Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. We lost more ground yesterday, perhaps a patchy ISM reading out of the US late in our session was to blame, perhaps the very tepid recovery is starting to weigh heavy on the recent rally. We sank all through the day, down nearly a percent by the end. Most of the selling came in the resources sector, obviously the Chinese PMI number was weighing on the commodities complex. The platinum stocks continue to get beaten, the sector as a whole is down 25 percent for the year now. And that follows last year where the stocks were down 28 percent last year. In fact, since the May 2008 highs, the platinum index as a collective are down 68 percent. This (May 2008) was when we had abnormal highs as a result of a surging platinum price as the lights literally went out with energy producer Eskom unable to supply the country properly.

That was a low time in our country, ironically whatever was produced back then was sold at much higher prices, so it more than offset the lower production. Since that point the miners have been sucking wind principally as a result of the demand outlook not looking as strong as they would have liked. Aquarius Platinum have arguably been the only company to react strongly, remember our piece from early July this year titled Aquarius Platinum suggest others are in denial. I am left with the same conclusion every time I look at the group of platinum producers as a whole. As an investment perhaps they do not make the grade. But the metal that they all produce has legs, the price at least. Emissions controls will continue to remain tough, and if anything get tougher. The outlook for the metal remains good, but I suspect the companies might not be the great investments of yesteryear. I hope that I am very wrong.

Richemont released a five month sales update this morning and it looks decent enough. The sales per region are always an indicator of who is doing well. However, the sales in Europe have not mirrored the real economies, and this is often attributable to the tourist buying. You see, in places like China, where luxury goods are taxed at a higher rate than in Europe, tourists from the East often pick up cheaper products whilst travelling. And of course on the high streets of Europe consumers can be sure that they are getting the finished product. A discerning customer can always spot the genuine product, that goes without saying, not so? This is what the release says: "Europe was strong, particularly in the retail channel in major tourist destinations."

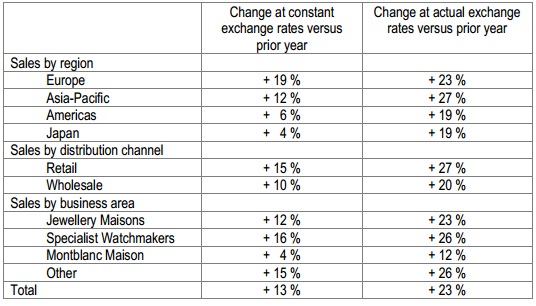

Let us drill into these numbers, there is again a wide variance in the actual exchange rate sales and constant exchange rate sales. Let me hack the sales table from the release, which you can download Richemont announces that its sales for the five months ended 31 August 2012.

Lots of numbers in there, the important part is to know that in constant currencies (Euros in Europe, Dollars in America and Yen in Japan), sales increased by 13 percent. In Euro terms, actual exchange rates, sales grew by 23 percent. Thanks in this case to a much weaker Euro. Over the last five months, since the end of March, the Euro is five and a half percent weaker to the USD. The Euro is ten percent weaker to the Yen. Five percent weaker to the Pound Sterling. So this is a company listed in Zurich, where they use Swiss Francs (pegged at the Euro at the 1.20 level) and possibly most of their products are priced globally in Dollars. You can see where the variance comes in terms of constant currencies and then at the actual exchange rates. In the release, the biggest impact is noted: "The weakening of the euro against the dollar, in particular, had a positive impact on the Group's reported sales."

And then there is of course the associated commentary with the sales tables. Where the company reaffirms their guidance is important, I guess the last four weeks have been no weaker I guess: "We can confirm that operating profit for the six months should be some 20 to 40 % higher than last year, as was anticipated in the announcement made on 6 August." We continue to add to Richemont, we think that the stock is cheap. The company is well run. The two risks that I can identify is that ironically if the European situation improves, the currency headwinds would go against them. And the other is one of the reasons that investors follow the company closely. Johann Rupert might be a South African business legend, but also his family interests have the voting rights ultimately. And I don't know about you, but whenever I watch the earnings releases his fellow directors look more like troopers next to the General. I am sure that all the execs are brilliant, do not get me wrong, but Rupert seems to wield slightly too much power for my liking. This is both positive, as well as a risk for investors. Buy.

Bart's shorts. I remember this segment from a while back, and it never turned out how I wanted it to. Perhaps because I was reluctant to enter into the linkfest that so many blogs have. Bart Simpson of course used to tell everyone to eat his shorts. I tried to find out what "eat my shorts" actually means, but not even this entry page can tell me: Eat My Shorts! My shorts however will be a linkfest, stuff I read during the day that I think you should too, if you get the time.

First, BHP Billiton released a presentation, J. Michael Yeager, the Chief Executive of the Petroleum division presented an overview and update. Follow the link of the Energy & Power Conference. The map part on slide 4 is the validation again of the geographical diversity of the company. The petroleum division has been one of the great parts of owning this company. But the recent shale acquisitions are a place where a lot of the growth is going to come from. For the time being however, no matter which way you look at it, the price paid by BHP Billiton was too much. Flip through the slide show, let me know whether or not you feel better about their business.

I quite liked this, via an optimist that I follow, U.S. auto sales increase 20% in August to a 4.5-year high. Although if you look at the graph, you can see that we are still a long way away from the all time highs. But, nice to see.

There was loads of reaction to the two key speeches last evening at the Democratic National Convention, the one from Julian Castro, which you can watch via one of the folks I follow on Tumblr, shortformblog - Julian Castro. Inspirational guy and great story about three generations. The other one was the president's wife, Michelle, awesome speech too, watch in from the same source, which suggests she wrote the whole thing herself: shortformblog - Michelle Obama. Sounds more like real people.

You might love the Democrats but not exactly agree with their economic policies, James Pethokoukis has a stinging piece titled Forget Greece, the U.S. is now France. France seems fine to me? Left and right of centre in America is a few degrees, I wish we could say the same here.

And with that, we end this segment, meant to be fun, and to show you something different.

- Byron's beats

Yesterday we got those full year results from Steinhoff which gives us some clarity on the business. Remember we covered the trading update Steinhoff trading update sizzles last week which indicated a 30%-35% increase in EPS and HEPS. The update also explained the makeup of the business with all it's moving parts so if you need a refresher check out the link.

Highlights of the numbers include a 48% increase in operating profits to R8bn, headline earnings per share growth of 32% to 317c and a 23% increase in dividends to 80c. In the financial commentary they state that this headline number was achieved notwithstanding a 17% increase in the weighted average number of shares from the issuances relating to the Conforama acquisition and the groups share swap for its investment in PSG. With that said the stock looks very cheap trading at 2605c. This gives it a historic PE of 8.2 and a dividend yield of 3%.

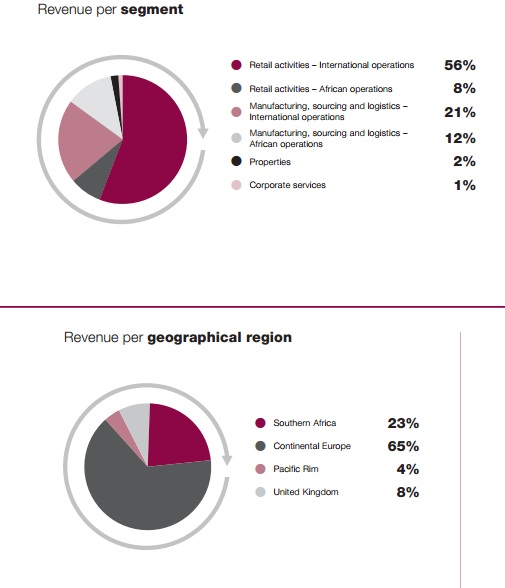

To understand where the sales come from for this company these pie charts say a thousand words.

Here you can see that that its international retail business is the biggest revenue driver. Retail in Africa is small. You can also see that revenue is dominated by continental Europe throughout all its businesses. Southern Africa is only 23% showing us that this is far from a South African company anymore.

Like I said we like the stock on a contrarian basis geared towards less than expected declines in Europe. That Conforama business has in fact showed good growth in this region. "Despite the challenging consumer environment in France and southern Europe, particularly in the electronic product division, Conforama delivered a very solid sales performance driven by the furniture and home decoration product segment. Switzerland and Iberica experienced very strong growth while encouragingly, France gained market share in the important furniture product category. In line with expectations, Italy and Croatia reported a decline in sales. Italy performed in line with market trends while Croatia outperformed the market in furniture and electronic products."

We also believe that most of the negativity is already factored into the share price. Yes we will probably see a decline in sales next year because of the markets they operate in but any unexpected upside will be handsomely rewarded. In fact because they operate at the lower end of the furniture market maybe they'll prove to be quite defensive. We continue to add but not for the faint heated investor. I'll leave you with management's outlook which is positive and informative.

"The global markets and future consumer spending trends remain uncertain. However, the group is confident that the diversity inherent in its earnings will continue to protect the group against any prolonged downturn in any one market where we operate. The fragmented European household goods market and our positioning in the discount sector of the market, provides comfort of the group's ability to compete and grow in the future. The group's strategy remains to invest in strategic brands and real estate assets to expand its retail footprint and securing appropriate sites currently available on attractive terms.

The favourable interest rate environment in Europe is also conducive to property investment opportunities. These investments should secure the longevity of the retail operation concerned, without volatility in profitability that may arise as a result of rental escalations. In addition, the African investment transactions completed during this year will further strengthen and diversify the group. These investments have been consolidated for only three months and will further strengthen the geographical diversity of the group once these businesses have been consolidated for a full year."

New York, New York. 40o 43' 0" N, 74o 0' 0" W. FedEx corporation, nothing to do with the once beau of Britney Spears, but rather the company that delivers packages. So you would think that FedEx have their finger on the pulse of the economy. They can see how many packages they are delivering across the globe, across the US. FedEx, in their very short release say the following: "Earnings during the quarter were lower than originally forecast, as weakness in the global economy constrained revenue growth at FedEx Express more than expected in the earlier guidance." As per their website, FedEx express handles 3.6 million shipments a day.

Wow, FedEx express is huge. FedEx operates 45 thousand (the overall company is double that) motorized vehicles (I guess that means bikes, trucks and panel vans) and 660 aircraft, including 241 Cessna 208B's. Which is bizarre, because this is what the single turboprop engine looks like. They are little dinky planes to ones that you are used to. Your package can wait a day or two I say! All those planes and 146 thousand employees service nearly 50 thousand drop off locations. Whoa! One up, the entire group employs 300 thousand people. Sounds very complicated. The stock sank nearly three percent in after hours trade on the news. I am still in shock and awe at how awesome the operation is that humans built. And to think they did it without using gold, what a feat!

Currencies and commodities corner. Dr. Copper is last at 344 US cents per pound, the gold price is lower at 1690 Dollars per barrel. The platinum price is much lower at 1547 Dollars per fine ounce. The oil price is lower at 94.98 Dollars per fine ounce. The Rand is weaker, the markets are marginally weaker, the ADP report is actually tomorrow and not today. So we have to wait until then.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment