Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. We celebrated Human Rights Day yesterday, some said on the wireless this morning that the day should still be remembered as Sharpeville day. After the events that the day is associated with, those awful events that took place back in 1960. Hurting on Tuesday too was the BHP Billiton comments from their slide presentation in Perth, I showed you two of the slides that I thought were important, obviously slowing to only single digit growth in iron ore saw folks sell the sector hard on Tuesday, as a whole down nearly two and a half percent. In case you missed it -> BHP Billiton iron ore presentation spooks Mr. Market.

And that led to the rest of the market falling hard, because that is what tends to happen, our market still is a top heavy commodities market. The Jozi all share index closed down 0.98 percent on the day, a loss of 335 points to 33878. Eish, more not so good news in the form of Chinese flash PMI from the fellow over at HSBC this morning. At face value at least, but drill down a little further and you always get the real news. Because of the underperformance of the commodity stocks relative to the rest of the market, the swing from the commodity producers in importance has been somewhat diluted. In our market at least. Remember that BHP Billiton is underrepresented in our market, globally the market cap is around 180 billion Dollars. But here the market cap is only 509.5 billion Rand, it is not the two different listed entities, that would include the Sydney one. Whereas, the British American Tobacco market cap is fully accounted for here, 783 billion Rand, the weighting is not.

The service for all the weightings used to be free, but sadly is not anymore, the description of the constituent data on the JSE website is as follows: "This service provides subscribers with a file which contains information on all the index constituents, inter alia the constituent name, the ISIN and Exchange Code, the closing price, the total market capitalisation, the investable market capitalisation (the total market cap adjusted for free float), the number of shares in issue and the percentage weight of the constituent in the index"

The top ten companies by market cap on the JSE make up nearly 52 percent of the overall index. Meaning that the other 366 stocks listed on our exchange make up the balance, 48 percent of all the listed stocks weighting by market capitalisation. Taking that one step further, the top 20 stocks account for just over 68 percent of the overall JSE by market capitalisation. And the top 40 companies by market cap account for 81 percent of the overall index. So 336 companies below them collectively account for 19 percent of the value on our markets. And probably less by traded value, because of a tight ownership structure of smaller companies and low liquidity. Astonishing. So we should only talk about the same top companies, as boring as it is, because they constitute all the value. Imagine giving a third rate winger for a social club team the same time of day as Lionel Messi. Imagine.

Beijing central. 39o 54' 50" N, 116o 23' 30" E Flash saved everyone of us according to the guys at Queen who wrote the song for the movie, which was as far as I understand it, the only good thing about that movie. Talking Flash, the HSBC flash PMI for China was released this morning, and it disappointed. This number is by far and away the focus point today. Here it is sports (and food) lovers, the official HSBC Flash China Manufacturing PMI. Immediately when I saw this on my twitter stream earlier this morning I thought, right, time for the Chinese authorities to cut the triple R again, remember that they have done it once already this year. Without much fanfare at the time, I think that there was bigger news just then.

So the report shows a contraction in new export order, which is a change, but weirdly shows signs of employment growth, also a change. With input prices the same and output prices contracting, hey presto, the authorities can wait for the official release closer to the end of the month and make a decision from there. Although I will tell you something, the official report differs from the HSBC report, and there has been some divergence over the last few months. Whilst you might think, oh dear, this is another read under 50, the silver lining is that this is a four month high. And that perhaps accounts for the increase in employment, "things" might just be getting better, and not worse.

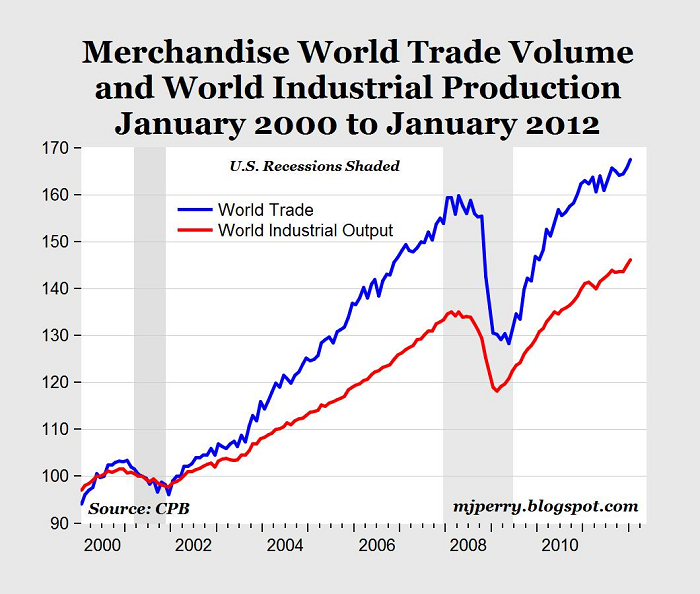

I love this blogger, Mark J. Perry and his blog, Carpe Diem. Perhaps because he is an optimist, but then again, as a collective we all are. Otherwise we would all still be sitting in the cave wondering what our next move is. Or not wondering in fact, just eating the same old stuff. This is his latest piece, titled World Trade and Output Set New Records in Jan. But what about hard landing in China, European recessionary concerns, all of that jazz? Well, take a look at the picture and you can see the heavy fall off in 2008 and 2009, but the bounce back now sees world trade volumes and world industrial output at an all time high. Now obviously we only compete with ourselves, as far as I know it, the aliens on Mars are very secretive about their industrial production data. Ditto the ones on Mercury, it is too hot to collect statistical data there.

But check out the graphic, courtesy of the good professor and his blog, which you should subscribe to -> CARPE DIEM - Professor Mark J. Perry's Blog for Economics and Finance

His conclusion on the data: "Both world trade volume and world industrial output reached fresh record monthly high levels in January. Trade and output are now far above their pre-recession levels, providing evidence that the global economy has made a complete recovery from the 2008-2009 recession. For the U.S., the annual growth rates for exports (10%) and industrial output (3.5%) reflect the underlying strength in America's manufacturing sector."

Notwithstanding the few hiccups we have had in the commodities space so far this year, the talk on the screens is that we have moved from a space of fear to one where people are talking about the selling of fixed income in favour of equities. We are actually having that conversation. With intelligent people on the screen. But, that means that the people who are paid vast sums of money to manage err.... money, are emerging from the woods. And in desperate need of a wash and a good meal, the hiding perhaps is over.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Oh dear, Jim Skinner the McDonald's CEO has announced his retirement. He has been at the company basically all of his working career, four whole decades. At retirement, his last day at work will be 30 June 2012, he would have been running the company for seven and three quarters of a year. And who is going to supersize Jim? Well, none other than current Chief Operating Officer, Don Thompson, this is a classic McDonald's move. Hey, don't say that they are nothing other than predictable. Just like their burgers. Predictable.

Currencies and commodities corner. Dr. Copper last traded at 377 US cents per pound, the gold price is now higher than the platinum price, at 1636 and 1615 Dollars per fine ounce respectively. The oil price is lower, last at 105.74 Dollars per fine ounce. The Rand is weaker at 7.73 to the US Dollar, 12.21 to the Pound Sterling and 11.21 to the Euro. We have started much lower again here. Chinese anxieties.

Parting shot. I had a light bulb moment when chatting to my dad about the encyclopaedia Britannica crowd no longer printing the physical version. It was not to do with the quaint way of accessing information, but rather the world that is Wikipedia. Let me try and explain. Wiki is for free (provided you have an internet connection) and is moderated by a community for free. And if there are question marks about the content, then that is queried by the community. Only the pages that are open to vandalism are locked for editing by the community. Locked from the haters. Just don't be haters yo! There are according to their own website 100 thousand regular contributors, people who watch the news and make it their mission to keep the content up to date. Which lead me in my conversation with my father to believe that these people give their time for free on a platform for free and are forming the most pure form of democracy on the planet. Did I get that right? Anyhow, if Wiki was a country, I would want to live there. Because it seems that there are no politicians.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment