Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. Whilst some fellow who seems to capture all of our imagination was appearing in court up the drag in Polokwane, the markets were taking a serious drubbing here. Again, with all the unrest in the local mining industry, the local miners led the way south again. Gold miners lost over four percent, the platinum stocks collectively got thumped three and two thirds of a percent. I saw another analyst report on one of the majors suggesting that it was a conviction sell. Yuck. Session end the all share had sold off a whopping one and three quarters of a percent to 35415 points. And we have waved cheers to three and one quarter of a percent in the last eight or so trading sessions.

OK, not all of the blame can be pointed at the local miners and the unrest for having a negative impact on our markets since last Monday or so. Much of the finger pointing can be in the direction of the Spanish government dragging their heels. Or at least that is what Mr. Market thinks. In fairness to the Spanish they have been preparing for this point, as per the Reuters report: Spain to pass reforms, budget cuts with eye on aid. Last night was the second evening, where protestors who are obviously opposed to more cuts, took to the streets to vent their anger towards the government on all the spending cuts.

To be a politician in Southern Europe is probably akin to flying a Zero on behalf of your political party on a Kamikaze mission of cutting benefits. How can you possibly expect to be re-elected? Perhaps I am being very dramatic, but the last lot were booted as a result of perceived poor economic planning (we are all to blame, right?), how much of a chance do the current crop have? I suspect they are all one term leaders. Perhaps Hollande will last of the current crowd, but maybe that is just because he was elected "last" in the cycle.

Whatever the case, markets have pulled back a little in recent days. We always consider these to be buying opportunities, there have been a whole lot of dividends that have accrued lately, over the last week. Opportunities are there for the brave, but as an investor you should always be looking for opportunities. Email us, reply to this message as a full account holder. Of course, if you want an account with us too, let us know, we can facilitate all transactions for you.

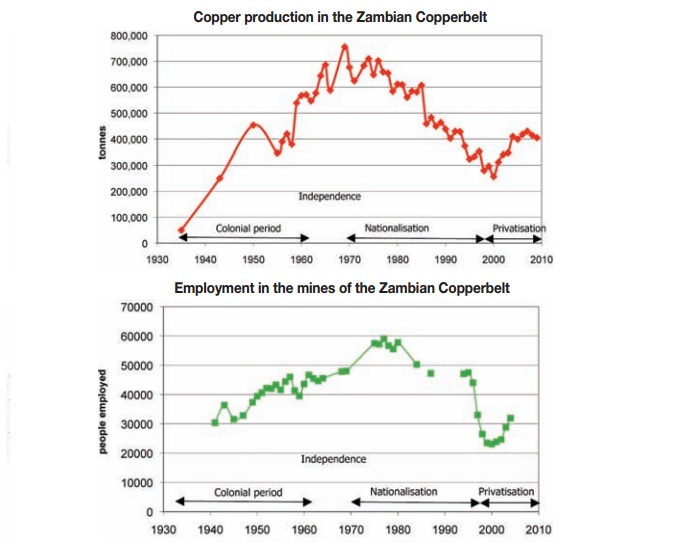

I think that whilst the debate around nationalisation of the mining sector in South Africa is not front and centre of the conversation, it is always "trending" beneath the surface. An avid reader sent us a piece that was published over a year ago, BUT is still relevant. Why? Because not only does the author Daniel Limpitlaw point out how production falls, but he points out how expensive it is to revitalise the sector once the long period of under development and under investment have passed. Two graphs that I have hacked from the piece titled: Nationalization and Mining: Lessons from Zambia. I hacked these two graphs.

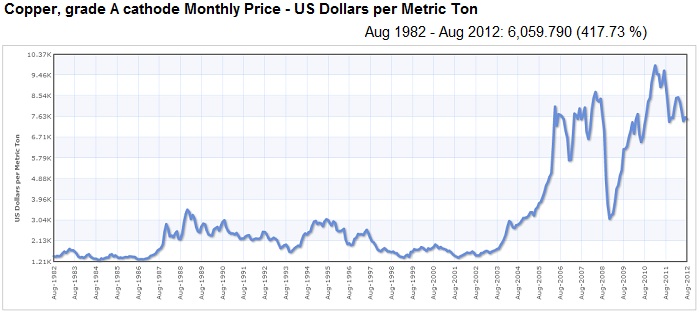

It suddenly struck me that perhaps the global demand picture did have something to do with the copper price. Which, as per this graph below shows you that for a couple of decades almost nothing (price wise) was happening:

But the key to the piece that Daniel has written is that once nationalised, mines chase away all the skills required to build the mines effectively. Why? Well, here are some reasons, an excerpt from the piece:

- "Mining is a high risk, capital intensive industry that requires access to large numbers of highly skilled people, most of whom are motivated by personal gain. There are very few examples of efficiently run state-owned mines that make a positive contribution to their country's economy, the copper operations of Chile's Codelco being the exception. Chile's success in running nationalized mines is in no small part due to the fact that Chilean mining schools have historically

produced more than double South Africa's number of mining engineering graduates. These Spanish-speaking engineers are also less mobile than South African graduates in the English language dominated world of mining."

If you remove the personal incentives for the stakeholders, productivity falls. Without a doubt. And then another telling half a paragraph should seriously be governments mantra on this issue, putting to rest the debate once and for all.

- "Removal of the risk/reward profit motive will accelerate the current flight of skills to other mining locations—already the Australians pay a substantial premium over local salaries for mining engineers. This will leave South Africa unskilled, uncompetitive, and begging for international buyers for the now rundown mines, with nothing but ruined assets to sell."

Do you honestly think that Chinese capital would be the White Knights in the event of a mining disaster in South Africa? I doubt it, money knows one colour and that is green. If the shortish piece written by Daniel is the only other thing that you read today, do it. And as ever, if you have "stuff" to share that you think other people will enjoy, send it onwards to us.

Digest these links.

There are many things that intellectuals cannot understand. Perhaps those folks are way too analytical. One of those things is the human element. A couple of days ago a surprise US Consumer confidence (read) at seven-month high in September. These are real humans making assumptions on how they feel currently and this always has a marked impact on the economy. As one fellow on the box said yesterday, the US does not need to do much to start addressing the debt issues, all they have to do is to grow their economy by more than 3.5 percent per annum. Yes. This is true. How to get there, well, that is another debate entirely. A debate that culminates in presidential elections in around 40 days. Gosh the US presidential debates are actually going to be exciting! You might have heard the Mitt Romney gaffe around the 47 percent, so this is a good post to read: Who really benefits from big (US) government?

The unintended consequences of your actions possibly mean that people do not think the implementation of something new in the first place. I am talking about this, from the FT: L'Oreal chief hits out at 75% income tax. Look, the French plan is to tax the Über wealthy for a couple of years, just so that the rich can pull their weight too. This issue is a global one, obviously people with more resources will be able to sail through a financial crisis easier. This line of thinking is very popular, but there are unintended consequences. The rich have more choices than the middle classes. The rich are mobile and can move almost anywhere. Luxembourg, Cyprus and Malta must be looking attractive. Dare I say it, even places like Serbia.

Forget Apple, Howard Lindzon had a compelling argument for why Google will be the First Trillion Dollar Company. All points are good points. They do make some sizeable and quality acquisitions. Perhaps Twitter is next, says Lindzon. And just two days ago: Driverless Cars: Now Street-Legal in California. I for one would prefer to be driven around and get work done in the back seat.

I always say that communication is hard coded in each and every one of us. That is why I am not too surprised to see this WSJ article suggest Cellphones Are Eating the Family Budget. So people spend more on their phones on average than they do on cable. Perhaps the Emmy's in years to come will be replaced by the Youtube's and nerds will rule! I am not too worried about the Americans cutting back on food, if you know what I mean. This is a preview into the world of MTN and Vodacom, the fact that people are spending on their mobile bills over their traditional forms of entertainment, such as visiting movies or going shopping leads me to believe that will start to happen here too. It is of course going to have to take some time.

- Byron's beats

Last night I came across this WSJ article titled Consumer Rebound Based on Solid Foundations which gave some interesting stats on the US housing market. It is subscription only so I will summarise it and add a few of my own thoughts.

It seems like the US housing market is the only shining light amongst a whole slew of negative economic data reads. But how significant is it and does it have the shoulders to carry us through these tough times? According to the article, housing prices have increased 5.9% so far this year up until July. In 2010 68.6% of US families owned a home compared to 49.9% who owned stocks. The average value of each home was $209,500 while the average value of stockholdings was $29000.

What does this mean? When the stock market picks up people often refer to the wealth affect on consumer patterns. Because ones share portfolio has picked up they feel more confident to consume. Looking at the stats above you can see that the housing market is a much more significant asset to most consumers and should therefore have an even bigger wealth affect.

This is why Warren Buffet says that when the housing market turns, that is when the US economy will be in full recovery. And we have already seen signs of the US consumer showing more confidence. The article also elaborates on the affects of the financial crisis on confidence. Ever since the crash there has been a standoff between companies and consumers. Will they spend? Should we invest? Should we save? Fingers were burnt and trust was lost in a matter of days. It has taken years to build up that trust again. And with the emergence of the European Sovereign Debt Crisis in recent years the process has been even slower.

So does the US housing market have what it takes? The US consumer is integral to global growth as demand for Chinese and many of the big European exporter goods starts to pick up. Mario Draghi said that Europe will start seeing growth as early as next year. The Fed is also on board pushing that US housing market and trying to install that much needed confidence. Once these things start to take its toll on top of the emergence of the Chinese consumer, global growth should get out of this rut. That is why we should be buying assets now for our own personal gain and to add our little bit to the confidence index.

New York, New York. 40o 43' 0" N, 74o 0' 0" W Stocks across the board took some tap as the "issues" in Europe once again came to the fore. I suppose the stone throwing, the clashes with police in both Madrid and Athens do little for confidence. The odd Molotov cocktail here or there do very little to calm the nerves about Europe. When I heard some fellow say something to this effect "We all thought that the problems of Europe were solved, but clearly when we see the visuals of today, that is clearly not the case" I fell on the floor laughing and gripping my belly. What I thought? I was completely gob smacked, some fellow on the floor at the NYSE was changing his mind again.

But, this is the reality, the hypersensitivity of markets and the skittishness of all involved means that the rally we saw recently still is being questioned by many. I think that again this is a good thing. As buyers of quality stocks, we view this as a positive. Why? Because if there are loads of people who are unconvinced about a specific asset class, and one has long term conviction about a specific company, then the balance of probabilities is weighted towards you. Does that make sense to you? Session end stocks sank, blue chips ended one third of a percent worse, whilst tech stocks lost over three quarters of a percent with the broader market S&P 500 somewhere in-between that.

Currencies and commodities corner. Dr. Copper is last at 372 US cents per pound, higher on the session. The gold price is flat at 1755 Dollars per fine ounce. The platinum price is also flat at 1635 Dollars per fine ounce. We were just wondering here what Amplats line was with their labour force this morning. 90.24 Dollars will buy you a barrel of WTI oil as per the last traded price on NYMEX. Except one contract is 1000 barrels. So in order to get that price you will have to buy 1 contract. The Rand is steady. There is of course the inclusion into the Citi World Government Bond Index of South African government bonds. As such people would be natural buyers of our bonds. And I guess, although much of the buying has probably been done, this is good news! And the equities market has also bounced back today, which is also pleasing.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment