"The short term story is under pressure for Cisco and we also feel the Executive Chair John Chambers has overstayed his welcome. New management could be a breath of fresh air for Cisco. Weighing up the pros and cons mentioned above, I recommend a hold on this stock. Net neutral (excuse the pun)."

To market, to market to buy a fat pig. We were only higher locally for a small part of the trading session, the first part of the morning. For most of the day people were talking about a Japanese recession, the technical definition of a recession is 2 consecutive quarters of economic activity lower, relative to the prior reporting period. Investopedia says: "The technical indicator of a recession is two consecutive quarters of negative economic growth as measured by a country's gross domestic product (GDP)"

The Japanese economy for the last quarter was expected (by those in the know) to have printed a positive number, after a quarter prior was hammered as a result of a higher sales tax having being pushed through. Abenomics, named after the Japanese Prime Minister Shinzo Abe, the grand plan to inflate prices and stimulate the Japanese economy is working in some senses, this quarter, not so much. The Japanese market tanked, in some senses it has never recovered from the levels seen in late December 1989. What?

On the 29th of December 1989, the Nikkei 225 hit an intraday high of 38957.44, nearly 39 thousand points. The market today, 18 November 2014 is trading 1.7 percent better as we speak at 17267, near the levels of October 2007, the last market high. In some senses, even if the market doubles from here, the Japanese investor that did nothing, waiting for recovery would have seen a whole generation pass.

This is pretty much like the Dow Jones during the period from the Great Depression onwards, taking 22 years to surpass the all time high again. During the Great Depression the Dow Jones erased 30 years of gains in just three years, taking 22 years to get back to those highs. That is more than half a lifetime. If my great grandfather had bought the Dow Jones Index at 100 points in 1914, around the outbreak of the "War to end all Wars" (it had tracked sideways for 8 odd years), then 17 thousand today would have been a handsome level!

Talking of World War One, I saw the production of War Horse on Friday, it was absolutely magnificent, truly magical and by the end, you forget that there are humans controlling the puppets. Some would argue that it is not too dissimilar to monetary policy, nudge, nudge, wink, wink. Mind you, with every bad story there is almost always invariably a good story, the closing low for the Nikkei 225 (last 25 years) was March 2009, no different from enduring a washout like the rest of global markets, at a level of just above 7000 points and over 80 percent below the highs from nearly 20 years prior.

Since then the ride has been rocky, the average age in Japan is rising, this presents an interesting conundrum from an immigration point of view, the Japanese should probably be more aggressive in this regard. The average wealth per adult in Japan is higher than Germany, yes sir, believe that! Double Greece and nearly three times that of South Korea (no love lost between the two countries). Like Italy, Austria and Germany, there is actually little average debt per adult. That unfortunate distinction in the OECD belongs to Iceland, where the debt to net average wealth stands at the highest percentage.

The Japanese economy is around 7.9 percent of global GDP. Adjusted for Purchasing Power Parity (PPP) it is 5.29 percent in 2014, a whole lot lower than the 7.04 percent in 2004. On a per capita basis in constant prices it is around the same levels of 2008 when measured in Dollars, the Yen has been weakened with aggressive monetary policy. The Bank of Japan's balance sheet has tripled over the last year and a half. As a result of many cross holdings of assets globally, the good news for Japan is that we are more interconnected than at any other time in human history.

For the Japanese economy to come out of their funk it requires global consumption to continue to rise as it was in the golden age of Japan, the roaring 80's. Economies around them continue to consume goods from all of the exporters around. You cannot force the population to consume more, the place is by no means cheap, it is very expensive relative to some of the bigger economies around, certainly not like a Switzerland and Norway.

The most expensive rentals in the world, according to this measurement -> Cost of Living Index for Country 2014 Mid Year is Angola!! Nepal is nearly 40 times cheaper to rent than Angola. South Africa on that table rubs shoulders with Mexico, Bulgaria, Romania and Malaysia, that sounds about right, not so? I suspect that as long as Japan stumbles around they will continue to be, relative to the rest of the world, less important. Although as we know as a collective from an investment point of view, the Japanese flows are very important. We can only hope that this current rising in the land of the rising sun is not a false dawn, whatever a false dawn is!!

After I had written all of this the Japanese Prime minister had announced a snap election, dissolved parliament, and delayed the sales tax hikes. I guess this is what the average Joe in Japan wants, a delay, and an opportunity to give the Japanese ruling alliance a stamp of approval. So, I think everyone in an advanced democracy then gets what they want, to vote along economic lines, although truth be told, I am pretty sure that it is almost always about that.

Company corner snippets

Holdsport have announced that they are paying a special dividend of 99 cents, the pay date is 15 December, the last day to hold them to qualify will be 10 days prior to that. After the 15 percent dividend tax, the net amount is 84.15 cents. This of course was telegraphed in the results, the interim dividend of 85 cents (72.25 cents after tax) will be paid on the same day, a lovely early Christmas present for shareholders. The stock is up smartly over the last month and a half, as are the rest of the local retailers, trading closer to a YTD high.

Whoa! The Group Five share price was absolutely trashed, down 17.4 percent during the course of the day. The reason was a Management interaction with stakeholders, which you can find on the SENS segment of their website. Basically the company said that they would not be chasing revenue at the expense of margins, indicating that less (hopefully more profitable) work is forthcoming. At the same time you can see that HEPS and EPS will be more than 20 percent lower than the 2 odd Rand worth of earnings. More than, without further guidance for now, we should see another trading update towards the end of the year, and results around Valentines day next year. No loving for them I am afraid, it is tough out there.

Taste Holdings released their Domino's Pizza update at around half past three yesterday afternoon, the stock price added over four and a half percent. The company has been on a really strong marketing drive, for this brand specifically, I have seen promoted adverts for Domino's on my Twitter feed, Byron pointed them out to us in the office the other day, as well as the "find the next location" radio adverts to get the next location of the global pizza chain. Good for this management team, they work hard, they punch above their weight and now they are going to bolster and rebrand, check it out -> Taste - Domino's Pizza update.

PPC have released their results for their full year to end September, after a trading update earlier in the cycle. The company is in a state of shifting to being more and more active outside of their core market, South Africa, there have been the major distractions with regards to the board versus the former CEO, I am sure that it is not easy for all those impacted by something taking place outside of the course of normal business.

And of course the local business environment has been more than a little tough for PPC, it has been positively a giant slog. A company with over a century of operating experience would have seen these cycles before, check out their results presentation -> Final results for the year ended 30 September 2014. The dividend payout ratio is at the lowest level in an absolute age, that does tell you however that the company is going to be investing heavily in the coming years, check it out.

Byron beats the street

Last week we received results from Cisco for the first quarter of their financial year. It was the best Q1 of their history with revenues of $12.2bn which saw an increase of just 1%. Non-GAAP earnings came in at 54c per share which beat consensus by 1c. Earnings estimates for the full year are expected to come in at $2.13. Trading at $26.47 the stock affords a forward multiple of 12.4. Not expensive by any stretch of the imagination. The company also sits on cash and cash equivalents of $52bn (nearly 40% of its market cap) and has bought back $1bn worth of stock in the quarter with a remaining $7.5bn still to come.

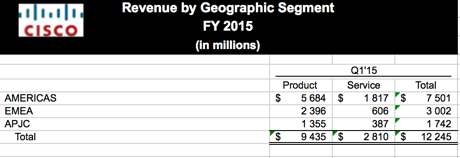

Let's remind ourselves what they do. Simply put Cisco provides the hardware which allows the internet to work. Companies like Vodafone, MTN and AT&T spend billions of Dollars with companies like Cisco to lay down the foundations in order to supply connectivity. Of their revenue mix 77% comes from selling the product while the rest comes from servicing the products they sell. Below is an image of their geographic mix which is pretty well balanced. (EMEA stands for Europe, Middle East and Africa and APJC stands for Asia Pacific, Japan And China).

But why is the stock so cheap? Guidance was disappointing and order growth of 1% is slow. Companies like AT&T have pulled back on capex as the net neutrality debate reared it's ugly head. Why would companies pay to provide faster internet speeds if they cannot charge a premium for it? The industry also comes with strong competition from Asian businesses and weaker emerging market demand. Sometimes having strong international diversification can be a curse, especially when the US economy is where everyone wants to be. These are some of the concerns facing Cisco. But there certainly are some exciting elements.

The concept known as the internet of things is very reliant on Cisco hardware. The internet of things means making all electronic devices "smart". For example fridges, geysers, alarms, TV's. All these household goods getting smarter in order to save energy costs and in general make our lives easier. The business also has incredible margins. Gross margin of 63.3% beat expectations for the quarter of 61.7%. Operating margins were above 29%.

In my humble opinion I do not believe the net neutrality issue will be significant because I do not think it will ever be implemented. The US is too competitive by nature and with a stronger Republican influence I doubt we will see any legislation arise. From the readings I have done on Vodafone, a company who is investing heavily on supplying true 4G connections around Europe I am certainly encouraged. Apparently 4G doubles the demand for data compared to 3G so you can see the attraction for the networks. As smartphones get better and people demand more content (and more data intensive content like HD movies) we should see demand for faster internet.

The short term story is under pressure for Cisco and we also feel the Executive Chair John Chambers has overstayed his welcome. New management could be a breath of fresh air for Cisco. Weighing up the pros and cons mentioned above, I recommend a hold on this stock. Net neutral (excuse the pun).

Things that we are reading, that we think you should be too

The Business Insider wrote a piece on why Apple should buy Tesla, this is a counter argument from the Transport editor of Business Insider - No, Apple Should Not Buy Tesla. Apple and Tesla will probably never end up together but it was still interesting to read the characteristics of each company.

Josh Brown is having a look at how Buffett is a mythical creature - That time Buffett smashed the Efficient Market Hypothesis. For something as complex as the economy to make sense we have to make some big assumptions and one of those assumptions is that the market is efficient.

Statistics, if tortured enough, will tell you whatever you want them to tell you - How to lie with indices.

Home again, home again, jiggety-jog. Gold and platinum single stocks are up smartly again, the rest of the market is down, and as such we are lower today. Construction stocks as a collective are down around 20 percent year to date, it is tough out there!

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

011 022 5440

No comments:

Post a Comment