Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. It was a strange old day for equity markets here in Joburg. After the markets had closed the scoreboard showed why. Retailers were thrashed, there were a number of broker downgrades and some high fliers were dumped, most unceremoniously. Mr. Price sank over seven percent. Woolies, careful here, they were ex-div too (123 cents), but the stock sank by more than double that, down four and a half percent. Standard Bank led the banks lower, down five and a quarter of a percent, the stock was also ex-div, but were also hit with a broker downgrade. The retail stocks ended the session down 3.72 percent, ouch, the banks as a collective closed down 2.71 percent. At the other end of the spectrum another announcement from the Chinese regarding their infrastructure spend sent commodity prices higher, the resource stocks rallied three quarters of a percent. Sasol's superb results saw the stock touch its highest levels since March this year. SA inc. taking a bashing, resources getting a leg up here.

Bart's shorts.

Glencore decided officially to up their offer to the Xstrata shareholders, well, the balance of them anyhow, the other 66 percent of Xstrata shareholders. Remember that they, Glencore, own 34 percent. Under the new revised offer, the ratio was bumped up to 3.05 from 2.8, but you knew that already. Mick Davis will be offered a six month interim CEO role, after which Ivan Glasenberg will assume the role. The WSJ reports that Xstrata was feeling rather cold to the new offer, let alone the old offer. Glencore now have to wait until the 24 of September, two Mondays time when Xstrata will recommend the deal to their shareholders. If they say no, some expect Glencore to go hostile and look for that 16 percent needed to control the business. What is of most interest to me is that if Xstrata shareholders are firstly recommended the deal, and then they say yes, what then of a renewed launch of having a go at Anglo American. Perhaps. The last four or so trading sessions have seen nearly a ten percent gain for Anglo. Speculation. I would first like to know that Glencore has sealed the deal. Today Anglo is taking some tap, as the recent concerns around mining in South Africa and labour unrest sends shareholders scurrying.

They said that they would never make money from bailing out the banks, it was like pouring money down a hole. We would be far worse off now if the US government had not acted swiftly back then. Far worse. Over the weekend, in case you missed it, the US government said that it would be selling more AIG shares. But the US government are still in waist deep, with this New York Times article, Big Step in Selling A.I.G. Stake, but Other Bailouts Remain, saying that 343 institutions are still part of the TARP program, but are working their way out slowly. It worked. It might have cost a lot, but it worked. And the US Treasury did not lose all the money, in some cases it made money.

We often say around here, don't worry too much about what non-Europeans say about the Euro zone, because the implications and subsequent decisions do not really impact on them. So when I read in Der Spiegel Why Merkel Wants To Keep Greece in Euro Zone, I am not surprised. Europe has been working on the Euro project since the Second World War so that there would not be another war. Free trade and all that. Movement up and down. Perhaps the idea is starting to sink into everyones head that it is better to be inside of the inner circle than to be out.

Oh dear. The Japanese Minister of Financial Services allegedly hung himself at his own home. This ministry is similar to the FSA or the SEC, or locally the FSB, but with more powers. Amazingly Japan has a very high suicide rate, 30,000 per year, and this keeps pace with an ever decreasing population. The pressures of the job were just too much, I imagine this must be the case. In many cultures the act of suicide is not seen in the same way as it is in Japan. Phew, I guess culturally we will always struggle to understand.

Richemont are getting a punch in the guts this morning, Nomura have downgraded Burberry, but it comes after the luxury goods maker suggested that full year profits would be at the bottom of the expected range. Check out the Burberry First Quarter Trading Update and Interim Management Statement. So you read that right? Seems ok. But the stock got drilled, down over 18 percent. It is not even the most expensive of its peer group. Trench coats. Turns out people prefer watches. Although I can see myself in this one: VELVET COLLAR CHESTERFIELD COAT. For the five days or so that I might need it in winter down here, I am going to pass. Cheapskate. My point however is simple, trench coats are not watches and jewellery.

- Byron's beats

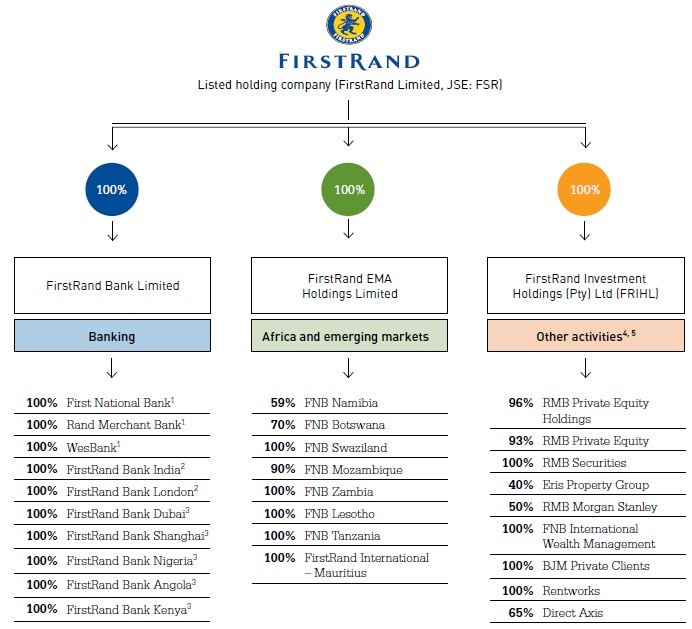

This morning we had full year results from First Rand. There are lots of moving parts here so let's take a look at the structure of the business to get a better understanding. This image hacked from the results presentation pretty much sums it up.

The Numbers. They looked good, Steve has managed to convince many clients to move to FNB backed by what seems to be a better service from my own experience and word of mouth. Diluted normalised earnings grew by 26% to R12.73bn which equated to 225c per share. The dividend also grew by 26% to 102c per share while normalised return on equity grew to 20.7% from 18.7%.

Let's look at the earnings mix. FNB is still the big earnings driver contributing R6.6bn (53%) after growing 25% for the year. RMB and GTS (Global Transactional Services) contributed R3.6bn (29%) after contracting 5% while WesBank contributed R2.6bn (20%) after growing a whopping 40%.

FNB. The bank has been at the forefront of innovation and has really improved its services with the likes of eBucks, fuel rewards, the FNB app and offering iPads and other gadgets through current accounts. This has resulted in 1.3 million new accounts in the year. If FNB was separately listed I would certainly buy the stock for its innovativeness and originality, much like Discovery. ROE grew to 35% whilst margin growth grew thanks to an increase in unsecured lending. That book is now worth R11.4bn, about a fifth of African Bank.

RMB. This is the investment banking division which interestingly announced the termination of outright propriety trading activities due to regulatory changes and the expected macro environment. This is the division we are not the biggest fans of but due to such regulatory constraints it does become less risky. It will however be a lot less profitable than the ''good old days'' before the financial crisis. Earnings depleted from what is described as a high base last year because of muted M&A activity and a tough environment. We still see investment banks as risky remuneration vehicles that benefit employees more than shareholders.

Wesbank. This has grown fantastically and we can see why when we look at vehicle sales figures. Motor finance was up 20% while interestingly unsecured lending played an important role growing 17% to a book now worth R4.3bn. Operating costs were kept down to 3% while corporate new business grew by 15% to R11.8bn.

In the commentary I was interested to see the following statement which I think proves my point that retailers who grow sales north of 15% but say conditions are so horrendous are talking absolute rubbish.

"Consumer demand remained quite resilient throughout the financial year with household spending on durable goods particularly strong. This demand was underpinned by growth in real disposable income and a gradual increase in the uptake of credit by households, particularly unsecured credit. Continued low interest rates provided further support."

I do like the company for its innovation and position to grasp the under banked African consumer. However we prefer African Bank who focus all their activities on unsecured lending, an area where FirstRand are experiencing a big chunk of its growth now and going forward. FirstRand trade on a historic PE of 12.1 compared to African Bank's PE of 10.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Chips. Not the kind that you eat, but rather in South Africanisms, when you say, watch out. Well, in this case chips is relevant to both Intel and watching out, their share price sank 3.84 percent as the chip maker said that they expect to wind in their revenue projections for the current quarter by as much as one billion Dollars. Why? Because PC sales are slowing. So I guess we knew that already. And I guess we knew this already too: Apple's iPad overtaking PC sales in schools.

So tablets are crushing the personal computer. And of course nowadays everyone wants a laptop, they are more powerful than they once were. It is all about the speed. I last used a desktop about four years ago. And I guess perhaps never again. Although naturally the processor in my laptop is an Intel chip. Perhaps the PC revolution will catch up again, once tablet sales become a defined part of total hardware sales. Or perhaps the semi conductors deserve their lower ratings and are more utility like in nature. Time will tell, but we prefer for the moment to be long Apple, Google and Amazon, as well as Cisco in a slightly different space.

Along with the poor news from Intel, tech stocks registered a one percent fall, the broader market S&P 500 dropped just short of two thirds of a percent, whilst the Dow Jones had a modest sell off. Of course this week there is the FOMC and the anticipation of QE3 is heightening. The FOMC statement is due on Thursday. I don't have to tell you that this is the most anticipated FOMC statement, well, since they last released a statement! Hah-hah. No, really, Mr. Market is keen as beans to interpret the Fedspeak and what they will be up to. The politicians no doubt are also hanging around waiting for this one.

I quite liked this Barry Ritholtz article that slightly messed with the Barons idea that the housing bottom had arrived. In part Ritzholtz discredits the publication because they have done it more than once, calling the bottom. Read the article: Barron's Cover Calls Housing Bottom (Yet Again). Ritholtz makes some good points, if you scroll down lower you will see the part about foreclosures, the Fed targeting zero on interest rates and the last one, about home builders stock prices and home prices. The last one I am not so concerned about, that takes care of itself.

But surely foreclosures slowing puts a stop to fire sales and means that the mean price should start to trend higher? But as Ritholtz points out that distressed sales have slowed. I am going to side with Buffett, who said that single homes were the best investment around, that was back in February. He said that if he could, he would buy a couple of hundred thousand collectively. For the record Buffett bought his five bedroomed house in 1957 and still lives there. If not a bottom, then we are as close as we are going to get.

Currencies and commodities corner. Dr. Copper is last at 362 US cents per pound. The gold price is higher at 1731 Dollars per fine ounce, the platinum price is also better at 1595 Dollars per fine ounce. The oil price is also higher at 96.60 Dollars per barrel. The Rand is steady to slightly weaker. We have started lower here, some stocks getting trashed, almost the opposite of yesterday. Mining stocks, South African ones, are getting thrashed as a certain fallen political hero agitates a little.

Partly cloudy with a chance of something. The next three days are thought to be key. Key to looking ahead to the next calendar event. Tomorrow there is the German court ruling, Thursday as we said is the FOMC statement. Today however is one of those anniversaries where you would have remembered where you were. The 9/11 attacks will be commemorated, but lower key than the ten year anniversary which was last year. I remember exactly where I was. We were all watching the old giant tube TV in a dealing room, I was standing next to an old timer, an incredibly likeable chap. I turned to him and asked, what does this mean? And he said something along these lines, "very, very, very, very bad". And he was right. This is not an event that covers humankind in glory and the subsequent associated and ongoing wars are nothing to be proud of. And still we search for answers, why?

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment