Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. We finished marginally higher on the day, we initially traded lower after the most anticipated number of the month from market nerds and junkies alike failed to impress. More on that a lot later. The Jozi all share closed off trade at 35744, up nearly one fifth of a percent. Banks sank 0.85 percent, I did see a sell recommendation on some of the majors in a general note about South African banks. Resource stocks absolutely rocked, the general retailers sank 2.36 percent. I am starting to wonder if the folks that priced in another rate cut here locally might have actually been disappointed with the Draghi commitment to "saving the Euro". And as such, a rate cut becomes less likely? I am not too sure, all I know is that the MPC meet later this month. The currency strengthened markedly too, that has a positive impact for the inflationary outlook. It will be what it is.

Sasol have released their full year numbers for their financial year to end June 2012 this morning. At face value they certainly look good. Turnover increased sharply to 169.4 billion Rands, costs rose, but the group seems comfortable with that, they say in-line with inflation, 8.6 percent. Production was much better in the second half, full year production was basically the same as last year. Operating profit increased 23 percent to 36.8 billion Rands, the average crude oil prices received increased 17 percent and the exchange rate weakened by 11 percent inside of the financial year. Headline earnings increased by a little more than that to 42.28 Rands per share, the dividend, and this is a big surprise, increased by 35 percent to 17.5 Rands for the full year. Dividend cover has been lowered (that is good) to 2.3 times. The final dividend has clocked 11.80 ZAR, expect just over 10 ZAR after dividends withholding tax. Listen to this, in direct and indirect taxes, Sasol paid 28.2 billion ZAR to the South African government. Anyone who calls for the nationalisation of the business (in my view for what it is worth) should be gagged immediately.

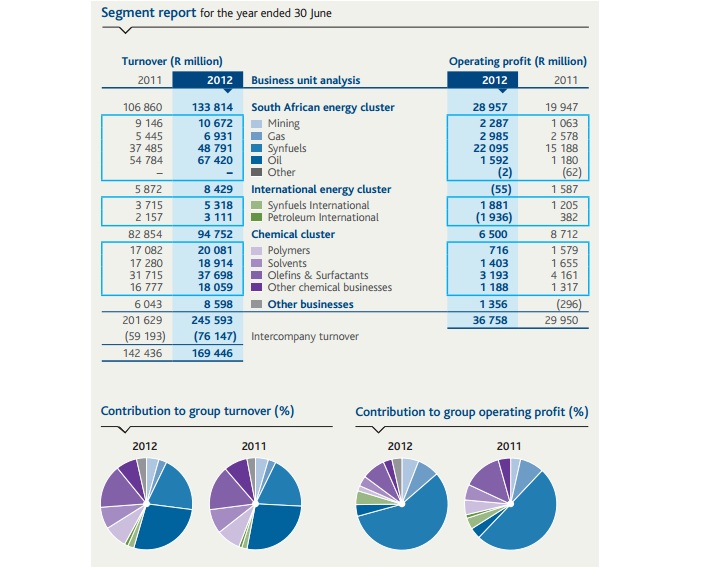

The best performing segment, as per usual is the Synfuels business which is obscenely profitable. On turnover of 48.791 billion ZAR the division manages an operating profit of 22.095 billion ZAR. Astonishing. See what the group operating profit is above (36.8 billion ZAR), and you can quite quickly see that Sasol Synfuels is 60 percent of the overall group profitability. And therefore, by far and away the most important division. To put it into perspective, inside of the chemicals cluster, the Olefins & Surfactants segment is the second most profitable unit for the group, clocking 3.193 billion in operating profits, nearly one billion Rands less than this time last year. Here is a screen grab from their Sasol audited financial results presentation, page 2:

There were some well telegraphed once off charges, which totalled 2.121 billion Rands. The largest of these were the partial impairments of their Canadian shale gas assets, an amount of 964 million Rands. Byron wrote about this when Sasol released a trading update last month, in a piece titled Sasol take a write down on their gas business. Whilst this is disappointing, the timing of these purchases, we certainly think that this is the future of the business. We will deal with this in a tick.

OK, so is the share price expensive? It is clear that we like the company as an investment theme, they are a mix between an energy and chemicals company, as well as being a technology company. Technology in the sense that they are able to posses these extraordinary skills at that sort of scale, which makes the company sort of unique globally. On that basis I often think that one should expect to pay a premium. But this is not the case, the stock trades on less than 10 times historical earnings, but this is not out of line with the broader oil and gas sector globally. The dividend yield (after tax) is around four percent as at the close of business Friday. That sounds appealing to me.

One of the reason why the market is reluctant to afford the broader sector a higher valuation is simple, at least in my mind, the oil price is volatile. From their release: "For forecasting purposes, a US$1/barrel increase in the average annual crude oil price results in an increase of approximately R580 million (US$72 million) in operating profit with a similar negative consequence if the average annual crude oil price decreases by US$1/barrel (This is based on assuming an average rand/US dollar exchange rate of R8,01)." If the average price per barrel remains at these elevated levels and the Rand remains weak, then the expectation would be for the company to be much more profitable than last year. In fact the last two months have already been good for the company.

The outlook column is as you would expect, I think, cautious, you can read it on page 8 of the analyst booklet, Profit Outlook* - strong management focus in challenging environment. There are uncertainties of course, but production at Synfuels should improve. Oryx is going to be just fine, the Canadian shale gas production should grow, after initially disappointing. Their very important and not talked about enough chemicals division should continue to perform steadily.

The company is shifting gears. And whilst they have been criticized for looking a little slow in making decisions, this has not been the case recently. There are three sizeable gas-to-liquids projects and exploration on the go right now, the one with perhaps the quickest conclusion is the Uzbekistan Gas-to-Liquids plant. The government in that region themselves have started developing the surrounding infrastructure where the proposed plant is expected to be built. The two other major gas-to-liquids projects are in Louisiana and Western Canada, but they are further away than the Uzbek one. These plants, should they go ahead, will be the future. The dirty coal to liquids past is being shifted. And therein lies both many risks and rewards. We continue to buy the company, they look cheap at these levels, even though the stock has had a good run recently. Over the last five and a half years, the stock price reached 515 Rands, but then plummeted to 212 Rands, currently at 380 odd ZAR. Buy.

Bart's shorts.

This is the least exciting market rally for much of my industry, I think that a lot has to do with the fact that it was not supposed to happen this way. At least that is what the majority of Wall Street "thinks" and I can hear that view echoed by all the anchors on my favourite business TV stations. Our own view in-house has been to remain long. Many people are miffed at policy response. I am guessing that they worried about the debt ceiling, the Euro crumbling, Grexit, the fiscal cliff, presidential elections in the US and France, and the list goes on. But when I see this, I had to fall on the ground laughing: Sell Side Indicator. More bearish than ever. And notice friends, that just before the Tech bubble exploded, analysts were even more positive than ever before. The reverse is true now. The only next question to ask then, is when will they (the sell side) crack? Or am I living in cloud cuckoo land?

- Byron's beats

On Friday we had an announcement from BHP Billiton which described the completion of the sale of its 37% non-operating interest in Richards Bay minerals to Rio Tinto for $1.9bn. From a South African perspective that is a sizeable deal but for a company of BHP's size it barely reached the headlines.

What I found important to note was this constant trend of the biggest miner in the world divesting from South Africa. I understand that where there is a seller there is a buyer and where BHP want to get out, Rio see an opportunity. But this is not the point. The point is that BHP are only interested in low risk tier one assets and South Africa does not seem to fit this bill as a mining destination.

I don't blame BHP Billiton. Look at what has happened at Lonmin. And it looks like this mindset is spreading which is very dangerous. It is now reported that Implats employees are demanding a further wage increase following an agreement only 4 months ago in April. This is very bad news as NUM loses control of their members at more and more and mines. It also completely undermines the previous conditions set during negotiations in April. What is the point of even discussing a contract if the conditions are so easily broken?

The Marikana incident received so much airtime and flared many polarized emotions already. This mindset could spread like wild fire as workers who are angry and desperate look for any alternative to current conditions. What they don't understand is that the companies in question cannot afford these wages. If Lonmin do not reach an agreement soon and by soon I mean in the next few days, they will have to start shutting down shafts. Then there will be no jobs available and everyone, including all South African citizens will lose out.

Sasha has mentioned this before but I will repeat it for emphasis. The ANC have said that the Marikana incident has not affected foreign direct investment. This BHP Billiton sale is a first class example of a company divesting even though negotiations were probably underway before the incident actually happened. It is the conditions in general which allow for such incidences to occur which will ward off many potential investors. This situation needs to be fixed and fixed fast before it gets out of hand.

Washington. DC. 38o 53' 42.4" N, 77o 02' 12.0" W The jobs release from The Labor Department was a big disappointment for Mr. Market. 96 thousand jobs added for the month of August missed the expectations of somewhere closer to 125 thousand. BUT, the ADP report the day before had teed the market up to expect a whole lot more. I suppose the only (at face value) positive was the unemployment rate falling to 8.1 percent, but when you scratch a little harder, this is not the best news, here is a NYTimes piece: Why Did the Unemployment Rate Drop? My point about these numbers having an overinflated importance must be getting you bored on the subject. But it is an overtrumped number. The miss was 30 thousand jobs. That is all. Out of a workforce of 154 million, what is 30 thousand. That is 0.02 percent.

As Paul asked, how many jobs reports before the elections? The conspiracy theory is that the unemployment rate would fall below 8 percent by the next elections, somehow manipulated. But, Diane Swonk one of the regular guests for the jobs number, she told Jo to get rid of that theory. If you want a blow by blow account, check it out: NFP August CNBC Video. Too much emphasis on one number. Mr. Market is all primed for QE3 now.

Currencies and commodities corner. Dr. Copper is starting to get all hot again, 363 US cents per pound. Remember that Friday the Chinese announced a big 60 project infrastructure plan. The gold price is off the best levels, last at 1733 Dollars per fine ounce. Spot platinum is last at 1595 Dollars per fine ounce. Crude oil is last at 96.40 Dollars per barrel. The Rand is firmer, 8.14 to the US Dollar, 13.07 to the Pound Sterling and 10.45 to the Euro. A very mixed start here today, SA inc. getting thrashed. Sasol is roaring ahead, and the rest of the commodities complex is also catching a bid. But overall, the market is lower.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment