"Around 46 million turkeys are eaten at Thanksgiving, 205 million are raised each year in the US. The turkey pardon at the White House by the president has been around since 1947. The day itself, the day of Thanksgiving is 225 years old today. Forget that, Black Friday, the big shopping day after Thanksgiving dinner attracts over 90 million shoppers."

To market, to market to buy a fat pig. Some average data from the US saw to it that the brakes were applied to a market that must have left the bears licking their wounds and wondering what has happened in the last 40 days. The S&P 500 is up 11.28 percent since the lows of the market washout in October, the speed of the recovery matches the speed of the draw down, there was high fives all around, it was short lived however. Yesterday was another closing high for both the Dow Jones Industrial and the S&P 500, with the blue chip and older index, the Dow Jones within striking distance of 18 thousand points. The Dow Jones is up 10.45 percent in the last 40 days, the gains have been swift and the period of oops from Mid October have washed by.

Locally we did not have a chance to break the resources shackles, remembering that we get one less hour of US markets through the local summer. We get the princely sum of half an hour of US trade, ten minutes of that includes a closing auction. Obviously with the futures market almost always trading we get direction all the time. Gold stocks had another good day yesterday, bullion is starting to gain a little more momentum, the oil price has however been under huge pressure. The OPEC announcement comes out at around 11am, OPEC are however not what they used to be. The WTI (West Texas Intermediate crude oil for delivery at Cushing in Oklahoma) price is down 20 Dollars over the last year. The budgets of many OPEC countries desperately need higher prices.

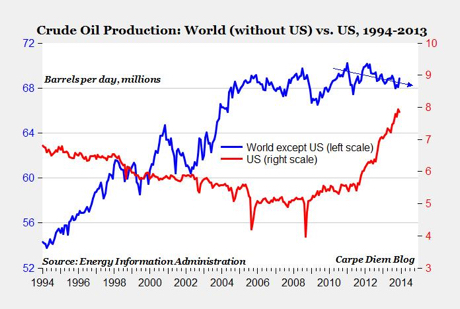

So why is OPEC no longer the force to be reckoned with as before? Simple. This graph via this article explains everything about lower prices: The surge in US shale oil has offset declines elsewhere, stabilized world oil supply, prevented gas prices from rising, courtesy of Mark J. Perry and AEI. It is all that you need to know about weakening oil prices which is excellent for the global consumer.

Let us talk turkey for a little. No two turkeys are the same, the rage this year (for the last few in fact) for hipsters and the wealthy (and maybe the healthy) is to go for a heritage turkey at Thanksgiving dinner. A heritage turkey is a turkey that has the characteristics of the original turkey that was served the first ever Thanksgiving meal. Skinnier, more pheasant looking, they could perhaps outrun humans in the old days. The price difference between an organic heritage turkey and mainstream one is as much as 48 percent more. The price of being a hipster/trendsetter is more than ordinary people. Question, do hipsters tell the other people around them of their organic expensive tastes? Or are they quiet about it? They just post it on Instagram.

Around 46 million turkeys are eaten at Thanksgiving, 205 million are raised each year in the US. The turkey pardon at the White House by the president has been around since 1947. The day itself, the day of Thanksgiving is 225 years old today. Forget that, Black Friday, the big shopping day after Thanksgiving dinner attracts over 90 million shoppers. Yowsers. The Holidays - All Markets at the NYSE point are out as this is a holiday in the US, one of only 9 days that the markets close completely. I think that it is a half day for the US trading tomorrow, short straw for that one! I guess if you live in the surrounds you can go to work for half a day and not be off, an extra days leave to use elsewhere. The US actually has no statutory minimum for leave days (paid), the typical package allows for around 15 days.

In South Africa it is about the same, workers are entitled to 21 consecutive days leave, 1 day per 17 days worked, 1 hour per 17 worked. I guess the more you work, the more leave you get. If your average day is around 10.5 hours, your average week is around 52.5 hours, which means three hours leave a week. A more conventional 8 hours a day (know anyone who does that?) equates to 2.35 hours leave a week, or 122.35 hours a year. Which divided by 8 hours = 15.29 days. If you are a security guard and work a 12 hour shift, the measure (divided by 8 hour working day) of leave days is 23.

So it matters where you work and how, our leave days are pretty much inline with the rest of the world. I read an article that suggested the Austrians, Portuguese and Spanish have the most paid leave and public holidays in the world, around 35. Wow. Japan, Canada and the US in the developed world are the folks that demand the most from their workforce, from being at work and being there a lot. Well done, work hard today y'all! I am thankful that my roof did not blow off last night during a hectic storm.

Company corner snippets

Michael makes a good point, after we saw a SENS announcement yesterday that Christo Wiese had bought 30 thousand contracts (representing 3 million ordinary Brait shares) at 73.505 Rand for a total value of 220,515,000 Rand. He suggests that Wiese must know how Brait are going to invest the cash that they are potentially left with, obviously a few hurdles to clear now. Wiese would have bought these two days ago, when the market fell hard, it fell hard again yesterday, down to 70 Rand. I wonder how leveraged he is, this takes relatively large sized you-know-whats to do this. He thinks the fall in the share price of Brait is overdone, he leveraged this, he thinks that he can make back his money quickly. Imagine the funding cost on 220 million Rand! And imagine if you were down 3.5 Rand multiplied by 3 million shares (on paper) in one day. Don't feel bad for Wiese, his shareholding in Shoprite, 15.31 percent of the business equals 87 699 198 shares. The recent final dividend, after 15 percent dividends tax, equals 162.5 million Rand paid to him mid September. Good work if you can get it! Finding a home for it you see, I am sure that it hurts a little.

Santam released an operational update yesterday afternoon. It is a general 10 month communication with shareholders, which in case you forgot (who the shareholders are), as per the last annual report, 3 shareholders own 73 percent, including the gorilla shareholder, Sanlam, who own 57.83 percent. Remember that at this time last year there were plenty of hail related claims, that storm last night happened at a good time for the insurers, i.e. when most folks were off the roads. I cannot imagine what happen with crops, or whether the high winds could fuel fires, that is a possibility. All around however the trading update indicates that it is tough out there, the one line sums it up: "Underwriting conditions remain challenging, with continued pressure on claims costs and the tough general economic climate impacting on growth." Ian Kirk moves up to deputy CEO as main shareholder in January, a new CEO will be announced shortly. The stock took a sharp leg down, it has recovered somewhat today.

Biggest news of the day so far, a release today: SABMiller, The Coca-Cola Company and Coca-Cola Sabco to form Coca-Cola Beverages Africa. This will form the largest Coca-Cola bottler on the continent, 40 percent of all beverage volumes across the continent, the 10th largest on the planet. 30 plants, 14 thousand people. The shareholding split will be SABMiller 57 percent, Coca-Cola Company 11.3 percent, with the balance, 31.7 percent in the hands of the Gutsche Family Investments, you can read the family history and involvement in the business via their Coca-Cola Sabco Our Company profile on their website. Fascinating change of ownership from a sales person, Phil Gutsche joined the business as a sales person, and ended up with all of it 20 years later. He worked for 16 years (Gutsche) at the business before acquiring a stake, and then 4 years after that had everything, talk about being in the right place at the right time. The SABMiller price has barely budged in London, up a touch.

Things we are reading and we think you should be too

Ronald Wayne's sale of his 10% share in Apple for $800 is considered one of the worst trades ever - Apple's Forgotten Cofounder Is Auctioning Off A Collection Of Early Documents. At least he can make a couple bucks off these documents.

It is great to see how technology moves, for Sasol this should save them some costs as well as being more environmentally friendly disposing of industrial waste - Microbes to munch Sasol sludge

This link is to a 19 minute Ted talk, if you have the time I recommend watching it - How not to be ignorant about the world. How did you do on the three questions about which way the world is moving? The basic message from the video is things generally are getting better and not worse as our biases would point toward.

Management remuneration is a hot topic at the moment - What's a CEO Really Worth? Too Many Companies Simply Don't Know.

Cullen Roche gives a brief look at the FED borrowing and the US government debt and gives his reasons why the myths are wrong - When Gurus Say Strange Things.

Home again, home again, jiggety-jog. I am deeply saddened by the passing of Australian cricketer Phil Hughes, who was struck on the head by a cricket ball two days ago in a first class match in Sydney. The sport is not associated with contact, the ball is extremely hard, even though it weighs only 163 grams, batsman are genuinely scared with quicker bowlers. I feel sorry for all and sundry, the family and friends, the broader cricketing fraternity and indeed for the fighter Hughes himself, on the cusp of muscling his way back into the side. Sad.

OPEC, are they as relevant as before? The US need to be able to export a whole lot more oil than they did before, currently they cannot. I have no idea what vehicles we will be driving in 2040, I can only assume that if the economics dictate that a battery operated vehicle is cheaper in all respects, then no doubt that is what we will drive, not combustion engines. Talking of which, did you see the "poo bus" in the UK, the bus that runs on biomethane energy from from human waste, from the sewerage plant. In the UK alone there is enough biomethane to power half of the truck fleet. And on that note, we have fallen to talking potty, it is time to sign off!

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment