"The prices for the balancing of the budgets for Iran, Algeria, Libya, Nigeria, Venezuela, Saudi and Iraq are all north of 100 Dollars a barrel. UAE, it is around these levels, after last evening, the slump in the oil price, it looks harder. Qatar and Kuwait are fine. Saudi, as the biggest of the oil producers has been more prudent, some people say that the health of the Saudi Royal Family is more important at this point in time. Some countries have been prudent with their resources, some have not."

To market, to market to buy a fat pig. Oil, it is possibly the most immediate necessary commodity, other than food and water. The market cares less who produces it, the market always finds what is the best level at any given time for a specific commodity. Without the consumer for a specific commodity, the price would be next to nothing. You can have as much of the stuff as you want, when the consumer changes their minds and uses something else, that price might as well be finished. You know the old saying that the rocks did not run out when the stone age ended.

Think of some of the examples known to humankind, whale oil, it is practically extinct as a commodity, as a result of a) no more demand for the product and b) we now protect the giants of the sea. Whale oil was exceptionally valuable before kerosene was used for lamps and cooking oils obtained from plants was more widespread and used for cooking. Sounds like a whole lot easier than going out to find Moby Dick, it made economic sense eventually to switch.

Nutmeg, you can find it in your spice drawer, did you however that wars were fought over a series of islands known as the Banda Islands, at the time they were the only source of nutmeg globally. Why? Nutmeg was not only a preservative, it was thought to ward off the bubonic plague. All this from Wiki. Today the cost of something transported from either Indonesia or Grenada is negligible, compared to what it used to be. Still expensive at nearly 40 Rand for 35 grams whole or 45 Rand for 50 grams ground, not 90 shillings a pound as it was back in 1760 (Wiki). Not so tasty really and once people figured out that it was the rats and the associated fleas, the plague was exterminated.

Coffee is at the opposite end of that spectrum. According to Wiki, the first European coffee house opened in Rome in 1645. Roughly half of the US population over the age of 18 drink a cup of Joe daily, they are the leading market with daily consumption of 400 million cups a day. Per capita however, the distinction of being the most highly caffeinated country per capita belong to the Finns. Nearly 10 cups per person per day. It is not surprising when you consider that they endure 100 days of winter in which the mean daily temperature is below 0 degrees celcius. I would drink a lot of coffee too on that basis. It is however the second most important commodity on the planet currently, after oil.

And we are talking oil today for the very reason that OPEC met yesterday. I for one have not seen this much excitement around an OPEC meeting in an age. The Venezuelan oil minister, Rafael Ramirez, criticised the US fracking community, suggesting they should be reigned in. Sorry pal. Free enterprise has trumped your ideology and cartel, consumers dictated that, not dictating to consumers. Rafael Ramirez suggested that everyone had to make sacrifices. He also said something dumb like lower oil prices was bad for consumers. Really? Perhaps for fingerprinted Venezuelans forced to buy a set number of food items at a set price, their lives are about to become harder, as are the ruling elites. 95 percent of all export earnings are derived from oil. The market always beats you if you try and manufacture something idiotic. I feel for the people of Venezuela.

Forget my Venezuela bashing, the prices for the balancing of the budgets for Iran, Algeria, Libya, Nigeria, Venezuela, Saudi and Iraq are all north of 100 Dollars a barrel. UAE, it is around these levels, after last evening, the slump in the oil price, it looks harder. Qatar and Kuwait are fine. Saudi, as the biggest of the oil producers has been more prudent, some people say that the health of the Saudi Royal Family is more important at this point in time. Some countries have been prudent with their resources, some have not. Dutch disease as Michael reminded me, is a real thing, the whole idea that your manufacturing sector is decimated due to natural resources that are exported furiously. Your currency strengthens, industrialists concentrate on the resources industry, the existing manufacturing industry cannot compete with cheaper imports. Balance I guess.

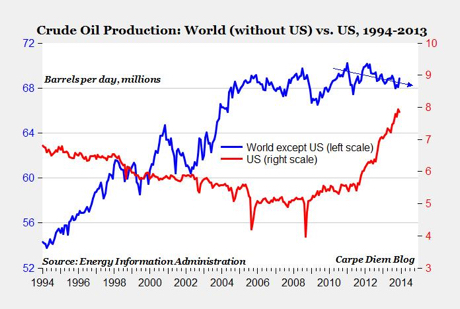

The upshot of the OPEC decision to keep oil production flat at 30 million barrels a day (pretty loose and fast) has been that the oil price has gotten completely smoked, down over 6 Dollars a barrel at one stage, for Brent the biggest one day fall since 2011. We are now at a four year low and not too dissimilar to the slide in the other commodity prices. Well supplied markets, including the US, have seen to that. The question then becomes, at what level is US shale production unprofitable? According to the FT, that level is around 40 Dollars a barrel for the least cost producers, 115 Dollars a barrel for high cost producers. Guess what will happen with enterprise, they will be forced out immediately. If governments are too reliant on one income stream, that is their problem, not ours. For us here in South Africa and in many parts of the world, a weaker oil price is fabulous for consumers, it is like a massive tax break.

Company corner snippets

Truworths have been busy, yesterday announcing that they were acquiring the Naartjie brand locally from a crowd called ZA One, as well as the US holding company. Did you know that? The headline misspelt the name, it read: Proposed acquisition of the Naatjie Kidswear Business. I wonder how many people read it and missed the mistake. The business has been around since 1989, there is a store network of only 26 stores, clearly the plan is to sell more kids clothes in the stores, rich people go nuts for this brand that the little darlings grow out of so quickly. Just a few weeks ago Truworths announced something similar, they announced that they intended buying Earthchild, again, another rich peoples clothing option for their children. Expensive clothes and children, do they go together? Why not. The deals themselves are possibly not that big, for now. It is still about the fashion of the parents, you can imagine trendy tots too though.

Santam have announced the replacement for Ian Kirk, Lize Lambrechts joins the company from Sanlam, where she has been since 1985. Lambrechts was chief of Sanlam Personal Finance, which is the retail arm of that business for the last 12 years. She is an actuary, studied at the business through her career. Hard work, studies and keeping in the same place seems to have rewarded this smart person. There is a lesson in that, well done to Ms. Lambrechts and good luck to Captain Kirk at Sanlam.

Things we are reading and we think you should be too

Given that it is thanksgiving, Nassim Taleb's most famous Black swan analogy comes to the fore - NASSIM TALEB: Consider The Thanksgiving Turkey…. The analogy shows the futility in placing a high degree of confidence in forecasts because we simply do not know what tomorrow holds.

This article sums up the reality of economics perfectly - FARMING: Prices on a peel. Given the uncertainty around land reform, farmers have moved their longterm investments to where they feel they have more certainty. Another note is the economies of scale and the stronger position that the bigger guys are in due to them being larger.

BMW is taking a feather out of the cap of Apple when it comes to customers - BMW's genius move is from Apple's playbook. As car companies place higher importance on the customer experience I think having private dealers will become out of date because the car companies will want to have maximum control over the experience. This is a fight that Tesla is already in.

Healthy wage growth is good for companies everywhere - Private-Sector Wages Up 5% For Year Through October

If Europe is to catch up to the US in the growth department Germany is a key driver - German Jobless Rate at Record Low as Confidence Improves

Having your own drone would be very near the top of most peoples Christmas lists - GoPro to release consumer drones next year, report says. If the drones are as cool as the current GoPro's they should be awesome.

Giving some relativity to the size of Apples market cap - Sizing up What Apple's $700B Market Cap Could Buy

Then to end off, a thought provoking article - Why can't a billion Chinese people rise up and overthrow the Communist Party and make China democratic?.

Home again, home again, jiggety-jog. It is Black Friday, the shopping holiday in the US where the queues are long and the urge to splurge exists. It is starting to go global, I have had many emails here today suggesting that I have a chance at a discount. If only I was a shopper!! Sadly for commerce I am not, I do however encourage everyone to get something that they desperately need on the cheap.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939