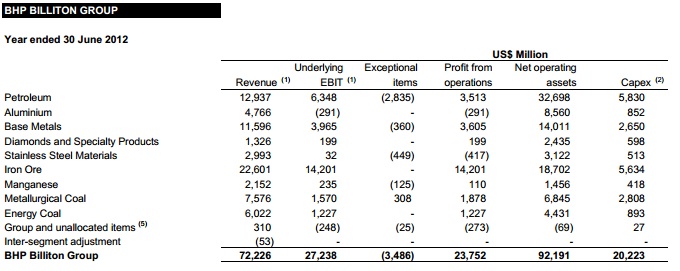

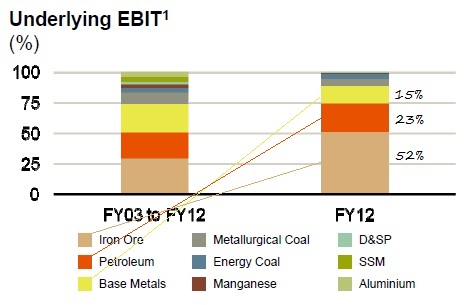

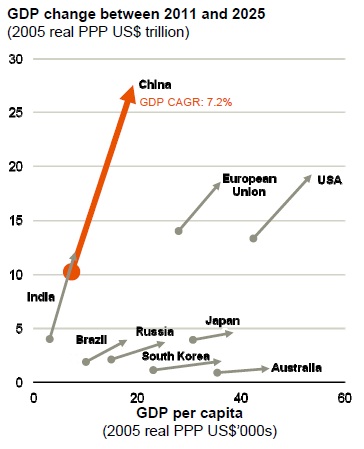

Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. Whoa! We took a thrashing yesterday, most of that was centred around the resource shares. Collectively they fell two and a third of a percent, sending the Jozi all share index down 1.2 percent on the day. I think there is also this thought process that "nothing" is going to come out of the weeks most important speech, that of Ben Bernanke a little later today. Phew. I can't tell at all. What has also been happening is that iron ore prices have been thrashed, down 15 percent for the month of August. And now they are below 90 Dollars a ton. At that level the squeeze is now on. The Chinese iron ore industry, as low grade as it is, is unprofitable below 120 Dollars a ton. Guess what they are doing? Not producing is my best guess. This is the lowest price that iron ore has been in three years. Yes. Three years.

Remember, we wrote about this back in March this year: BHP Billiton iron ore presentation spooks Mr. Market. Even the BHP Billiton forecast was for the iron ore prices to not breech 120 Dollars a ton, that I guess was wrong in the short term. UBS however put out a note suggesting that in the short term the iron ore prices could go back to 125 Dollars a ton, but that there might be weakness again in the short term. The all time high price for iron ore is more than double what the current price is, talk about wild gyrations! So, almost anything could happen between today and the fourth quarter. In the fourth quarter steel demand picks up.

Check this piece out from a crowd called Iron Ore Team: Global iron ore demand soft in H2 VS. supply rising, Baosteel says. Well, not theirs, but this is Baosteel talking. So, what to do? Well, BHP Billiton and Kumba Iron Ore have some of the best margins out of all of the producers. BHP Billiton's outlook over the next decade plus remains unchanged, that is what Marius Kloppers said in the Q&A segment in the last set of results. Should you get anxious? We have said many times that being invested in single commodity stocks, that is always going to be the trickiest of the lot. And that is why we continue to say that as a premier investment choice, BHP Billiton is top of the pile. World class assets, a great management team, a good geographical mix, and a more solid portfolio over the longer run.

Aspen released a trading update yesterday. Aspen has been a wonderful performer, a great company with exceptional leadership. We know that. Their timing from an acquisitive point of view has also been nothing short of very good, and the praise should be laid directly at the desk of management. But one must learn to never get married to a company. Stockholm syndrome in a way, you know, believing yourself and being captured by a specific investment at the same time.

The company gives three ranges of earnings, so it looks a little messy. But they put diluted normalised HEPS from continuing operations as "adjusted for transaction costs, restructure costs and forex gains on transaction accounting". On that measure, earnings are expected to increase between 18 to 24 percent for the full year to end June 30. HEPS are expected to increase between 21 to 27 percent, whilst earnings per share are expected to increase by 4 to 10 percent. Why not as big an increase? The footnote explains it as follows: "The growth in earnings per share has been reduced as a result of capital profits on the disposal of discontinued businesses and products in the present year being lower than in the prior year."

On these three measures expect diluted normalised HEPS to be in the 595 cents per share region, EPS should measure 529 cents and HEPS should come in at 633 cents per share. No matter which way you look at the stock at 143 Rands a share, this is stretching it a little. BUT, as I am often reminded, people have been paying up for this company for a long time. In part because their acquisition history and timing is very good, the earnings do come through. Turnover for the last five years has grown on average by 35 percent, whilst the bottom line has increased by a more impressive 38 percent. Cash generated per share has also increased by 34 percent. Operating profit margins have been maintained at the 25 percent mark. The market is suggesting that at this point Aspen can keep up the current run rate. Of course this becomes a whole lot more difficult as the company continues to expand. But expand rapidly they still do, Byron wrote about this just a few weeks ago: Aspen buys a business from Glaxo. This type of relationship will continue to exist. We do not have to wait long, results are expected not next Wednesday, but the one thereafter, the 12 of September.

Byron's beats explore another trading update, this time from Mr. Price.

- Yesterday we had a 4 month trading update from one of the darlings of the JSE, Mr Price. The stock has been one big success story coming from R15.10 in July 2008 to R136 today, just short of a ten bagger which I'm sure we will see pretty soon. How did the update look? It was solid with 14.9% sales growth, 9.7% of that was from an increase in sales while the rest was due to price increases or inflation as retailers like to call it.

Comparable sales grew 9.5% while the company opened 24 stores and closed 5. Cash sales is still big but decreasing slowly, now 78.5% from 81.2% last year. Apparel is still the big money driver which includes Mr Price, Mr Price Sport and Miladys. This constitutes 71.6% of group sales and grew 15%. The home division which is Mr Price Home and Sheet Street also grew nicely at 14.4%.

This is good news on two fronts. Firstly, this is a very recent update (4 months to 28 August 2012) and shows that the South African consumer is still showing a lot of strength. Because most of the sales are cash you cannot say that this growth is driven falsely by credit. The South African middle class is still growing, wages are increasing and the retailers are benefiting. That is the Macro view.

From a micro view it still looks like Mr Price are getting it just right. There are queues at every one I go to as people from every background and income group enjoy their great value for money. The fashions are up to date and I really like their sports division. Everyone loves sport and with the great weather we are having at the moment (sorry Cape Town) who doesn't want to get outside and soak in the rays with some outdoor activities. We have the climate, the culture and the geographic makeup for sports apparel to really take off as a consumer good in this country.

Although their goods are cheap the share price certainly isn't, trading on 27 times last year's earnings. But I wouldn't bet against these guys. Opening up 24 stores in 4 months is huge! And this will continue to grow. And who is to stop them from taking this winning formula further up into Africa which they are doing already of course. Clothing is less complicated than food when it comes to African expansion so expect this to be rolled out quicker than the grocery guys.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. In the wait and see week where the crowd were moving over to the side that suggests the Fed will do nothing new, in other words no QE3, the equity markets took to this announcement like serious tea party types took to the old flags. Why now would old conservative types want to be associated with the past, all the way down south in Florida? No cell phones, no cable TV, progress must be limited, right? Well, I guess the conservative types want to return to the old ways. Fiscal discipline, of course if there is a war, then that discipline goes out of the window, not so? Cost of War is a horrible website, but at least you get the point of the National priorities project, which is a far superior website. Much better and a wealth of information, designed to help those. 27 cents in each Dollar in 2011 went to military spend. But that subject is always taboo. As a percentage of mandatory spend, the military accounts for 57 percent.

Check out the pie graphs a little lower down on the FEDERAL BUDGET 101 - Where Does the Money Go? page. The word military was mentioned twice in the Mitt Romney speech. Twice, check out the TRANSCRIPT: Mitt Romney's Speech at the Republican National Convention. And the one reference was as a result of the planned reduction in military spend, the other was talking about keeping the military strong. The word defense was used once. Surely if the debate is about cutting back, it should be more front and centre? I am going to do the same when President Obama makes his speech. Because as much as entitlements worry the right, surely continued defense spend should worry them as much? I watch and wait, like all of us.

Currencies and commodities corner. Dr. Copper is flat at 343 US cents per pound, the gold price is slightly better at 1658 Dollars per fine ounce. The platinum price is also up a smidgen, last at 1510 Dollars per fine ounce. The oil price is better at 95.06 Dollars per barrel. The Rand is firmer, 8.38 to the US Dollar. We started better, got worse, heard that the ECB might get some extraordinary powers around banking licences and are now back in the green. Marginally.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440