"That is where we will leave it, the brands are timeless, you are buying hundreds of years of excellence and craftsmanship. Europe might be in a little bit of a funk, China might have experienced a slowdown in sales growth (indeed going backwards a little), the target market for the company is bigger and in better shape. Quality is timeless, the company has the benefits of holding the brands and making good progress. We continue to hold the stock, notwithstanding the six and a half percent gain Friday. Sales growth is going to be muted for a while, it is however one of the finest companies that we have access to here on this market."

If you did not get the email on Friday about the number change, here goes again: We have changed our telephone number with immediate effect to 087 985 0939. Thank you for your patience, if you battled to get through to us recently.

To market, to market to buy a fat pig. I never realised that the song and album "Another Brick in the Wall" (released 35 years ago) had been banned in South Africa under the apartheid government, I remember watching the video at school. Perhaps it had been fed to us by our English teachers, I was not very taken with it at the time, I thought both the music videos and the songs themselves were weird, I watched them anyhow. Why is it relevant? Well, the Wall, the Berlin Wall, came down 25 years ago yesterday, folks in tight jeans (riding a little too high), spiky hair and loud t-shirts smashed the wall to pieces. Our history teacher summoned all of us to the common room and shook his head in disbelief, he might have been mumbling something or other along the lines that he could not believe it.

And so the east had fallen apart, the wonk economic ideas of communism (which somehow conveniently excludes the human spirit) fell like a bunch of dominos, the Tiananmen Square protests had taken place earlier in 1989, perhaps that was a catalyst, who knows? The upshot of it all was more progressive economic policies through Europe, more consumers who are still catching up to their more developed Western European cousins, wealth is something that comes with several generations and not something that appears out of thin air. Wealth is created and fought for, the same way that many other ideological battles are won.

Again, let us be clear, the wall was erected to keep people inside East Germany, inside of communism. The people of East Germany were fleeing to the West for better opportunities and more freedoms. 4 million people went from East to West during the period from 1950 to 1988. If "things" in East Germany were so awesome, why was the command given to shoot on people willing to escape, and why did many risk their lives in order to get to "freedom". It was not happening the other way around. You see, there is this strange thing about people, whilst they may talk about equality, we are hard wired to one-ups-man ship. I think I said that right.

Equality at the most basic levels for everyone, life is however surely not fair. If you do not encourage ordinary people to achieve (i.e. you tell them they are all equal), you get what you ask for, ordinary. Don't take your freedoms for granted, they were hard fought for. Read the FT piece and watch the video if you have time, the "cold war" is something that is making a small comeback: Angela Merkel: ‘fall of Wall showed us dreams can come true'.

Back to market quickly chaps, the history lesson is not exactly something that makes everyone comfortable. My mum always drummed into me that history is written by the victors, I guess there are always three sides to a story is what she is saying, both sides and then the truth somewhere in the middle. We saw non-farm payrolls on Friday that were marginally worse than anticipated, the unemployment rate was improved as was the labour participation rate. In fact, even though the headline numbers was a miss, this was by some measures the best labour report period in around 15 years, indicating once again that the US economy was in better shape, better than their developed market peers. Revisions higher in the prior months too, the trend is your friend as they say in trading circles.

The upshot for equity markets was a percent gain here in Jozi on the all share, commodity prices and stocks recovered (sending the resource index up around 3 percent). The broader market S&P 500 in New York eked out a marginal gain, the Dow Jones added just over one tenth of a percent, both those indices once again closing in record territories. The nerds of NASDAQ had registered the best level in around 14 odd years on Monday. A pretty good week all around for markets, not that much of a gain though, 0.69 percent on the S&P 500 for the week, just over a percent for the Dow Jones, the NASDAQ was flat on the week. There goes, Mr. Market news.

Richemont delivered numbers for the first half of the year on Friday that obviously were less bad than the market anticipated, at a headline level they were average. On the conference call, the archived one, I noticed that Gary Saage, the group CFO led the charge. Gary is an American, 54 years old and has been a board member at Richemont since 2010. Johann Rupert has been on the board before the Berlin Wall came down, it shows you a thing or two.

I remember an interaction between him (Rupert) and an analyst at a presentation, where he managed to establish that nobody in the room had worked for their employer for more than around 9 years, other than the Richemont board who had been at it for decades. He said to all of the folks in the room, how can you expect us to build a long term business and understand it, when your industry sees no job loyalty and job hopping? He had a point no doubt, a very good point to make.

Anyhow, that is besides the results and their relative importance to shareholders that have had to be very patient this year. The stock has certainly under performed after some of the most incredible outperformance over the last five years. The crackdown on the gifting culture and Chinese government inward reflection on spending outside of the normal parameters has led to a slide in sales growth in the region. The big flashy billboards of luxury items in what is still a communist country has attracted the big wagging finger of the Xi Jingping administration.

It has also had a negative impact on the company trying to ride the wave of the new luxury market in China, it will undoubtably be the most important single consumer market in the 21st century. It is astonishing to think that in the period of 1959-1961 (a little over 50 years ago) 40 million (top end of the range) Chinese people died of starvation. As a result of poor weather, mostly dumb policies though. That is a distant memory now, the China that everyone does business in today is a very different place.

Download the investors presentation FY 15 - Interim Results, and check all the key information. Sales of course are reported in Euros, the company however is based in Switzerland where they use Swiss Francs. I guess the Swiss Franc now has a Euro peg zone (the Swiss National Bank does some interesting "stuff"), so it is essentially Euro linked. One thing I learnt about Switzerland is that there is a fourth language, Romansh (60 thousand odd regular speakers) which has been used for centuries. Romansh? Sounds like something that is spoken after too much schnapps, you do however keep learning each and every day.

Quickly, here are the numbers: Revenue was up 4 percent at constant rates, up 2 percent in Euro terms (negative impact of stronger Euro in the big areas) to 5.430 billion Euros. That is 76 billion Rand. Operating profit fell 4 percent to 1.311 billion, gross profits actually increased 3 percent, thanks to lower commodity prices. On a per share basis (A prerequisite for South African reporting), 1.613 Euros per share.

Remember that here, we have the 1/10th GDR, i.e. 10 shares here in South Africa = 1 Richemont listed in Switzerland. The price in Europe for the share, right now is around 83 Swiss France, the stock trades on a price to earnings multiple (historic) of around 18.8 times. Not expensive, not cheap, goldilocks! If the market had to prove the stock more aggressively, at the top end of the recent range, 35 odd percent higher would be where the price would be now. Too many ifs and buts, we don't do that in this office, ifs and buts! Ha-ha.

Half of the sales are watches (49 percent), 28 percent jewellery, 5 percent leather goods and 3 percent writing instruments (who still buys pens?) and the rest, 15 percent is clothing and other. Purdey, they sell shotguns!! Really. For hunting with your hound, you know. Clothing and other was actually the fastest growing segment, up 12 percent in actual rates, leather goods were getting blasted, down 11 percent.

Most of the difficulties came in what has been the fastest growing markets, Hong Kong, Macau and China, those October sales just passed has seen ongoing impact from the Hong Kong unrest, the Macau gambling revenues have plunged recently, this point to lower visitation from mainland China. Obviously Japanese sales have been impacted by sales taxes having risen this year, they might rise more.

Less visitors to Europe from Asia has also impacted, the cut down on gifting has filtered through to lower sales, you could say job done by the Chinese government. From a geographic sales basis, the Middle East and Africa (the smallest division) grew sales in actual rates at a whopping 19 percent, to overtake Japan! No longer the smallest region, well done! The Americas is where all the action was, up 10 percent in actual rates on a sales basis, Asia Pacific down two percent, still the biggest region at 38 percent of total sales.

The outlook suggests they are going to have a stronger focus on the high end jewellery division, to push Cartier, Van Cleef & Arpels and Piaget, those high end brands. As usual lots of new releases to look out for, including the Cartier Royal HJ collection, I guess if you need to ask for the price of the pieces, that is the wrong starting point. For instance, the Pur Absolu Necklace from that specific collection has 106.38 grams of platinum, a 30.21 carat D IF pear-shaped diamond (D and IF are colour and clarity), about the same amount in various other diamonds on the necklace as well as a 17.41 grain natural pearl. Grain is a pearl measurement, according to Wiki, one grain is 64.79891 milligrams. A grain is actually just that, based on the weight of a single seed of cereal/grain. Adds to allure no doubt, perhaps one of you can work out the price of such a piece.

That is where we will leave it, the brands are timeless, you are buying hundreds of years of excellence and craftsmanship. Europe might be in a little bit of a funk, China might have experienced a slowdown in sales growth (indeed going backwards a little), the target market for the company is bigger and in better shape. Quality is timeless, the company has the benefits of holding the brands and making good progress. We continue to hold the stock, notwithstanding the six and a half percent gain Friday. Sales growth is going to be muted for a while, it is however one of the finest companies that we have access to here on this market.

Things that we are reading, that we think you should be too

The value of Amazon is a highly subjective matter, given that it does not make any profits. This article views an investment in Amazon as an investment in founder Jeff Bezos - Amazon Bound: Is Bezos reaching his limits?. Trying to value Bezos is probably an even harder thing to do.

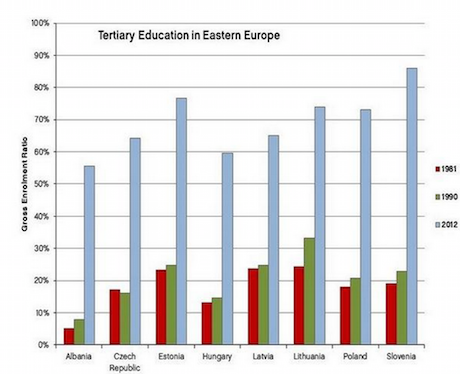

An image I found on twitter comparing the differences in education levels between Eastern Europe under capitalism and Eastern Europe under socialistic control.

We can be our own worst enemies when it come to investing - The Value of I Don't Know. Sometimes we know so little that we don't know we don't know or sometimes it is a case of not wanting to admit we don't know. Watch the video clip in the blog piece, very entertaining.

Home again, home again, jiggety-jog. Stocks are higher here again this morning, up three quarters of a percent. Commodity prices seem to be catching a bid, there was a whole host of company news between now and this morning, results from a ton of businesses, Sappi, Vodacom, Lonmin, Lewis, Invicta, the list goes on!

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment