Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. We were lower for most of the day, nothing too awful, but the same concerns have been ongoing. You know. Europe having kicked the can really hard down the road, that sort of talk. So debt swaps are seen for most people as kicking the can down the road, I can't imagine that when General Motors bond holders took cents in the Dollar on their corporate bonds, they thought it was a good idea. Better than getting nothing. In a European context, what do you think is better from here? I have just also seen a chat moderated by David Tweed, the Bloomberg London Economics editor involving himself and guests Jim O'Neill and Nouriel Roubini, at the beautiful lake Como in northern Italy. Certainly, for all the woes of Europe, the place still looks incredibly beautiful. And as I often say, people want to live there as opposed to North and West Africa, where there are large growing communities of immigrants. That chat between the two should be up somewhere shortly.

We had the end of the SARB's MPC meeting with the interest rate announcement yesterday. The decision after all was said and done was to keep rates on hold, the repo rate would remain at 5.5 percent, and the main banks would then keep the prime interest rate at 9 percent. I think the tone of the statement was a little more upbeat, there were tweaks to the outlook for growth, in the positive column, that was the first time I have seen a subtle upgrade to growth. All I am saying is that if the change to growth had been lower, the headline would have read, "SARB lowers growth outlook". But the headline in reverse makes for less appealing reading. Somehow, humans are drawn to the morbid details in life. This Statement of the Monetary Policy Committee is not that morbid, as I said, a little more upbeat.

The line, slightly better outlook than previously expected sets the tone to tell us that growth for this year has been upgraded: "The Bank's GDP growth forecast has been revised marginally upwards to 3,0 per cent in 2012, compared with 2,8 per cent in the previous forecast, mainly as a result of a slightly more favourable global outlook, which remains uncertain. The growth forecast for 2013 has increased from 3,8 per cent to 3,9 per cent." OK, that is nice, but tell me a story (as my father in law would say) here, what will the forecast be at the end of this year? If "things" continue to improve this year, then I expect that rate to be raised even further. In a South African context somewhere around five and a half percent growth should be the magic number that we try and gravitate towards. That number of course has not been reached for a while.

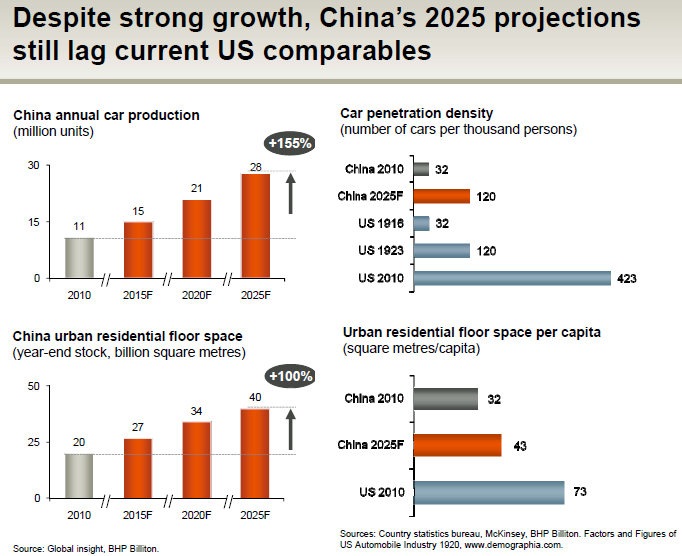

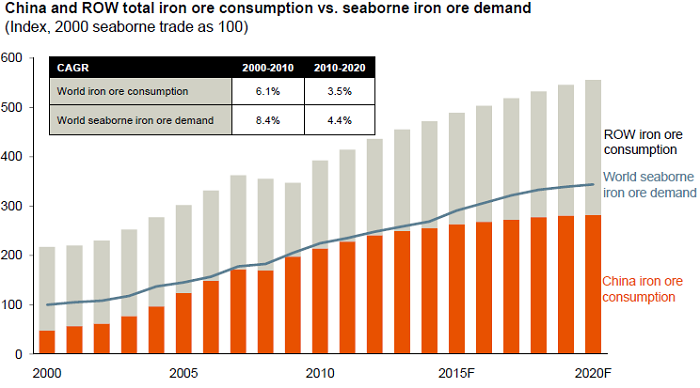

So, what are the other important take aways from this statement? No change, no change likely for a while in interest rates, oil price shocks remain a major concern, inflation seems to be anchored just outside of the target range and the MPC are keeping a close watch on all of these factors. Plus, the stodgy situation in Europe, closer to some sort of resolution than not is also being watched. By all of us, expect the ceiling on the various funds to be raised over the weekend. Spain presents their budget today in the face of one third of the population having taken to the streets in protest to the austerity cuts. And of course the small matter of China. Some folks call it a slowdown, I call it a less steep ascent. Slowdown points to negative growth. So, if anything changes with any of these things expect the Reserve Bank to act. I would think that based on all the new information that we have, the Reserve Bank is more likely to hike rates next, and that would mean that the economy is showing signs of improvement. When that is coming however, that is perhaps the nerdy debate amongst economists right now.

Byron's beats takes a look at the MTN response, released a little after market yesterday.

- Yesterday MTN released a SENS in response to the Turkcell allegations headed MTN to oppose Turkcell claim; reaffirms commitment to independent Hoffman Investigation. That pretty sums up their stance, deciding to stick to their guns. The SENS goes on to describe what MTN know about the Turkcell law suit.

"While the claim has not been served on MTN, MTN understands that a claim has now been filed by Turkcell in the US courts against MTN and its wholly owned subsidiary, MTN International (Mauritius) Limited, in which Turkcell claims no less than US$4.2 billion, plus interest and punitive, consequential and other damages in connection with the award of the second GSM licence in Iran to Irancell."

What does $4.2bn mean to MTN? It's big. For the year ending December 2011 they made $3.2bn in earnings. And as I mentioned earlier, Iran forms a big part of MTN's future plans. Did you know that they have a population of 75 million? That is a big country. MTN still find no merit in these allegations and are ready to fight it in court.

"MTN continues to believe that there is no legal merit to Turkcell's claim and no basis for such claim to be brought before a US court. MTN will accordingly oppose the claim. MTN further notes the South African government's denial of the allegations that MTN exercised influence over it."

Their defence mechanism is going to be based around the Hoffmann committee which has already begun its investigations and tried to engage with Turkcell.

"In advance of Turkcell filing its claim, MTN announced the formation of an independent committee, under the chairmanship of the internationally renowned jurist, Lord Hoffmann, to investigate Turkcell's factual allegations. The Hoffmann committee has already begun its investigations and will report its findings to the MTN board, together with any recommendations as to actions to be taken as a result of its findings, including as to their publication. The Hoffmann committee has invited Turkcell to participate in its investigation, but Turkcell has to date not done so. The invitation remains open to Turkcell to participate in the Hoffmann committee's investigation."

There is a lot of copy paste here but everything needed to be read. Am I confident in their response? Again how can you tell? Unless you have inside information we are stuck on the sidelines. My gut says Turkcell are clutching at straws. Especially by filing this in the US and trying to involve US law. I do not see how the US can have jurisdiction. Not that I am an expert. We will carry on holding this one with caution. For further reading Mail and Guardian published another piece yesterday evening

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Phew, poor Research in Motion. Ironically the company is located in a town by the name of Waterloo, in Ontario, a province of Canada. Now it all depends who you are, but at the battle of Waterloo (in Belgium) it would have been better to have been the Duke of Wellington, rather than Napoleon. Research in Motion have kind of done this backwards, having experienced their Elba, and about to try and make a comeback, will there ultimately be a St. Helena moment? Post Waterloo? The history buffs will know what I am talking about. The company talks about having shipped 11.1 million handsets last quarter, that is around a 21 percent drop in handsets from the prior quarter. Amazing! Phew, but strangely, this was ahead of peoples overly pessimistic forecasts.

They do say that they also shipped 500 thousand PlayBooks, most sold through deep discounts. They also took a hit from a charge taken from inventory valuation related to the Blackberry 7 product. Meaning that they think it is less than initially thought. Thorsten Heins seems upbeat. He has only been in charge for two months, as of today he is left with fewer senior execs. Including long time former co-CEO, Jim Balsillie, he is departing. As is the chief technology officer, he is leaving the business after 13 years in charge, a fellow by the name of David Yach. Jim Rowan, the global operation chief operating officer is also on his way out. Sad. But I guess Heins is doing some long broom cleaning here.

I do not know what to say about RIM, they have posted a loss of 125 million Dollars for the quarter, mostly through write downs. Their products are no longer the only business tool, both Android and Apple have left them in the dust. I suspect that RIM will make a comeback of sorts, but at the expense of who? I often see throwaway comments that people swapping from their beloved "crackberry" to a superior phone, be that an Android or an Apple product. For the time being whilst the business goes through all these changes, I expect them, like Nokia, to hang onto the customers that have not already migrated to other handsets.

The Business Insider had this nice piece: RIM MISSES BIG ON REVENUE, STOCK TANKS. The stock did pick up a little. But the worst part is that there is no more guidance from RIM, because things are just going to be awful. Perhaps this is a moment to pounce, perhaps wait for the beast to really be on its knees before you see a bid.

Besides, like I pointed out this morning, the market cap of RIM is three and a half billion Dollars less than newly listed LinkedIn. As I tweeted this morning: Apple is worth 79 times more than Research in Motion. In June '08 Apple was worth roughly 2.2 times more than RIM. Since then RIMM down 88%. Wow. RIMM has crashed and Apple has taken off. And the customer has spoken. When I kept telling my friends 24 months ago, they kept telling me I was wrong. Only the brave would be attracted to the stock right now, in hoping that ultimately an HP Palm type tie up would unlock some sort of value. Not for us.

Currencies and commodities corner. Dr. Copper is last at 383 US cents per pound, not really going anywhere for now, that has been my perception for a while. The gold price is last at 1664 Dollars per fine ounce, slightly higher on the day, the platinum price is also higher, last at 1643 Dollars per fine ounce. The oil price is last at 103.44 Dollars per barrel. The Rand is firmer today, 7.66 to the US Dollar, 12.27 to the Pound Sterling and 10.23 to the Euro. We have started higher here, as a result of a better finish in New York.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440