Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. Not helping matters following on from the Chinese "disappointment" was the fact that the Europeans weighed in with weaker PMI data across the zone, and from the two majors, France and Germany. French and German services PMI managed to keep their noses in front of 50, which indicates growth, but manufacturing PMI disappointed, just like the manufacturing data had disappointed earlier in the day from the worlds growth engine, China. From that point on the commodity stocks, which are in a sector that has looked vulnerable, sold off heavily. Paul recounted a day where BHP Billiton had fallen 8 percent in a single day back in 2004 or 2005, strange how we remember the price falling from 84 to 76 Rand (thereabouts), but not the exact date. The reason that they sold off back then was because Chinese growth was seen to be slowing. And Paul said, how many times over the last decade have we been anxious about Chinese growth slowing? At least once a year.

And all the while we continue to see growth ahead of expectations off an ever increasing base. So without dismissing the anxiety yesterday and earlier in the week, we all have several t-shirts associated with this slow down talk. The ultimate plan for the Chinese is to lift their economy to rival the poorer nations in the developed world (Portugal and the like) and there would be more focus placed on internal consumption. I don't get too anxious about the day to day moves, I know we are all human, but perhaps we should just ignore the absolute levels. And pay more attention to the companies and their results slash prospects. After all, we own companies, not share prices? But ultimately we want those share prices to go up a lot more from the levels that we bought them at, and get rewarded by way of dividend pay outs. Yip, that is the end goal.

Byron's beats looks at the large capital raising exercise announced by Shoprite yesterday. That caused the price to fall in a heap. But I guess that was expected.

- Yesterday we had a somewhat surprising announcement from Shoprite who are raising R8 billion. I say this is surprising because the company is in a fairly strong financial position. A closer look tells us why they are raising the money which we will discuss later on.

The raising will be done through an issue of 27.1 million shares at a price of R127.50. This represents 5% of existing shares and looks to raise R3.5 billion. A further R4.5bn will be raised using convertible bonds which are also potentially dilutive. Like Sasha mentioned, the share price took a knock as it converged to the new (lower) issue price.

Here is the rationale from the company. "The net proceeds of the Transaction are intended to be used by Shoprite to strengthen and improve the structure and efficiency of its balance sheet, to enhance working capital management, to continue investment in organic growth initiatives and to selectively pursue acquisition opportunities."

That is quite general but the speculations have started doing the rounds especially concerning the last part 'acquisition opportunities'. Cashbuild has been thrown into the mix by a few reporters. It makes sense. Big rivals Massmart have Builders Warehouse while Spar own Build it. Shoprite do not have a building retailer and the Cashbuild consumer falls well within their target market.

To be honest though I think most of this capital will be used for organic growth. I'm not writing off an acquisition but after seeing interviews with Whitey Basson I get the sense that north of our borders is where the focus is. In countries like Nigeria, where Shoprite are exposed, there is a big lack of infrastructure and not many shopping malls. So unlike in South Africa where the company can just rent, Shoprite will have to build their stores. This will include parking lots, infrastructure, water, cooling, electricity and distribution. Although the base is very low in many of these countries the lack of infrastructure requires massive capital expenditure.

Shoprite are the biggest retailers in Africa with 250 stores in 15 countries outside of South Africa. We know Massmart are targeting this market aggressively with the backing of Walmart. For Shoprite not to lose market share they are going to have to be proactive. With the share price at over 24 times earnings maybe raising capital through equity is not such a bad idea after all.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. Slipping and sliding away on Wall Street, markets globally taking their cue from a weaker Chinese PMI number released from the HSBC guys. I also read a report which was kindly sent to me that suggested that the Chinese were going to look to manage higher commodity prices over time. Well, I thought, they should have thought about that before the price of iron ore went up tenfold over roughly a decade. If anything the great Chinese growth miracle has enabled mining companies to enjoy sustained periods of gains, which have led to them embarking on bigger projects to meet the pending demand. We had a throw away question, who was the biggest and strongest economy in the world in 1700? It was India and then China.

And as a percentage of the overall contribution to the global economy you will be pleasantly surprised. Angus Maddison, a famous economist was featured in the Economist, I remember, with some surprising graphics. The world economy in 1700, according to him, was 371 billion Dollars, in 1990 Dollars. India was 90 billion Dollars, 24.25 percent of all world GDP, whilst Chinas economy was 82 billion Dollars strong, 22.1 percent of global GDP. So, collectively 46 percent plus of global GDP back in 1700. So, all this is, this massive shift in economic growth is a return to the past. Rewind back to 1AD in the same Maddison model and India (32 percent) and China (25.5 percent) account for 57.6 percent of global growth. In fact, Asia (excluding Japan) as a whole accounted for 72 percent of global GDP. But remember that the USA were completely unimportant as far as economic prowess was concerned. Even in 1700 where the USA contributed a paltry 0.14 percent to global GDP. How times have changed.

Nike delivered their third quarter earnings after the race bell last evening. It was a beat which is all the street really seems to care about I guess, EPS for the quarter clocked 1.20 Dollars versus the streets estimates of around 1.17 Dollars. So a comfortable beat. As much as I care about whether they managed to do better than the analyst community thought they would, I also don't get too excited about that specifically, the pitfalls of contracting quarteritis skew what you are trying to achieve. And what we as investors are trying to achieve is buying quality companies in a sector that we like. Nike happens to fall into an investing theme that we like, aspirational consumerism. Or soft luxury in this case, on the local front we like Richemont, which is at the other end of the spectrum.

Nike managed to grow revenues by 15 percent to 5.8 billion Dollars in Q3 when compared to the corresponding third quarter in 2011, 16 percent better on a currency neutral basis, in other words in same currency sales. Headline earnings increased 7 percent to 560 million Dollars, gross margins were squeezed lower by 200 basis points to a still healthy 43.8 percent. Mostly as a result of higher product costs. There were cost saving initiatives in the form of product cost reductions, whilst more online sales decreased costs too. I have no doubt that whilst many of us are comfortable to shop online, many of us have still yet to embrace the future yet. There was of course some shares purchased in the buy back program, 239 million Dollars was spent on buying back 2.5 million shares, well done guys, you got them below 100 bucks. Current price at last evenings close was 110.99 Dollars per share. Good going. Since the repurchase program was announced in 2008, the company has bought back 48.1 million shares for 3.9 billion Dollars. 1.1 billion left to go, I suspect another five quarters. And average price of around 81.08 Dollars per share, that sounds about right.

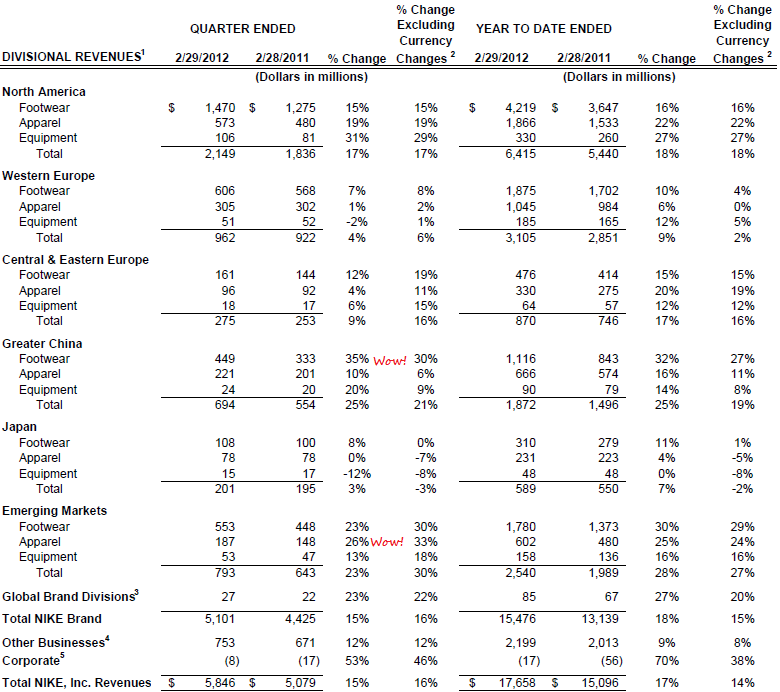

So, sales better, earnings better, margins the only weakness really. And down the line the product pipeline looks really good. The US still is the main part of their business accounting for 2.149 billion Dollars worth of sales, which was a healthy 17 percent increase in regional sales, driven by a 31 percent increase in equipment sales, but more importantly, a strong performance from the core of the group, the footwear (+15 percent) and ever growing apparel (19) divisions. Western Europe, as finished as it is, managed to clock a 4 percent increase in revenue, thanks to a 7 percent jump in footwear sales. Taking to the streets both protesting and getting rid of that frustration, beating the streets I guess. Greater China sales increased 25 percent, with a 35 percent increase in footwear sales driving the overall mix there. Even Japan managed to increase sales by three percent. Emerging markets, which I guess is us increased sales by a whopping 23 percent, much the same as China. Apparel in our segment, not so much in China where I guess you can get cheap clothes all of the time. That is completely Linsane! I mean, you need to find out, if you do not know already about Linsanity.

Take a look for yourself at this graphic that I hacked from their results pdf, which you can find at this link -> CONSOLIDATED FINANCIAL STATEMENTS FOR THE PERIOD ENDED FEBRUARY 29, 2012. The two things to look out for are increased footwear sales in China (Nike shoes!) and apparel in the developing markets, football shirts! Those are growing at breakneck speed. The first two measure the two corresponding quarters against each other, whilst the other two columns are the nine months of the financial year thus far.

Future orders, so that is stuff in the pipeline increased by 18 percent in home based currencies and 14 percent in Dollar terms. And take note of these decent results in a very ordinary year. A very ordinary year across the globe still managed to translate to their main division, footwear, growing revenue by 17 percent. I suspect that as we start to see a little more confidence return, the apparel division should continue to grow even stronger. And if Tiger should emerge from the drought Woods, then expect people to get excited about the golf club buying again. Golf, not for me. But I will beat the streets and kick a ball or two. We continue to accumulate the stock at current levels, even if 23 times earnings looks expensive, it is for a reason, the company is growing exceptionally fast in the poor times.

Currencies and commodities corner. Dr. Copper bounced a little yesterday, last at 3.81 US Dollars per pound. The gold price is last quoted on my screen at 1645 Dollars per fine ounce, the platinum price is below that at 1625 Dollars per fine ounce. The oil price, which took a drubbing yesterday, like the rest of the commodities complex, last traded at 105.82 Dollars per barrel, WTI as per quoted on NYMEX. The Rand is slightly firmer at 7.68 to the US Dollar, 12.19 to the Pound Sterling and 10.22 to the Euro. We have started better this morning, around one quarter of a percent higher.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment