Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. We sank one third of a percent for the Jozi all share index, I get the sense that the waiting part is making some folks fidgety. Waiting for direction from either the ECB or the Federal Reserve, that is seemingly some folks plan in the short term. Lucky for us, this is not a gladiator battle, but rather another event in the long term savings plan. Yip, that is how you must treat equities. The 1988 Berkshire Hathaway chairman's letter, written by of course the Oracle of Omaha, Warren Buffett had a simple line: "our favorite holding period is forever." Ha-ha, although if you read the first part it seems like selective picking, here from the To the Shareholders of Berkshire Hathaway Inc. 1988:

- "In 1988 we made major purchases of Federal Home Loan Mortgage Pfd. ("Freddie Mac") and Coca Cola. We expect to hold these securities for a long time. In fact, when we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever. We are just the opposite of those who hurry to sell and book profits when companies perform well but who tenaciously hang on to businesses that disappoint."

Some sage advice there, Berkshire still owns Coca Cola. A "Long time" means the long time as in what your grandparents would think, not the hyperactive, trigger happy trader types. Because those folks are worried about the prices, not the companies. We continue to buy companies, not share prices. That second part is also important, because everyone makes mistakes. When you make one, identify it and move on. Don't wed your investments, I promise, they owe you nothing. You have rights as a shareholder, not privileges. You assume risks as a shareholder, but you are entitled to excess capital, in the form of dividends. Sometimes when the company is falling on hard times, they turn to shareholders cap in hand with a rights issue. Equally if the company wants to expand, acquire other businesses, the shareholders decide. They assume the risk. If it was so very easy to be a business shareholder, many more people would do it. The shareholder, I always want to know what "they" think.

The most anticipated event of the week? Well, that perhaps depends who you are really, but I guess the TV screens are telling me that, so I had better pay attention. It is the ECB decision day today, the expectations are for the European Central Bank to present their plans for buying short term sovereign debt, to lower the borrowing costs in the short run. A fix of sorts, this is like burning a fire break, perhaps not so dramatic, but something like that. I was fascinated by the always relaxed manner of my hero, Jim O'Neill, yesterday. He was on Bloomberg TV and was answering the usual bout of anxious questions about the Euro zone. Check out the interview: Jim O'Neill: ECB Will Do What's Necessary for Euro.

O'Neill said that a small part of him suggests that there might not be too much after the announcement. But he thinks that the ECB is all hands on deck. The markets were pricing for a Euro break up, but the ECB said that they were not going to allow for that. And as such, that is why the Euro has rallied and the periphery equity markets in Europe have stormed ahead. Admittedly off a very low base.

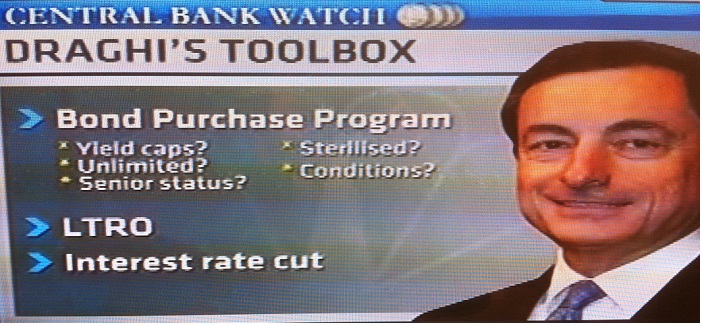

Sylvia Wadhwa, one of my favourite market journalists had a little piece. I grabbed a bit from my TV, courtesy of CNBC, which shows Mario Draghi's toolbox. Here it is below.

Yield caps on the spreads between peripheral and core bonds, making borrowing costs for Spain and Italy cheaper. But for the investor, is this attractive? Maybe not. Unlimited? Well, I just don't know about that. Unlimited. Sterilized? What exactly are sterilized bond purchases? Not increasing money supply basically, that is sterilized. But I like the O'Neill interview, where he says we won't have to wait long to find out, it is coming!

Bart's shorts.

Byron commented this morning that it must have been very disheartening for the Nokia employees and shareholders when as Stephen Elop was unveiling the new phone, the Lumia 920, the stock price was taking a thrashing. I cannot quite tell why, the reviews looked ok, perhaps the lack of clarity on the pricing is key here. There are some features that are almost certainly to be liked, the camera, the casing, the speed of the phone. But some folks just think it is the same old phone from before. Check out this blog review, that suggests there is not that much clarity. Nokia Lumia 920 First Impressions: Lots of Unanswered Questions And if you needed a reminder, Apple has a launch next week Wednesday. People have been invited. The next iPhone apparently is going to be launched, no hints given with regards to what it is. There are only 757 seats in the Apple amphitheatre. Follow @CNET, they have a reporter on the ground, who got an invite.

What do you want to be as a nation? The Americans quite clearly have changed their reliance on the state over the last sixty years. Perhaps that is a good thing, but if you are a free market libertarian type, then this is pretty worrying. Here is an excerpt from a piece, America's Real Fiscal Problem: Federal Gov't Has Become a Gigantic Wealth-Transfer Machine, that you should read:

- "Our long-term fiscal problems won't be fixed until we address what might be our nation's most serious fiscal-related problem: we're increasingly becoming a European-style "entitlement nation," with "payments to individuals" increasing both in absolute dollar amounts and as a share of total federal spending, while at the same time the share of Americans who face a zero or negative tax liability is above 40 percent and rising. In other words, a declining share of American taxpayers is being forced to finance the rising cost of the federal government, which is increasingly being spent on payments to individuals."

It is a problem. But perhaps a society that protects the most vulnerable is a good one. Equally though, success must be celebrated and if people make a lot of money, they should be allowed to do what they want with it. Taxing very rich people chases rich people away. No matter how much rich people like their country, they seemingly always prefer their money. I can understand how sometimes there are outbursts that leave you feeling that some folks are just out of touch, like the recent ones from Gina Rinehart. Look, they might have been taken out of context, but judge for yourself via this Aussie reaction: World's media pan Rinehart's $2 a day African miner comments. And then if you have time, watch her in this republished piece where people are able to comment: Gina Rinehart. She makes good points, money has legs. Money can move places. But then you take risks, part of the argument above.

- Byron's beats

Yesterday we had another good set of full year numbers from Discovery Holdings Limited. "The year under review to 30 June 2012 was a pleasing one for Discovery, with solid performance across all businesses. The period saw growth in: new business API up 24% to R9.3 billion; normalised operating profit up 21% to R3.4 billion; normalised headline earnings up 14%; and embedded value growth up 12% to R30.2 billion."

Just to clarify things, this is our thesis on investing in insurers. Usually we stay away and this is why. Insurance companies are normally good profitable businesses but it is what these companies do with the premiums that determine their returns. The usual model will involve investments in all sorts of assets from property to bonds to equities. This means that their earnings often track the market. As equity investors we want exciting stocks with the potential to beat market returns, not to track it. We also back ourselves as asset managers to put our client's money into better performing assets then what the fund managers at these insurers decide on.

Discovery however is different. They are an exciting, innovative businesses who have taken advantage of the state's failure to provide affordable, quality healthcare in South Africa. Our private hospitals are quality but they are very expensive. This requires insurance. What has put Discovery above the rest has been their innovative Vitality programme which rewards clients for being healthy. This is a win-win situation for both the client who gets healthier and Discovery who can monitor the client's activities while paying out less medical claims. The nation also benefits from healthier more productive citizens. I have often emphasised how good things happen to companies who do good, well Discovery falls into that category.

Let's get back to the numbers. This is the highest number in the company's history for new business, R9.3bn coming in which is up from R7.5bn last year. That is strong sustainable growth because the company has been very successful in maintaining existing clients. Both Discovery Health and Discovery Life which are the big money spinners showed strong growth in profits, up 10% and 14% respectively. There are a lot synergies between these two businesses and have been very well integrated with the Vitality programme.

Discovery invest which deals with financial services grew nicely (50%) from a low base. PruHealth and PruProtect, the UK businesses are coming on nicely making R300 million in profits compared to a loss last year due to big capital expenditures. The uptake of Vitality has been well received there. New businesses which cost the company 331 million include Discovery insure, The Vitality Group (introducing the Vitality concept in the US) and Pingan which is the Chinese version of Discovery in South Africa using Vitality as a draw card.

Normalised headline earnings came in at 417c, the stock trades at R56 and a historic PE of 13.4. If you consider that the new business ventures sucked up a whole lot profits on top of this companies amazing growth history I would call this a very compelling price. We continue to like the stock as one of our entries into the lucrative healthcare sector.

Currencies and commodities corner. Dr. Copper is last at 349 Dollars per pound, the gold price is last at 1707 Dollars per fine ounce. Yesterday I said per barrel. I wish I could have sold it today and bought it yesterday. The oil price is last at 96.12 Dollars per barrel, higher on the session. The platinum price is last at 1584 Dollars per fine ounce. The Rand is firmer today, there certainly is great anticipation that the ECB are really going to do something "special". Phew. I don't know. There is the small matter of ADP employment data out today as well. And Hashim Amla also got a bucketload of runs again.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment