Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. Just. But, as they say in the classics, we won the day in the end. We earned our winners spurs. If you work slowly but constantly, you will succeed better than if you work fast for a short while and do not continue. Err.... that is via theFreedictionary.com and is attributed to the Aesop's fable "The tortoise and the hare". Enough already! The Jozi all share index snuck in through the back door to register a modest gain yesterday and close at a fresh all time high, after having clocked an intraday high earlier in the session. This time it was the resource stocks that led us higher, collectively adding over a percent. I almost felt like welcoming them to the rally. The overall market added a mere 18 points to close at 35487. Who would have thought? Stocks are up 11 percent this year. Oh yes, and we had unusual weather here, as did everybody in the country. It was fun to see a few (more than a few) snowflakes lying on the ground for ten minutes or so. For us over here it is like sunshine in Northern Scotland. People tend to stare in wonder for a minute or two.

I wrote something yesterday to a journalist friend of mine about the focus of short term reporting, I thought that I might share it with you:

- How could it possibly be so awful out there, when equity markets are reaching all time highs? So whilst it might feel bad for the people in Spain and Italy, in China life is immeasurably better than it was in 1990. As is it in India. And Brazil. And possibly the entire European continent, now that you can travel anywhere. In fact, the standard of living for the average person across the globe has improved over the last two decades. And we now fell on hard times. But how hard are they? There are no queues in the US outside of soup kitchens. The unemployment rate is 8 percent and not 25 percent. GDP contracted by a bit, but is now higher than it was in 2007/2008. Bad news sells, and if you sound bearish then somehow you know something that someone else does not. Why does Nouriel Roubini and Niall Ferguson get so much airtime? How much money do they manage? Not a frikkin cent. So I don't care that both of them are academics. (I think I meant to say that I don't really care what they think in the short term) I do care what some equity fund manager thinks however.

Reaching for a reason why people are participating daily in equity markets is necessary, but in a strange way not the full picture. We do not change our minds on a day to day basis. Never. It takes weeks and months for us to make a structural decision. And we don't always get those right in the short term.

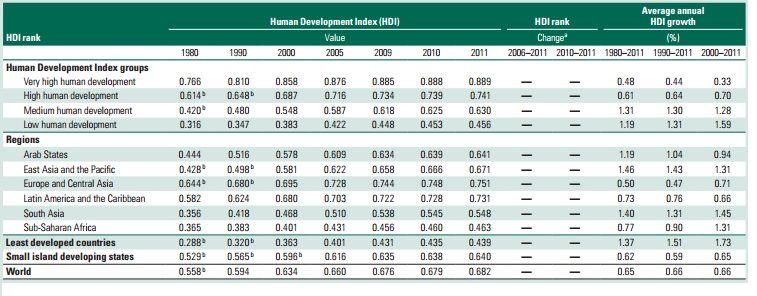

I started thinking, is that right? Are lives much improved over the globe over the last 20 years? Is this true? Surely it must be true. There is a report that the United Nations publishes called the Human Development Index (HDI). As luck would have it, the HDI was launched around two decades ago, devised by a Pakistani and then Indian economist. See, those two can work together, that counts for something. Wiki describes what the HDI actually is pretty well. "The HDI is a comparative measure of life expectancy, literacy, education, and standards of living of a country." So, if you are making headway in those areas, you are doing well for your citizens.

I found the Human Development Index (HDI) landing page and then clicked away to the Human Development Index trends, 1980-2011. I then scrolled through the list and right to the bottom, where you get the world performance over the last twenty and thirty years. So yes, we have made progress!

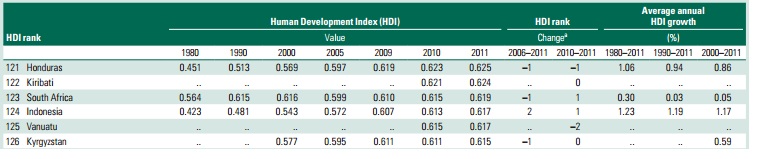

So you can see that the Asian countries are the ones that have been making the most progress, Sub Saharan Africa too. Making progress is always good! I thought that I might find ourselves on the list and then compare this to the overall number. And I am very sorry to say that we have not been making progress. We are just above Indonesia who have been making remarkable progress:

Sis. We could do a whole lot better. Check out this article in the newly launched BusinessDay website 'Bankrupt SA' warning if business is sidelined. How can one expect tax receipts to increase if government continues to adopt a combative approach to business? Business does not like uncertainty. I speak to lots of people who tell me how tough it is out there and how they are watching and waiting. Meanwhile cash on company balance sheets continues to swell, and the finance minister says companies must deploy this. Another argument for another day, I am just pleased that this data corroborates my initial thoughts, life has improved for humans solidly over the last twenty years. Paul sent me another great piece last evening, read it: The generations that are going to drive China's growth. Feeling anxious about China after that piece? Perhaps not.

Notwithstanding the fact that South Africa does not seem to be making headway, relative to the rest of the world, what is making progress is MTN. A business that is only as old as the country is a democracy. 18 years old. In that time the company has managed to attract just short of 176 million subscribers spread across 22 countries across Africa, the Middle East and one in Europe (Cyprus), clock half year revenue of 66.426 billion Rands and register group EBITDA of 29.798 billion Rands. As a listed company the stock has done remarkably well. I remember a time when the company was expensive at 20 Rands, they did not have the earnings to back the price is what the analyst community said. The stock was beaten up, because the company would not "make it" in Nigeria, the analyst community was very sceptical. I swear I remember a time when the cell phone industry was called a "vampire" industry because it leached money from retailers. Now, every single major retailer has a booth with a wide array of mobile phones. Let us just say that communication is hard coded in each and every one of us.

On a per stock basis, adjusted EPS increased 14.3 percent to 537.4 cents. Adjusted EPS excludes once off items, such as amortisation in particular for MTN. The dividend has been hiked to 321 cents. The dividend policy is to pay 30 percent of last years fully adjusted HEPS. The payout ratio for the interim dividend was adjusted subtly upwards to compensate for the dividend taxation.

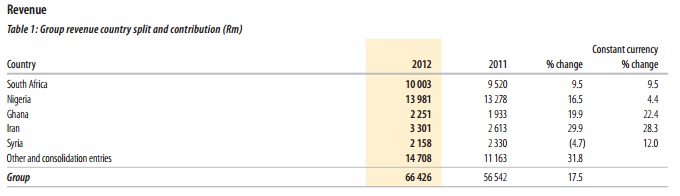

I am going to take quite a few graphics from their results presentation, which you can download here Interim results for the six months ended 30 June 2012. First up, which countries does MTN get the majority of their revenues:

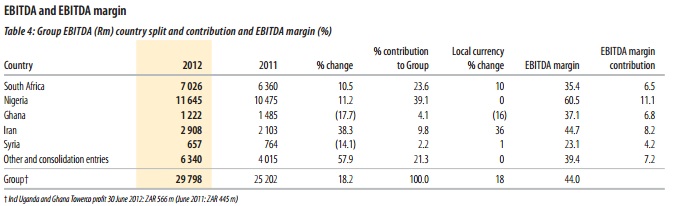

Nigeria and South Africa are still the crown jewels of the overall group number, Nigeria has the most subscribers (43,184 million) and South Africa the third most (23.5 million subscribers). Iran is wedged there in-between, with a whopping 38.3 million subscribers. And then perhaps more importantly, in which of these territories are MTN the most profitable?

Massive margins in Nigeria, the most profitable part of their business. Collectively the South African and Nigerian businesses contribute 62.7 percent of group EBITDA. These areas remain the focus of the group, most Capital expenditure is being focused on both Nigeria and South Africa in improving the network coverage, with most of the focus on 3G and the quality and capacity. Here it is:

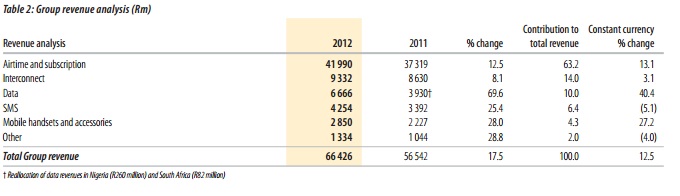

And then lastly, the reason for rolling out the 3G network aggressively is that data, as a percentage of the overall group revenue is now ten percent. SMS is still huge. Interconnect is still huge too! Check at the rate however that data is growing, at nearly 70 percent. We remember scoffing at the notion that the mobile companies were ex-growth, because in our minds with the improving network speeds (and poor quasi government organisation in the form of Telkom), and vastly improved handsets, both high end users and middle of the road users are consuming more and more data. You would have perhaps expected data growth to slow a little, but folks love being connected all the time. Next table, where the overall group gets their revenue from:

You get the picture operationally. Of course there are more than just a few challenges for the company, both Syria and Iran remain problems, and there is some 8.8 billion Rands tied up. And possibly not easily extractable. Clearly they can't extract that, because they would have. And as Paul pointed out, both those local currencies have been under pressure, away from the official rate of course. Sanctions are biting in Iran and there is a bloody civil war in Syria if you needed reminding. There is commentary about Iran that suggests it is tough: "The rollout of some projects has been slower than anticipated because of delayed equipment delivery and the impact of sanctions on certain equipment." Although in their Syrian business commentary MTN are less forthcoming, referring to the "very challenging socio-political environment" and "the current political situation in the country" is impacting the conversion to a full licence.

What should you then expect from MTN then for the balance of the year, as well as for the next few years? For starters the company plans to add 21.250 million subscribers to their group networks, the majority thereof in Iran (5 million) and Nigeria (4 million). The group number was revised slightly lower, mostly as a result of Iranian subscriber predictions being lowered. But we are talking 50 thousand subscriber difference in guidance, negligible. Any business that can add over ten percent new customers in a year is a business to be admired, especially when we are talking these sizeable numbers. The company plans to spend the next six months "maintain(ing) its leadership position with an increased focus on customer experience and countering competition through innovative and relevant products and services."

Their continued roll out of their data infrastructure, in particular in Nigeria is key to them maintaining their longer dated success in that territory. Data revenue grew by a whopping 160.8 percent in Nigeria. There is a pretty poor state service provider, Nitel. It is fair to say that MTN have also benefitted from the poor state competitor. Iran remains a big problem for investors. There is a young population that might not (or might) subscribe to the states political views. It is more than tricky. I do think that the discount is applied for both that business and the Syrian business. It is a mixed bag in terms of the countries, luckily the two best businesses are politically stable. Byron points out that there are only 4.4 million smart phones in South Africa, but 11.9 data users. I am guessing all data users want a smart phone. Nigeria has only 2.6 million smart phone users and 480 thousand dongles. In Syria and Ghana they are trying, but it is still small.

There is also potentially more value unlock as MTN continue to sell the towers infrastructure to America Tower Company, including a recent sale of their business in their Ugandan sites. Whilst we always remain anxious about margins being maintained through their data expansion, everything still looks good, so far. We continue to acquire the shares, and continue to see ourselves holding the stock of what is a really great African success story.

Byron's beats loves covering all things retail. But I can promise you that he does not walk in on Monday morning with a new shirt. Strange, he likes the businesses, but does not buy too many "things".

- Over the last few days we have had updates from two of our recommended retailers, Cashbuild and Massmart. Through Massmart's Builders Warehouse brand they are actually direct competitors. Let's start with the Cashbuild numbers.

There is not much commentary, just a divisional and quarterly breakdown. We'll look at what numbers to expect from the update but will go into more details of the company when the full release comes out. Revenues for the full year 53 weeks are expected to grow 11% but they also mention that gross profit margins continue to edge higher. For the first half of this year the company managed to grow headline earnings by 24% on the back of a 9% revenue growth. So let's assume they manage to maintain this earnings growth of 24% for the full year. This is being conservative because revenues are actually up because of that extra week.

So in the first half of the year the company made 656c per share. Because they are maintaining their earnings growth from the first half, let's double this number to get an annualised figure of 1312c. The company trades at R159 on an earnings multiple of 12.11. It looks cheap for a retailer but they operate in a very competitive environment. We still like the stock at these levels especially as a potential buyout target. More details to follow when the full release comes out.

The Massmart update came out yesterday and the stock was down over 3% because this stock is priced for perfection. Headline earnings per share for the 52 week period ended 24 June 2012 looks to increase by 26.8%-33.8% to between 549c-579c. However there have obviously been a lot of recent activities with this one with the Wal-Mart deal bringing in extra costs. Last year headline earnings per share before transaction costs came in at 641c. This year HEPS before costs looks to come in between 641c and 679c per share so not much growth there.

When you exclude transaction costs the stock still trades on 25 times earnings. Investors, which include ourselves expect the growth to only come at a later stage. The Wal-Mart influence will take time and the expansion up into Africa inevitably requires big capex. We continue to like the stock and are not deterred by the high valuation. The stock is 90% foreign held so it is not us who are determining this premium. More details to come when the full release comes out on 22 August.

Currencies and commodities corner. Dr. Copper is last at 342 cents per pound, the oil price is slightly lower at 93.15 Dollars per barrel. The gold price is slightly lower at 1606 dollars per fine ounce. The platinum price is last trading at 1399 Dollars per fine ounce, lower on the day. We have started a little better here at the start. Which is good news for the bulls! Another record high.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment