Jozi, Jozi. 26o 12' 16" S, 28o 2' 44" E. It was an improvement throughout the day, first the German based IFO report showed that "things" were improving in Europes biggest economy and then perhaps the most exciting event all day was the Bernanke speech. It really was a day, other than those two events and the Spanish regional election results completely devoid of news to digest. Instead it was scraps, and you got the sense that those tasked with the news jobs were scratching like chickens do when looking for grubs. Ever hopefully two and then one scratch with opposite feet. Markets turned green by two in the afternoon, and continued, albeit slowly to gain a little traction. The Jozi all share index managed to by the end of the market tack on 92 points to close up shop at 33664, a percentage gain of 0.28 percent.

New York, New York. 40o 43' 0" N, 74o 0' 0" W. There was of course "the Bernank", or the commentary from him, Ben "the measured" Bernanke delivered a speech that changed the tone of the whole day before we even started. It is kind of crazy if you think about it. Ben Bernanke tells us that the Fed are ready to act and that the labour markets are better than most people thought. Yes, we have been paying attention and watching the same data. But Mr. Market and all the participants suddenly get the faith and send all the major markets much higher on the day. What? That almost sounds crazy and I was definitely scratching my head. Surely we could have or should have been trusting our own instincts and in seeing the same data come to the same conclusion? But yet we see headlines like this: Hedge Funds Capitulating Buy Most Stocks Since 2010. The article came to me via a counterparties RSS feed, and there was a cheeky headline that said "Smart money" joins the long crowd. Smart indeed.

OK, so here is the speech that Fed chairman Ben Bernanke gave yesterday that has gotten everyone so excited across the globe. Here is the speech available for anyone to download off the Federal Reserve's website -> Recent Developments in the Labor Market. The best part of the speech was that there were a whole host of cute slides attached to the speech.

Before I get into that, there are some very interesting and important comments that Ben Bernanke makes about long term structural unemployment, something that this great country of ours (South Africa) is cursed with. Listen in and see if this sounds at all familiar.

- "Long-term unemployment is particularly costly to those directly affected, of course. But in addition, because of its negative effects on workers' skills and attachment to the labor force, long-term unemployment may ultimately reduce the productive capacity of our economy. The debate about how best to address long-term unemployment raises another important question: Is the current high level of long-term unemployment primarily the result of cyclical factors, such as insufficient aggregate demand, or of structural changes, such as a worsening mismatch between workers' skills and employers' requirements? If cyclical factors predominate, then policies that support a broader economic recovery should be effective in addressing long-term unemployment as well; if the causes are structural, then other policy tools will be needed. I will argue today that, while both cyclical and structural forces have doubtless contributed to the increase in long-term unemployment, the continued weakness in aggregate demand is likely the predominant factor."

Wow. What does he actually mean by all of that? Well, clearly the first part is understandable, being out of work long term is awful to the individual concerned and it does very little for their skills development, that much we can definitely understand. But the impact on productivity to the overall economy is even worse, because quite simply when folks re-enter the workforce, their skills at the companies expense need to be brought back to the level required. And by doing that, you impact on overall productivity. Sound familiar? You betcha! OK, but the second part, the questions that Ben Bernanke asks, and then concludes that weakness in aggregate demand is to blame. OK, what is aggregate demand?

Definition time, from Investopedia: "Aggregate demand is the demand for the gross domestic product (GDP) of a country, and is represented by this formula: Aggregate Demand (AD) = C + I + G + (X-M)

C = Consumers' expenditures on goods and services. I = Investment spending by companies on capital goods. G = Government expenditures on publicly provided goods and services. X = Exports of goods and services. M = Imports of goods and services." Also known as total spend of a country. So what the Fed plans to do then is continue to maintain their accommodative monetary policy stance, which should continue to lower the overall unemployment rate. Now the question is asked, why? Why should the Fed do this?

In the explanation, from the Feds pdf site: Monetary Policy and the Economy, "The Federal Reserve sets the nation's monetary policy to promote the objectives of maximum employment, stable prices, and moderate long-term interest rates. The challenge for policy makers is that tensions among the goals can arise in the short run and that information about the economy becomes available only with a lag and may be imperfect." So, quite simply, they will act with a mind to make sure that these factors are balanced. Seeing that rates are rock bottom and prices are stable, then it is best to act to promote maximum employment. Because that is in the interests of all Americans, which also includes the White House. So no, Bernanke might be a political appointment, but he accepts the job based on his own views and in his desire to be a civil servant. He could have stayed at Princeton and earned more. No really.

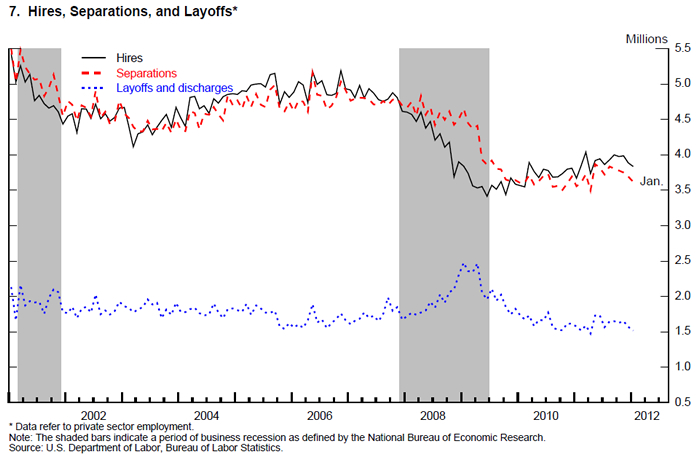

What Bernanke said was interesting. "And the unemployment rate in February was still roughly 3 percentage points above its average over the 20 years preceding the recession. Moreover, a significant portion of the improvement in the labor market has reflected a decline in layoffs rather than an increase in hiring." See that, the twenty year long term average is around 5 percent, so there is loads of work for the Fed still to do, in order to get there!

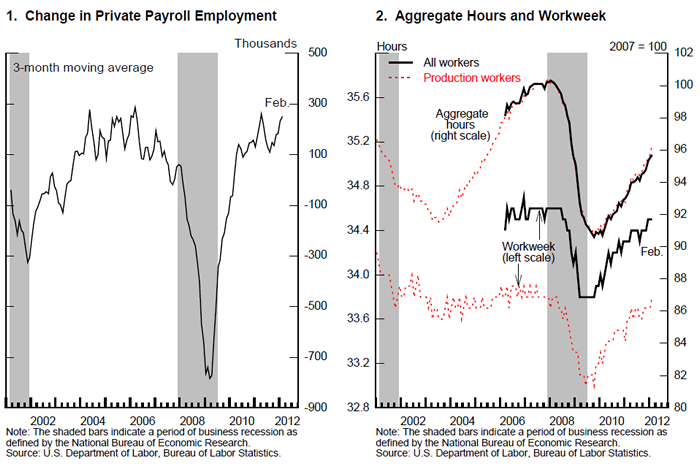

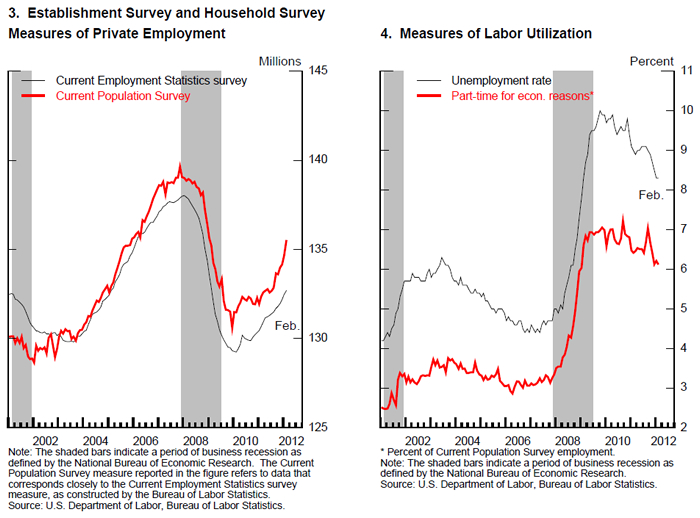

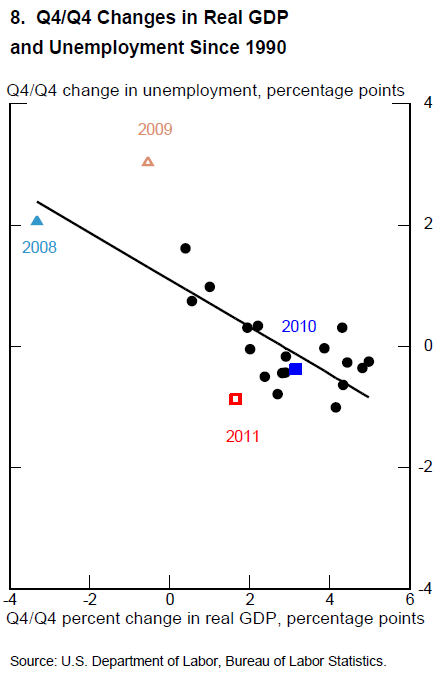

OK, people will still shout that the US has kept an accommodative monetary policy, or simply been too loose. That is the choice that they took, better than the 1930's choice. Let us search and look at those Bernanke graphs that were attached to the speech. First one, which I thought was very interesting, because as private payrolls start to improve (number 1 graph titled Change in Private Payroll Employment), so labour utilization drops (number 4 graph, titled Measures of Labor Utilization). But that is obvious.

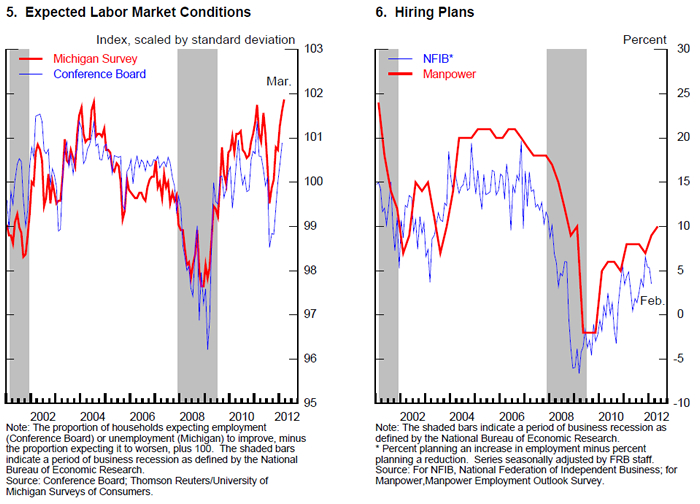

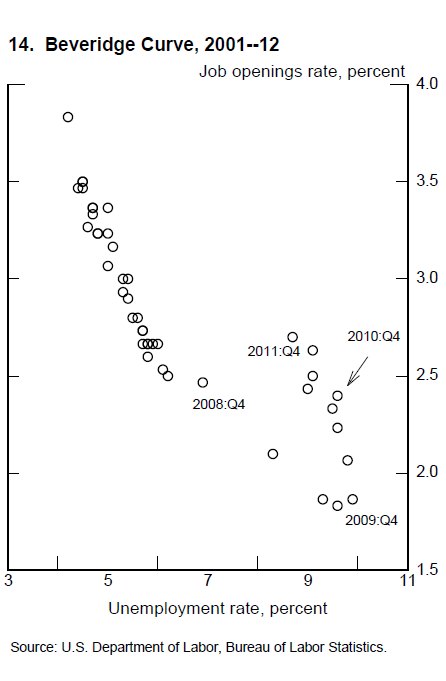

And then the slides go on, let us look at the balance of the slides, in succession, all visual today:

OK, and now the picture that started the whole conversation. Long term unemployment and duration of unemployment. This graph makes for the most horrible looking at. Because the levelling off is one thing, but we are hoping for a decline at some stage. My spider sense intuition tells me that it is coming. And you can see that in graph 13, Probability of reemployment by Duration of Unemployment.

The jobs opening rate from the very last visual attached to the speech is starting to improve as the unemployment rate falls away.

I am now pretty sure that you have a complete information overload. Too much information and graphics, but that was intentional, this was the single biggest event from yesterday. And this made markets across the globe go completely bananas and buying giddy. And strangely, a whole lot more bullish than before.

Currencies and commodities corner. Dr. Copper is last at 385 US cents per pound. The gold price of course rocketed on the whiff of whatever it is that folks who trade the precious metal think that the Fed is going to do now. QE3 you know. I keep saying, they never built that ship. The gold price is last at 1689 Dollars per fine ounce. The platinum price is last at 1658 Dollars per fine ounce. The oil price is also higher at 107.26 Dollars per barrel. The Rand is firmer as Mr. Miyagi says that it is risk back on, 7.55 to the US Dollar, 12.06 to the Pound Sterling and 10.09 to the Euro. We are better today, our markets, but not as much as before, because there was a Spanish and Italian bond auction that seemingly did not go ahead in the same way as other expected. Sigh, who knows.

Parting shot. I have spoken about the human element often in markets and in business, the future innovation that people are creating today. And then this is confirmed when you look back in time at what has happened. Now I am referring specifically to a piece I found via Carpe Diem that points to a dramatic jump in fuel efficiency. "Adjusted for inflation, gasoline today is about the same price as in 1980 ($3.58 per gallon in February). However, adjusted for both inflation and increased fuel efficiency over time, the costs per mile driven were about 23 cents in 1980 compared to 16-17 cents per mile in February 2012, according to the EIA." Find the original EIA article here -> Gasoline prices rise due to increased crude oil costs. So the motor vehicle industry has adapted to higher gasoline prices, and continues to innovate. You see, as humans we are better at innovating. Which means we are making progress.

Sasha Naryshkine and Byron Lotter

Follow Sasha and Byron on Twitter

011 022 5440

No comments:

Post a Comment