 percent (no range) than they made in the prior period. Less than 20 but not less than ...... ? is hardly encouraging for shareholders. Of course if you needed reminding, Anglo American holds four out of every five shares at Amplats. And it has been a bad week for them, Capex overrun at Minas-Rio, Kumba Iron Ore earnings to be lower (Anglo own nearly two thirds of Kumba) and now this trading statement from Amplats. Eish.

No wonder the stock looked so cheap, the market knows. I have already seen a few sell recommendations on Anglo American. And earnings are expected to slump. I saw a note that suggested the following: "Anglo trades in line with the sector average but in our view demands a discount. As such, we reiterate our SELL recommendation." I have however also seen lots of buys and holds, an equal amount, so let us just say that the jury is out on this one. Trying times indeed. Forward the stock demands a multiple of around 14 times, which does seem expensive considering the deep fog that seems to have set over it.

Talking fog, let us just put this out there. Anglo American costs on Minas-Rio are set to be roughly 20 percent of their current market cap. How did I work that out? I took the Pound Sterling market cap, 23.68 billion Pound Sterling and then multiplied it by the Dollar currency cross, 1.5845 and got to 37.52 billion Dollars. 8 billion dollars is to that market cap 21.3 percent. In April of this year, if you read this document, Minas-Rio is one of our four major strategic growth projects, it says: "The $5 billion project is expected to produce 26.5 million tonnes per annum." Add the revised upwards costs of 8.8 billion, that is the high number, and the whole cost of the exercise is closer to 14 billion Dollars. That includes the purchase price. Wow. Words fail me really.

Two difficult phone calls to have made would have been the project co-ordinator to Cynthia Carroll and then her call to the chairman John Parker. And then, the more important question is, when Anglo American start shipping iron ore in 2014, what is the iron ore price going to be, and what will global steel demand look like? I suspect that global steel demand will be robust, still driven by the Chinese consumption, albeit at a much slower rate than before. All around, this project has been awful for the company and is perhaps the main reason why Cynthia Carroll resigned, or was forced out. Yech. And if you needed reminding of how bad it has been, MTN and Richemont are breathing down Anglo American's neck here in Jozi, in terms of market capitalisation. Richemont are a mere 7 percent away from Anglo, whilst MTN are only 9 percent away. Different histories, MTN and Anglo American, the one is a whole 77 years older than the other. Wow. Times changed quickly. If MTN were a person, they would only now be illegible to vote or get a drivers licence this year.

Digest this.

Don't laugh ok. But this story is hard not to laugh at: Puppies: The new indicator of prosperity? This kind of makes sense. If you are rich, you are going to own a nice puppy that you are going to have to look after, Make no mistake, I feed my hounds in the morning, every day and it is their absolute favourite time of day. What does however amaze me is that there are fewer people getting puppies in the developed world, perhaps it is expensive.

The housing recovery improves, and I guess this is a sign. Housing Inventory declines 17% year-over-year in October. What does that mean? Lower inventory means sellers are fewer, which means the demand side could or should continue to drive prices higher.

Dave Rosenberg has been a little bearish. For quite a while, so I was more than a little bemused to come across this post from Cullen Roche, in which he quotes Rosenberg extensively: David Rosenberg: The Most Compelling Argument for Equities. The part about fixed income yields relative to the dividend yields: "I think that for those investors who are running into cash or cash-like instruments or government bonds in the name of safety need to realize that interest income is in a full-fledged bear market and dividend income is in a massive bull market." You kind of knew that part though, yields on government bonds that are safe are really low, whilst company cash reserves have swelled to massive levels, and they are being more generous. This part made me really sit up though, the "five-year Treasury yield down to 60 bps, at a time when the dividend yield in the stock market is closer to 2.3%, for a 170 bps gap we haven't seen since 1958." So does this mean Breakfast with Dave is going to be an equities affair? Perhaps his view on housing has changed.

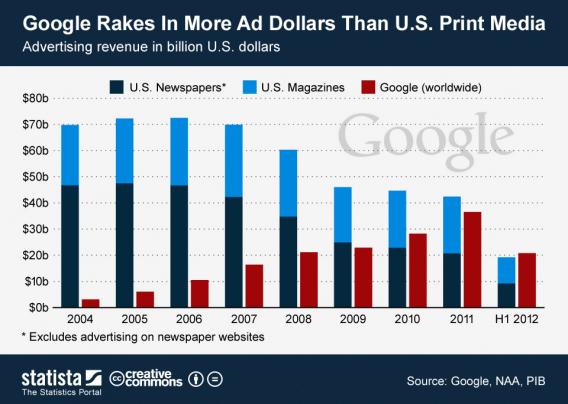

We showed you something similar the other day, the post from Josh Brown titled and then Google ate the entire newspaper industry really hits you hard. The graphic which shows that Google ad Dollars has absolutely crushed the US Newspaper and Magazine industry Advertising Dollars shows how consumers have changed the flow of the dollars. Check out the associated graphic, thanks Josh for this, I really appreciate it:

Oh, and while I am here I must give Josh's book a punt, I just finished reading it. Check it out: Backstage Wall Street: An Insider's Guide to Knowing Who to Trust, Who to Run From, and How to Maximize Your Investments. I must warn you however. It is actually shocking how the bucket shop houses operate. And Josh lays it all out here. A must read.

Facebook announced something different last evening. Here it is from the horse’s mouth: Announcing the Social Jobs App. What is it? Well, this is the app that helps users connect with roughly 1.7 million job offerings. The Social Jobs Partnership or SJP will "make it easier for people on Facebook to find and share employment opportunities." I must say that this was perhaps a long time coming. The only downside I can see is that if you are mates with your boss on Facebook, how do you keep this a secret? I am tuned into the LinkedIn stream which suggests so and so added new skills or even better upgraded to a fully paid service. That kind of hints to me that someone is more than putting themselves out there.

So what does the rest think? Well, it turns out that this has been positively received: Facebook Launches Job-Listing App. That was the Wired view. What about the WiredIn view? If such a thing exists. Turns out that it does, but not what I would have thought. But again, I am getting off the point here. The point that I am trying to make is that this announcement coincided with 800 million shares becoming available to be sold in the market. Huh? You would expect that price to go down then. But instead it was up over 12 and a half percent. Still, the stock is half of what its all time high was. Some are suggesting that the selling will come in days as those wanting to exit now can. And who knows how that will end.

Crow's nest. The leadership change in China has gone off smoothly, we can cover that in the coming days. American markets got bashed around their ears as there were more worries about the fiscal cliff, the ongoing negotiations between the two parties. Both have kicked off, this is going to be exciting. Everyone on the tv screens that I see are committed to this, wearing little buttons called "Rise Above". I think it might actually be a CNBC initiative. In fact I found reference to that: Why 'Rise Above?' We should have the same initiative here too. Rise above the political rhetoric in order to get the real problems solved. Make education an absolute priority. You can't take away the smarts of a person, if you know what I mean.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment