Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. Hmmm.... stocks rocked across the board. There is no doubt that there was a huge sigh of relief as the German constitutional court gave the ESM the go ahead, but they did attach conditions, which no doubt need to be looked at. It was pretty much a broad based rally, industrials and resources contributing to a 0.82 percent uptick in the all share index, but banks sank half a percent. Platinum miners took another punch in the guts with the news coming through that Amplats had basically shut nearly one quarter of their production, to not compromise the safety of their labourers. Who Amplats are adamant want to work, but are being intimidated by outside parties with vested interests elsewhere, how bizarre is that suggestion? So if the employees want to work, but are being intimidated by outside forces, who are those people and what is their agenda? Amplats fell over four percent, the platinum price rose to multi month highs. We will have a detailed piece on the platinum stocks later.

Aspen Pharma released their full year numbers yesterday, not in time for us to catch them and put them in the message. We first added this to the recommended list as a core part of our clients portfolios, back in 2005 Adding Aspen Pharmacare to the A-list. I laughed when I saw that last line from Paul, who writes much better than us, but does so not as often: "Perhaps more importantly, we believe that Aspen is a company which could double its earnings repeatedly in the years ahead, producing outstanding returns for its shareholders." Well, I would guess that has been about right. Over the last five years, compounded annual revenue growth of 36.5 percent, whilst profits on the same basis have increased 36.6 percent. The market actually has afforded the company a higher valuation, as the size and scale has increased, in part due to their geographic diversity and in part due to their Glaxo tie up.

Aspen are a far more global business than when we first recommended the stock, and they supply medicines to more than 150 countries, as per the Aspen Pharmacare 2012 year end results presentation. Group revenue clocked in at 15.3 billion Rands, normalised headline earnings (from continuing operations) increased 22 percent to 2.9 billion Rands. Normalised diluted headline earnings per share clocked 636 cents per share with the capital distribution to shareholders up 50 percent to 157 cents. At 142 Rands a share that means the stock trades at a very demanding 22.3 times earnings and a pretty poor yield of just over a percent. More on the valuations a little later.

This is no longer a South African business. South African revenues only represent 38 percent of group sales, lower than the 40 percent last year. Asia Pacific is breathing down their neck, with 37 percent of group sales. Sub-Saharan Africa sales (we somehow always exclude ourselves from the region) represent 10 percent of total sales. South Africa is however the most profitable region, accounting for 40 percent of EBITA. Group margins are steady at 27 percent, the same rate that they have been for the last five reporting periods.

But this is all going to change, the group suggests that there is going to be a ramp up in their Asia Pacific business, which will become the biggest revenue contributors. Aspen in the Philippines has commenced trading. There are obviously (because of population sizes and economic growth rates) many opportunities in the region with their South East Asia expansion. Think Vietnam and Indonesia, Malaysia and Thailand. Nice beaches, healthy looking people, generally speaking. I saw someone in the region on my twitter stream suggest that he hadn't seen a single overweight person. Hah-hah! And you thought that the Latin America businesses were exciting, this is better. Much better.

The group continues to invest heavily in capex, and boasts that they have spent 3 billion Rands in capex over the last 6 years. Whilst net debt has risen to just above 7 billion Rands (debt taken on to finance key deals), operating cash flows have quadrupled over the last six years. Two deals done recently are both deals done with GSK. The OTC and Classic brands (two separate deals) amounted to 4.3 billion Rands, both deals are set to close soon from a regulatory point of view. There was also a smaller deal with Novartis with two key products worth 442 million Rands concluded on the first of August. Bloomberg projects revenue growth for the current financial year to be comfortably ahead of their peer group. This should translate into the highest profits amongst their peer group, which includes Sun Pharma, Dr. Reddy's and Ranbaxy. Those are all Indian generic giants.

Never sitting still are the management team, who we regard as amongst the best in the country. Which, dare I say it might well mean that they are amongst the finest on this continent of ours. Based on the slides from the presentation, Aspen has collected data from Bloomberg via JP Morgan to illustrate that they are in fact still a compelling investment. Based on 2013 earnings numbers, at current valuations Aspen trades 15 times forward. We continue to acquire the stock. It is still a very important part of our portfolios in one of our key themes that we invest in, healthcare.

Platinum miners woes I think the stirring of the pot needs to be understood at all levels, I think that the ex president of the youth league (Berets. You wear it like this guy -> President Chavez) has political agendas here. But I also think that the miners concerns are valid. But economically speaking, the mines cannot afford it. The most difficult and bitter pill in all of this to swallow is actually that there is not a shortage of labour, there are many in the labour force who would work for that amount of money in a flash. There are brutal economic realities. Every business and indeed the country itself has limitations. I worked out that over the last four financial years that the big three platinum producers (Amplats, Implats and Lonmin) paid around 21 billion Rands worth of taxes. Lonmin actually contributed only half a billion Rands to the national fiscus. Capex spend by these three, that was trickier, but I found it.

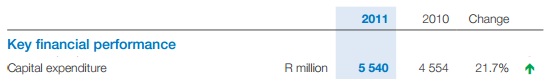

In 2010 and 2011, Impala Platinum, the company, ratified by the board and shareholders shelled out over ten billion Rands in capital expenditure. Check it out, here in their annual report, I have hacked a table too for a visual.

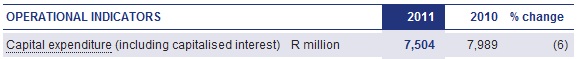

And then Amplats, via their Online annual report, key indicators, the company in those two years invested nearly 15.5 billion Rands in the South African economy by way of Capex. Check it out, hacked from the online report:

And then Lonmin, the sister that doesn't get the dates (sorry), invested 410 million Dollars in 2011 and 268 million Dollars in 2010 in their business. Again, I stress this, the board and the shareholders authorised this capital expenditure that no doubt would have created many jobs. Be they contract jobs, I am not even going to go there, that is a separate argument altogether. That Capex amounts to roughly 5.6 billion Rands when I use the ruling exchange rate. So, the point that I am trying to make is that these three companies invested over thirty billion Rands in their respective 2010 and 2011 financial years.

My point is not so much that the companies have invested vast sums of money in South Africa and that they have paid vast sums of taxes to the government (who arguably have not spent it as well as we would want), but rather that boards made these decisions based on the agreement of shareholders. Money is fickle. Money has choices. And the shareholders are sometimes fund managers making decisions on behalf of their retirees, and pensioners, who are looking for reliable and steady returns. After all, they saved the money and bestowed the responsibility to someone else to give them an acceptable return in their golden years.

That is how it works. If the fund managers decide that they no longer want to be shareholders, they sell. And then the buyer (there is obviously always one for each seller) is making their capital available to fund the business for their growth, you are expecting dividends, and you are expecting the market price to rise to compensate you for the risk taken. No risk willing to be taken, no allocation of new capital. No capital expenditure. No new jobs created. Fewer ounces produced, customers get irritated and look for more ways for substitution. Like this: Honda develops catalyst that reduces use of precious metals by 50%. Like Byron said when I tweeted that link (that was sent to me from our old mate Gareth), this is good for the world, bad for South Africa.

Bart Simpson's shorts, digest this.

Now that the Germans have saved the day, the Dutch electorate seemed have to voted in favour of pro European parties, what is the next thing that is going to get everyones knickers in a knot? Well, Jeff Miller in this blog post kind of told us: THE FISCAL CLIFF: WHAT NOW AND WHAT TO EXPECT. Yay! Time for more dithering politicians. I suspect that after the elections, the US ones, hopefully they will get it done soon!

Oh? Remember the end of the European Union? Well, not so fast. I think that we should compile a list of all the Euro sceptics. Look, it could have been terrible. It could have been worse. But we always thought that "they would get the job done". A Setback for Germany's Euroskeptics. As Paul said in his mad markets piece on 702 with Bruce Whitfield on Friday evening, all those people that he has 100 ZAR bets with around town about the Greek exit by year end, you might as well pay now!

Whilst everyone else is gearing themselves up for the FOMC announcement today, and the potential for more monetary stimulus from the Fed, I thought that this was at the core of what I had been talking about for a long time. Chart of the Day: We're missing out on low rates Agreed, they should borrow more. But then there is the whole issue of the fiscal cliff and borrowing too much. Lucky it is not me who has to deal with these issues. What to expect today from the FOMC? The WSJ has a great piece: Four Things to Watch at Fed Meeting.

Staying with low rates, the Fed and debt, we have seen several sides talking about how housing is improving. That Ritzholtz piece from a message or two ago was suggesting not so fast. But you cannot ignore it, via one of my favourite bloggers, which is strange for me, he is an academic comes the news: 2012: The year of the housing recovery. Who cares how it happens, for what reasons, as long as the resulting impact is that people feel better. More confident.

- Byron's beats covers the Cashbuild trading update from yesterday.

The last update we got from Cashbuild was a sales update for the 53 week period which suggested revenues will grow 11% on the back of some margin growth. We used the figure of 24% to estimate growth in headline earnings. This was based on the figures we saw in the first half of the year, giving us an estimate of 1313c headline earnings for the year.

It turns out we were fairly accurate because yesterday Cashbuild gave us an earnings update which suggests "that when comparing the June 2012 results adjusted for 52 weeks trading, to the comparative figures for the June 2011 year that exclude the effects of the BEE repurchase of shares and subsequent distribution to Trust beneficiaries, the adjusted headline earnings per share and adjusted earnings per share for the year ended 30 June 2012 are expected to be 20% to 30% higher than the prior financial year's adjusted figures."

This means we should be expecting around 1300c for the full year. The share price has pulled back in the last 2 weeks from R168 to R158 today. The company is also a good dividend payer so expect a fat increase from last year where a big BEE deal was done. In fact, in the interim report they mentioned an improvement from their usual 3 times cover to 2 times. That means more or less 650c should be distributed. At current prices this affords us a historic multiple of 12.15 and a dividend yield of 4.1%. For a retailer which is showing strong signs of growth this looks very compelling. We continue to add at these levels and take advantage of the recent pull back. We will cover the full year numbers in the next few weeks which will give us the operational details and some forward looking guidance.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Stocks ended the day flat. It was not great. The most amazing thing, before the FOMC meeting of course was the big release! Is the new iPhone 5 all wow and worth the excitement that some associate with the product? I "watched" the release of the phone by drifting through my Twitter stream and by following live blogging from cnet, this link is what you need to follow to compare the specs of the last version, and the new one: So, what's new? Comparing the iPhone 4S and iPhone 5. You can also check out the Apple iPhone 5 on the producers website.

The phone is bigger in size, but still thinner and lighter than previous models. It has a speedier processor, better camera, new connector integrated with old ones, faster connectivity, the phone certainly seems better at face value. But there is not too much different that we have associated with the new model launches. Or so it seems at face value. Someone actually said, this almost seems like the iPad presentation, everyone not completely wowed. With regards to sales, well, this is the very quickest roll out.

The features that stood out for me were the speed, the new maps (which Google must be miffed with), the panoramic photos were quite cool (you need the landscape to match) and the facetime application that will be possible through the faster networks. The screen and definition is going to probably also blow users away. Siri is a whole lot more useful, integrating better with the applications. Facebook is built in, don't take that part too lightly. I can assure you that not everyone is as excited as some of the blogs that I read. Some folks still love keyboards. So are saying, nothing different, innovation is going to be slower, the other phone releases are comparable in features. Competition. Maybe Apple are not as far ahead of the pack as before, but let multiple users, well, use it!

So when is it coming? Very, very soon. If you are in one of nine lucky territories, then you can pre-order that phone tomorrow. The phone will ship a week later, next Thursday. Yes. And then it will probably be available in late October or early November here. Wow. That is cool. Those who follow these things very closely are expecting around 50 million phones to be shipped in the coming two quarters, anything less than that would apparently be a disappointment. The margins on the iPhones are key for the Apple business, as long as people are still willing to pay what look like outlandish prices for a handset that is in many ways part of your life, then Apple will continue to be more and more profitable. As the phone was released and my Bloomberg app told me, it is happening, I told my eldest daughter, Apple has a new iPhone. She immediately piped up, very excited, I want one! And I can tell you, this is a little person who has just used the products before and thinks that they are awesome. As long as the user experience remains, the customers will be there. Communication is hard coded.

Currencies and commodities corner. Dr. Copper is last at 366 US cent per pound, the platinum price is higher at 1650 Dollars per fine ounce. The gold price is slightly higher at 1731 Dollars per fine ounce. The oil price is last at 97.14 Dollars per barrel. The Rand is weaker, banks in particular are getting trounced. The market is marginally higher, but not really going anywhere. FOMC, that is what it is all about.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment