Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. We tried hard throughout the day and managed to close comfortably off the worst levels, but not quite enough to squeeze us into the black. If you want to use accounting terminology, I prefer green and red, that is the colour on the screen. The Jozi all share closed 8 points lower to 34214 points. 0.02 percent lower on the day. Banks were the hardest hit of the lot, down nearly a percent on the news that the regulator is going to be probing the unsecured lending space, with worries that it is growing too quickly. The analysis is expected to come sometime in the second half of the year. And specific reference is made to the big banks. Who is big and who is not?

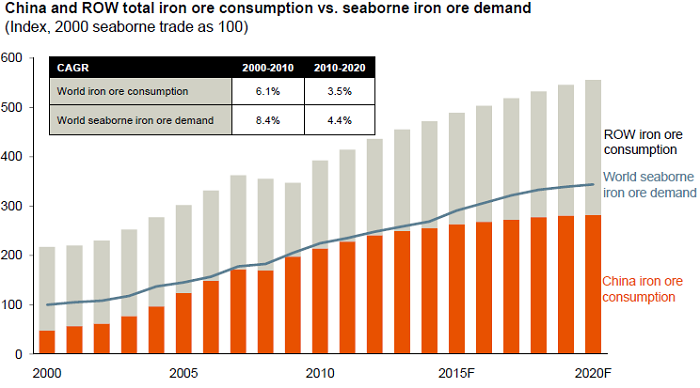

This is very important, pay attention. This morning the fellows from BHP Billiton said that they thought that Chinese iron ore demand would drop to single digit growth, if it is not there already. This is as the Chinese economy continues to slow. Oh dear I hear you say, but wait, because in addition to their current consumption, expectations are that Chinese iron ore consumption will grow at 100 million tons per annum for the next eight years. And in addition to that 600 million more tons to satisfy growth expectations, as well as replacing around 200 million tons of current supply. So that sounds like over one and a half billion tons of iron ore needed in excess to the current supply. Wow. Just to put it into perspective, the chamber of mines website told a friend who told me that more steel is poured in one hour than all the gold ever poured. I am pretty sure that if you did the math you would come to the conclusion that perhaps gold ought to be priced higher, simply because of the rarity.

BHP continued to say that they expect their annual run rate to top the forecast 159 million tons, and to be closer to 165 to 170 million tons. Nice. They also expect a floor on iron ore prices of around 120 dollars per ton. Since November the spot price for iron ore has nearly clocked 150 dollars per ton, and traded as low as 130 dollars per ton. Back in August last year however the price traded at around 177 Dollars per ton, so we have seen a slide since then. So, the share prices of all the iron ore producers have taken a knock, but I think the bigger picture still remains intact. China will continue to grow, but not at the same pace as in the past. All this talk is interestingly taking place at the AJM Global Iron Ore & Steel Forecast Conference in Perth, Australia. The presentation, given by Iron Ore group President, Ian Ashby is available here -> BHP Billiton Iron Ore - Growth and Outlook.

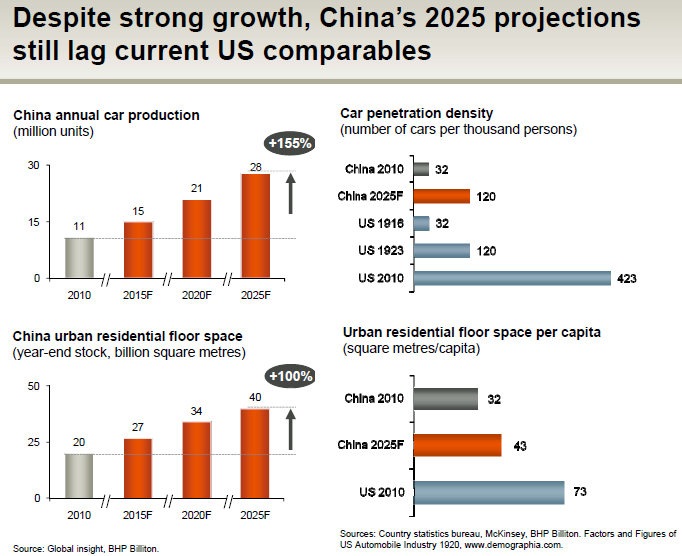

The line about the long term outlook is what I am interested in: "Structural drivers of industrialisation and urbanisation in the developing world remain intact." This chart is eye popping, it compares the US at various junctures with where the Chinese are now. It measures motor vehicle density in the US in 1916, during the first world war, and suggests that in China 2010, the density is the same. Let me get that right, the number of vehicles to population in the USA in 1916 is roughly the same as it is in China now. Wow.

Wow. This next slide however is the one that you have to see, before you get too anxious about all the headlines on the Iron Ore market that you no doubt are going to see today. The next graph is the one you have to see.

Errrr.... slowdown? Where do you see a hard landing? Not really. But I guess it is what it is.

PPC announced an acquisition yesterday of a crowd called Pronto Holdings. The acquisition was actually made back in November, but the competitions authority has given unconditional approval. The purchase price in total is not expected to exceed 400 million Rand, and is expected to be completed in two years times. The first tranche, 25 percent of the purchase price, based on a 5.6 times EBITDA less net debt comes to 70 million Rand. The second tranche of 25 percent will be paid next year and the next 50 percent will be paid in Feb 2014 as far as I understand it. In the official release, the PPC CEO says that this transaction would be value-adding for shareholders and customers of both parties. Both Pronto and PPC. All I can say is that deals happening normally come after the bottom. Or near the top. I am confident to say that we are passed the bottom, we kind of indicated that with much improved cement sales in the last quarter of last year.

Byron's beats explores the South African informal building sector. And a stock that has done fabulously well.

- This morning we had 6 month results from Cashbuild. Remember that they released a trading update two weeks ago that got me very excited about the valuations of this fabulous business. Here was my analysis of the update which also covered the financial details of the BEE transaction. I'm not going to go through that again, we will just use headline earnings per share for comparative purposes.

The results came in the middle of the range with headline earnings per share up 24%. This equated to income of 158 million from R5.6bn of revenue which had grown 9%. Per share earnings equated to 661c with 296c paid to share holders. Like I mentioned in the update, this puts the company at some very attractive valuations. If you annualise these earnings with a dividend cover of 2 (which I think is a realistic assumption) you get a forward PE of 9.2 and a dividend yield of 5.5%. This for a retailer is fantastic.

Let's look at where the growth came from. "Stores in existence since the beginning of July 2010 (pre-existing stores - 185 stores) accounted for 8% of the increase in revenue with the remaining 1% increase due to the six new stores the group has opened since July 2010. Despite the competitive environment, gross profit percentage margin increased to 22.8% during this half-year and was higher in percentage terms than the 22.3% achieved for the comparative period of the prior year. Operational expenses for the half-year remained well controlled with existing stores accounting for 6% of the increase and new stores 1%. The main contributor to the increase on existing stores is the people cost component in order to maintain and improve customer service standards."

So good management and cost cutting resulting in a company that is more efficient and profitable. And how do the prospects look? "Management remains positive about the top line trading prospects for the next quarter. The first nine trading weeks since period-end have reported an increase in revenue of 10% on that of the comparable nine weeks."

I don't want to sound repetitive because I did talk about the fundamentals behind this company in the update but I really do like the sector. This company has captured the core of the up and coming middle class in South Africa. They have situated their outlets in the right areas and got the pricing spot on. Your home and comfort is a priority and one of the first things you invest in when you get more economic freedom. Home improvement has become a South African pastime, like braaing. At these levels I would definitely be adding.

I think that spend is the wrong word here. Apple might be buying back shares to the tune of 10 billion Dollars, using shareholders cash, neutralizing employee equity grants and stock purchase programs for the same said employees, but the other 35 billion Dollars is expected to be used for dividends. Apple has announced that they will start with a not so modest 2.65 Dollars per quarter dividend. Sure, it sounds modest when you annualize that (10.60), and then work out the yield at the closing share price (601.1 Dollars, a record high), you get to a yield of 1.76 percent. Hardly a kings ransom, but to put it into context, when Cisco announced that they were paying a modest quarterly dividend of 6 cents per quarter, the annual yield was around 1.3 percent at the time.

So does this mean that the company is ex growth? Nope, what it does mean is that there was building pressure from stock holders for Apple to do something with their cash, and in this case it is their domestic cash of course. Domestic being US cash. Because their foreign cash cannot be brought back home to the US, without being taxed again. And Apple will continue to reinvest in their business rolling out retail stores, spending wild sums on R&D, building their own infrastructure and continuing to spend the necessary capex on their supply chain, Tim Cook explained. This was just another part of their cash redeployment, this time to the rightful owners, the stock holders. I know that some people think that the board are better placed to make decisions re the companies cash, but it has been shown that stock holders make better decisions. Why? Because naturally it is theirs.

The stock price initially took a tumble as soon as they became unsuspended in pre market trade, around 30 minutes before the opening bell, but in normal trade on the spot market the stock opened up and proceeded to close at the record high of 601 dollars and ten cents. Leaving you with a mind boggling 4718 percent return over exactly ten years. Err.... what is that measured in gold.

And to add to the excitement, the company announced that they had the very best "new iPad" launch ever, selling over three million on the first weekend alone, take that at one million per day, because the launch was Friday morning. The run rate last quarter on a daily basis was roughly 167 thousand units a day, so iPad sales were six times hotter than usual over the weekend. And to think that the new tablet goes on sale in an additional 24 countries on Friday. Don't ask when it is coming here, I do not know. Ask the people at the Apple stores around the land, and you get the same answer, they do not know either. The launch everywhere is very secretive, it is the allure of the product that keeps them comfortably ahead of the pack.

So do you still buy the stock? Well, for what it is worth, the few analyst reports that I have seen suggest somewhere in the region of 43 Dollars worth of earnings in 2012 and nearly 51 Dollars worth of earnings in 2013. At 600 Dollars a share that suggests a forward multiple of less than 14 times and a historic multiple of 17 times earnings. Cheap? For a company that is growing so fast, definitely cheap. The two major risks for me are growing legal risk and regulatory concerns and the most important one to watch of course is increased competition. For the moment it is a Sergey Bubka type scenario. Who still holds both the indoor and outdoor polevault records, set in 1993 and 1994 respectively. Yes, vaulting to new highs, careful of the Olympics though. He won gold in 1988 in Seoul, but never again through to his retirement in 2001. We continue to buy the stock, but take note of the risks.

Currencies and commodities corner. Dr. Copper is last at 386 US cents per pound, the gold price is steady at 1654 Dollars per fine ounce. The platinum price is a little lower at 1670 Dollars per fine ounce. The oil price is also a touch lower at 107.45 Dollars per barrel. The Rand is weaker this morning, but I get the sense that all commodity prices and by extension our currency has been hanging around these levels. 7.58 to the US Dollar is where last the currency traded to the US Dollar, 10.02 to the Euro and 12.02 to the Pound Sterling. We have started worse today, no surprise that the commodity stocks are taking some heat.

Parting shot. I liked this a lot. I am not too sure what it means however. It is an article titled New Restaurant Index Suggests Improving Economy. Not here, but in the US. Because as the article implies, when people are feeling better about their earnings power they are more likely to go to formal restaurants and not informal ones. However, do you remember the McDonald's same store sales in the US in February, it was a vastly better number than expected. So I would take it a step further and suggest that the whole sector is experiencing some uplift. But it makes sense. Things are getting better.

Sasha Naryshkine and Byron Lotter

Email us

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment