To market, to market to buy a fat pig. Locally, here in Jozi, Jozi 26o 12' 16" S, 28o 2' 44" E we had a cracking day. Stocks were up a percent and a quarter to an all time closing high of 37909 points. As I said, a whisper away from 38 thousand. We are possibly unlikely to see that early in the session today, we will have to wait a little bit longer. Leading the charge here locally were the resource stocks which rose two and one third of a percent. Gold stocks were buoyed by the Gold Fields news, another of the majors, AngloGold Ashanti rose nearly 4 percent. I am guessing that they are watching Gold Fields with much interest. Still, over the last five years AngloGold Ashanti is down 13.78 percent. Gold Fields is down 6.38 percent over the last five years. GLD, the Rand gold share price is up a whopping 169 percent over five years. This was Nick Holland's point yesterday, gold companies need their time in the sun again, relative to the price of bullion.

This WSJ article, titled Gold Fields Tries to Divide and Conquer makes a rather telling point: "Besides this year's violent labor unrest, that gap also reflects structurally higher costs for older, labor-intensive mines there. Wages account for 53% of South African cash costs, compared with a global average of 25%, according to Credit Suisse" The main reason must be because of two things, our mines are different from the rest. Deeper, more dangerous and more labour intensive, so hence the labour cost element is going to be higher. But I suspect that the point is worth noting too. Talk late yesterday however was the one also about consolidation in the South African mining industry: Sibanye Gold, Gold One deal 'on the cards'.

Over the seas and far away in New York, New York. 40o 43' 0" N, 74o 0' 0" W, there were some pleasing data points. One was GDP, which missed the expectations that had been revised higher. Bob McTeer had a good take on GDP in the US, here goes his piece: The Third Quarter GDP Revisions–Better, But Not By Much. Better is better is my sense, that is all that I care about. There was another housing read that was again a multiyear high, plus as Mark Perry points out, Lumber prices are up 35 percent this year: More signs of a housing recovery: Rising pending home sales and lumber prices. Nice. But, the naysayers will point to lower rates being the main drivers.

There was of course the fiscal cliff issues, a WSJ article from last evening showed us all that these negotiations are going to be more than prickly: Obama's Cliff Offer Spurned. The GOP said no and passed for the time being, without having presented the president a plan of their own. I am guessing that is imminent.

There was a wonderful interview with CNBC and Warren Buffett the other morning (their time) and Buffett made some great points. He was together with his old friend and longest serving Fortune employee, Carol Loomis. There are some juicy bits in the CNBC transcript, if you read further down, past the general banter you get to the meaty lines. Buffett weighs in with his lines about reducing the deficit:

- "Well, the plan would have—would get us in the near future to having 18 1/2 percent of GDP as revenues and 21 percent of GDP as expenses. We've had that plan basically in effect since World War II. I mean, it's bounced around a little bit, but that—those two levels, 18 1/2 and 21 are sustainable in the sense that they will not increase the ratio of the national debt to GDP. They'll run a deficit every year, but because our economy grows, 18 1/2 and 21 is a—is a very sustainable figure. In fact, it'll probably bring down the debt to GDP over time."

There is however something wrong with the American tax code, Buffett said that the tax that he has paid in the last decade is less than it was when he was in his 30's and 40's, surely there is something wrong with that? My absolute favourite part however was when Andrew Ross-Sorkin asks him about investing. The question goes along the line "what are you doing about the fiscal cliff". The answer after having first said, it doesn't change anything, is as expected: "The fiscal cliff has nothing to do with long-term investment decisions." Thanks for telling everyone what they should know already, but for whatever reasons "investors" (no they are not) sell the market off on anxieties over the fiscal cliff is the dumb headlines that I read. All presenting opportunities I guess. And then Loomis says that she bought Berkshire Hathaway stock in the early 70's and never sold. See, you don't have to be incredible, you just have to be patient. Granted that the Berkshire has been an amazing investment, but you get what I am trying to say.

- Byron's beats

Browsing through my daily market feed links this morning I came across this interesting article titled Mobile app sales exceed $30 billion by the end of the year. Wow that is a lot of money for an industry that is so young. That is already half the 2011 video gaming industry. It includes revenues from all the major app stores like iOS, Android, Windows and even Blackberry. Just a little off topic sideswipe at Blackberry, did you see this quote from Yahoo! CEO Marissa Meyer yesterday? "We literally are moving the company from BlackBerrys to smartphones. One of the really important things for Yahoo's strategy moving forward is mobile." Ouch, from the pioneer of the Smartphone to this, it's tough out there in the technology industry.

Back to the article, what's interesting is that figure is double what we saw in 2011 and as you can imagine, this growth is still going to be huge in the future. In case you were wondering, this revenue includes all app sales, subscriptions, in-app purchases and advertising revenue. It is an amazing business with so much potential. I use apps every single day and once you have those credit card details loaded it is so easy to carry on making purchases, whether it is new apps or in app purchase. Recently South African iOS users now get their app prices in Rands where it used to be Dollars. These things really are cheap and when buying an app for R7.99, one doesn't think twice. On my iPad I also buy all my magazines (R25 for the Getaway) whereby the app that provides that service will certainly take a cut. These are examples, the options are endless.

What really excited me about this article though is the emergence of a multibillion dollar industry that did not exist a few years ago. It's an industry that creates jobs, but you have to be proactive and entrepreneurial. Nothing wrong with working from your garage if you bring in the money. It is an industry that makes us as humans more efficient. Most apps are geared towards making life easier.

I guess what I am trying to get at is that people must stop complaining about mechanisation stealing jobs in the manufacturing and farming sectors because as one industry evolves to less labour intensive ways other industries pop up out of nowhere. And all with the goal to make our standards of living better. Humans are the most adaptable species on the planet so either you embrace it or fight a losing battle.

Digest this linkfest.

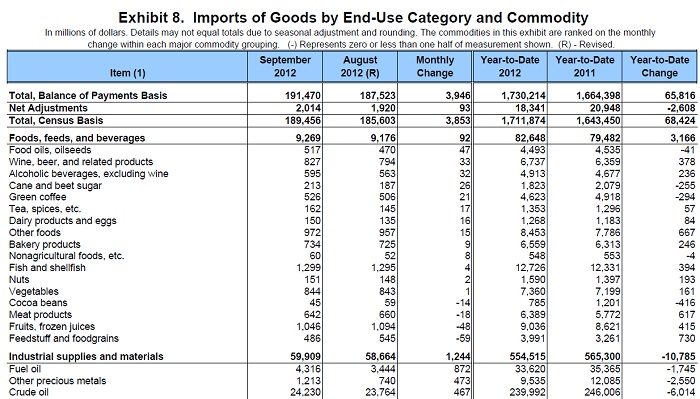

The headline says it all, this via my old favourite Mark J Perry: Energy facts of the week: oil production highest since 1994, oil imports lowest since 1992, and oil jobs highest since 1988. Why I think that this is important is because it goes a long way to addressing their (the USA's) trade deficit. If you look at the U.S. INTERNATIONAL TRADE IN GOODS AND SERVICES September 2012, scrolling down to Exhibit 8. Bear with me here, I have a point. Read the last item on the image that I hacked from the foreign trade table:

That is the single biggest reason why I think that the changing energy landscape in America is so very important for them, especially their trade deficit. But, with most things in life adoption of less expensive energy methods only comes when the alternative is cost effective, and this has taken some time. Now I wonder if we could present this evidence to the local lawmakers urging them to go ahead with hydraulic fracking. Provided the folks extracting the gas build both renewable power and desalinisation plants. Small scale of course, you can't expect the majors to do everything.

I found you might like this post, via Pragmatic Capitalism, a guest post from a website called Sober Look, which I also subscribe to the posts. The post is titled: How Spain Ended up With 25% Unemployment. The finding from the New York Fed was twofold, firstly the construction industry employed too many people and secondly, the lack of a flexible work force. The second one is very familiar back home, and I say that with a sweeping generalisation. What is of course unknown in South Africa is whether or not a free labour market would make a big difference to unemployment. As long as the labour unions are an integral part of government, it is not going to happen.

This is very useful commentary, but the conclusion leaves me believing that almost anything could happen in the next five years. Still, it is worth a read. China's Coming Growth Tests is written beautifully by Yu Yongding, who is a former insider at the People's Bank of China. Useful stuff like I said, conclusion, well, iffy. To me anyhow.

Crow's nest. We are slightly lower here today. What I do see however is some commentary from Mario Draghi, which suggests that things are getting better in the Euro zone. Who would have thought? That last comment is oozing with sarcasm. As I type that, some fellow on the screen says that fear is through the roof. Yeah, good luck with that buddy. Oh, and good luck to both Paul and Byron going to the Lady Gaga concert tonight. Me, not so much into that!

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440