Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E. There were a couple of events outside of the normal markets that were important I guess for our country, the first was the COSATU 11th national congress, in which all the incumbents hung onto their posts. Re-election must in some instances feel like you are "winning" again. The president at the COSATU congress acknowledged that the problems in the sector were impacting on the economy. Because he knows that the money does not come from thin air, Treasury has obviously been leaning on him to be a little more proactive. But the "damage" has been done. Anyone watching the impatience of European bond investors will know that money does not have time, and time waits for nobody.

As these two articles show me already, this one from the FT (subscription only sorry) Investors offload South African miners. And then this one from Bloomberg: Rand Weakens as Yields Rise to September High on Mining Unrest. The consequences of a weaker currency is that imported inflation becomes more of a problem. And if you needed reminding, inflation is a scourge that impacts on the lives of the poor, not the rich.

Talking about issues of the rich (how?) and the poor, the second event that made many shudder was when Julius Malema was blocked from giving a speech to the Marikana miners. Forget for a second the fancy cars, house in Sandton, watch and see what happened here. Police prevented someone from talking. The army chased that someone away. That is not altogether a good outcome and a defeat for democracy. The Daily Maverick has this take: Marikana: Malema's police-sponsored exit. You can't do that in my opinion. Now if I were the organisers, I would do this. I would get the man who was told to get on his bike to deliver a YouTube address and then play it back to the folks who had turned up to see him.

Unfortunately however, the questions about his wealth and the origins of the money still remain unanswered. Today there is a news conference under the banner "Economic Freedom Fighters" later today. And rumours of the man's arrest as a result of his recent statements, but more importantly around that acquired wealth, which continue to circulate. Political battles are starting to have real impacts on the economy, as they almost always do. To the detriment of all of us. There you go, my two cents worth. Which does not exist as a coin anymore, as a direct result of inflation.

Bart Simpson's shorts, digest this. Wow. I did not realise this. I know loads of guys who like to look after themselves, but perhaps for me this seems to be taking it a bit too far. Or not, each to their own I say. South Korean men see makeup as new face of success. Make up for men. You might think that is a small market, but as the article points out, Men in South Korea spend nearly half a billion Dollars a year on makeup. And a relatively small population, 19 million men in total, account for just over 1 in five Dollars spent on men's skincare products worldwide. But that does not really surprise me, I read a day or two ago that one in five Seoul women have gone under the knife. Looking good must be very serious business. A bit like PSY and Gangnam Style! And if you do not know who, or what that is, I cannot help you with get up to speed with your trendiness. Find out about it before it "jumps the shark".

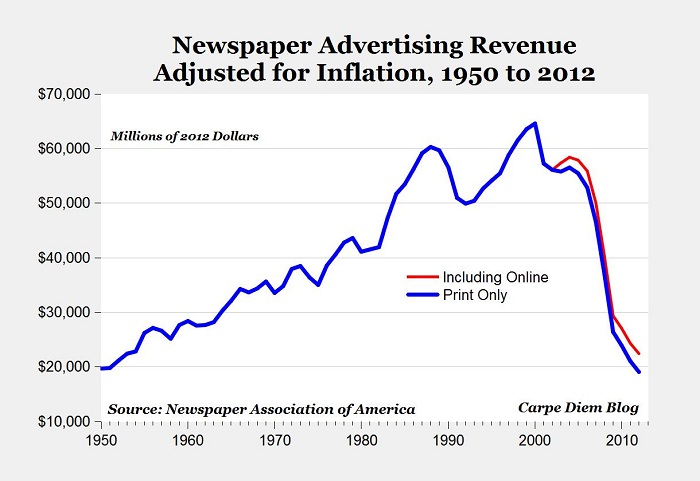

I have showed this to you before, but it continues to show a sharp decline. Check out this piece from Mark J. Perry: Free-fall: Adjusted for Inflation, Print Newspaper Advertising Will be Lower This Year Than in 1950. I hacked the graphic from the piece, a picture is all you need. Expect to pay in the coming years for your favourite publications that used to be free. That is going to be a huge jump in mindsets of the consumer, and I guess people are going to get pickier in what they choose to read.

Come on Spain, do something already! The FT reports Investor impatience lifts Spanish yields. As I mentioned above in the first part of this message, investors are about as patient as a five year old. Or perhaps investors and impatience should not go in the same sentence. In the endless search for yield in this low interest rate environment, there has also been a class of riskier Mediterranean bonds. When the PIIGS sovereign debt problems first reared their ugly heads after the financial crisis, everyone was shocked, dismayed and outraged that the yields were rising. Well, do not worry too much about what has happened in the last year and a half. Check out this long term graph, which I found via this ancient (by Internet standards) post titled PIIGS Yields Up, Maybe Permanently. This graph is going to make you dizzy, courtesy of MarketMinder. See how everyone gets anxious about five, six and seven percent yields in Spain. They must have been having a thrombosis at 20 percent plus. But that was back then.

Still confused about what the Fed is "doing" in their new program? Don't worry, you are not alone. I have read an extraordinary amount about the new measures and the open ended purchases. Everything that suggests that banks are scrambling to get new loan officers. Remember that the armies of old ones were fired as banks kept the bare minimum when the crisis hit. Loan officers working on a commission basis were giving loans to all sorts. I kid you not that Michael Lewis, in his book "The Big Short" documented a special case, something that Michael Burry (a weird-ish fellow) had discovered. A Mexican strawberry picker, who spoke no English, and had an annual income of 14 thousand Dollars, managed to get a loan. To buy a house worth 724,000 Dollars. Yes. Get your head around that. But read up, from Bloomberg: Defining Bernanke's New Fed Target. Trying to interpret Fedspeak will drive you nuts.

New York, New York. 40o 43' 0" N, 74o 0' 0" W Stocks slid away the whole session, and then in the last half an hour suddenly went higher. Perhaps that coincided with a fall in oil prices, inflationary outlook improves, that is good for stocks, not so? There was a New York manufacturing read that suggested that the Fed was right to make people feel richer, manufacturing in that region is at a two year low. There were a couple of issues dominating markets, first was an oil price plunge, which we look at lower and then Byron has a look at perhaps the most exciting news of the year, month, week, day! Apple heading towards 700 bucks a share.

- Byron's beats

Apple shares reached a record high yesterday crossing $700 for the first time ever. The scariest thing about this company is on an earnings basis it doesn't even look expensive. The company has just grown so fast and made so much money that earnings have always justified the rise in share price. We started buying the stock for clients "at all time highs" in April 2010 at around $250 a share. I'm telling you this to emphasise that you should not avoid a stock because it is trading at all time highs.

The reason for the recent surge has to be the news that the iPhone 5 has already sold 2 million units in 24 hrs. That is 23.15 phones per second, 1389 per minute and 83 333 per hour. This is double the take up speed of the iPhone 4S and lines Apple up with their target of selling 10 million in the first week. And people still get surprised that Apple products exceed expectations when they launch. To be honest I wanted one before I even saw it. There were so many rumours and supposed leaks that Apple didn't even need to market the launch.

A recent survey showed that 1/3 of US citizens want an iPhone. This included 56% of Blackberry users and 32% of Android users who want to switch. As big shareholders of Apple we are very happy with this launch. The iPhone remains its biggest profit driver so this was vital. Analysts expects 26 million phones to be sold this quarter and 58 million sold by the end of the year.

For 2013 these projections look even more impressive. Expectations of 165 million phones bringing in $186bn in revenues and earnings per share of $53 are what analysts have come up with. This means that if you exclude all of Apple's other businesses which includes iPads, Macs, iPods, iTunes and the app store and just look at the iPhone business you get a 2013 forward earnings multiple of 13. Conviction buy.

On another note iPhone's use much more data than any other phone. Not in a bad way. It is because their phones are more efficient. This creates opportunities elsewhere especially for the companies who provide the data. The likes of MTN and Vodacom should benefit handsomely from higher data consumption. Yes they operate in Africa where iPhone penetration is low but by raising the standards all smartphones are going to head that way. Take a look at this article titled The Mobile Browser Dominates in Emerging Markets and you will see why we are still happy accumulators of MTN and Vodacom.

Currencies and commodities corner. Wow, what happened to crude oil prices? Oil prices last evening had fallen as much as five percent at one stage, but recovered a little to pare half of those losses. I suppose the strong gains from the end of last week are juicy enough for the short termers to take some money off the table. The actual reason as to why it fell all of a sudden? It turns out that some people have no idea. Crude Oil's Quick Fall Leaves Trail of Queries. Currently the oil price is trading at 96.18 Dollars per barrel, that is for NYMEX WTI.

The gold price last is at 1756 Dollars per fine ounce, the platinum price is way off the best levels, last at 1658 Dollars per fine ounce. Dr. Copper is also trading lower at 373 US cents per pound. The Rand is weaker at 13.41 to the Pound Sterling, 8.25 to the US Dollar and 10.77 to the Euro. We are about flat here today. Treading water. Looking for something "new". Sasha Naryshkine and Byron LotterEmail usFollow Sasha and Byron on Twitter011 022 5440

No comments:

Post a Comment