"Last thing on Apple, also to do with the ecosystem, the services business recorded annual sales of 18.06 billion Dollars, 10 percent of total sales, an increase of 13 percent versus the prior year. A massive business in itself growing quickly, ahead of most of the market. The more iOS devices out there, the more people likely to spend, this amazing headline and associated graph tells you almost everything that you should know about the ecosystem: Apple Has Nearly A Billion Payment Cards On File."

To market, to market to buy a fat pig. Ahead of one of the most celebrated US holidays, the US markets slipped a touch, we had seen another negative day, courtesy of the commodity companies again sadly, as a collective they were down 1.8 percent. That hurrah was short lived. During the course of the session Apple topped 700 billion by market capitalisation, slipping back from the positive start. Does that make it the most valuable company of all time and the first to reach that level? Yes. 700 billion is huge. Yet strangely, Apple trades at a discount to the NASDAQ and a marginal premium to the S&P 500. With revenue expectations for the current quarter of over 60 billion Dollars worth of sales, the blockbuster iPhone 6 is selling like hotcakes.

Unbelievably the sales expectations for the current quarter are 71.5 million, which represents a 40 percent increase on the same quarter last year. That boggles the mind. Sales in the second quarter are expected to be nearly 50 million units, meaning that more than 120 million iPhones would have been sold inside of 6 months. Poor Byron cannot source one for love or money through MTN. He wants one, I guess I am in a different position, I will have to wait for my contract to renew before I can get the newer one. The Business Insider did a short survey, of course this is in the US, it seems however than many people want an iPhone: CHART OF THE DAY: Consumers Ready To Upgrade Want An Apple iPhone. Forget that. As I was saying to a couple of clients yesterday, it is being in the Apple ecosystem that is important, nobody owns as cool hardware and software together.

Last thing on Apple, also to do with the ecosystem, the services business recorded annual sales of 18.06 billion Dollars, 10 percent of total sales, an increase of 13 percent versus the prior year. A massive business in itself growing quickly, ahead of most of the market. The more iOS devices out there, the more people likely to spend, this amazing headline and associated graph tells you almost everything that you should know about the ecosystem: Apple Has Nearly A Billion Payment Cards On File. Nearly four times that of Amazon.com meaning that the Apple Pay service is actually more likely to work quicker than you think. Apple is not necessarily an inventor of the certain product or service, they certainly know how to make the most beautiful one.

Did you get a chance to see the local growth numbers here yesterday? Released at the same time as the Eskom numbers, more or less, I was not too sure which one was worse. Check out the GDP release from the StatsSa website: Gross domestic product -> "Real gross domestic product at market prices increased by 1,4 per cent quarter-on-quarter" That sounds really poor. By province, you folks down in the Eastern Cape really need to pull up your socks, if it is you that is trying hard, it is time to get the folks around you to try even harder. Gauteng Province, the place that the people in this office call home is the fastest growing according to the release. Nice, keep up the good work guys! The rest of the country has some sort of problem paying for the roads here, seemingly happy to get the tax receipts generated from here.

And then there was the biggest economy on the planet, the USA, which managed to grow at an annual rate of 3.9 percent, comfortably ahead of the markets expectations. This is a second look, there is of course a third and final look for the third quarter, which is released two days before Christmas. For the full release and just to get a chance to see the monster size of that economy, follow the link: Gross Domestic Product: Third Quarter 2014 (Second Estimate). $17,555.2 billion or 17.555 trillion Dollars is your number that you are looking for.

That number is simply mind blowing, nearly the entire size of the European Union economy, which is a touch bigger. Those 28 states are collective GDP estimated at 18.399 billion for the current year. As a collective the Europeans are in danger of being overtaken by the Americans. Ironically, if Goldman Sachs are right on their currency projection for next year, the Euro could settle around 4 percent lower than current levels, which would also see to it that the gap is closed. If the US economy grows by around 2.3 percent next year, and the Euro area is flat, we are looking at a tight race when the official data would be released early 2016. Something to look forward to, no doubt!

Company corner snippets

We saw this announcement, we had not had a chance to write on it until now. The news that Richemont were considering spinning off Net-a-porter during the course of 2015. Richemont owns two thirds of the business, Natalie Massenet is the founder of the business. The Bloomberg story: Net-a-Porter's Owner Said to Mull 2015 IPO of Retailer, perhaps someone is just kite flying a little here. I guess all we need to do is to wait and see if there is any official announcement from the business. As an aside, you can buy their expensive items on their website, delivered here to South Africa, it costs a fortune to get it here 22.5 Pound Sterling and then of course the courier would call you to let you know of the import duty.

I did a quick sort to see how expensive you can get with regards to a shoe, the Versace Embellished suede over-the-knee boots, which retails at 6008 pounds is currently sold out. True story. The most expensive dress is a Marc Jacobs Crystal-embellished sequined wool-crepe dress that retails for 20800 Pounds. That is nothing, a Bottega Veneta Roma medium crocodile tote retails for a mere 37439 Pounds. Wow. Guys, Mrporter.com is limited, yet there is a Loro Piana Montgomery Suede-Trimmed Beaver-Lined Cashmere Jacket for a cool 10485 Pounds, Berluti Venezia Leather Calf Boots for 2112 Pounds and a Santiago Gonzalez Crocodile backpack for 4934 Pounds. Merry Christmas everybody!

Everyone is starting to talk about the Glencore-Rio Tinto merger as something that will happen sooner rather than later. OK, the certainty was from a former JP Morgan dealmaker in the commodities complex, Ian Hannam, suggested this to a small bunch of investors in a restaurant. Yes. Even the restaurant is named in the Bloomberg article: Glencore-Rio Merger Will Happen, Hannam Tells Hedge Funds. 20 odd investors, middle of November, at a place called Corrigan's, where the Loin of Fallow Deer (36 Pounds) and side of Green beans (7 pounds) hardly comes cheap. The wine at around 8-14 Pounds a glass, 8.5 quid cheesecake finishes your meal off. On the other hand, the 70 odd pounds seems like a cheap price to pay for the information, the leakage to the press (person responsible asked not to be identified in this private manner), well, that is another matter for Hannam to deal with.

Byron beats the streets

Yesterday one of our recommend stocks Omnia released 6 month results for the period ending 30 September. These numbers were not well received by the market and the stock fell over 11%. Lets look at the structure of this chemicals business then delve into the numbers.

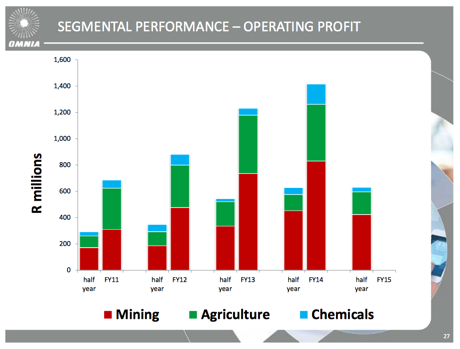

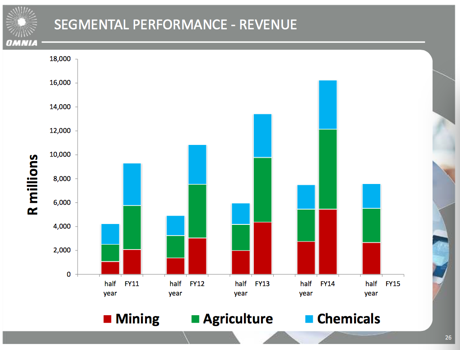

Ultimately it is three divisions; Mining explosives, fertilisers and chemicals. Here are 2 tables hacked from the presentation which shows you the contribution from each division.

As you can see Mining is the biggest profit contributor, with agriculture not far off. Chemicals is a big revenue contributor but adds very little to profits. We can also see here that the second half of the year is much bigger than the first, especially for fertilisers which is of course seasonal.

Revenues increased by 1.1% to R7.6bn, profits for the period decreased 4.7% to R404 million, operating margins remained the same at 8.8% and the dividend increased 2.7% to 190c. After all was said and done basic earnings per share were down 4.9% to 606c. The share currently trades at R194.80 but its hard to annualise this number because as mentioned above the second half is much bigger. Lets assume the company makes R14 a share for the full year, (down 6.5% from last year) the stock trades on 13.9 times earnings. Sounds fair for a business of this nature. Lets look at the different operations.

Mining. As you can imagine the division had a tough period. Revenue was down 2.7% and profits were down 6.4%. Commodity prices have slumped which means your smaller producers get pushed out the market completely and stop mining. The strikes on the platinum belt also did not help. It's not all doom and gloom. Omnia have a massive presence throughout Africa, especially in West Africa where mining spend is booming compared to SA. They are also more exposed to opencast mining which is less reliant on labour.

Agriculture. Africa has 60% of the worlds uncultivated arable land. Many farms are extremely inefficient. The room to grow here is huge. However certain macro factors have gone against Omnia. Ammonia is an input and due to a lack of global supply the price for the product has increased. This compared to the final demand for fertiliser which has remained stable means that Omnia have to absorb this price increase. We have also seen a decrease in maize and wheat prices which of course means less planting. The rains have come late this year so Omnia expect a much better second half. Revenues increased 5.2% and profits increased 40% (they had once off production costs last year).

Chemicals. This division is geared towards the South African manufacturing sector which is facing many challenges as we all know. Revenues increased 1% and profits were down 34%. Strikes and Eskom related issues have put pressure on the companies who demand Omnia's products. This division contributed 5.5% to overall profits.

Conclusion. It is tough, especially for their biggest profit driver in mining explosives. But this business is well managed, has a great infrastructure set up and should benefit from many fast growing sub-Saharan countries where they operate. Operations in China, Australia and Brazil give them some diversity. I continue to like this business but it is going to be a choppy ride.

Things that we are reading, that we think you should be too

For me this is probably the most thought provoking article I have read this week - Are Low Interest Rates Responsible For High Stock Valuations?. My conclusion from reading the piece and doing some thinking is that the research makes sense. Stock prices are leading indicators and interest rates are lagging indicators, so why should there be a significant link between the two? "That also means that, if rates were to begin to rise, valuations do not need to fall as the Fed Model suggests."

The positive impact of having a profitable company as your investment - The case for the profitability factor in your portfolio. It may seem obvious but very profitable companies are normally "expensive" to buy. The way I see it, a very profitable company can withstand headwinds better and they then have the cash flow to take advantage of opportunities, these traits I would say lead to companies beating expectations.

Fostering partnerships and trying to standardise charging will go a long way to an explosion in the number of electric cars bought each year - Tesla says in talks with BMW over car batteries, parts

Home again, home again, jiggety-jog. Gold up, platinum down, Eskom bleeding and paying their senior exec a whole lot of money, the Rand has weakened a little. It seems like the government may swap the debt at Eskom for more equity (only shareholder), shifting the debt from the parastatal to the government, which is you and I my fiends.

Sasha Naryshkine, Byron Lotter and Michael Treherne

Follow Sasha, Byron and Michael on Twitter

087 985 0939

No comments:

Post a Comment