Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. Chad le Clos, Chad le Clos, Chad le Clos and oh yes, Chad le Clos. And Cameron van der Burgh too, awesomeness. We were all so impressed down here, to borrow a phrase from John Cleese. Perhaps someone can supply us with a caption for this Reuters picture: I just beat my hero at the Olympics. That is mine. Good moments for us, it is nice to feel proud about something that we feel belongs to all of us, apparently he said "we won" and not "I won". Which means he was sharing it with all of us, or his team, or both.

Not sharing yesterday were the bears, they finally got their day in the sun here in Jozi, as the clouds closed in for some weird weather that we are not really used to. That did not prevent the Jozi all share index from pushing through the 35 thousand mark level for the first time ever (35,036), but after the bell was rung for the close, and all the selling had taken place, we had slipped over a percent. Banks were whiplashed, down almost 2.4 percent, there was a negative number from UBS, general selling in the sector. I guess the market term used yesterday was selling off after a decent rally, or the term that will get you six of the best at a certain news agency: "Profit Taking". Yech, I hate that term. We use reverse profit taking when the market is going up, just to show how silly that terminology actually is.

There is a significant announcement from Woolies this morning, and whilst not earth shattering, it was met with a pinch of scepticism in the office. Country Road today announced that it has entered into an agreement to acquire the Witchery Group from Gresham Private Equity for A$172 million. Now Country Road of course are the Australian subsidiary of Woolies, they own 88 percent. The purchase is going to be funded part through a rights issue by Country Road, which Woolies have indicated that they will follow theirs of course, and a debt facility of 92 million Aussie Dollars. But 172 million Aussie, that is a lot of money. One Aussie Dollar is 8.66 ZAR. At the current exchange rate that is 1.489 billion Rand, or when put into perspective, 3.5 percent of their current market capitalisation, not a big deal, but sizeable nevertheless.

The stock is up ahead of the market, just a little ahead of the market, but that tells me what I need to know. The reception of a piece of news is often the short term telling, in terms of the voting machine. Remember the old words from one of the greatest stock analysts of all time, Benjamin Graham. He said that in the short term the market is a voting machine, whilst in the long term the market is a weighing machine. You can't lie about the votes, but you can't fake your weight either, no matter how many votes you get. Capiche?

They have done well recently in their food division, clothing retailers are really a dime a dozen. And even if they seemingly do it well in Australia with this new (managed) venture, that is a very tough environment. Perhaps that was the scepticism. You can read via the GRESHAM PRIVATE EQUITY FUND NO. 2 description of the purchase at the time, why it made sense to Gresham, the private equity sellers. There is not too much information available in Aussie, but I did find this article Country Road snares Witchery for $172m, which suggests that Country Road got a good deal "in this current environment". Perhaps Gresham were forced sellers.

Byron's beats looks at a South African success story, another one of them!

- This morning we got interim financial results for the six months ended 30 June 2012 from Exxaro. Remember when they came out with a trading update last week I was quite confused that they managed to grow earnings even though that massive Sishen input had decreased. I wrote up the Exxaro trading update piece if you need reminding. Well this report does give some clarity.

As the update alluded, headline earnings per share are up 11% to 1162c, after excluding the mineral sands restructuring. I have done the valuations in the update message so today we will rather focus on the structure of this company. Basically it is a coal mining company (operationally) with holding stakes in Mineral Sands operations and the Sishen Iron ore operation. To clarify the mineral sands operations here is how the company explains it.

"The transaction entails the combination of Exxaro's mineral sands operations with the businesses of Tronox under a new Australian holding company, Tronox Limited, which listed on the New York Stock Exchange on 18 June 2012 under the ticker symbol TROX. Exxaro holds 39,2% of the shares in Tronox Limited and 26% each of the KZN Sands and Namakwa Sands operations."

Let's look at the divisional make up. Iron Ore. The Sishen stake now only contributes 52% to headline earnings per share. In 2010 it was 71%. Again it barely gets mentioned, there was only one reference in the whole release. Then there is the African Iron Ore acquisition for R2.7bn. This is not yet in operation and will take up R1.7bn in capital expenditure next year.

Coal. Coal contributes 20%to headline earnings but is of course where all the hard work is done. The reason sales to Eskom were down was because they had some operational issues at the mines that directly supply Eskom. Sales and prices have been down this half as we have seen with many commodities, especially energy based ones, in the first half of this year. The company continues to ramp up production and increase its relations with Eskom.

Mineral Sands. Mineral Sands now contributes 31% to headline earnings and is the reason group earnings grew this half. The business is doing fantastically well and has operating margins of 51%. From some quick Google research it seems the majority of mineral sands goes into titanium production. Titanium is predominantly used for industrial production and Aerospace. If you know more about mineral sands please send me through some info.

There are some base metal assets but these are insignificant at this stage. Conclusion time. The company looks cheap but this gain in earnings is probably not sustainable. The mineral sands division went from R333 million in headline earnings last year to R1.15bn this time around. I respect the company's aspirations to become a diversified miner but we already have the end result available to us in the form of BHP Billiton.

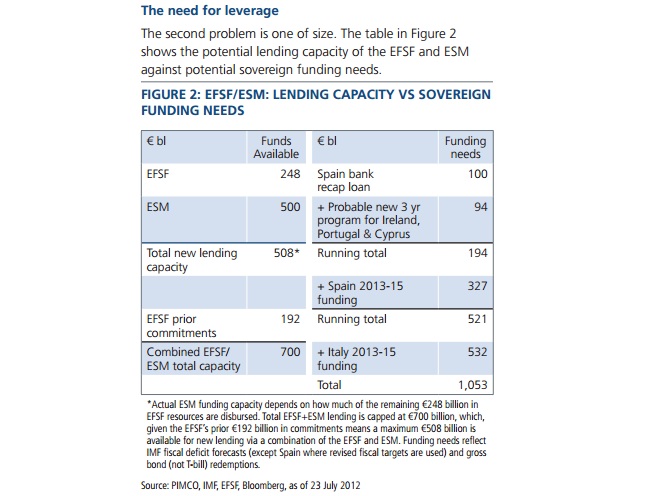

Brussels sprouting ideas 50o 51' 0" N, 4o 21' 0" E What can Mario Draghi, the ECB chief actually do? He certainly has spooked the "bond vigilantes", a term that JC Trichet often used when he was head of the European Central Bank. By shaking a big stick, the yields in Spain and Italy have come lower, by quite some margin just over the last week. There are many conflicting views on what can actually be done, the highest court in Germany still has to determine whether the European Stability Mechanism (ESM) is constitutional (expect that on the 12th of September), so in the very short term the funds to recap Spain's banks are to come from the European Financial Stability Facility (EFSF). Or so that is the theory, this great PIMCO piece, titled What Next for Spain? spells out that even the combined entities potentially do not have enough money to "solve" the European problems.

But of course all that could change, the Europeans could do everything in their power to change course, countries could find that the hardships that they are experiencing now are for the best in the long run. It does not feel like it when you are in it however. Meanwhile, if you missed it Reuters reported that Near-bankrupt Greece says cash reserves drying up. Reuters also apparently on the Twitter "thingie" said that our guy, le Clos was a Frenchman. Perhaps his family was a long time ago. But as the Nandos banned (from TV) advert went, we are a country that gets excited about our diversity.

The WSJ (subscription only sadly) is reporting that a Showdown Looms for ECB, Germans as the Bundesbank (the German Central Bank) is going to push back on the ECB. The ECB could jump over the Bundesbank, but that would be bad, you don't want to alienate the money, so to speak. The conclusion of the article is that although the conservative nature of the Bundesbank will continue to prevail, Angela Merkel will side with the ECB and as such it will be another loss for the German Central Bank. And that is what being European is, concessions in all directions it seems. If the collective want to move in the sovereign bond purchasing direction again, then that is what is going to happen. Mario Draghi, by going public might just have irritated some folks, but pleased the majority. For now, some are doubting what the ECB can actually do, but with political backing from Merkel and Hollande, Draghi has won another important battle again.

In concluding this piece on European central plans, I get the sense that everyone is open to many ideas. And the commitment to be inside of the zone and continue with the project is overwhelming, so much so that academics are trying to force their way into the heart of Brussels to put forward their idea. Brussels? Sprouting ideas? No really, read this piece: Economic Thinkers Try to Solve the Euro Puzzle. See that all you haters, yo? That was my attempt at being hip, but I am as hip as Dr. Evil. It seems Europeans want to, and will solve the problems (that are distinctly European) even with their many detractors.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Perhaps the Wall Streeters were watching swimming, or preparing for their summer vacation, or both, because markets slipped off what looked like a very good start. Team USA had a right to skip the screens in favour of watching the most coveted Olympian of all time, Michael Phelps. Check out the List of multiple Olympic gold medalists. The markets, well they were all a whole lot less exciting for the bulls, I am guessing here that the Bernanke void is currently where the spaceship is floating, but that void is going to come to an end today. Plus also there is the small matter of the monthly ADP jobs report, which is always a tantalising precursor to the nonfarm payrolls data due for release Friday. I am hoping that it is a gold medal release on Friday rather than fourth place, which is what the last three months have served up.

What can the Bernank do? And the FOMC? The Bernank of course is one of many names that the Fed chair has, some far ruder than that. Their announcement comes later this evening, Fed chair Ben Bernanke will deliver the FOMC statement at 14:15 US East Coast Time, add six hours on for us. That would be just after 8 pm here. The Business section of the online Time has a pretty insightful piece titled Will Ben Bernanke Pull the Trigger on More Bond Buying? I really like the Time blogs, I get a daily email full of insightful commentary. So they could follow the big bang approach as the author points out, an open ended approach to set no particular timeline, but rather conditions.

It makes sense I guess, the only real issue is that how would the Fed be sure that their stimulus has been enough, and now they should stop and let the economy stand on its own feet? Amity Shlaes in this Bloomberg piece: Ben Bernanke Could Lose for Same Reason as Olympic Sailor, is less convinced. But then again, look at where she works. For The Bush institute, an associate called the 4 Percent Growth Project. I am always amazed that ex presidents and ex champions of business always have the answers after their respective terms or at the helm of a business. Think Sandy Weill the other day, who now says that the big banks should be separated. He once ran Citi. But perhaps now as a shareholder (whatever is left) he thinks that there could be a value unlock. Jack Welch is seemingly always on GE's management case in that helium voice. Just like all the armchair Federal Reserve Chair(folks), let them get on with the job. I have confidence in Bernanke.

Currencies and commodities corner. Dr. Copper is last at 340 US cents per pound, the gold price is a fraction lower at 1613 Dollars per fine ounce. The platinum price is also a touch lower at 1409 Dollars per fine ounce. The oil price is up a touch this morning, 88.19 Dollars per barrel. The Rand is last at 8.23 to the US Dollar, 12.89 to the GBP and 10.14 to the Euro. We have started better here, green across the screens at the get go this morning.

Parting shot. At least the lights are on here. The poor folks in parts of India have been hit with a serious power outage. Paul, who knows power better than almost anyone else I know, tells us that turning a grid back on is not that easy, it takes time and expertise. The grid is back on, so that is the good news (or is it back on, these things take weeks), but the questions are being asked, who is to blame. Some blame the Greens/Government: Did Greens cause the Indian blackouts? Maybe, but the point is not the Greens delaying power stations, but rather that the coal producer is part of the government. Blaming yourself indirectly because of something that you did (or didn't) to try and make yourself feel better. About yourself. Mediocrity, business and politicians go hand in hand, business does business best. Just paint the lines. Sounds strangely familiar.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment