"The speed at which these things happen is incredible. The speed at which the iron ore price has come crashing down is eye popping, in November last year it was at 136 Dollars a ton, the last 12 month move has been around 45 percent. Over ten years however, the price of iron ore is up over 350 percent, if you put it into that sort of perspective, then it sounds marvellous. The reality is many companies (any company) at a higher price of what they sell, they tend to want to sell more of it and cost containment becomes less of a priority. I am pretty sure that it is exactly that now!!"

To market, to market to buy a fat pig. Resource stocks (except for Platinum and Gold stocks, those were on fire!!) led the broader market lower here, I fear that it will be the same today, perhaps a little worse in fact. Why? What is happening? Iron Ore prices are at a five year low as we speak, 62 percent Ore (quality) for delivery at Qingdao, fell over four percent during Asian trade to reach a touch below 72 Dollars a ton. Wow. The mighty price of iron ore has fallen, the marginal miners are getting roasted, there are many a project and producer (smaller) that are out of business or being shelved.

Remember that video from a few days ago that suggested that iron ore production and steel production (iron ore is the main component in steel, as is metallurgical coal for the carbon element), in which Jeffrey Currie from Goldman Sachs said that the iron ore market was quite far from being balanced. The speed at which these things happen is incredible. The speed at which the iron ore price has come crashing down is eye popping, in November last year it was at 136 Dollars a ton, the last 12 month move has been around 45 percent. Over ten years however, the price of iron ore is up over 350 percent, if you put it into that sort of perspective, then it sounds marvellous. The reality is many companies (any company) at a higher price of what they sell, they tend to want to sell more of it and cost containment becomes less of a priority. I am pretty sure that it is exactly that now!!

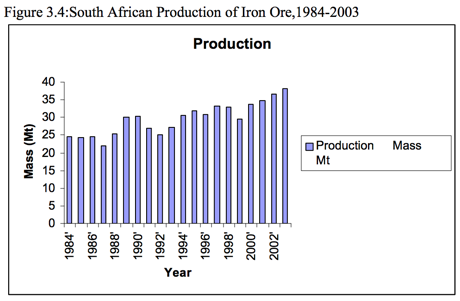

Expect some pain for the producers today, big ticket stocks will feel the heat, Kumba Iron Ore (and by extension Anglo American), Assmang (Assore and African Rainbow Minerals), BHP Billiton, they will all feel the sell off today. Check out production, from this old piece -> Overview of South African iron, manganese and steel industry during the period 1984-2003 locally, during the period when the iron ore price was completely flat:

See that, production has increased marginally, not much at all. The market at that time was made up of only Kumba Iron Ore and Assmang, if you have a look at their production for the last full year, Kumba Iron Ore is on track (estimates in September) for over 46 million tons this year, very close to current design capacity. Assmang (via the Assore results) produced nearly 16 million tons of Iron Ore (15.6 from 16 in the year prior) in their results in June. Put the two together and you get around 62 million tons of iron ore. You can very quickly see that production has ramped up as the price had gone nuts, due to demand having driven this unique moment in history, China (and their massive population) being urbanised at a rate never seen before. Draw your own conclusions from all of that! The demand side will still be there, at a lower rate.

The US markets notched another closing high. The S&P 500 reached 2050 for the first time. Turn down for what? The word on the street is that the European Central Bank is going to have to start buying bonds in the area, the Germans despise the idea. The French are calling on the rest of Europe to use real money to give their economy a jump start. If you think that is a little cheeky, it has been done before across the rest of Europe, including Germany.

I watched Charlie Rose this morning, he is amazing and normally has guests on each and every day that you want to watch and hear what they have to say. This morning it was particularly interesting, he had Josh Brown, Megan Murphy, Joe Wiesenthal and Felix Salmon, recognised bloggers in the financial sphere. Of those four, Josh is the only one who manages money, all the others work (and have worked) for big houses. Megan works for FT (changed gig to Washington DC from fast-FT), Joe now works for Bloomberg (ex BusinessInsider) and Felix worked for Reuters (now Fusion). What they all have in common is that they are disputers in the way that we consume information, collectively (along with everyone) they have made a difference.

Let me tell you something about my personal experience from searching for a diversity of subjects, I use Google primarily. Real time, nowadays, Twitter is the medium. If you are looking for something that just happened, you can be pretty sure that there is not a 600-1000 word article. There are real time events, that is what Twitter is for. Josh said one thing that I found really interesting, he said something along these lines: "47 percent of Americans live on an annual income of less than 50 thousand Dollars per annum, 20 percent of their spend is on energy, how can a plunge in energy prices not be good for the market?" He was making this observation as he had heard the theory that lower energy prices were bad for stocks, high oil inventories were bad.

Company corner snippets

Reunert had results yesterday, this was for the full year to end September. I cannot find too much to get excited about in this company, that sounds a bit strange for a business that has a turnover of 7.8 billion Rand, sizeable. A tough time of it in the cabling business with the lengthy mining strike. They do say however that the Nashua Mobile sale will free up the business to look for acquisitions: "This provides the group with the means to seek meaningful future inorganic growth." The company talks about social and economic uncertainties in the country, meaning that they (Reunert) struggles to see how they can grow organically. HEPS have been flat for five years. 505.6 in 2014 versus 505.5 in September 2010, five years of going nowhere. You would not then be surprised to note that the market cap (with a few less shares in issue) has gone backwards over the same time period. Anyhow, if you are looking for the results presentation, here goes: Presentation to investors.

That is seemingly the end for Protech Khuthele. This is another big reminder to the powers that be that the business of business is a really tough one. Here is the SENS: "The liquidators have advised that the company is in final liquidation; is totally unable to pay its liabilities; there is no chance that the company will be resurrected unless somebody proposes a scheme of arrangement in terms of Section 155 of the Companies Act, 2008 (Act 71 of 2008); and nobody has discussed the possibility of such a scheme of arrangement. Protech will be applying to the JSE to be delisted and will advise the outcome thereof." Just a reminder, 19 months ago (12 March SENS) an independent expert valued the company at between 79 and 88 cents. The board said to shareholders that they should reject the Eqstra offer of 60 cents per share. Again, the speed of it all is astonishing, a company that another one wanted to buy (the board and independent valuation) thought it was worth more. Turns out it is worth nothing.

Things that we are reading, that we think you should be too

The reason why stocks are still the best investment and will be for decades to come - The end of the population pyramid. There are two things to note in the video, the first is the rapid rate of population increase. Increased population, increased consumers and increase in the value of companies selling those goods. The second and probably more important thing is the shift in population distribution. In percentage terms the older age groups are getting bigger, so even if a population growth slows the age brackets that have disposable income is growing. So even more spending.

If you are worried that all this population growth will be the end of the planet here is a video that Bill Gates tweeted about yesterday - Population, Sustainability, and Malthus: Crash Course World History 215. The key line in the video is, less people will die of starvation this year than did 500 years ago. What you need to remember is that 500 years ago world population was less than 1 billion, we are currently over 7 billion.

It seems that smart money finds a service with low fees and then has patience - No Wonder They Call Hedge Funds 'Smart Money'!.

A feel good story - The 20 Most Beautiful Cities In The World

There is a debate about being diversified, to bring down risk but not having too many stocks, which results in you having essentially an index tracker - HOW CONCENTRATED SHOULD YOU MAKE YOUR VALUE PORTFOLIO? In summary having between 5 and 15 stocks seems to be the number.

Changing our perspectives when it comes to stocks - Market Earthquakes. "He likens the market to an excitable dog on a very long leash in New York City, darting randomly in every direction. The dog's owner is walking from Columbus Circle, through Central Park, to the Metropolitan Museum. At any one moment, there is no predicting which way the pooch will lurch. But in the long run, you know he's heading northeast at an average speed of three miles per hour. What is astonishing is that almost all of the market players, big and small, seem to have their eye on the dog, and not the owner."

Here is one of the main reasons why we think owning shares in New York is a great idea - The NYSE Makes Stock Exchanges Around The World Look Tiny

Home again, home again, jiggety-jog. Gold stocks have been on a tear, up over ten percent this week. Wow. Resource stocks as a whole are heading in the opposite direction, as a collective down over eight percent. Did you know that as a collective, resource stocks have delivered negative returns for 4 years in a row. True story. The last year that resources beat the overall market was a marginal outperformance in 2009 when we were in full recovery mode. Makes you wonder why we have an incredible affinity to resource companies, entrenched in the minds of the South African asset management community, the need to have to own these companies.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment