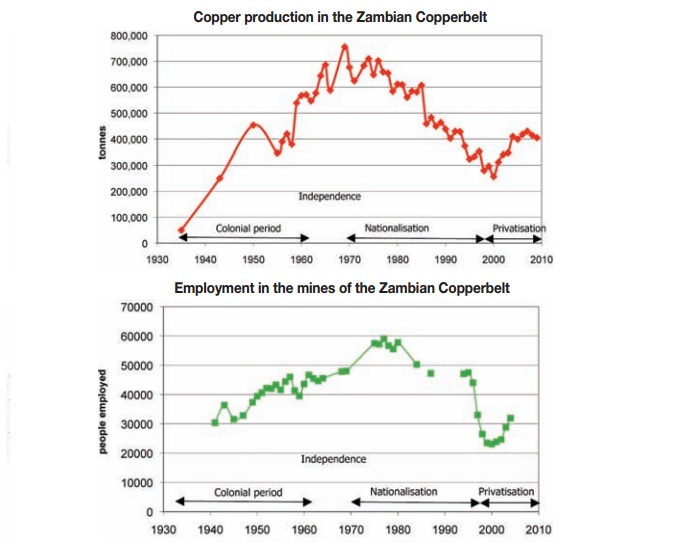

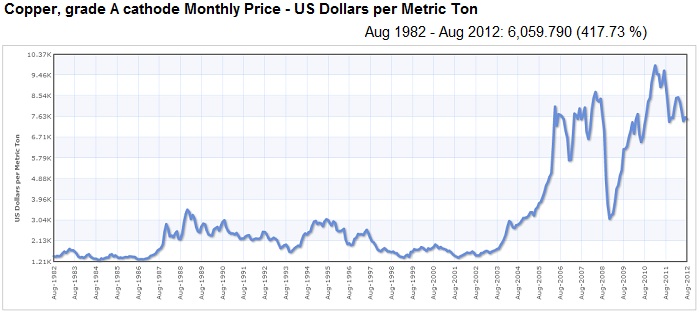

Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. We closed better yesterday, having traded higher through much of the day. The same sector that had been trounced Wednesday, resources, bounced back strongly in Thursday's session. The underlying commodities all helped enormously, I suspect that the anticipation is growing out there that the Chinese authorities are going to "do something" and that might involve the triple R again. As I read it, Beijing HQ are reluctant to do anything aggressive as a result of the property market still being an inflationary concern.

The Shanghai composite on the other hand has possibly been the worst equity markets out of the majors. Year to date, the Shanghai Composite is down nearly 6 percent. The expectations for a Chinese stimulus package has been raised, and just this morning I am reading headlines like: Asian Currencies Gain With Oil on Stimulus Bets; Copper Advances. What did the character, portrayed by Morgan Freeman say about hope being a terrible thing? I for one am optimistic, I suspect that in our industry you have to be.

Session end the Jozi all share index had tacked on 200 points, or 0.57 percent to end at 35616 points, now over 1000 points away from the all time highs. Collectively the resource shares added one and a half percent. Amplats caught a serious bid and traded up three and three quarters of a percent. But the fact remains, around 20 percent of the work force turned up for work yesterday, and now the company will proceed with firing more than 20 thousand workers. Check this MiningMx story out, we will deal with the second part straight after this: Implats chases peace in 4.8% wage hike. See that, Implats are desperate to avoid the same issues that Lonmin had. And if you read the transcript of the Moneyweb interview last evening with Nick Holland, it does not make for good reading. And that leads us to perhaps the biggest issue about our country, the ratings downgrade.

In case you missed it: Moody's downgrades South Africa's government bond rating to Baa1; outlook remains negative. These are the points that matter, that are at the start of the release:

- "The key drivers for the downgrade include:

1. Moody's reassessment of a decline in the government's institutional strength amidst increased socio-economic stresses and the resulting diminished capacity to manage the growth and competitiveness risks.

2. Shrinking headroom for counter-cyclical policy actions, given the deterioration in the government's debt metrics since 2008, the uncertain revenue prospects and the already-low level of interest rates.

3. The challenges posed by a negative investment climate in light of infrastructure shortfalls, relatively high labour costs despite high unemployment, and increased concerns about South Africa's future political stability.

The rating outlook remains negative because of the uncertainty surrounding critical policy decisions that will be made at the upcoming National General Conference of the ruling African National Congress (ANC) party in December. The ANC's National Policy Conference at the end of June left many such discussion topics unresolved. South Africa's medium- to long-term political and economic stability depends crucially upon how well the party is able to coalesce the ongoing policy discussions into concrete and effective decisions by that time."

So what do we think about this? People who buy South African government bonds surely do their homework enough to know the balance between risk and the potential rewards. Our bonds yields compensate the folks chasing yields enough to know that they are assuming risks, the above risks that Moody's have already outlined. But there is absolutely no ways that this is a positive event. Perception is reality, and unless we change our ways. Big government, you know my views on that. Whilst politicians dither around concentrating on issues around who is going to succeed who, our borrowing costs are going to rise. Or so Moody's think. And that figure of 40 percent government debt to GDP excludes of course parastatal debt, which government effectively backstops. I remember seeing a number closer to 80 percent. Possibly the biggest issue is that government is stuck in this mindset that they must be the main job creator. Think about how poorly Telkom have done, Vodacom are announcing just this morning that should be looking forward to 4G speeds at the end of the year. At the same time Telkom are increasing their ADSL speeds prices. Excuse me for being grumpy on this point.

Digest these links.

People on the streets said no. But the government pushed through further austerity measures in Spain. People on the street were visibly upset, venting their anger in running street battles with the police. The only silver lining is that the banks might need less than initially thought to shore up reserves. Check out the WSJ piece: Focus Turns to Spanish Budget Plan. With borrowing costs rising, and one checkbox ticked off, the Spanish budget, all eyes turn to what the conditionality would be for Spain to accept the European funds. I found this via my Atlantic Wire RSS feed, and then suddenly thought, where are all the haters now? Still, Facebook might have overpaid for Instagram now, but this suggests that they are moving in the right direction: Instagram Beats Twitter in Daily Mobile Users for the First Time, Data Says. Makes for interesting reading, maybe the Zuck is not such a schmuck you see. Anyhow, I back them all. I honestly think that Facebook is going to be an integral part of your life in the same way that mobile phones and then smart phones exploded. You want to be able to show people what you are doing, and interact with them. Some people really like that (excuse the pun) and others not so much. Keeping Facebook shareholders awake at night is the monetization of this fantastic resource. The minute I saw this article at the beginning of the week I knew that it had been written by Joe Weisenthal. He gets very excited about speed and news, but this guy is in a league of his own. The story is titled Meet Kevin Reynolds, The Man Behind The Most Mindblowing News Service In The World. He does look like a gold bull. In this office when someone comes on the screen with long hair, an earring and normally very animated, or just plain weird looking, we normally identify that fellow as a gold bug. Reynolds looks like a gold bug. But for all the traders out there who rely on the speed, he might well just be the most important guy at Bloomberg, for them. Other than Michael Bloomberg himself of course. Also via the Atlantic Wire, the story of the Renoir found at W.Va. flea market (that is) likely to fetch $100,000 at auction. The woman stuck the painting in a shed after having bought it for 7 bucks, thinking that it is a fake. But that is the point, right. The fake was sold for 7 bucks, the real deal might fetch 100,000 Dollars. All because it is supposedly the real deal. Not the quality of the painting, but rather the authenticity increased the value. Imagine if the same held true for the house that you lived in? Imagine finding out that Herbert Baker had drawn up the plans of your house, I suspect that this is the same thing more or less.

- Byron's beats

After the market closed in the US last night Nike, one of our favourite aspirational consumer stocks reported first quarter earnings which again disappointed the market. Revenues were up 10% to $6.7bn while earnings per share were down 10% to $1.23 beating estimates of $1.13. Earnings decreased from last year because of a decrease in margins, higher selling costs and an increase in the tax rate. Future orders were up 6% which was less than expected, this is why the stock is down premarket. Inventories increased 10%.

Analysts reckon earnings will be around $5.26 for the full year so trading at $96 the stock is priced for some strong growth. Let's look at the concerns from this announcement and then discuss the positives.

The fact that margins are decreasing is an issue but not unexpected. Materials are getting more expensive while labour in China is not as cheap as it used to be. Ironically increasing wages in China will benefit Nike from a sales point of view. Although this is declining, the margins at 43.5% are still fantastic and as the brand continues to grow their pricing power should strengthen.

Inventories have also been an issue. The company has experienced less demand, especially from China, than expected which means they are sitting on too much stock. This is something which will take time to offload and why the Nike share price has underperformed of late.

So what of this lack of demand from China? To put things into perspective China is responsible for 17.5% of their earnings mix and much of their growth over the last few years. We all know that China have hit a bit of a speed bump but I really don't think Nike should be too worried. The Chinese consumer is going to be the countries next growth spurt.

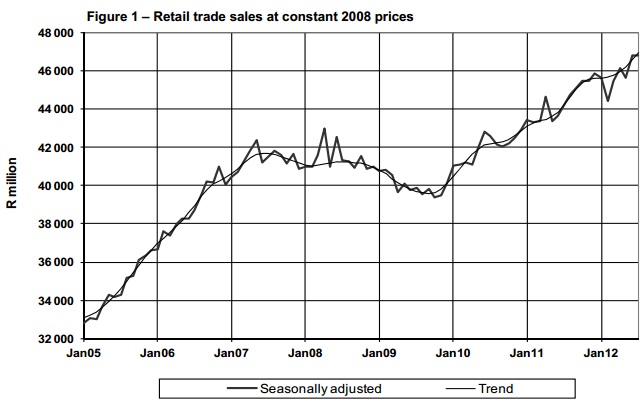

On the positive side North America who are responsible for a whopping 67% of profits grew earnings by 17%. Remember my article yesterday which spoke about the US consumer who was showing good signs of growth? Nike, with such big exposure to the area will certainly benefit. In the other regions Europe and Japan saw some hefty declines while emerging markets grew 17%.

When you look at these valuations you also need to note cycles amongst big sporting events and spend on R&D. Nike have been at the forefront of innovation in the industry when it comes to products, advertising and sponsorships. This company sits at the forefront of aspirational consumption whether it is their fantastic brands or peoples drive to get more active and healthy. The share price has pulled back and we will use this opportunity to add.

I'll leave you with a statement from CEO Mark Parker concerning Nike's strategy going forward.

- "We had a strong first quarter and a great start to the fiscal year. NIKE, Inc. delivered an amazing array of innovation across some of the biggest moments in sport. Innovation is how great companies sustain growth and build competitive separation. We'll continue to make strategic investments across our portfolio of businesses to capture our full potential over the long term and drive shareholder value."

Currencies and commodities corner. Dr. Copper is higher at 375 US cents per pound, the gold price is higher at 1777 Dollars per fine ounce. The platinum price is also higher at 1665 Dollars per fine ounce. The oil price is marginally better after a strong run last evening, 91.98 Dollars per barrel is where the price was last quoted. The Rand is slightly weaker. Perhaps the ratings downgrade is starting to have some impact. Time will tell. The weighing machines never lies, even when you stare at the scale hoping you will weigh less. The only positive struggle in life that goes in the wrong direction is your weight. The market, well, that almost never lies. The balance of the market might get (very) hot headed, but it never lies. Have a good weekend.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440