Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. Retail and banks led us higher yesterday, gold stocks also benefitted from a higher bullion price. Resources as a whole continued to drag, Sasol in particular was hit with a lower oil price, remember we discussed the strange goings on in the pits. The Saudis have actually said that they are willing to supply the market more, perhaps in an attempt to drive the price lower. I know it sounds strange, but the Saudis are well aware of volatile prices and what it can do for the global economy. We have an interest rate decision a little later this week, the consensus is for no change in rates.

So that is settled then, is it? Lonmin announced that they had reached a wage settlement with their employees last evening. I read the Miningmx story that was quoting SAPA titled Lonmin strike over - report.

The Lonmin release from this morning makes it official, Marikana Agreement Signed. The news however broke just after 7 in the evening and Joe Weisenthal tweeted an interesting price graph, where he said, try spotting the moment where the Lonmin agreement was reached pointing to this graph at Finviz: Platinum graph. I have hacked the graph and circled it, courtesy of FinFiz:

Reading the Lonmin agreement, I am left a little puzzled by the wording, because of course most of us would not know what the categories are: "The agreement includes a signing bonus of R2,000 and an average rise in wages of between 11 and 22% for all employees falling within the Category 3-8 bargaining units , effective from 1 October 2012. This includes the previously agreed 9-10% rises for these employees due to come into effect in October 2012. It also addresses issues of promotion for some categories of workers as well as other allowances."

Ok. The SAPA piece from Miningmx seems to shed more light on it, with a quote from an employee to put it into Rands and cents: "rock drill operators would now get R11,078 a month before deductions, production team leaders R13,022 and operators R9,883. Workers would receive a further once-off bonus of R2,000." The once-off bonus would of course help the strikers with pay day looming and no work having been done.

Our initial thoughts are that this is going to lead to job losses amongst the contract workers. The precedent has been set for violence translating to demands being met. And the higher cost base will make the businesses a whole lot less profitable for their shareholders, someone will do the math soon. And hopefully costs in the upper echelons of the business will come under pressure too, i.e. the execs will be paid less because the business will be less profitable.

So who wins and who loses? 45 people have lost their lives. These are workers, ex-workers, police men, security personal and a COSATU shop steward. They lose in the ultimate way, their families lose in the most unimaginable way. I suspect we lose jobs, we mentioned that above. The rest of the industry are going to have to agree to these hikes. The miners themselves become less profitable in time, as the cost base is set higher. Treasury then has less to gain, lower profitability will in turn mean lower tax collections. I suspect that local businesses will benefit, as the miners have greater spending power. And lastly, I have no idea how this affects COSATU. I read on my Twitter stream that some miners had vowed to change their allegiance to AMCU. As one person pointed out, this is what happens when you have choices.

- Byron's beats

I've been following this one quite closely through its recent sales and trading updates but finally Cashbuild have released their full year earnings for the 53 week period ended 30 June 2012. The numbers came in line with the trading update as earnings were normalised from a big BEE transaction last year.

This meant that earnings were up 88% from last year but on a normalised basis which also excludes the 53rd week, earnings were up a healthy 26%. The final number came in at 1260c with a full year dividend of 569c being declared. The stock which now trades at R155 has an historic multiple of 12.3 with a dividend yield of 3.7% before taxes. Compare that to other retailers like Massmart (P/E 30), Shoprite (P/E 26), and Spar (P/E 22) who all have building divisions and you can see that Cashbuild offer some value. Of course these three are big businesses with lots of other divisions and aspirations but you get my point. For the record the whole retail index has a P/E of 18.63 (via Bloomberg).

So why is Cashbuild so cheap? It is a very competitive division with the likes of BuildersWarehouse, Builders Express, Build It, Mica and even Makros and big supermarkets competing for clients. They are also quite a conservative bunch with only 4 new stores being opened in the period. That is because their location has been so vital to the company's success in the past. You may not see many Cashbuilds in the traditional more affluent areas but nearly every township will have one. In their prospects column they say they have experienced a 5% growth for the first 9 weeks of the financial year which they are disappointed with. This is maybe why the stock has pulled back of late.

You will already know that I like the stock. Even though the environment is competitive I feel there is more than enough growth available in the sector. Look at all the strikes we have been seeing recently, many of which have focused on living conditions. One of the first things people prioritise when they get an increase is their living conditions. It also adds value to an asset which is sustainable and encouraged.

Even when times are tough people substitute buying new homes for home improvement. In a developing economy like ours with such a massive informal housing sector and at historically low interest rates, Cashbuild who are one of the first movers in this industry and have many of the best locations should find themselves in a long term sweet spot.

The balance sheet looks strong, they managed to grow margins from 22.5% to 23.3% in a tough environment, they pay a good dividend and we do not mind a conservative management team. This makes them a very attractive takeover target from the likes of a big retailer like Shoprite or JD Group or even a Micro lender like African Bank who are looking for sale points. We are happy to add at these levels.

Simpson's shorts, digest these links.

This section confuses people. Bart Simpson is not a person, he is a fictional character in arguably the most successful animated series of all time. So from tomorrow this just becomes the linkfest. OK? And what I need from all of you readers out there is something interesting or juicy that you think that other people might want to see. Send these in and we can either attribute them to you or make them anonymous.

Do not get bulletproof. Ever. Just in the same way that people get bearish, be careful about sticking to hymnsheet all the time and being too optimistic. That is why I was fairly interested with this piece from the Business Insider. CHART OF THE DAY: Morgan Stanley Expects A Horrible Finish For The Market This Year. 1167 on the S&P 500 is the level Adam Parker set in December last year. And he is still looking for that this year. Wow. 300 points down from here. We will see I guess, it seems hard to see us losing that much, something really awful is going to have to happen. Fiscal cliff? As Paul said, one crisis normally replaces the previous one.

Are you still waiting? I mean, are you waiting for the perfect moment to get back into the market and are you a sceptic looking for the next big pull back in order to make further investments? Cullen Roche has written an interesting piece which is a question: "How Much Does the Market Have to Decline Before you Become Constructive?" Indeed, how much? Well, he answers it with a little bit of insight into human behaviour: "But it's a question that has been plaguing investors for years now as they wait for that perfect 2008 moment all over again. Many investors are convinced that if they just get one more crack at it they'll get it right next time and buy at the lows and it will be smooth sailing. It's a common bias that inflicts harm on many investors." Again, the next crisis is brewing somewhere. And waiting for it might require more than just a little patience. As a friend once said to me, when the next crisis hits, I will make sure that I have lots of cash to capitalise. The problem as ever is, how much cash? And how do you recognise quality companies that are cheap? Cool heads.

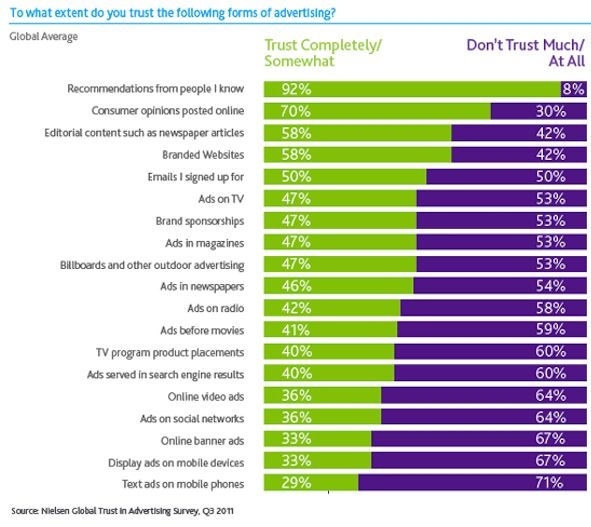

Who do you trust the most? It turns out that you trust your friends more than anybody else. I have seen on my Facebook stream people asking questions and getting answers. For that I use Google, but some folks are more likely to trust their friends than the internet. I get that. So then you would not be surprised to see The Chart That Shows Why Advertisers Won't Give Up on Facebook. I hacked the chart, courtesy of Neilsen, it makes for interesting viewing:

Does your football team make a good investment? Lots of me says no. And then I remembered this piece from earlier in the year, from two seasons back: Premier League clubs lost £361m last year despite record £2.3bn income. Yes. Only Newcastle made a handsome profit when they sold Andy Carroll. Manchester City FC suffered the biggest ever loss in football history, losing 197 million pounds for the 2010/2011 season. They did win the league a year later. Arsenal does a wonderful job with Wenger keeping the club in the black. Sir Alex does an awesome job with his team, and the company eked out a profit back then. But just yesterday the Red Devils reported a 24 million Dollar loss. Sis. And this WSJ piece about ManU leaves me leaving that when the fans vote with their hearts, leave the investment to someone else: Man United Needs a Team Effort. Oh, and good luck to them this evening!

This Felix Salmon piece titled Chart of the day, housing bubble edition, which does a great job of again exposing human nature. Like he says "I suspect the number of people answering 12% or more is going to be greater than the number of people who think the value of their home will quadruple in ten years." But yet they are the same thing. Nice piece suggesting that the housing market in the US remains on the mend.

And then I guess this Carpe Diem blog ties in nicely to the revealing piece above: Builder Confidence Index Rises in September to 6-Yr. High, With Largest 12-Month Gain in History. I am slowly starting to believe that even the housing bears are going to have a hard time with these recent releases.

Meanwhile, Inditex Profit Beats Estimates as Revenue Accelerates. Who? The holding company for Zara, amongst many others. Things are so bad that the company crushed estimates.

New York, New York. 40o 43' 0" N, 74o 0' 0" W Half baked. It felt like a draw really for both the bulls and the bears, stocks gained a little for blue chips, whilst the broader market S&P 500 fell a couple of points. The nerds of NASDAQ ended flat, a little bit lower even as Apple continued to add, now through the 700 Dollar mark good and proper, see this WSJ article Apple Shares Top $700: iPhone 5 Euphoria Setting In. Apple is 2.8 times the size of Google, in terms of market capitalisation. In terms of historic market valuation, believe it or not, Google is more expensive. Google trades on a little over 21 times earnings, whilst Apple trades on 16.5 times, according to Google Finance. Heck, Lenovo trades on a more demanding multiple than Apple. But I am reminded that the biggest risks to Apple are of course their competitors.

One stock that took a clang to their heads was FedEx who lost three percent on the session. It was all about guidance for the coming quarter, which fell very short of expectations. Strangely however, the past quarter was a beat. There was loads on the go that the company could point fingers at. Exports are slowing from China as a result of lower demand in both Europe and also in their home base in the US. FedEx looking weak.

And then there was this news: Goldman names new CFO, heralding end of an era. The longest serving CFO on Wall Street is finally on his bicycle. David Viniar is giving way to the younger Harvey Schwartz, who himself comes with a good pedigree. I laughed when I read Viniar quoted in the WSJ saying that not a single day at Goldman Sachs was boring. Quite. Schwartz having been there basically his whole working career knows that too, the current landscape however is different from anything seen before.

Currencies and commodities corner. Dr. Copper is last at 377 US cents per pound. The gold price is higher at 1773 Dollars per fine ounce, the platinum price is higher at 1635 Dollars per fine ounce. The oil price is a little lower at 95.07 Dollars per barrel. The Rand is steady, last trading at 8.20 to the US Dollar. The market is marginally higher here to start with.

Sasha Naryshkine and Byron LotterEmail usFollow Sasha and Byron on Twitter011 022 5440

No comments:

Post a Comment